Rio Tinto's Dual Listing Structure Remains After Activist Campaign

Table of Contents

The Activist Campaign Targeting Rio Tinto's Dual Listing

Who were the Activists and What were their Arguments?

Several prominent activist investors targeted Rio Tinto's dual listing, arguing for a single listing, either on the LSE or the ASX. While the precise identities and specific investment stakes of all involved may not be publicly available for confidentiality reasons, the general consensus is that these investors felt the dual listing structure was inefficient and detrimental to shareholder value. Their core arguments revolved around:

- Improved Corporate Governance: They argued that a single listing would simplify corporate governance, making oversight and accountability more straightforward. The dual listing, they claimed, created unnecessary complexities in reporting and regulatory compliance.

- Increased Efficiency: Maintaining two separate listings incurs higher administrative and compliance costs. The activists believed that streamlining to a single exchange would lead to significant cost savings, which could directly benefit shareholders.

- Potential Share Price Benefits: The activists suggested that a simplified structure could lead to a higher share price, reflecting improved efficiency and a more streamlined corporate structure. They argued that the dual listing created unnecessary complexities that weighed on the share price. A potential for share price discrepancies between the two exchanges was also highlighted.

Rio Tinto's Response to Activist Pressure

Rio Tinto responded to the activist campaign with a detailed defense of its dual listing structure. The company emphasized the strategic benefits of maintaining its presence on both the LSE and the ASX. Their key arguments included:

- Access to a Broader Investor Base: A dual listing provides access to a wider pool of capital from both the UK and Australian markets, as well as international investors. This diversification mitigates reliance on a single market's fluctuations.

- Strategic Considerations: The company likely highlighted the strategic importance of maintaining its presence in both key markets—the UK and Australia—for reasons related to investor relations, regulatory compliance and existing relationships within both regions.

- Concessions (if any): While Rio Tinto ultimately maintained its dual listing, they may have made some concessions to appease shareholder concerns. This could have included increased transparency regarding compliance costs or improved communication strategies to better address investor questions across both markets. Publicly available information should be consulted for specific details.

The Advantages and Disadvantages of Rio Tinto's Dual Listing

Advantages of a Dual Listing

- Increased Liquidity: Investors can trade Rio Tinto shares on two major exchanges, potentially leading to higher trading volumes and greater liquidity. This makes it easier to buy and sell shares.

- Broader Investor Base: The dual listing expands the pool of potential investors, allowing Rio Tinto to access more capital for expansion and growth opportunities. A wider investor base brings diversification in perspectives and reduced reliance on one particular market segment.

- Enhanced Market Visibility: A dual listing enhances the company's profile and brand recognition amongst investors globally, attracting more attention and investment. Greater visibility contributes to a more robust market capitalization.

- Risk Diversification: A dual listing can reduce the risk associated with relying solely on one market. If one market experiences volatility, the other might offer stability, reducing overall risk exposure for the company and its investors.

Disadvantages of a Dual Listing

- Increased Compliance Costs: Meeting the regulatory requirements of two different stock exchanges increases compliance costs, reducing overall profitability.

- Complexity of Governance: Managing a dual listing requires more complex corporate governance structures and reporting mechanisms. Maintaining accurate and timely reporting across two exchanges demands higher administrative overhead.

- Potential for Share Price Discrepancies: Share prices may fluctuate differently on the LSE and ASX, creating potential arbitrage opportunities and leading to inconsistencies in valuation.

- Shareholder Communication Challenges: Communicating effectively with shareholders across different time zones and regulatory environments requires careful planning and logistical coordination.

The Implications of the Decision to Maintain the Dual Listing Structure

Impact on Share Price

The share price performance of Rio Tinto around the time of the activist campaign and following the decision to maintain the dual listing is crucial to assess the market’s response. Analysis of share price movements requires access to financial data and understanding of multiple market influencing factors beyond just the listing structure.

Future Outlook for Rio Tinto's Listing Structure

While the immediate future seems secure for the dual listing, the possibility of future challenges remains. Changing market conditions, evolving investor sentiment, or new activist campaigns could reignite the debate. Furthermore, future regulatory changes could also influence the company’s decision.

Lessons for Corporate Governance

The Rio Tinto case offers valuable insights into corporate governance and the dynamic relationship between companies and activist investors. It highlights the importance of clear and transparent communication, proactive engagement with shareholders, and a robust strategy to defend corporate decisions while considering shareholder concerns.

Conclusion

Rio Tinto's decision to maintain its dual listing structure on the LSE and ASX, despite pressure from activist investors, underscores the strategic importance the company places on its access to diverse capital markets and its presence in both the UK and Australian markets. While the dual listing presents certain complexities and increased compliance costs, the advantages in terms of liquidity, broader investor base, and risk diversification appear to outweigh the drawbacks, at least for the foreseeable future. The campaign, however, serves as a reminder of the ongoing dialogue between corporations and their shareholders, particularly regarding corporate structure and efficiency.

Stay updated on the evolving landscape of Rio Tinto's dual listing strategy and learn more about the complexities of dual listings and their impact on corporate governance by visiting Rio Tinto's investor relations website and following reputable financial news sources.

Featured Posts

-

45 Vuelta Ciclista A Murcia Triunfo Para Fabio Christen

May 03, 2025

45 Vuelta Ciclista A Murcia Triunfo Para Fabio Christen

May 03, 2025 -

Finding Your Dream Home A Practical Guide To A Place In The Sun

May 03, 2025

Finding Your Dream Home A Practical Guide To A Place In The Sun

May 03, 2025 -

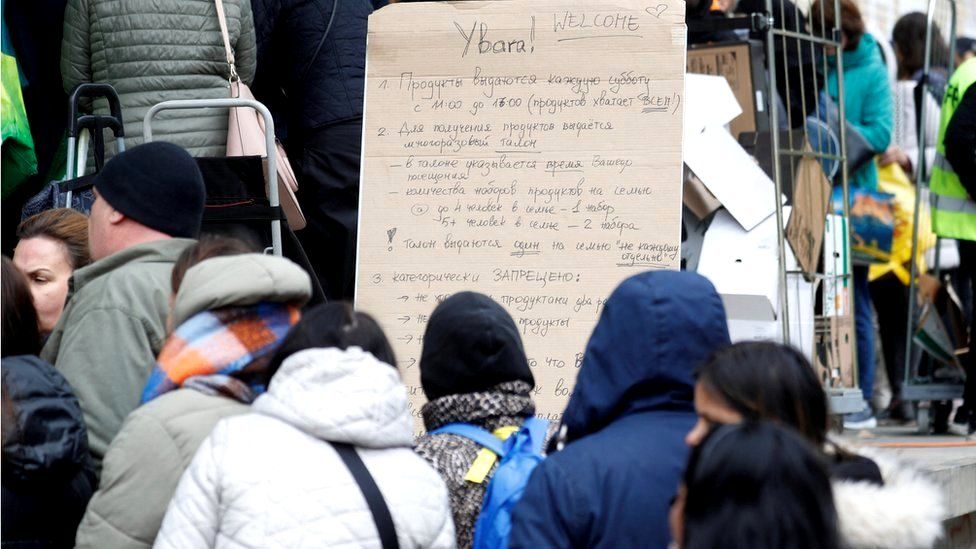

Swiss President Reiterates Strong Support For Ukraine Amidst Conflict

May 03, 2025

Swiss President Reiterates Strong Support For Ukraine Amidst Conflict

May 03, 2025 -

Dont Miss Out Glastonbury 2025 Resale Tickets

May 03, 2025

Dont Miss Out Glastonbury 2025 Resale Tickets

May 03, 2025 -

Alwde Yzdad Khtwrt Jw 24 Yhdhr Slah Mn Mghamrath

May 03, 2025

Alwde Yzdad Khtwrt Jw 24 Yhdhr Slah Mn Mghamrath

May 03, 2025

Latest Posts

-

The Countrys Newest Business Hot Spots Investment Opportunities And Growth Areas

May 04, 2025

The Countrys Newest Business Hot Spots Investment Opportunities And Growth Areas

May 04, 2025 -

Two Days At A Crypto Party A Recounting Of Events

May 04, 2025

Two Days At A Crypto Party A Recounting Of Events

May 04, 2025 -

The Post Roe Era Exploring The Significance Of Over The Counter Birth Control

May 04, 2025

The Post Roe Era Exploring The Significance Of Over The Counter Birth Control

May 04, 2025 -

Anchor Brewings Closure 127 Years Of Brewing History Concludes

May 04, 2025

Anchor Brewings Closure 127 Years Of Brewing History Concludes

May 04, 2025 -

Blue Origins Subsystem Issue Results In Rocket Launch Cancellation

May 04, 2025

Blue Origins Subsystem Issue Results In Rocket Launch Cancellation

May 04, 2025