Rethinking QE: Greene's Call For A Scaled-Back Approach At The BOE

Table of Contents

The Bank of England's (BOE) recent monetary policy, particularly its extensive use of Quantitative Easing (QE), has faced intense scrutiny. A significant voice advocating for a change is Catherine Mann, the External Member of the Monetary Policy Committee. Her call for a scaled-back approach to QE has ignited a crucial debate about the effectiveness and long-term consequences of this powerful tool. This article delves into the arguments surrounding this critical reassessment of QE at the BOE.

Greene's Critique of Current QE Policy

Concerns about Inflation

Catherine Mann's primary concern centers on the inflationary pressures stemming from continued large-scale asset purchases under QE. The argument is that the current level of QE is injecting excessive liquidity into the economy, fueling demand-pull inflation.

- Rising Inflation Rates: The UK has seen a significant rise in inflation in recent years, exceeding the BOE's target rate. This increase is partly attributed to the expansionary effects of QE.

- Potential for Wage-Price Spirals: Sustained high inflation could lead to a wage-price spiral, where rising prices trigger demands for higher wages, further pushing up inflation. This creates a self-perpetuating cycle that is difficult to break.

- Impact on Consumer Spending: While QE initially boosts consumer spending through increased asset values and lower borrowing costs, prolonged inflation can erode consumer confidence and purchasing power, potentially hindering long-term economic growth.

Diminishing Returns of QE

Mann also argues that the effectiveness of QE is diminishing. Further expansion, she suggests, yields minimal additional economic benefits while carrying increasing risks.

- Diminishing Marginal Returns: Each successive round of QE has a progressively smaller impact on key economic indicators like GDP growth and inflation. The "bang for the buck" is decreasing.

- Potential for Market Distortion: Massive bond purchases by the BOE can distort market mechanisms, potentially creating asset bubbles and misallocating capital.

- Increasing Cost of Bond Purchases: The BOE's balance sheet continues to expand, leading to increased financial risks and potentially limiting the BOE's ability to respond to future economic shocks. The cost of unwinding this position in the future also poses a significant challenge. [Link to relevant research paper or economic report].

Alternative Monetary Policy Proposals

Targeted Support for Specific Sectors

Instead of broad-based QE, Mann and others suggest exploring targeted support for specific sectors of the economy struggling with the post-pandemic recovery.

- Rationale behind Targeted QE: This approach aims to direct resources towards sectors most in need, maximizing the effectiveness of monetary policy and minimizing the risk of widespread inflation.

- Examples of Potential Sectors: Sectors such as renewable energy, manufacturing, or small and medium-sized enterprises (SMEs) could benefit from targeted support. This can be done through purchasing specific types of bonds related to these sectors.

- Improved Efficiency and Reduced Inflation Risks: By focusing resources, targeted QE could improve the efficiency of monetary stimulus and reduce the risk of generalized inflation.

Emphasis on Fiscal Policy Coordination

Mann emphasizes the importance of increased cooperation between the BOE and the UK government on fiscal policy.

- Advantages of a Coordinated Approach: A coordinated approach between monetary and fiscal policies can lead to a more potent and effective stimulus, potentially reducing the need for large-scale QE.

- Reduced Reliance on QE: By leveraging both monetary and fiscal tools effectively, the economy could rely less on QE as the primary tool for economic stimulus, mitigating its potential risks.

- Potential Challenges: Challenges could include political differences between the government and the BOE, as well as the complexity of coordinating such a multifaceted approach.

The Broader Debate on QE's Long-Term Effects

Impact on Income Inequality

The distributional effects of QE are a subject of ongoing debate. Some argue that QE disproportionately benefits wealthy individuals and institutions, exacerbating income inequality.

- Arguments for Exacerbated Inequality: QE can boost asset prices, primarily benefiting those who own significant assets. This widening wealth gap can lead to social and economic instability.

- Arguments Against Exacerbated Inequality: Others argue that QE's positive impact on employment and economic growth ultimately benefits all segments of society. [Include data or studies supporting these arguments].

Long-Term Sustainability of QE

The long-term sustainability of QE and its implications for future monetary policy remain a major concern.

- Risks and Challenges: The significant expansion of the BOE's balance sheet raises concerns about debt sustainability and the potential for unintended consequences in the long run.

- Potential Unintended Consequences: Prolonged reliance on QE may lead to financial instability, reduce the effectiveness of future monetary policy responses, and distort market signals. [Include links to relevant expert opinions and forecasts].

Conclusion

Catherine Mann's call for a scaled-back approach to Quantitative Easing highlights crucial concerns about inflation, diminishing returns, and the broader long-term consequences of QE at the BOE. The debate surrounding targeted support, fiscal policy coordination, and the impact on income inequality is vital for shaping future monetary policy decisions. Understanding these arguments is essential for informed discussion. Further research into the effectiveness and long-term consequences of QE is essential to ensure sound monetary policy decisions that best serve the UK's economic interests. Stay informed on the evolving debate surrounding QE and its potential impacts.

Featured Posts

-

Reds Historic Losing Streak A 1 0 Defeat Sets Unprecedented Mlb Record

Apr 23, 2025

Reds Historic Losing Streak A 1 0 Defeat Sets Unprecedented Mlb Record

Apr 23, 2025 -

Jelentos Forgalmi Akadalyok Az M3 Ason Heti Tervek Es Utvonaltervezes

Apr 23, 2025

Jelentos Forgalmi Akadalyok Az M3 Ason Heti Tervek Es Utvonaltervezes

Apr 23, 2025 -

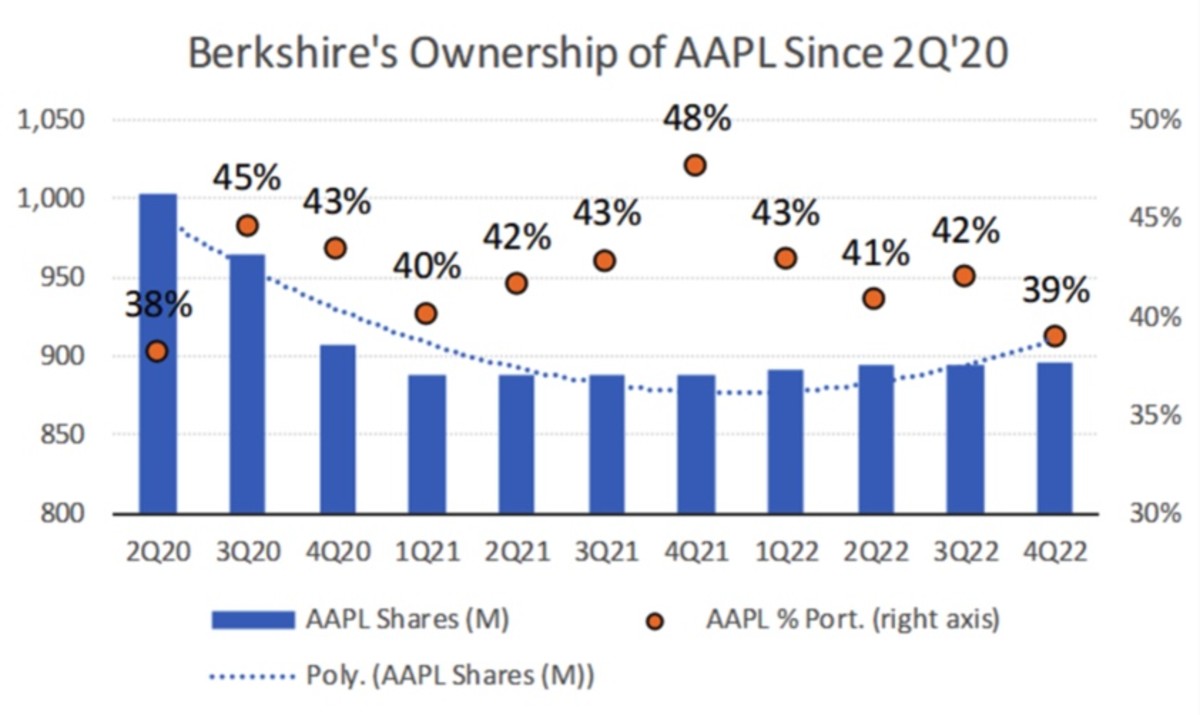

Warren Buffetts Apple Stock Sale A Strategic Move And What It Means For Investors

Apr 23, 2025

Warren Buffetts Apple Stock Sale A Strategic Move And What It Means For Investors

Apr 23, 2025 -

Uk Diy Shopping Our Guide To The Best And Worst Stores

Apr 23, 2025

Uk Diy Shopping Our Guide To The Best And Worst Stores

Apr 23, 2025 -

1 050 V Mware Price Increase At And T Sounds The Alarm On Broadcoms Proposal

Apr 23, 2025

1 050 V Mware Price Increase At And T Sounds The Alarm On Broadcoms Proposal

Apr 23, 2025