Riot (RIOT): 52-Week Low And Future Outlook For Investors

Table of Contents

Understanding Riot Platforms' Current Situation

The 52-Week Low: Causes and Context

Riot's recent 52-week low is a result of several converging factors impacting the broader cryptocurrency and Bitcoin mining sectors.

-

Recent Market Volatility in Cryptocurrencies: The cryptocurrency market is inherently volatile. Sharp price swings in Bitcoin directly impact the profitability of Bitcoin mining companies like Riot. A decline in Bitcoin's price reduces the value of mined Bitcoin and the overall revenue generated. This volatility creates significant uncertainty for investors in crypto mining stocks.

-

Impact of Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies globally presents a significant headwind for Bitcoin miners. Changes in regulations, particularly those impacting energy consumption for mining operations or the legal status of Bitcoin itself, can dramatically affect profitability and investor confidence. This uncertainty contributes to the price fluctuations seen in RIOT's stock.

-

Influence of Energy Costs on Mining Profitability: Energy costs are a major expense for Bitcoin mining operations. Fluctuations in energy prices, especially electricity costs, directly impact the profitability of mining. Higher energy prices reduce margins, affecting the overall financial health of mining companies like RIOT and consequently impacting their stock prices.

-

Recent Company-Specific News or Announcements: Any negative company-specific news, such as delays in expansion plans, operational issues, or financial setbacks, can also contribute to a decline in stock price. Keeping abreast of all relevant RIOT announcements is crucial for investors.

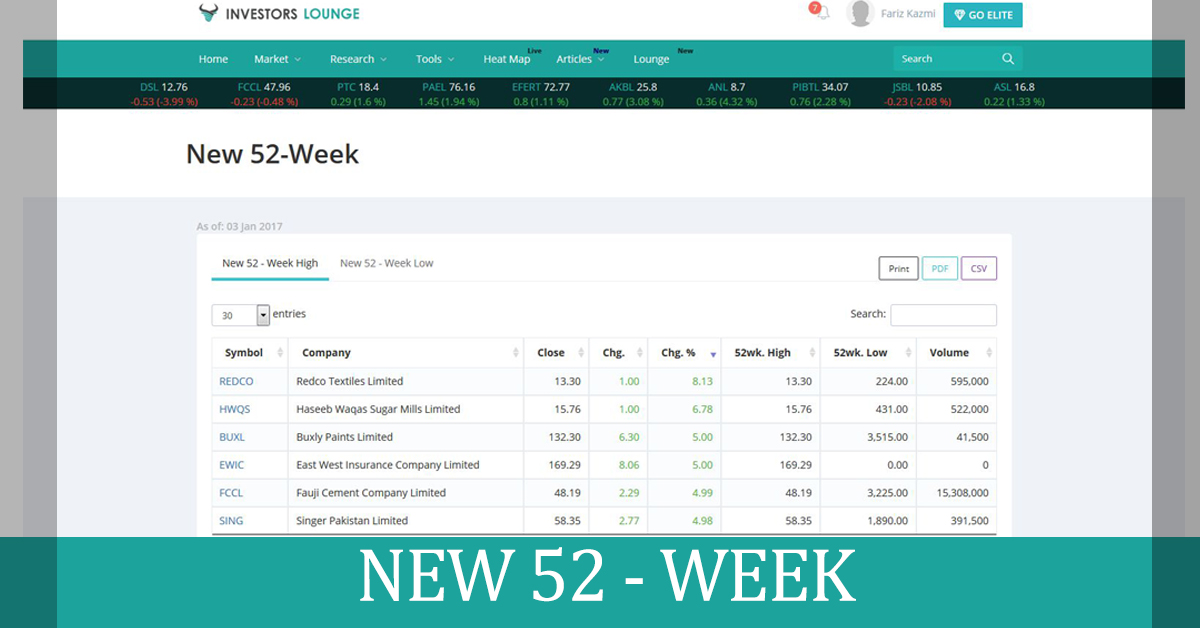

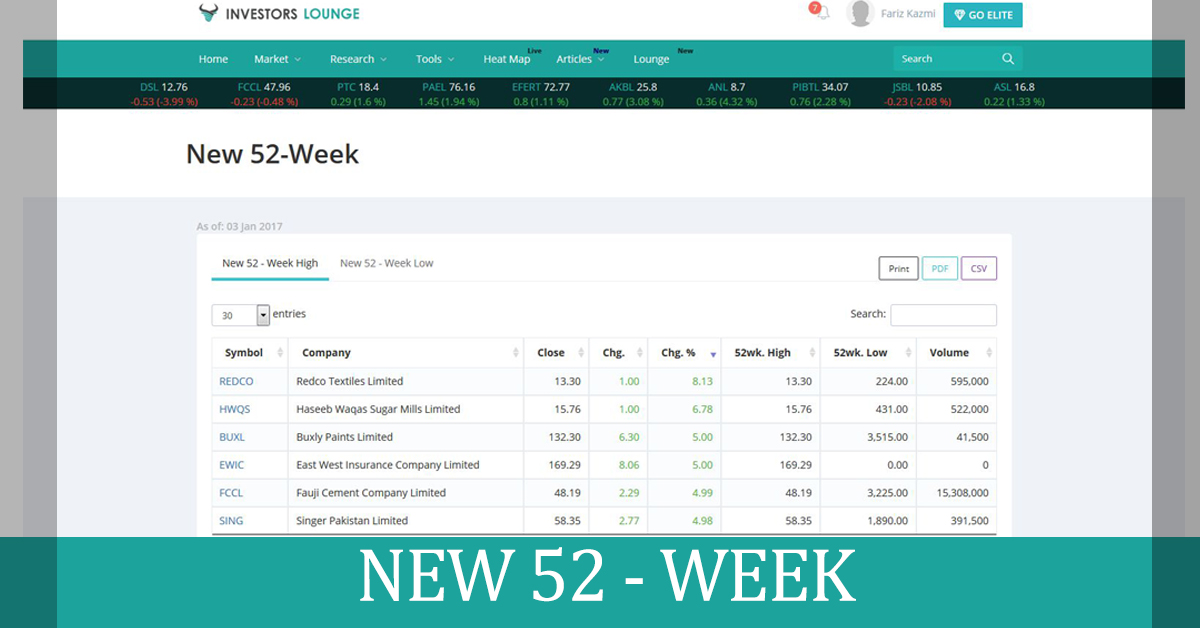

[Insert chart or graph visually representing RIOT's stock price decline over the past year here]

Financial Performance and Key Metrics

Analyzing Riot's recent financial performance is critical to understanding its current situation. Key metrics to consider include:

-

Revenue Streams: Riot's primary revenue stream comes from Bitcoin mining, but it may also have other revenue sources, which should be analyzed for diversification. Understanding the breakdown of these streams provides a clearer picture of the company's financial stability.

-

Mining Hash Rate: The mining hash rate is a crucial indicator of a miner's computational power and ability to successfully mine Bitcoin. A higher hash rate generally translates to greater Bitcoin mining capacity and potential revenue. Monitoring RIOT's hash rate performance is crucial.

-

Bitcoin Holdings and Balance Sheet Impact: Riot typically holds a significant amount of mined Bitcoin, acting as both an operational expense and a potential asset. The value of these holdings directly impacts the company's balance sheet and overall financial strength. Analyzing these holdings' market value is critical.

-

Profitability and Margins: Examining Riot's profitability (net income) and margins (gross profit margin, operating margin) provides a clear picture of its financial health. Comparing these metrics to previous quarters and years reveals trends and potential areas for concern.

Factors Influencing RIOT's Future Outlook

Bitcoin Price and Market Sentiment

The price of Bitcoin is intrinsically linked to the performance of Riot Platforms.

-

Correlation Between Bitcoin's Price and RIOT's Stock Performance: A rise in Bitcoin's price generally leads to increased profitability for Riot and a rise in its stock price. Conversely, a decline in Bitcoin's price negatively impacts RIOT's profitability and stock value. This strong correlation needs to be considered.

-

Potential Future Price Movements of Bitcoin: Predicting future Bitcoin price movements is challenging, but analyzing market trends, technical analysis, and expert opinions can offer insights into potential scenarios and their impact on RIOT.

-

Investor Sentiment Towards Bitcoin and the Crypto Market: Investor sentiment plays a significant role in the price of both Bitcoin and RIOT stock. Positive sentiment can drive up prices, while negative sentiment can cause a decline.

Regulatory Landscape and its Impact

Regulatory changes significantly influence the Bitcoin mining industry.

-

Ongoing Regulatory Developments Affecting Cryptocurrency Mining: Governments worldwide are actively developing regulations for cryptocurrencies, including Bitcoin mining. These regulations can impact energy consumption, taxation, and the overall legality of mining operations.

-

Potential Changes to Mining Regulations in Key Jurisdictions: Changes in key jurisdictions where Riot operates will have a direct impact on the company's operations and profitability. Careful monitoring of these regulatory changes is critical.

-

Impact of Potential Legislation on RIOT's Operations: The passage of restrictive legislation could significantly impact RIOT’s operations, potentially leading to reduced profitability or even operational limitations.

Technological Advancements and Competitive Landscape

The Bitcoin mining industry is constantly evolving.

-

Advancements in Mining Technology: Technological advancements in mining hardware (ASICs) continuously improve efficiency and reduce energy consumption. Riot's ability to adapt to these advancements is crucial for maintaining its competitive edge.

-

Competitive Landscape within the Bitcoin Mining Industry: The Bitcoin mining industry is competitive, with several other significant players. Analyzing the strengths and weaknesses of competitors, including their mining capacity, operational efficiency, and financial resources, helps to understand Riot's position within the market.

-

RIOT's Competitive Advantages and Potential Challenges: Riot needs to identify and leverage its competitive advantages, such as its technological innovation, operational efficiency, and strategic partnerships, while mitigating potential challenges posed by competitors.

Is RIOT a Buy at its 52-Week Low?

Risk Assessment and Potential Rewards

Investing in RIOT carries inherent risks:

-

Key Risks Associated with Investing in RIOT: These include volatility in the cryptocurrency market, regulatory uncertainty, changes in energy costs, and competition from other Bitcoin miners. A thorough understanding of these risks is crucial.

-

Potential for Significant Returns: Despite the risks, investing in RIOT at its 52-week low offers the potential for significant returns if the Bitcoin price rises and the company performs well. This potential needs to be carefully weighed against the risks.

-

Volatility of the Cryptocurrency Market: The inherent volatility of the cryptocurrency market means that RIOT's stock price is likely to remain highly volatile.

Investment Strategies and Considerations

Several investment strategies can be considered:

-

Different Investment Strategies (e.g., buy-and-hold, dollar-cost averaging): The choice of investment strategy depends on the investor's risk tolerance and financial goals. Dollar-cost averaging, for example, can help mitigate some risk.

-

Diversification as a Risk-Mitigation Strategy: Diversifying one's portfolio by investing in other asset classes reduces the overall risk associated with investing in RIOT.

-

Alternative Investment Options within the Crypto Mining Sector: Investors should also consider other crypto mining companies to diversify within the sector and mitigate risk further.

Conclusion

This analysis of Riot Platforms (RIOT) highlights both the challenges and opportunities presented by its recent 52-week low. The future performance of RIOT hinges on several critical factors, including the price of Bitcoin, regulatory developments, and technological advancements in the Bitcoin mining sector. A thorough understanding of these factors, as well as a careful assessment of the associated risks and rewards, is crucial for any investor considering adding RIOT to their portfolio.

Call to Action: Are you considering adding Riot (RIOT) to your portfolio? Remember that thorough research is essential before making any investment decisions in the volatile cryptocurrency mining sector. Consult with a qualified financial advisor to assess your risk tolerance and develop a suitable investment strategy. Continue monitoring the evolving landscape of Bitcoin mining and its impact on RIOT's future prospects. Remember that diversification is key in managing investment risk within the crypto mining sector and beyond. Thorough due diligence is crucial before investing in RIOT or any other cryptocurrency mining stocks.

Featured Posts

-

Christina Aguileras Transformation The Details Behind Her Youthful Look

May 02, 2025

Christina Aguileras Transformation The Details Behind Her Youthful Look

May 02, 2025 -

Airbus Us Airlines Responsible For Tariff Payments

May 02, 2025

Airbus Us Airlines Responsible For Tariff Payments

May 02, 2025 -

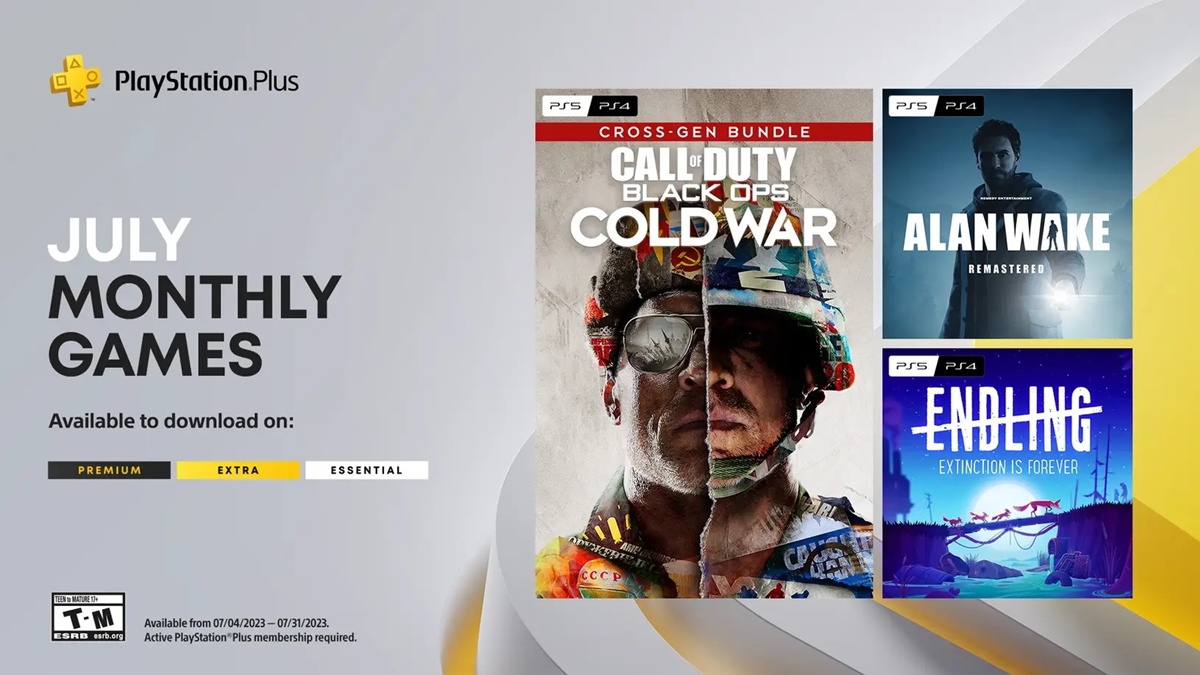

A Sleeper Hit On Ps Plus Game Name 2024

May 02, 2025

A Sleeper Hit On Ps Plus Game Name 2024

May 02, 2025 -

Fortnite Wwe Skins Obtaining Cody Rhodes And The Undertaker

May 02, 2025

Fortnite Wwe Skins Obtaining Cody Rhodes And The Undertaker

May 02, 2025 -

View The Daily Lotto Results For Tuesday 15th April 2025

May 02, 2025

View The Daily Lotto Results For Tuesday 15th April 2025

May 02, 2025

Latest Posts

-

Shrewsbury Visit Farage Attacks Conservatives On Relief Road Plans

May 03, 2025

Shrewsbury Visit Farage Attacks Conservatives On Relief Road Plans

May 03, 2025 -

Mariya Zakharova O Semeynoy Zhizni Emmanuelya I Brizhit Makron

May 03, 2025

Mariya Zakharova O Semeynoy Zhizni Emmanuelya I Brizhit Makron

May 03, 2025 -

Nigel Farages Shrewsbury Visit Flat Cap G And T And Tory Criticism

May 03, 2025

Nigel Farages Shrewsbury Visit Flat Cap G And T And Tory Criticism

May 03, 2025 -

Nigel Farage Whats App Leaks Fuel Reform Party Crisis

May 03, 2025

Nigel Farage Whats App Leaks Fuel Reform Party Crisis

May 03, 2025 -

Defamation Lawsuit Rupert Lowe Takes Legal Action Against Nigel Farage

May 03, 2025

Defamation Lawsuit Rupert Lowe Takes Legal Action Against Nigel Farage

May 03, 2025