The Country's Newest Business Hot Spots: Investment Opportunities And Growth Areas

Table of Contents

Are you seeking lucrative investment opportunities in dynamic, high-growth sectors? This article identifies the country's emerging business hot spots, highlighting key areas poised for significant expansion and offering valuable insights for savvy investors. We'll explore promising sectors, analyze market trends, and discuss potential risks and rewards. Identifying these emerging markets is key to smart investment strategies.

Tech Hubs: Silicon Valley South Emerges

The country is experiencing a technological boom, with several regions rapidly transforming into thriving tech hubs. These "Silicon Valley South" areas are attracting significant investment and creating numerous opportunities.

Artificial Intelligence (AI) and Machine Learning:

Rapid advancements in AI are driving significant growth. The sector is experiencing a surge in startups and related services. This growth is fueled by:

- Government Support: Initiatives promoting AI research and development are providing crucial funding and infrastructure.

- Talent Acquisition: A large pool of skilled professionals is attracting both domestic and international companies.

- Infrastructure Development: Investment in data centers and high-speed internet connectivity is supporting the growth of AI businesses.

Successful AI companies are already making significant impacts, revolutionizing industries like healthcare, finance, and transportation. However, potential risks include:

- Intense Competition: The rapid growth attracts many players, leading to a competitive landscape.

- Ethical Concerns: The use of AI raises ethical questions regarding bias, privacy, and job displacement.

- Regulatory Hurdles: Government regulations and standards are constantly evolving, potentially creating challenges for businesses.

Fintech Innovation and Blockchain Technology:

The Fintech sector is booming, driven by increased mobile phone penetration and widespread digital adoption. This creates a fertile ground for innovation. Key areas include:

- Mobile Payments: The rise of mobile payment systems is transforming the financial landscape.

- Blockchain Applications: Blockchain technology is being applied to various financial and supply chain solutions, enhancing security and transparency.

- Investment Opportunities: Numerous startups and established companies offer investment opportunities in Fintech infrastructure and services.

Examples of successful Fintech companies demonstrate the potential for high returns. However, potential risks include:

- Cybersecurity Threats: The digital nature of Fintech exposes businesses to various cybersecurity risks.

- Regulatory Uncertainty: The evolving regulatory environment can create uncertainty for investors.

Renewable Energy and Sustainable Development:

The growing awareness of climate change is driving significant investment in renewable energy and sustainable development. This sector presents lucrative opportunities for investors.

Solar and Wind Power Investments:

Government incentives and subsidies are making renewable energy projects increasingly attractive. The demand for green energy is escalating due to:

- Climate Change Concerns: The urgency to reduce carbon emissions is driving investment in renewable energy sources.

- Technological Advancements: Improvements in solar panel and wind turbine technology are reducing costs and increasing efficiency.

- Energy Storage Solutions: Advances in battery technology are addressing the intermittency of renewable energy sources.

Market trends project substantial growth in the renewable energy sector in the coming years. However, challenges remain:

- Intermittency: Solar and wind power are intermittent sources, requiring effective energy storage solutions.

- Grid Infrastructure: Upgrading existing grid infrastructure is crucial to accommodate the influx of renewable energy.

Green Technologies and Sustainable Business Practices:

Growing consumer demand for sustainable products and services is driving innovation in green technologies. This includes:

- Eco-friendly Products: Companies are developing and marketing environmentally friendly products across various sectors.

- Sustainable Business Models: Businesses are adopting sustainable practices throughout their operations.

- Government Regulations: Government regulations and standards are promoting sustainable development.

Investing in sustainable businesses offers both financial returns and positive environmental impact. However, potential risks include:

- High Initial Investment Costs: Developing and implementing green technologies can require significant upfront investment.

- Fluctuating Market Demand: Market demand for sustainable products can fluctuate depending on consumer preferences and economic conditions.

Healthcare and Biotechnology Breakthroughs:

The healthcare and biotechnology sectors are experiencing rapid growth, driven by an aging population and advancements in medical technology.

Pharmaceuticals and Medical Devices:

Growing healthcare spending and an aging population are creating high demand for pharmaceutical products and medical devices. This translates into:

- Pharmaceutical Research: Significant investment in pharmaceutical research and development is leading to new drug discoveries.

- Medical Device Innovation: Technological advancements are producing innovative medical devices and improved healthcare solutions.

- Telehealth Expansion: Telehealth platforms are increasing access to healthcare services.

Market projections indicate continued growth in this sector. However, challenges exist:

- Stringent Regulations: The pharmaceutical and medical device industries are heavily regulated, requiring lengthy approval processes.

- High R&D Costs: Research and development in these sectors are expensive and time-consuming.

Biotechnology and Genomics Advancements:

Rapid advancements in genomics and personalized medicine are transforming healthcare. Key areas include:

- Gene Editing Technologies: CRISPR and other gene editing technologies offer the potential to cure genetic diseases.

- Personalized Medicine: Tailoring treatments to individual patients based on their genetic makeup is becoming increasingly common.

- Biotech Startups: A surge in biotech startups is driving innovation in the sector.

While offering tremendous potential, this area also presents risks:

- Ethical Concerns: Gene editing and other biotech advancements raise complex ethical questions.

- High R&D Costs: Developing new biotech therapies is expensive and time-consuming.

- Long Development Timelines: Bringing new therapies to market can take many years.

Conclusion:

This article highlighted the country's most promising business hot spots, including thriving tech hubs, the burgeoning renewable energy sector, and the dynamic healthcare and biotechnology industries. Each area offers significant investment opportunities, but careful consideration of market trends and potential risks is crucial for success. Understanding the nuances of each sector, including the regulatory landscape and potential disruptions, is paramount for making informed investment decisions.

Call to Action: Ready to capitalize on the country's newest business hot spots? Explore these exciting investment opportunities further and discover how you can participate in shaping the future of these dynamic growth areas. Learn more about [link to relevant resource/investment platform]. Don't miss out on the chance to be a part of the next wave of economic expansion!

Featured Posts

-

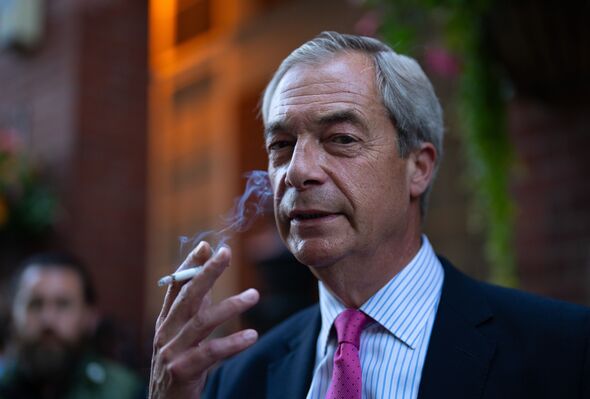

Rupert Lowes Defamation Lawsuit Against Nigel Farage False Allegations

May 04, 2025

Rupert Lowes Defamation Lawsuit Against Nigel Farage False Allegations

May 04, 2025 -

Fabio Christen Se Impone En La Vuelta Ciclista A La Region De Murcia

May 04, 2025

Fabio Christen Se Impone En La Vuelta Ciclista A La Region De Murcia

May 04, 2025 -

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler Tam Bir Rehber

May 04, 2025

Kivinin Kabugu Yenir Mi Oence Bilmeniz Gerekenler Tam Bir Rehber

May 04, 2025 -

Rethinking The 10 Year Mortgage A Canadian Perspective

May 04, 2025

Rethinking The 10 Year Mortgage A Canadian Perspective

May 04, 2025 -

Finding Your Perfect Special Little Bag Size Style And Practicality

May 04, 2025

Finding Your Perfect Special Little Bag Size Style And Practicality

May 04, 2025

Latest Posts

-

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025

Understanding The Recent Gold Price Downturn Back To Back Weekly Losses In 2025

May 04, 2025 -

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025

Golds Unexpected Dip Two Weeks Of Losses In Early 2025

May 04, 2025 -

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025

Analysis Golds Recent Decline And What It Means For Investors In 2025

May 04, 2025 -

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025

Canadiens Vs Oilers Your Morning Coffee Hockey Recap And Outlook

May 04, 2025 -

2025 Gold Market First Double Week Loss Of The Year

May 04, 2025

2025 Gold Market First Double Week Loss Of The Year

May 04, 2025