Ripple's XRP: Can It Overcome Resistance To Reach $3.40?

Table of Contents

Analyzing XRP's Current Market Position and Technical Indicators

Technical Analysis of XRP Charts

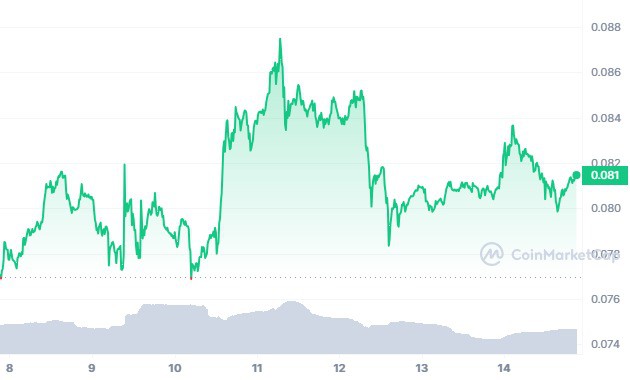

Analyzing XRP charts is crucial for predicting its future price movement. The $3.40 price point represents a significant resistance level. Breaking through this barrier would signal a strong bullish trend. Examining technical indicators helps us gauge the strength of this potential move.

-

Support and Resistance Levels: Identifying key support and resistance levels on the XRP chart—using daily, weekly, and monthly timeframes—is essential. A break above the $3.40 resistance could trigger a significant price surge. Conversely, failure to break this resistance could lead to further consolidation or a price drop. Analyzing the historical performance of XRP at these levels provides valuable insights. Keywords: XRP technical analysis, XRP charts, XRP support resistance.

-

Moving Averages: The 50-day and 200-day moving averages provide insight into the short-term and long-term trends. A bullish crossover (50-day MA crossing above the 200-day MA) would suggest a positive long-term outlook. Conversely, a bearish crossover would signal caution.

-

Technical Indicators: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands can offer further confirmation of trends. Overbought or oversold conditions indicated by the RSI can signal potential price reversals. MACD crossovers can highlight momentum shifts, while Bollinger Bands show price volatility and potential breakout points. Analyzing these indicators in conjunction with price action helps in formulating a more accurate XRP price prediction.

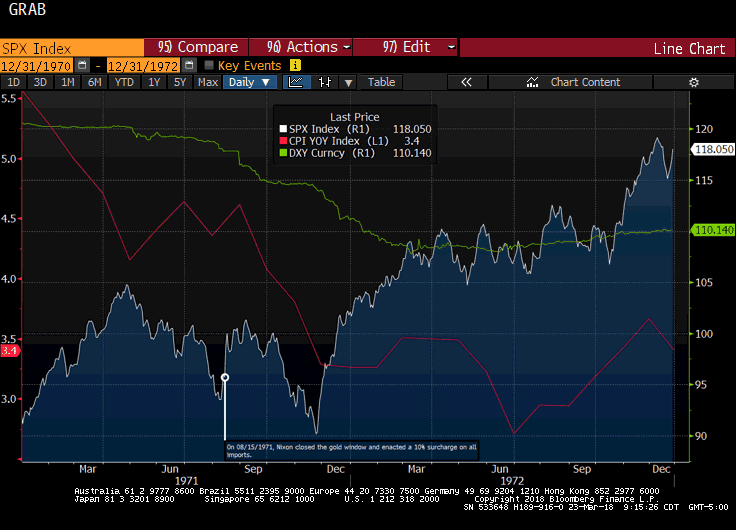

(Include relevant charts and graphs here illustrating the above points.)

Fundamental Analysis of Ripple and XRP

Fundamental analysis considers factors beyond just price charts. Ripple's ongoing legal battle with the SEC significantly impacts XRP's price. Adoption rates and partnerships also play crucial roles.

-

Ripple SEC Lawsuit: The outcome of the Ripple SEC lawsuit is a major determinant of XRP's future. A favorable ruling could significantly boost investor confidence and propel the price upwards. Conversely, an unfavorable outcome could lead to a substantial price decline. Keywords: Ripple SEC lawsuit, XRP adoption, Ripple partnerships, XRP fundamentals.

-

XRP Adoption: The increasing adoption of XRP by financial institutions and payment providers is a positive sign. Wider adoption translates to increased demand and potential price appreciation. Tracking the number of institutions utilizing XRP for cross-border payments is vital in understanding its future value.

-

Ripple Partnerships: Ripple's strategic partnerships and collaborations significantly influence XRP's value. New partnerships with major financial institutions can drive increased demand and lead to higher prices. Analyzing the impact of existing partnerships and any new collaborations is crucial for an accurate XRP forecast.

Factors that Could Drive XRP to $3.40

Increased Institutional Adoption

Increased institutional investment is a key factor that could push XRP to $3.40. Large-scale buy-ins from institutional investors can create significant upward pressure on the price.

-

Institutional XRP Investment: The entry of large institutional investors like hedge funds and asset management firms into the XRP market can trigger substantial price increases. Increased institutional interest would signal a growing confidence in XRP's potential. Keywords: Institutional XRP investment, XRP institutional adoption, large XRP buyers.

-

Catalysts for Institutional Interest: Positive regulatory developments, successful partnerships, or significant technological advancements could attract institutional investors, leading to a surge in demand and price.

Positive Regulatory Developments

Regulatory clarity is paramount for cryptocurrency adoption. A positive outcome in the SEC lawsuit or other favorable regulatory developments could significantly boost XRP's price.

-

XRP Regulation: Clear regulatory frameworks for cryptocurrencies, particularly a favorable ruling in the SEC lawsuit, could significantly increase investor confidence and unlock institutional investment. Keywords: XRP regulation, SEC XRP lawsuit outcome, XRP regulatory clarity.

-

Impact of Regulatory Clarity: Regulatory certainty reduces uncertainty and risk, encouraging greater participation from institutional investors and mainstream adoption. This would likely lead to a sustained price increase.

Growing Demand for Cross-Border Payments

XRP's technology is designed to facilitate efficient and cost-effective cross-border payments. Increased demand for such solutions could drive XRP's price higher.

-

XRP Cross-Border Payments: The increasing need for fast, cheap, and transparent international money transfers fuels the demand for XRP as a solution. Keywords: XRP cross-border payments, XRP payment solutions, XRP remittance.

-

Increased Usage in Payments Industry: Wider adoption of XRP by payment providers and financial institutions would increase its utility and demand, potentially driving price appreciation.

Challenges and Risks Hindering XRP's Ascent to $3.40

Ongoing Legal Uncertainty

The ongoing SEC lawsuit remains a major risk. An unfavorable outcome could significantly impact XRP's price.

-

XRP Legal Risks: The uncertainty surrounding the SEC lawsuit creates volatility and could deter potential investors. Negative news related to the lawsuit can trigger price drops. Keywords: XRP legal risks, SEC lawsuit XRP impact.

-

Potential Negative Outcomes: A ruling against Ripple could negatively impact investor sentiment and lead to a significant decline in XRP's price.

Market Volatility and Crypto Market Sentiment

The cryptocurrency market is inherently volatile. Overall market sentiment significantly influences XRP's price.

-

XRP Market Volatility: The cryptocurrency market is prone to sudden price swings. Negative market sentiment can trigger widespread sell-offs, impacting XRP's price. Keywords: XRP market volatility, crypto market sentiment, XRP price fluctuations.

-

Influence of Market Corrections: Broader market corrections can severely impact XRP's price, regardless of its underlying fundamentals.

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies offering similar functionalities.

- XRP Competitors: Several other cryptocurrencies compete with XRP in the cross-border payment space. The competitive landscape affects XRP's market share and price. Keywords: XRP competitors, XRP market competition.

Conclusion: The Verdict on XRP Reaching $3.40

Whether XRP reaches $3.40 depends on a confluence of factors. While increased institutional adoption, positive regulatory developments, and growing demand for cross-border payments could propel XRP higher, the ongoing legal uncertainty, market volatility, and competition present significant challenges. A balanced perspective considers both technical analysis (XRP charts, indicators) and fundamental analysis (Ripple's legal battles, XRP adoption). Reaching $3.40 requires a combination of favorable outcomes and sustained market momentum. Conduct thorough research, monitor XRP price movements, and stay updated on developments within the Ripple ecosystem to make informed decisions. Remember, investing in cryptocurrencies carries inherent risks. Consider the potential for $3.40 XRP alongside a comprehensive understanding of the market dynamics and the inherent volatility of the cryptocurrency space.

Featured Posts

-

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025

Bitcoin Rebound Is This The Start Of A New Bull Run

May 08, 2025 -

Navigating The Stock Market In The Shadow Of Liberation Day Tariffs

May 08, 2025

Navigating The Stock Market In The Shadow Of Liberation Day Tariffs

May 08, 2025 -

Buy Signal Flashes On Ethereum Weekly Chart Analyzing The Potential For A Rebound

May 08, 2025

Buy Signal Flashes On Ethereum Weekly Chart Analyzing The Potential For A Rebound

May 08, 2025 -

The Night Counting Crows Changed Snls Influence On Their Success

May 08, 2025

The Night Counting Crows Changed Snls Influence On Their Success

May 08, 2025 -

Speculation Counting Crows 2025 Concert Setlist

May 08, 2025

Speculation Counting Crows 2025 Concert Setlist

May 08, 2025