Ripple (XRP) Price Surge: Will It Reach $3.40?

Table of Contents

Current Market Conditions and Ripple's Performance

Understanding the current cryptocurrency market landscape is crucial to assessing Ripple (XRP)'s potential. The overall market sentiment, often heavily influenced by Bitcoin's price movements, significantly impacts altcoins like XRP. A bullish Bitcoin market often leads to increased interest in altcoins, potentially driving up their prices, while a bearish Bitcoin market can result in widespread sell-offs.

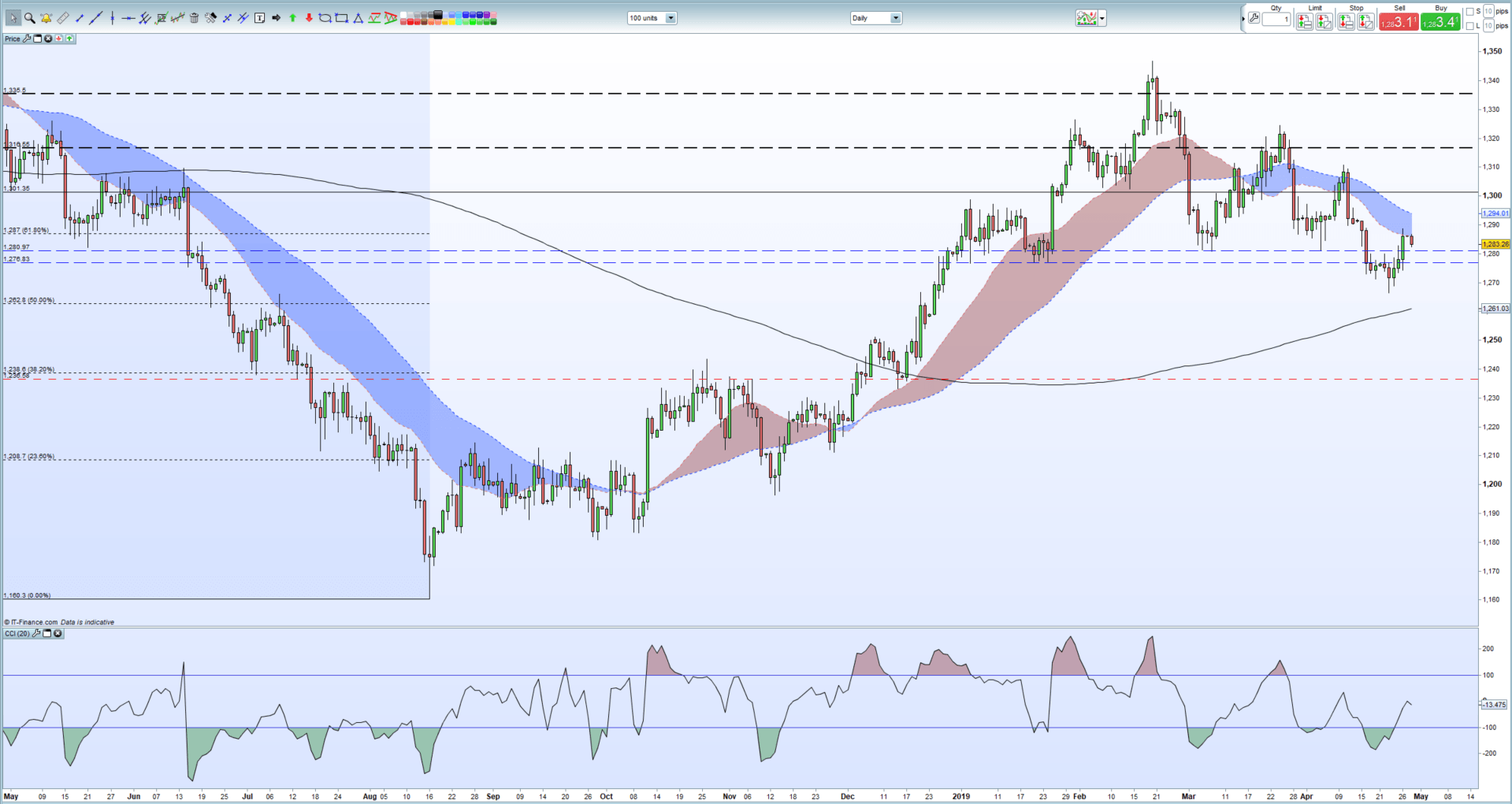

XRP's recent price performance has been a rollercoaster. We've seen periods of significant gains fueled by positive news and periods of decline influenced by market corrections and negative headlines. Analyzing XRP's price charts, we can identify key trends.

- Recent XRP price highs and lows: Tracking these highs and lows provides a visual representation of the volatility.

- Trading volume analysis: High trading volume often indicates increased interest and potential for further price movements.

- Market capitalization changes: Monitoring XRP's market cap helps understand its position relative to other cryptocurrencies.

- Comparison to other major cryptocurrencies: Comparing XRP's performance to Bitcoin, Ethereum, and other major cryptocurrencies provides context for its price movements. (Insert relevant charts and graphs here illustrating these points).

Factors Influencing XRP Price

Several key factors could potentially propel XRP to $3.40, although reaching this price point is by no means guaranteed.

The SEC Lawsuit and its Impact

The ongoing SEC lawsuit against Ripple Labs significantly impacts XRP's price. A favorable resolution could trigger a substantial price surge, while an unfavorable outcome could lead to a significant decline. The uncertainty surrounding the lawsuit creates volatility, making accurate price prediction challenging.

Adoption and Partnerships

The growing adoption of XRP in payment systems and its partnerships with financial institutions are crucial factors. Increased usage and collaborations with established players enhance XRP's credibility and potential for mainstream adoption. Examples of significant partnerships and their subsequent impact on XRP's price should be detailed here.

Technological Developments

Ongoing technological upgrades and innovations within the Ripple network are also important. Improvements in transaction speed, scalability, and security could attract more users and investors, positively impacting the price.

- Impact of positive legal news: Positive developments in the SEC lawsuit could dramatically boost the price.

- Increased institutional adoption: Large financial institutions adopting XRP for transactions increases its legitimacy and demand.

- New partnerships and collaborations: Strategic alliances with key players broaden XRP's reach and utility.

- Technological advancements in the Ripple network: Upgrades to the network's infrastructure can improve its efficiency and attractiveness.

Technical Analysis and Price Prediction

Technical analysis, employing indicators like moving averages, support and resistance levels, and the relative strength index (RSI), offers insights into XRP's potential price trajectory. However, it's crucial to remember that technical analysis is not an exact science.

Various analysts and experts offer price predictions, ranging from conservative estimates to significantly more bullish projections. It's vital to consider diverse opinions and understand the underlying assumptions of each prediction.

- Technical chart analysis: Examining charts reveals trends, support, and resistance levels.

- Support and resistance levels: Identifying these levels helps predict potential price reversals.

- Price prediction ranges from various sources: Comparing predictions from reputable sources provides a balanced perspective.

- Disclaimer on the inherent volatility of cryptocurrency: Always emphasize the unpredictable nature of crypto markets.

Risks and Considerations

Investing in XRP, aiming for a $3.40 price target, involves substantial risks. It's crucial to have realistic expectations.

- Market volatility risks: The cryptocurrency market is notoriously volatile, and XRP is no exception.

- Regulatory uncertainty: Regulatory changes can significantly impact the price of cryptocurrencies.

- Competition from other cryptocurrencies: XRP faces competition from other digital assets vying for market share.

- Importance of diversification: Diversifying your investment portfolio reduces overall risk.

Conclusion

The Ripple (XRP) price is influenced by a complex interplay of market conditions, legal developments, adoption rates, and technological advancements. While the potential for price increases exists, particularly if the SEC lawsuit concludes favorably and adoption grows, substantial risks and uncertainties remain. Before investing in Ripple (XRP), it is vital to conduct thorough research, analyze Ripple (XRP) price predictions from multiple sources, and understand Ripple (XRP) risks. Remember to manage your investments responsibly and diversify your portfolio to mitigate potential losses. Research Ripple (XRP) carefully before making any investment decisions.

Featured Posts

-

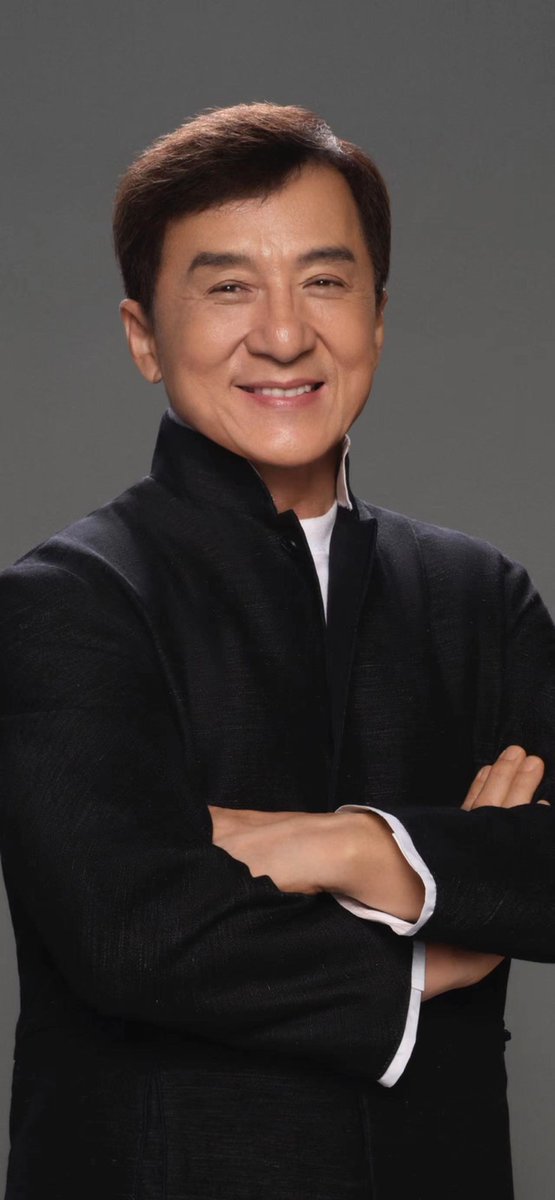

Jaky Shan Yhsl Ela Jayzt Injaz Alemr Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025

Jaky Shan Yhsl Ela Jayzt Injaz Alemr Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025 -

Biles Seeks Police Intervention After Receiving Threatening Messages

May 07, 2025

Biles Seeks Police Intervention After Receiving Threatening Messages

May 07, 2025 -

See The Winning Lotto Numbers April 16 2025

May 07, 2025

See The Winning Lotto Numbers April 16 2025

May 07, 2025 -

Ovechkins Mystery Training Partner Former Nhl Star Kasparaitis

May 07, 2025

Ovechkins Mystery Training Partner Former Nhl Star Kasparaitis

May 07, 2025 -

Minnesota Timberwolves Unexpected Contenders In The Western Conference

May 07, 2025

Minnesota Timberwolves Unexpected Contenders In The Western Conference

May 07, 2025

Latest Posts

-

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Rebound Potential

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Rebound Potential

May 08, 2025 -

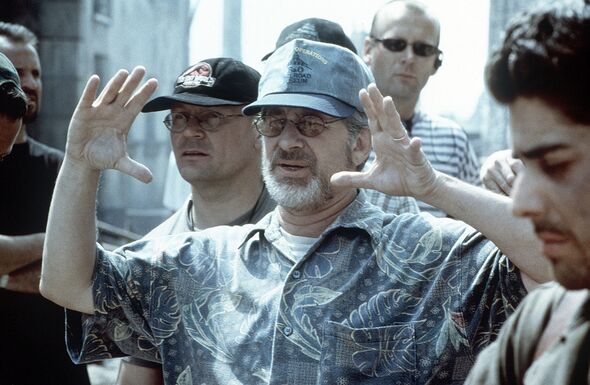

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Saving Private Ryans Unscripted Moment A Cinematic Masterpiece

May 08, 2025

Saving Private Ryans Unscripted Moment A Cinematic Masterpiece

May 08, 2025 -

Ethereum Market Crash 67 M In Liquidations Warning Signs

May 08, 2025

Ethereum Market Crash 67 M In Liquidations Warning Signs

May 08, 2025 -

Ethereum Price Rebound A Weekly Chart Indicator Signals A Potential Buying Opportunity

May 08, 2025

Ethereum Price Rebound A Weekly Chart Indicator Signals A Potential Buying Opportunity

May 08, 2025