Rio Tinto Weathers Activist Investor Push To Restructure Listing

Table of Contents

The Activist Investor Campaign and its Demands

Several activist investors, including [Insert Name(s) of Activist Investor(s) and their firms if known], have recently targeted Rio Tinto, demanding a restructuring of its dual listing. Their campaign centers on the belief that the current structure is inefficient and detracts from maximizing shareholder value.

-

Specific demands: Proposals vary, but key demands include a potential shift to a single listing, either on the London Stock Exchange or the Australian Stock Exchange, or potentially a delisting from one of the exchanges entirely. Some activists may also suggest structural changes within the company to improve governance and efficiency.

-

Reasons cited: The activists argue that a single listing would simplify corporate governance, reduce administrative costs, and potentially lead to a more efficient allocation of capital. They believe a streamlined structure would improve transparency and potentially boost the share price.

-

Timeline of events: [Insert a timeline of key events in the activist campaign, including dates of initial announcements, public statements, and any significant milestones]. This section should include links to credible news sources that back up these claims for greater SEO benefit.

Rio Tinto's Response and Defense of its Current Structure

Rio Tinto's management has strongly defended its dual listing structure, arguing that it offers significant advantages. Their response has involved direct engagement with shareholders and a robust defense of their current strategy.

-

Arguments for the dual listing: Rio Tinto maintains that the dual listing provides access to a broader and more diverse investor base, both in London and Australia. They argue that maintaining a presence on both exchanges offers crucial strategic advantages, enhancing liquidity and providing access to different pools of capital.

-

Counter-arguments to activist claims: Rio Tinto likely counters claims of inefficiency by highlighting the robust processes already in place. They may argue that the costs associated with maintaining a dual listing are outweighed by the benefits of diversified investor access.

-

Actions taken: The company has likely engaged in extensive dialogue with shareholders, potentially including presentations and detailed reports outlining the benefits of the current structure. Board-level discussions have undoubtedly taken place to address the concerns raised by the activist investors and to determine the best course of action.

Market Reaction and Share Price Performance

The activist investor campaign and Rio Tinto's response have naturally influenced market sentiment and share price performance.

-

Impact on share price: [Describe the impact on Rio Tinto's share price following the initial announcement and throughout the campaign. Include specific data points if available (e.g., percentage changes, dates of significant fluctuations).] Include charts or graphs if possible to visually represent the data.

-

Investor sentiment and analyst commentary: [Summarize the prevailing investor sentiment and the opinions expressed by financial analysts. Include quotes from reputable sources if available.]

-

Comparison to other companies: [Compare Rio Tinto's share price performance and market reaction with that of other companies with similar dual listings. This helps provide context and allows for a more nuanced analysis.]

Implications for Corporate Governance and Shareholder Value

This situation raises important questions about corporate governance in the mining industry and the balance between management strategy and shareholder interests.

-

Broader corporate governance issues: The Rio Tinto case highlights the increasing power of activist investors and the ongoing debate about the best way to balance shareholder interests with long-term strategic planning. This section might also discuss the broader implications for corporate governance in multinational corporations.

-

Long-term effects on shareholder value: Regardless of the outcome, this situation will influence how shareholders view dual listings and how companies structure themselves for maximum shareholder value.

-

Changes in investor behavior: This event may encourage other investors to scrutinize the corporate governance practices and dual listing structures of other companies in the industry, leading to a more critical evaluation of corporate strategies.

Conclusion

This article explored the recent pressure on Rio Tinto from activist investors seeking a restructuring of its dual listing. While Rio Tinto has defended its current structure, the situation highlights the ongoing tension between shareholder demands and management strategy in large multinational corporations. The outcome will have significant implications for corporate governance and shareholder value within the mining sector.

Call to Action: Stay informed on the evolving situation surrounding Rio Tinto and its ongoing efforts to balance shareholder expectations with its business strategy. Continue to follow our updates for the latest developments regarding the future of the company's listing structure and the impact of activist investor pressure on Rio Tinto's overall performance. Further analysis of the Rio Tinto restructuring debate is crucial for understanding future trends in corporate governance and the relationship between multinational companies and their shareholders. Understanding the implications of this Rio Tinto restructuring attempt will help investors navigate similar situations in the future.

Featured Posts

-

This Country Your Ultimate Travel Guide

May 03, 2025

This Country Your Ultimate Travel Guide

May 03, 2025 -

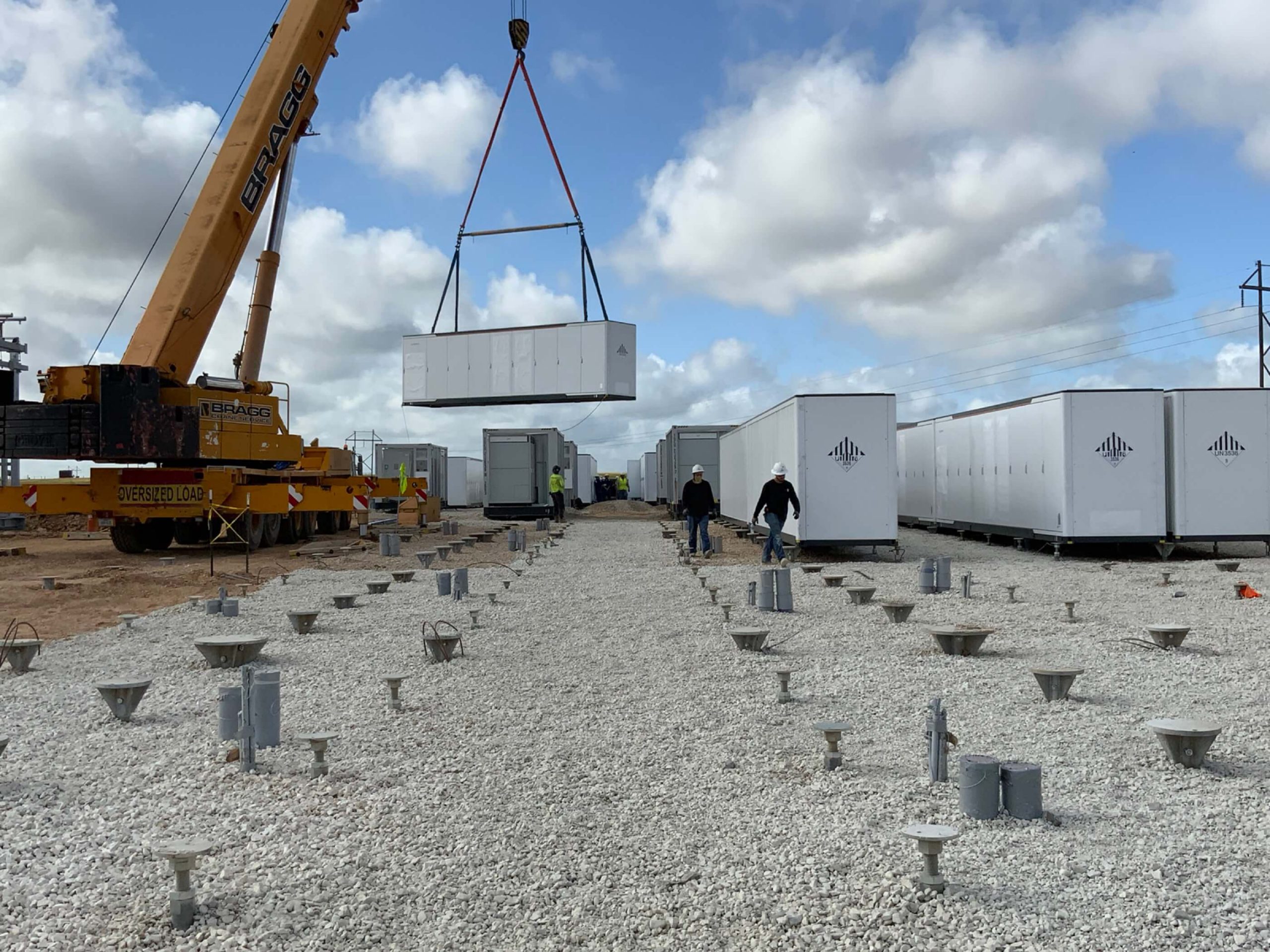

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025 -

Bukan Sekadar Sampah Cangkang Telur Untuk Nutrisi Tanaman Dan Hewan

May 03, 2025

Bukan Sekadar Sampah Cangkang Telur Untuk Nutrisi Tanaman Dan Hewan

May 03, 2025 -

Loyle Carner Announces Dublin 3 Arena Concert

May 03, 2025

Loyle Carner Announces Dublin 3 Arena Concert

May 03, 2025 -

Israil Meclisi Nde Yasanan Esir Yakinlari Guevenlik Goerevlileri Catismasi

May 03, 2025

Israil Meclisi Nde Yasanan Esir Yakinlari Guevenlik Goerevlileri Catismasi

May 03, 2025

Latest Posts

-

Nebraskas Successful Voter Id Campaign A National Model

May 03, 2025

Nebraskas Successful Voter Id Campaign A National Model

May 03, 2025 -

Excellence In Voter Id Programs Nebraskas Award Winning Campaign

May 03, 2025

Excellence In Voter Id Programs Nebraskas Award Winning Campaign

May 03, 2025 -

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025

Analyzing The Ap Decision Notes Implications Of The Minnesota Special House Election

May 03, 2025 -

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025

National Award Honors Nebraskas Voter Id Campaign

May 03, 2025 -

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025

Minnesota Special House Election Key Takeaways From Ap Decision Notes

May 03, 2025