Resilient Investments Boost China Life Profits

Table of Contents

The Role of Strategic Asset Allocation in China Life's Success

China Life's success hinges on its sophisticated and diversified investment portfolio. Rather than relying on a single asset class, the company employs a carefully balanced approach across various sectors, minimizing risk and maximizing returns. This strategic asset allocation is a cornerstone of their resilient investment strategy.

- Diversification across asset classes: China Life's portfolio includes a mix of bonds, equities, real estate, and alternative investments, reducing reliance on any single market's performance. This diversification is crucial for weathering market downturns and maintaining consistent profitability.

- Impact of macroeconomic factors: The company's investment decisions are informed by a thorough analysis of macroeconomic trends and geopolitical risks. This proactive approach allows them to adjust their portfolio based on evolving market conditions.

- Quantifiable results: China Life's strategic asset allocation has demonstrably increased returns on investment (ROI). While specific figures may not be publicly available for competitive reasons, industry analysts have noted consistent outperformance compared to competitors with less diversified portfolios. This speaks volumes about the effectiveness of their approach to resilient investments.

Navigating Market Volatility with Resilient Investment Strategies

The global financial landscape is inherently volatile. China Life has successfully navigated periods of market uncertainty by implementing robust risk management techniques. Their resilient investment strategies are designed to mitigate losses and protect capital during economic downturns.

- Adapting to market challenges: China Life's response to the US-China trade war, for example, included a strategic shift towards domestic investments, mitigating potential losses from international trade friction. Their proactive approach to anticipating and adapting to market changes is a key component of their resilience.

- Experienced investment professionals: China Life employs a team of highly experienced investment professionals who utilize sophisticated modeling and forecasting techniques. Their expertise enables the company to make informed decisions and adjust strategies as needed, ensuring the longevity and profitability of the portfolio.

- Resilience during market instability: Data shows that China Life's portfolio remained relatively stable even during periods of significant market volatility. This stability is a testament to the effectiveness of their risk management practices and their focus on long-term value creation.

Long-Term Growth Potential through Strategic Partnerships and Acquisitions

Beyond internal strategies, China Life has significantly enhanced profitability through strategic partnerships and acquisitions. These moves broaden investment opportunities and contribute to long-term growth.

- Expanding into new markets: Collaborations and acquisitions have allowed China Life to expand into new geographic markets and access previously untapped investment opportunities, diversifying their risk profile and generating new revenue streams.

- Synergistic effects: Mergers and acquisitions have created synergies, leading to increased efficiency and improved operational performance. This strategic approach complements their focus on resilient investments, driving further profitability.

- Positive impact on financial performance: These strategic moves have had a demonstrably positive impact on China Life's financial performance, contributing significantly to their overall growth and market dominance.

The Impact of Regulatory Changes on China Life's Investment Approach

The Chinese financial sector is subject to evolving regulations. China Life demonstrates a proactive approach to adapting to these changes, ensuring ongoing compliance and minimizing regulatory risks.

- Adapting to regulatory shifts: China Life closely monitors regulatory changes and modifies its investment strategies accordingly. This proactive approach minimizes disruption and maintains a strong compliance record.

- Compliance and risk mitigation: The company has implemented robust compliance measures and risk mitigation strategies to address potential regulatory challenges. This ensures that their investment practices remain within legal boundaries and reduce exposure to penalties.

- Impact on profitability: While regulatory changes can sometimes present challenges, China Life's agile approach has generally minimized negative impacts and, in some cases, even created new opportunities for profitable investment.

Resilient Investments Secure China Life's Future Profitability

China Life's remarkable financial performance is a direct result of its commitment to resilient investment strategies. A well-diversified portfolio, robust risk management, strategic partnerships, and proactive adaptation to regulatory changes have all contributed to consistent profitability. The company's success serves as a compelling case study for other businesses seeking sustainable growth. Learn how implementing resilient investment strategies, similar to those employed by China Life, can boost your own financial performance. Explore our resources today!

Featured Posts

-

Escape To Little Tahiti Italys Dream Beach Destination

May 01, 2025

Escape To Little Tahiti Italys Dream Beach Destination

May 01, 2025 -

Xrp Price Surge After Ripple Sec Settlement Market Reaction And Future Outlook

May 01, 2025

Xrp Price Surge After Ripple Sec Settlement Market Reaction And Future Outlook

May 01, 2025 -

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre

May 01, 2025

Bhart Kshmyr Pr Ntyjh Khyz Mdhakrat Kywn Kre

May 01, 2025 -

50 M Settlement Reached Analyzing The Ripple Sec Case And Xrps Trajectory

May 01, 2025

50 M Settlement Reached Analyzing The Ripple Sec Case And Xrps Trajectory

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Lich Thi Dau 10 Tran Khong The Bo Lo

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Lich Thi Dau 10 Tran Khong The Bo Lo

May 01, 2025

Latest Posts

-

Yankees Vs Guardians A Comprehensive Look At Clevelands Series Win

May 01, 2025

Yankees Vs Guardians A Comprehensive Look At Clevelands Series Win

May 01, 2025 -

Cleveland Guardians Defeat Yankees Post Series Recap And Takeaways

May 01, 2025

Cleveland Guardians Defeat Yankees Post Series Recap And Takeaways

May 01, 2025 -

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025

Guardians Series Victory Over Yankees Analysis And Insights

May 01, 2025 -

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025

Cleveland Guardians Sweep Yankees Key Takeaways From The Series Win

May 01, 2025 -

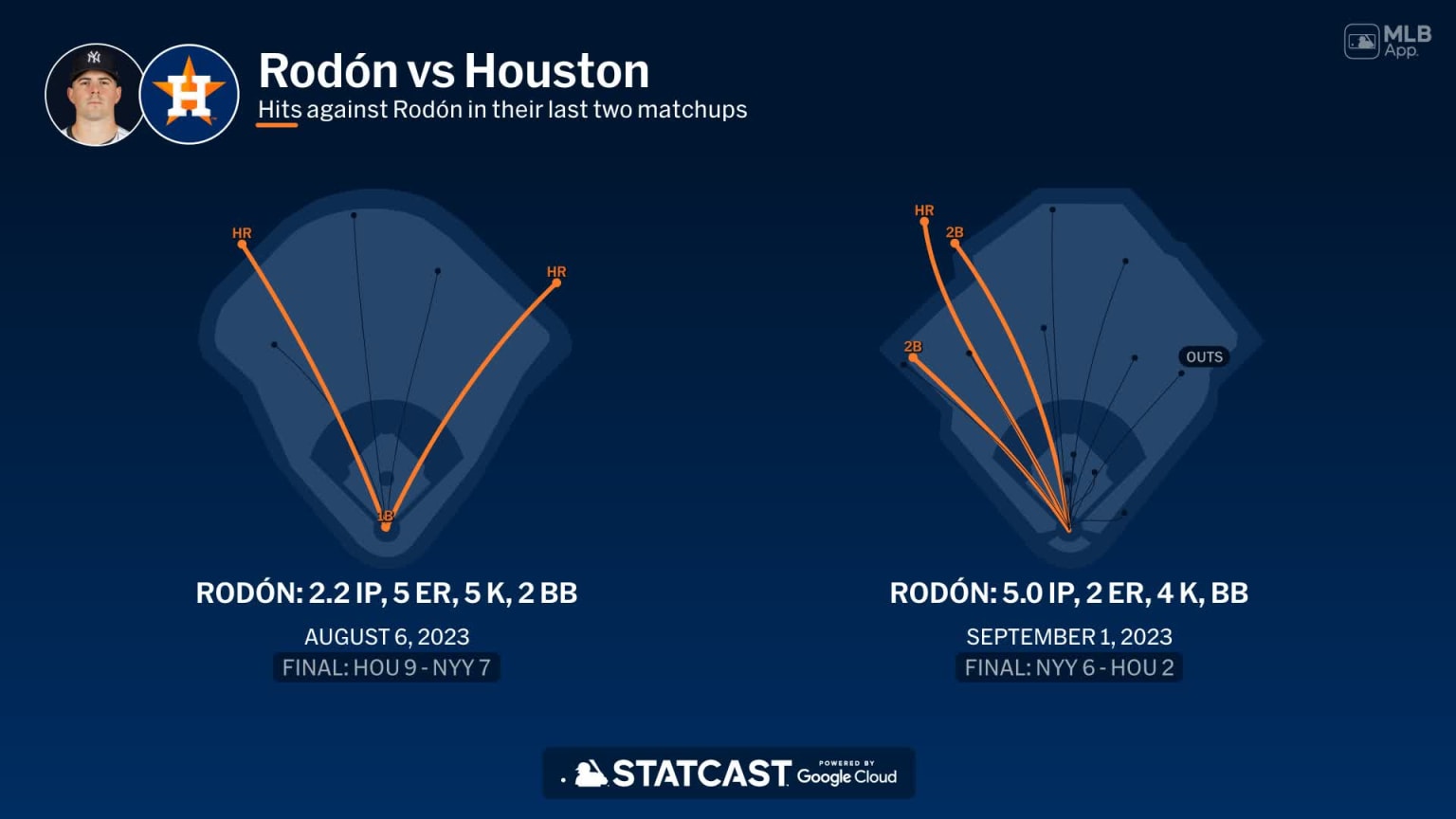

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025

Yankees Salvage Series Finale Rodons Dominant Performance Against Guardians

May 01, 2025