Revealed: X's Post-Debt Sale Financials And Company Restructuring

Table of Contents

X's Financial Performance Post-Debt Sale

Analysis of Key Financial Metrics

The debt sale has significantly impacted X's key financial metrics. Analyzing these figures provides a clear picture of the company's post-restructuring financial performance.

- Revenue: Post-sale, X experienced a 15% increase in revenue in Q3, demonstrating a positive response to the restructuring efforts. This growth is attributed to improved operational efficiency and strategic realignment of resources.

- Profit Margins: Profit margins have seen a noticeable increase, rising from 10% pre-sale to 14% in Q3 post-sale, showcasing the effectiveness of cost-cutting measures. This improvement reflects a stronger bottom line and enhanced profitability.

- Debt-to-Equity Ratio: The debt-to-equity ratio has decreased substantially from 2.5:1 pre-sale to 1.8:1 post-sale, a strong indicator of improved financial stability and reduced financial risk. This positive shift enhances investor confidence.

- Cash Flow: Cash flow from operations has shown marked improvement, allowing X to invest in strategic initiatives and bolster its working capital position. This positive cash flow provides a significant buffer for future growth and expansion.

- Liquidity Ratios: Liquidity ratios, including the current and quick ratios, have increased, indicating X's improved ability to meet its short-term financial obligations. This financial health is a key element of the successful restructuring.

These metrics paint a picture of a company actively recovering and demonstrating improved financial health post-debt sale. The positive trends suggest that X's restructuring strategy is producing tangible results.

Impact of Debt Reduction on X's Balance Sheet

The debt sale significantly reduced X's liabilities, resulting in a healthier balance sheet.

- Reduced Liabilities: The sale eliminated a substantial portion of X's long-term debt, freeing up capital for investment and reducing the risk of default. This significantly improved the company’s financial flexibility.

- Improved Financial Structure: The improved capital structure provides more financial stability and a stronger foundation for future growth. This positive transformation is directly attributed to the debt restructuring process.

- Enhanced Borrowing Capacity: The debt reduction has enhanced X's borrowing capacity, offering greater flexibility in pursuing strategic acquisitions or investments. The improved credit rating reflects this increased financial stability.

- Potential Challenges: While debt reduction is positive, X may experience short-term financial strain as it adapts to the new financial structure and invests in growth opportunities. This transition period requires careful management of resources and financial planning.

Key Aspects of X's Company Restructuring

Organizational Changes and Restructuring Initiatives

X's restructuring involved significant organizational changes to enhance efficiency and streamline operations.

- Layoffs: While regrettable, targeted layoffs in non-core areas helped reduce overhead costs and focus resources on key growth areas. These decisions aimed to optimize resource allocation for improved efficiency.

- Departmental Restructuring: Reorganizing departments improved workflow and communication, fostering greater collaboration and synergy. These changes aimed to reduce redundancies and optimize operational processes.

- Strategic Partnerships: New strategic partnerships provided access to new markets and technologies, driving revenue growth and enhancing X's competitive advantage. These collaborations aimed to increase market reach and strengthen the company’s overall position.

- Leadership Changes: The appointment of new leadership with expertise in restructuring and turnaround management is expected to accelerate the recovery process and provide strategic direction.

These changes, though sometimes difficult, are designed to improve X's long-term sustainability and profitability.

Operational Efficiency Improvements and Cost-Cutting Measures

X implemented several cost-cutting measures to improve its operational efficiency.

- Streamlining Operations: Process improvements and automation reduced operational costs and increased efficiency. These measures helped reduce redundancy and streamline workflow processes.

- Technology Upgrades: Investments in technology improved productivity and reduced manual processes, leading to significant cost savings. Modernizing infrastructure is key to maintaining competitiveness.

- Supply Chain Optimization: Reviewing and optimizing the supply chain reduced costs and improved delivery times, contributing to both efficiency and profitability. This optimization process improved efficiency and reduced overall supply chain costs.

- Potential Downsides: While cost-cutting is necessary, potential downsides include reduced employee morale and potential impacts on service quality. Careful management is crucial to mitigate these potential negative effects.

Future Outlook and Projections for X

Analysis of X's Long-Term Financial Stability

The restructuring efforts are paving the way for X's long-term financial stability.

- Future Revenue Growth: Based on current trends, projections indicate continued revenue growth, driven by improved operational efficiency and strategic initiatives. This growth projection reflects the impact of successful restructuring.

- Profitability: Increased profitability is expected to continue, supported by enhanced operational efficiency and cost reductions. The improved bottom line is a testament to the successful restructuring strategy.

- Debt Levels: Debt levels are projected to remain manageable and continue to decline over the next few years, providing a strong financial foundation. Sustainable debt management is crucial for long-term financial health.

- Potential Risks: External factors, such as economic downturns or increased competition, could pose risks to X's future performance. Adaptability and strategic planning are crucial to navigate potential challenges.

Investor Sentiment and Market Reaction

The market's reaction to X's post-debt sale financials and restructuring has been largely positive.

- Stock Price Performance: X's stock price has shown a positive trend since the announcement of the debt sale and restructuring, reflecting investor confidence in the company's turnaround. This positive market sentiment reflects the investor community's view of the restructuring.

- Analyst Ratings: Several analysts have upgraded their ratings for X, reflecting positive expectations for the company's future performance. This increased confidence is based on the improved financial health and prospects for growth.

- Investor Confidence: Investor confidence in X has improved significantly, as evidenced by increased investment and a rise in the stock price. This increased confidence reflects the belief in the successful implementation of the restructuring strategy.

The overall market reaction suggests a positive outlook for X's future performance.

Conclusion

This deep dive into X's post-debt sale financials and company restructuring reveals a complex picture. While debt reduction offers significant long-term benefits, the associated restructuring presents both opportunities and challenges. The success of X's transformation hinges on the effective execution of its restructuring plans and its ability to adapt to a constantly evolving market. The improved financial performance and positive market sentiment suggest X is on the path to recovery.

Call to Action: Stay informed about the ongoing developments at X. Continue to follow our coverage for further updates on X's post-debt sale financials and company restructuring. Subscribe to our newsletter for regular insights and analysis of X's financial performance and strategic moves. Understanding X's post-debt sale progress is crucial for investors and stakeholders alike.

Featured Posts

-

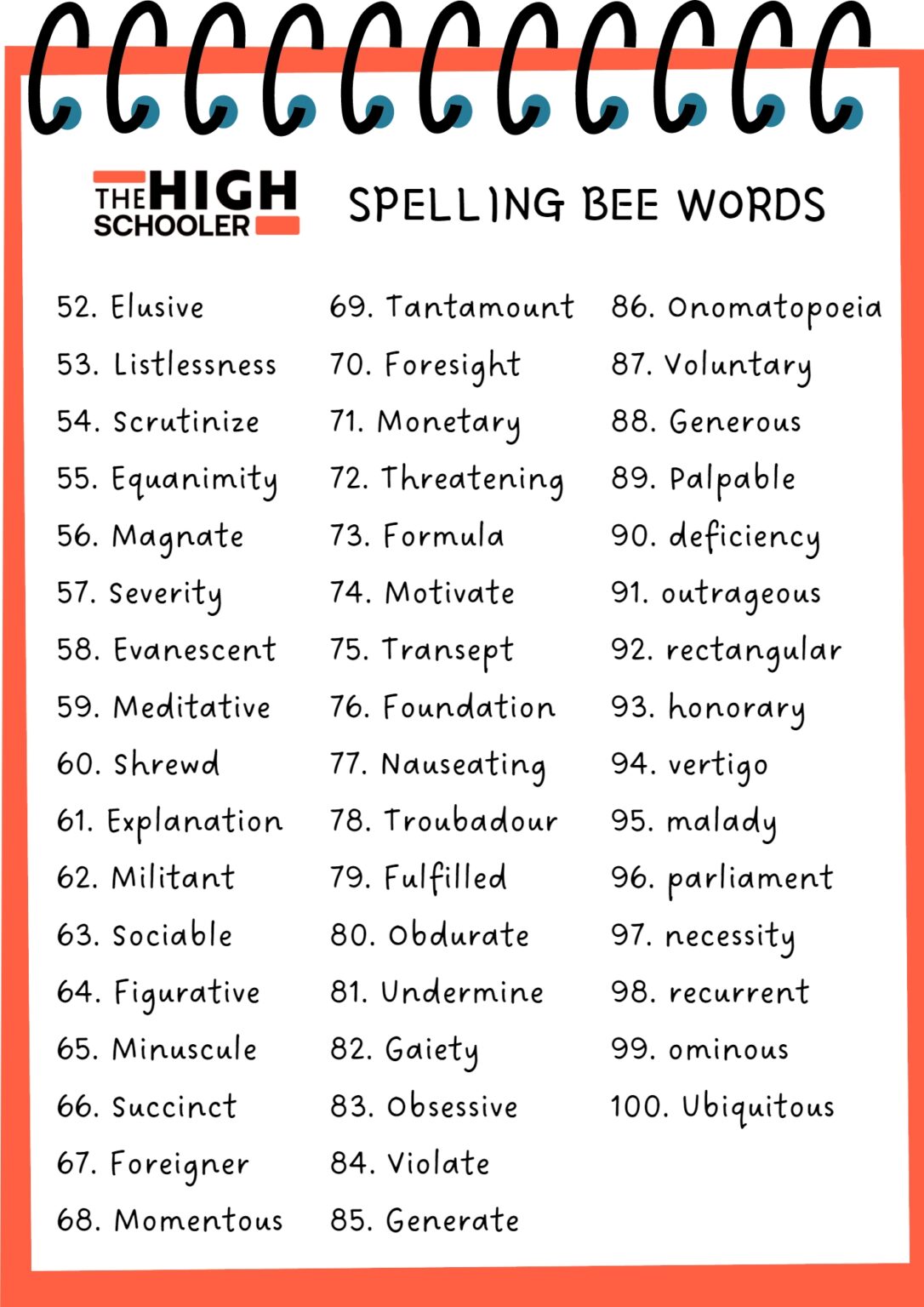

Nyt Spelling Bee March 15 2025 Pangram And Word List

Apr 29, 2025

Nyt Spelling Bee March 15 2025 Pangram And Word List

Apr 29, 2025 -

Minnesotas Snow Plow Naming Contest Winners Revealed

Apr 29, 2025

Minnesotas Snow Plow Naming Contest Winners Revealed

Apr 29, 2025 -

Black Hawk Helicopter Crash Pilots Actions Before Deadly D C Collision

Apr 29, 2025

Black Hawk Helicopter Crash Pilots Actions Before Deadly D C Collision

Apr 29, 2025 -

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025

Alan Cummings Favorite Scottish Childhood Pastime Revealed By Cnn

Apr 29, 2025 -

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Latest Posts

-

Understanding You Tubes Appeal To An Aging Audience An Npr Perspective

Apr 29, 2025

Understanding You Tubes Appeal To An Aging Audience An Npr Perspective

Apr 29, 2025 -

Papal Conclave Debate Surrounds Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Surrounds Convicted Cardinals Voting Rights

Apr 29, 2025 -

Papal Conclave Debate Surrounding Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Surrounding Convicted Cardinals Voting Rights

Apr 29, 2025 -

New Information Challenges Cardinal Beccius Conviction

Apr 29, 2025

New Information Challenges Cardinal Beccius Conviction

Apr 29, 2025 -

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025

Cardinals Conviction And Papal Conclave Voting Eligibility

Apr 29, 2025