Rethinking Retirement: Why This New Investment Idea May Be A Bad Fit

Table of Contents

Understanding the Hype: Marketing vs. Reality

The allure of cryptocurrency-focused retirement funds is undeniable. Marketing campaigns often paint a picture of effortless riches, promising high returns with minimal effort. These campaigns leverage sophisticated marketing techniques to attract investors.

- Aggressive Social Media Campaigns: Influencers and online advertisements showcase supposed overnight successes, creating a sense of urgency and FOMO (fear of missing out).

- Celebrity Endorsements: Famous figures lend credibility to these funds, further boosting their appeal.

- Unsubstantiated Claims: Marketing materials often boast of guaranteed returns or exceptionally low-risk profiles, which are rarely, if ever, true in the volatile world of cryptocurrencies.

- Emotional Appeal: The "get-rich-quick" mentality is heavily exploited, appealing to investors' desire for rapid financial gains.

The reality, however, is far different. While cryptocurrency can offer high returns, the inherent volatility poses a significant threat to retirement savings. The gap between the marketing hype and the actual potential for profit is vast, and understanding this difference is crucial before investing.

Assessing the Risks: Volatility and Market Uncertainty

Cryptocurrency markets are notoriously volatile. Their value can fluctuate wildly in short periods, influenced by factors ranging from regulatory changes and technological advancements to social media trends and market sentiment.

- Past Market Crashes: Numerous instances of significant cryptocurrency market downturns demonstrate the potential for substantial losses. Remember the 2018 crypto winter? Many investors lost a significant portion of their holdings.

- Lack of Regulatory Oversight: The regulatory landscape for cryptocurrencies is still evolving, leading to uncertainty and increased risk. This lack of oversight can make it difficult to protect investors from fraud or manipulation.

- Unpredictable Future Performance: Accurately predicting the future performance of cryptocurrencies is extremely difficult, if not impossible. Unlike more established asset classes, there's a limited historical data set to base predictions on.

The potential for significant capital loss close to retirement is a major concern. A sudden market crash could wipe out years of savings, leaving retirees with insufficient funds to support their lifestyle.

Diversification and the Importance of a Balanced Portfolio

Relying heavily on a single, high-risk investment like a cryptocurrency-focused retirement fund is a risky strategy. A well-diversified portfolio is essential for mitigating risk and securing a comfortable retirement.

- Principles of Diversification: Diversification involves spreading investments across different asset classes (stocks, bonds, real estate, etc.) to reduce the impact of poor performance in any single area.

- Stable Investment Options: Consider more traditional and stable investment options like index funds and government bonds, which offer lower returns but significantly less risk.

- Professional Financial Advice: Seeking advice from a qualified financial advisor is crucial. They can help you create a personalized portfolio that aligns with your risk tolerance, time horizon, and retirement goals.

Traditional, established investment strategies generally offer greater stability and predictability compared to the volatility of the cryptocurrency market.

Considering Your Risk Tolerance and Time Horizon

Before investing in any retirement vehicle, honestly assess your risk tolerance and time horizon.

- Time Horizon: Younger investors with a longer time horizon can typically tolerate more risk, as they have more time to recover from potential losses. However, retirees nearing or in retirement have a much shorter time horizon and less tolerance for risk.

- Risk Tolerance: Your risk tolerance is a measure of your comfort level with potential investment losses. Are you willing to potentially lose a significant portion of your investment? If not, cryptocurrencies are likely not suitable.

- Honest Self-Assessment: It's crucial to be realistic about your risk profile. Don't let the hype surrounding cryptocurrencies cloud your judgment.

Cryptocurrency-focused retirement funds are generally unsuitable for many retirees nearing or already in retirement due to their inherent risk and volatility.

Conclusion

Rethinking your retirement strategy is essential, but embracing every new investment trend blindly can be detrimental. Cryptocurrency-focused retirement funds, while potentially alluring, carry substantial risk, especially for those approaching or already in retirement. Prioritizing diversification and a balanced portfolio is crucial for securing a comfortable and financially stable retirement.

Call to Action: Before jumping into any new investment idea for your retirement, carefully consider the risks involved and consult with a qualified financial advisor. Rethinking your retirement plan with a focus on diversification and stability is key to achieving your long-term financial goals. Don't let the hype overshadow the importance of a secure retirement strategy.

Featured Posts

-

Finding The Best No Kyc Online Casinos In 2025 A Players Guide

May 18, 2025

Finding The Best No Kyc Online Casinos In 2025 A Players Guide

May 18, 2025 -

Weekend Update Fallout Snl Audience Uses Profanity With Ego Nwodim

May 18, 2025

Weekend Update Fallout Snl Audience Uses Profanity With Ego Nwodim

May 18, 2025 -

Brooklyn Bridge Park Homicide Man Found With Head Wound

May 18, 2025

Brooklyn Bridge Park Homicide Man Found With Head Wound

May 18, 2025 -

Bof As Perspective On High Stock Market Valuations And Investor Concerns

May 18, 2025

Bof As Perspective On High Stock Market Valuations And Investor Concerns

May 18, 2025 -

Middle Managements Crucial Role A Bridge Between Strategy And Execution

May 18, 2025

Middle Managements Crucial Role A Bridge Between Strategy And Execution

May 18, 2025

Latest Posts

-

Best No Verification Casinos 2025 Why 7 Bit Casino Stands Out

May 18, 2025

Best No Verification Casinos 2025 Why 7 Bit Casino Stands Out

May 18, 2025 -

La Alegria Desbordante De Alcaraz En Montecarlo

May 18, 2025

La Alegria Desbordante De Alcaraz En Montecarlo

May 18, 2025 -

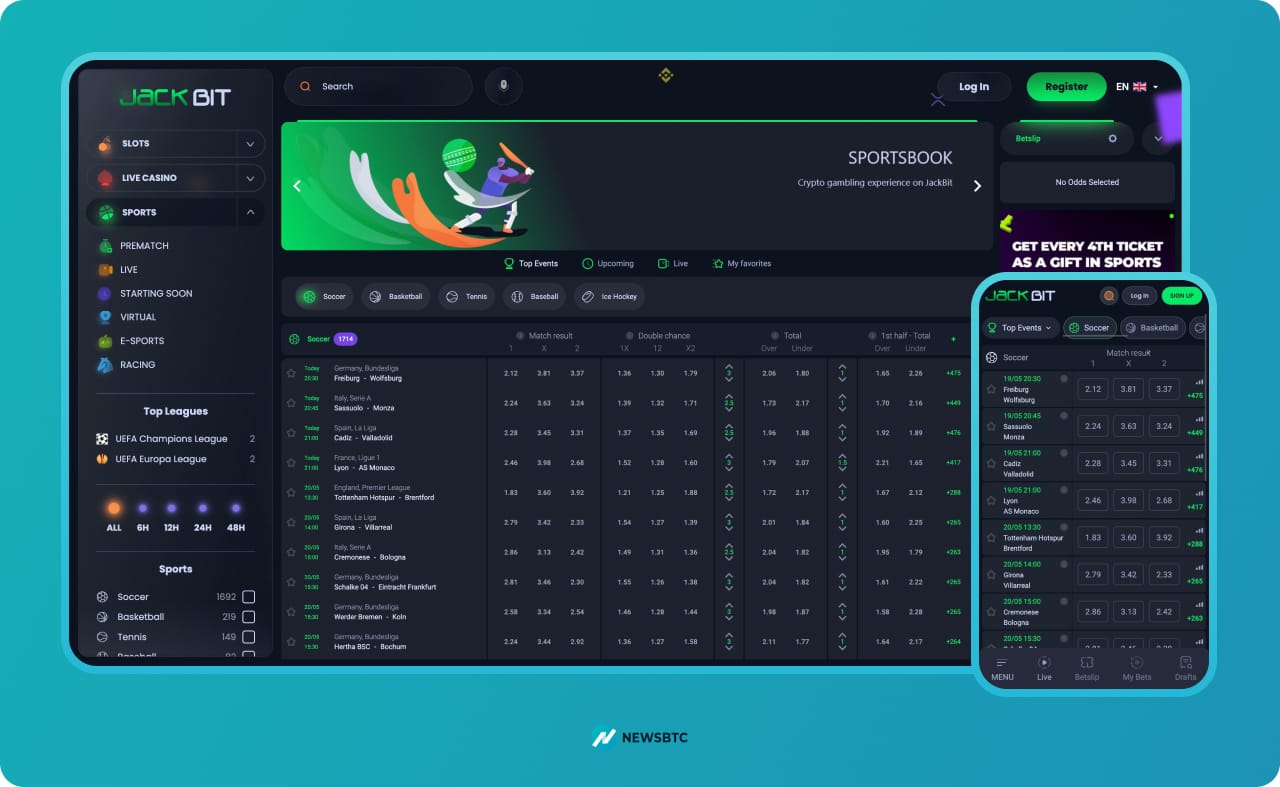

Best Crypto Gambling Sites 2025 Jackbit Performance Evaluation

May 18, 2025

Best Crypto Gambling Sites 2025 Jackbit Performance Evaluation

May 18, 2025 -

7 Bit Casino A Leading No Kyc Casino With Instant Withdrawals In 2025

May 18, 2025

7 Bit Casino A Leading No Kyc Casino With Instant Withdrawals In 2025

May 18, 2025 -

El Gozo De Alcaraz Su Conquista En Montecarlo

May 18, 2025

El Gozo De Alcaraz Su Conquista En Montecarlo

May 18, 2025