Ripple Lawsuit: SEC Considers XRP Commodity Classification In Settlement Talks

Table of Contents

The SEC's Case Against Ripple and its Arguments

The SEC's initial complaint against Ripple Labs, Brad Garlinghouse (CEO), and Christian Larsen (Executive Chairman) alleged the unregistered sale of XRP as a security. The SEC argues that Ripple's distribution of XRP constituted an ongoing securities offering, violating federal securities laws. Their central argument rests on the Howey Test, a legal framework used to determine whether an investment contract qualifies as a security.

- The Howey Test: The SEC argues that XRP satisfies all prongs of the Howey Test: investment of money, in a common enterprise, with a reasonable expectation of profits derived from the efforts of others. They point to Ripple's marketing efforts and the potential for profit from XRP's price appreciation.

- Evidence Presented by the SEC: The SEC presented evidence of Ripple's internal communications, sales strategies, and XRP distributions to institutional investors, all allegedly suggesting an intent to raise capital through the sale of unregistered securities.

- Key Figures: The lawsuit centers around the actions of Ripple's leadership, Brad Garlinghouse and Christian Larsen, with the SEC alleging their direct involvement in the alleged unregistered securities offerings.

Ripple's Defense and Counterarguments

Ripple's defense vigorously contests the SEC's claims, arguing that XRP is a decentralized digital asset functioning as a currency or utility token, not a security. Their strategy focuses on highlighting XRP's operational independence from Ripple and its widespread use in various applications beyond Ripple's control.

- Decentralization and Utility: Ripple emphasizes that XRP operates on a decentralized, open-source blockchain, independent of Ripple's direct control. They argue that its use in cross-border payments and other applications demonstrates its utility as a currency, not an investment contract.

- Evidence Presented by Ripple: Ripple has presented evidence showcasing the decentralized nature of XRP, its widespread adoption, and the active participation of numerous independent exchanges and developers in the XRP ecosystem.

- Legal Strategies: Ripple has employed various legal strategies, including expert witnesses on blockchain technology and financial markets, to support its claim that XRP should not be classified as a security.

The Potential for Settlement and XRP Commodity Classification

Settlement negotiations between the SEC and Ripple are ongoing. A crucial aspect under consideration is the potential reclassification of XRP as a commodity. This would represent a significant shift from the SEC's initial stance.

- Impact on XRP's Price and Market Capitalization: A commodity classification could lead to a surge in XRP's price, as it would remove the regulatory uncertainty currently weighing on the market. Its market capitalization could also see substantial growth.

- Effects on Ripple's Business Operations: A favorable settlement could significantly boost Ripple's business prospects, allowing it to operate more freely without the looming threat of securities violations.

- Wider Consequences: The outcome will set a crucial precedent for how other cryptocurrency projects are regulated, influencing investor confidence and shaping the future of crypto regulation.

The Broader Implications for the Crypto Industry

The Ripple lawsuit's outcome has far-reaching implications for the entire cryptocurrency industry. Its impact extends beyond XRP, potentially influencing the regulatory landscape and investor sentiment.

- Future SEC Enforcement Actions: The ruling will guide future SEC enforcement actions against other crypto projects, setting a precedent for how digital assets are classified and regulated.

- Investor Confidence and Market Sentiment: A clear and favorable resolution could restore investor confidence, potentially leading to increased investment in the crypto market. Conversely, a negative outcome could severely damage market sentiment.

- Need for Clearer Regulatory Frameworks: The lawsuit highlights the urgent need for clear and comprehensive regulatory frameworks for cryptocurrencies, providing much-needed clarity and stability for investors and businesses operating in the space.

Conclusion: Ripple Lawsuit and the Future of XRP Classification

The SEC vs. Ripple lawsuit presents a complex legal battle with significant ramifications for the future of cryptocurrency regulation. Both sides have presented compelling arguments, with the SEC emphasizing the Howey Test and Ripple focusing on XRP’s decentralized nature and utility. The possibility of the SEC considering XRP a commodity in a potential settlement underscores the evolving landscape of digital asset classification. Staying informed about the developments in the Ripple Lawsuit is crucial for investors and anyone involved in the crypto community. To stay updated, follow reputable news sources covering the case and consult legal professionals for advice tailored to your specific circumstances. The Ripple Lawsuit’s resolution will undoubtedly reshape the future of XRP classification and the crypto market at large.

Featured Posts

-

Dragons Den Backs Omnis Plant Based Dog Food Brand

May 01, 2025

Dragons Den Backs Omnis Plant Based Dog Food Brand

May 01, 2025 -

Trtyb Alhdafyn Fy Aldwry Alinjlyzy Haland Ytsdr Bed Hdfh Fy Twtnham

May 01, 2025

Trtyb Alhdafyn Fy Aldwry Alinjlyzy Haland Ytsdr Bed Hdfh Fy Twtnham

May 01, 2025 -

Crisis In De Tbs Meer Capaciteit Dringend Nodig

May 01, 2025

Crisis In De Tbs Meer Capaciteit Dringend Nodig

May 01, 2025 -

Shrimp Ramen Stir Fry Customize Your Flavor Profile

May 01, 2025

Shrimp Ramen Stir Fry Customize Your Flavor Profile

May 01, 2025 -

Tbs Klinieken Structureel Overvol En Te Weinig Capaciteit

May 01, 2025

Tbs Klinieken Structureel Overvol En Te Weinig Capaciteit

May 01, 2025

Latest Posts

-

Jalen Hurts White House Absence Trumps Tush Push Remark Steals Spotlight

May 01, 2025

Jalen Hurts White House Absence Trumps Tush Push Remark Steals Spotlight

May 01, 2025 -

Exclusive Details On Trumps Automotive Tariff Mitigation

May 01, 2025

Exclusive Details On Trumps Automotive Tariff Mitigation

May 01, 2025 -

Exclusive Deal Closed Wall Street Banks Complete Sale Of Elon Musks X Corp Debt

May 01, 2025

Exclusive Deal Closed Wall Street Banks Complete Sale Of Elon Musks X Corp Debt

May 01, 2025 -

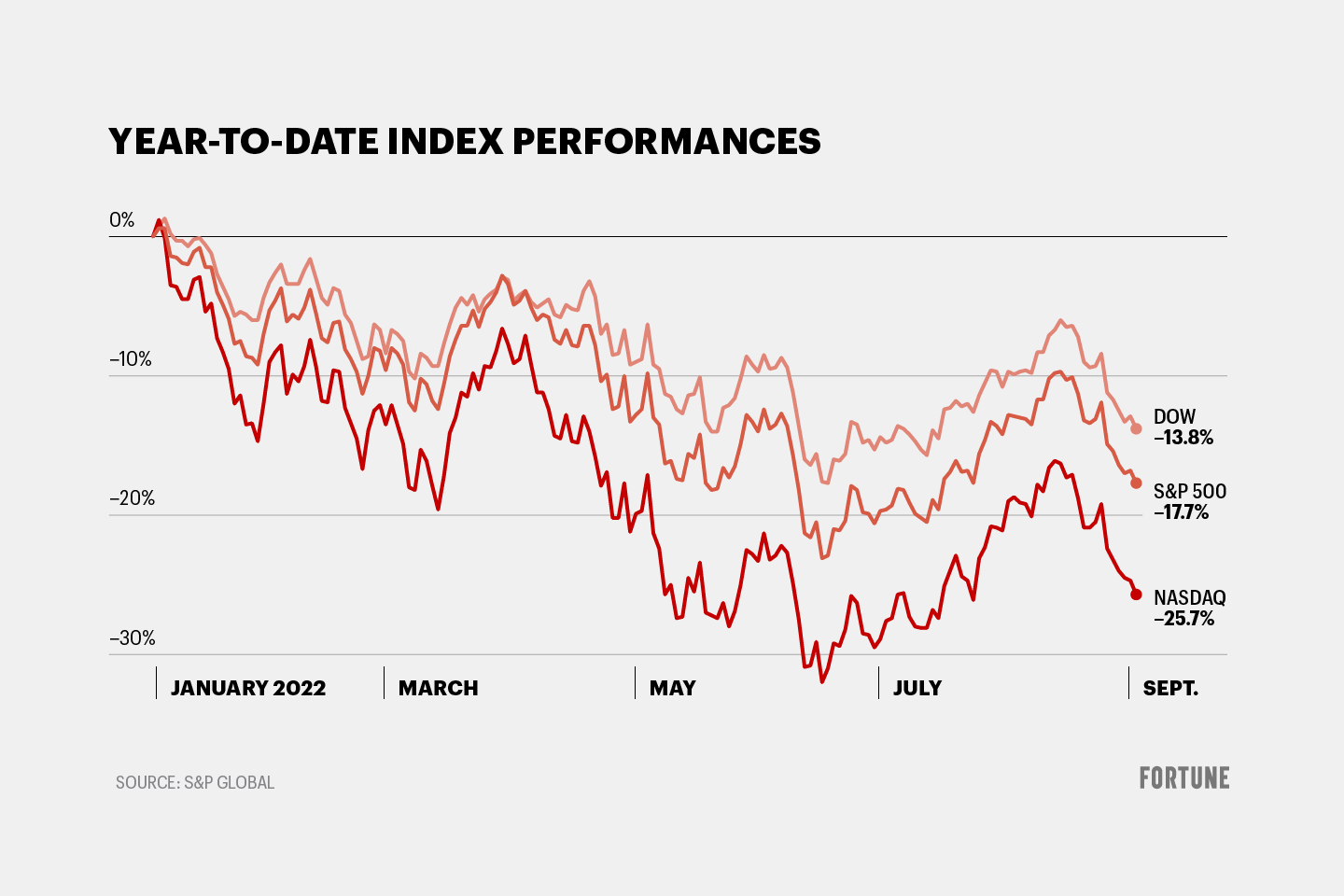

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025

Analyzing Todays Stock Market Dow Futures Earnings And Market Trends

May 01, 2025 -

Exclusive Final Sale Of Elon Musks X Debt By Wall Street Banks

May 01, 2025

Exclusive Final Sale Of Elon Musks X Debt By Wall Street Banks

May 01, 2025