Report: 47% Increase In Real Estate Investment In India (Jan-Mar 2024)

Table of Contents

Main Points: Understanding the Q1 2024 Real Estate Boom

2.1 Government Policies Fueling Growth

Government initiatives have played a pivotal role in stimulating investment in Indian real estate. These policies have created a more favorable environment for both developers and potential homeowners, driving the significant increase in Q1 2024 real estate activity.

H3: Impact of Affordable Housing Initiatives:

The Indian government's commitment to affordable housing is evident in several schemes designed to boost homeownership. These initiatives have significantly contributed to the recent surge in investment.

- Pradhan Mantri Awas Yojana (PMAY): This flagship program offers subsidies and financial assistance to eligible individuals, making homeownership more accessible. The scheme has resulted in a substantial increase in the construction of affordable housing units across the country.

- Credit-Linked Subsidy Scheme (CLSS): CLSS provides interest subsidies on home loans, reducing the financial burden for prospective homeowners and further boosting demand.

- Impact: Data indicates a significant rise in housing units constructed under these schemes, directly contributing to the 47% investment surge observed in Q1 2024 real estate.

H3: Infrastructure Development and its Influence:

Massive infrastructure development projects across India have played a crucial role in attracting real estate investment. The creation of smart cities, improved transportation networks, and enhanced urban amenities boost investor confidence and increase land values.

- Smart Cities Mission: This initiative focuses on developing sustainable and technologically advanced cities, increasing their attractiveness to both residents and businesses.

- Improved Transportation: Investments in metro rail projects, expressways, and other transportation infrastructure enhance connectivity and accessibility, driving up property values in strategically located areas.

- Impact: These infrastructure projects are transforming previously underdeveloped areas, creating hotspots for real estate investment and directly impacting land values and investor sentiment.

2.2 Economic Factors Driving Investment

Strong economic fundamentals have provided a fertile ground for real estate investment growth in India.

H3: Economic Growth and Disposable Income:

India's sustained economic growth has led to a rise in disposable incomes, increasing the purchasing power of potential homebuyers and fueling demand across various real estate segments.

- GDP Growth: India's consistent GDP growth has contributed to a rise in overall consumer spending, with a considerable portion directed towards real estate.

- Disposable Income Increase: Higher disposable incomes empower more individuals to invest in properties, both for residential and commercial purposes.

- Impact: This increased purchasing power has fueled demand across all segments of the real estate market, from luxury apartments to affordable housing options.

H3: Low Interest Rates and Financing:

Favorable interest rates and readily available financing options have made real estate investment more attractive.

- Mortgage Rates: Relatively low mortgage rates have made home loans more affordable, encouraging more individuals to enter the market.

- Financial Institutions: Various financial institutions offer competitive loan schemes, further facilitating real estate investment.

- Impact: Easy access to financing, coupled with low interest rates, has significantly contributed to the increased investment observed in Q1 2024 real estate.

2.3 Emerging Trends in the Indian Real Estate Market

The Indian real estate market is witnessing several dynamic shifts that are reshaping investment landscapes.

H3: Rise of Tier 2 and Tier 3 Cities:

Investment is no longer limited to major metropolitan areas. Tier 2 and Tier 3 cities are experiencing significant growth, driven by factors such as lower land prices and improving infrastructure.

- Growth in Smaller Cities: Data shows a considerable increase in investment in smaller cities compared to Tier 1 cities.

- Reasons for the Shift: Lower land prices, improving infrastructure, and government initiatives promoting development in these areas are key drivers.

- Impact: This diversification of investment across different geographical locations showcases the broadening of the Indian real estate market.

H3: Technological Advancements and PropTech:

The integration of technology is revolutionizing the real estate sector, improving efficiency and attracting investment.

- PropTech Solutions: Online property portals, virtual tours, and other technological advancements streamline processes, improve transparency, and enhance the overall buyer experience.

- Innovative Technologies: Blockchain technology, AI-powered valuation tools, and other innovations are transforming various aspects of the real estate industry.

- Impact: PropTech is not only improving efficiency but also attracting a new generation of investors who are comfortable with digital transactions and data-driven decision-making.

Conclusion: Capitalizing on the Booming Indian Real Estate Market

The 47% surge in Indian real estate investment during Q1 2024 is a testament to the market's dynamism and potential. This significant growth is a result of a synergistic interplay between supportive government policies, a thriving economy, and emerging market trends. The rise of Tier 2 and Tier 3 cities, coupled with the integration of PropTech, further diversifies and strengthens the sector. The future looks bright for the Indian real estate market, presenting lucrative investment opportunities for both domestic and international investors. Invest in Indian real estate now and capitalize on the growing Indian real estate market. Explore real estate opportunities in India and discover the potential for substantial returns.

Featured Posts

-

Analyzing Thibodeaus Impact How He Prevented Knicks Collapse

May 17, 2025

Analyzing Thibodeaus Impact How He Prevented Knicks Collapse

May 17, 2025 -

Cassidy Hutchinsons Memoir A First Hand Account Of The January 6th Attack

May 17, 2025

Cassidy Hutchinsons Memoir A First Hand Account Of The January 6th Attack

May 17, 2025 -

Secure Your Free Cowboy Bebop Gear Fortnites Limited Time Event

May 17, 2025

Secure Your Free Cowboy Bebop Gear Fortnites Limited Time Event

May 17, 2025 -

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025

Deepfake Detection Foiled Cybersecurity Experts Clever Technique

May 17, 2025 -

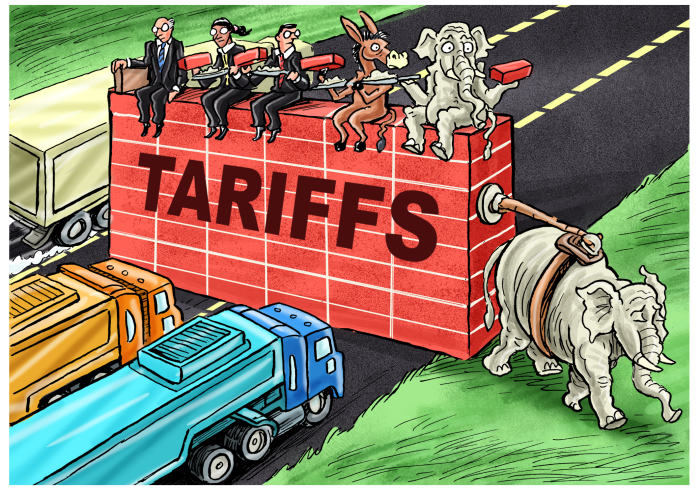

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

The Trump Tariffs Hidden Cost More Expensive Phone Repairs

May 17, 2025

Latest Posts

-

Laporan Keuangan Interpretasi Dan Pengambilan Keputusan Bisnis Yang Efektif

May 17, 2025

Laporan Keuangan Interpretasi Dan Pengambilan Keputusan Bisnis Yang Efektif

May 17, 2025 -

Analisis Laporan Keuangan Kunci Sukses Mengelola Bisnis Anda

May 17, 2025

Analisis Laporan Keuangan Kunci Sukses Mengelola Bisnis Anda

May 17, 2025 -

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

Jenis Jenis Laporan Keuangan And Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025

Jenis Jenis Laporan Keuangan And Pentingnya Bagi Kesuksesan Bisnis

May 17, 2025 -

Principal Financial Group Nasdaq Pfg What 13 Analysts Predict

May 17, 2025

Principal Financial Group Nasdaq Pfg What 13 Analysts Predict

May 17, 2025