S&P/TSX Composite Index: Canada's Markets Hit New Intraday Record

Table of Contents

Key Factors Driving the S&P/TSX Composite Index's Record High

Several interconnected factors have propelled the S&P/TSX Composite Index to its new intraday high. Understanding these drivers is crucial for navigating the Canadian equity market effectively.

Strong Performance Across Sectors

The recent record high isn't solely driven by one sector; instead, it's a testament to broad-based strength across the Canadian economy.

-

Energy Sector Boom: The energy sector has been a significant contributor, fueled by rising global commodity prices, particularly oil and natural gas. Companies like Suncor Energy and Canadian Natural Resources have seen substantial gains, directly impacting the S&P/TSX Composite Index's overall performance. This sector’s growth reflects increased global demand and ongoing geopolitical instability. The market capitalization of energy companies has increased significantly, pushing the index higher.

-

Technology Sector Innovation: The technology sector has also shown robust growth, driven by advancements in artificial intelligence, clean technology, and other innovative fields. Companies focused on software, cybersecurity, and renewable energy solutions have experienced strong investor interest. This growth signifies Canada’s position as a growing hub for technological innovation.

-

Financials Showing Strength: The financial sector, encompassing banks and insurance companies, has also performed well, reflecting a healthy Canadian economy and increased lending activity. Strong earnings reports and positive outlooks from major financial institutions have bolstered investor confidence.

Positive Economic Indicators

Positive macroeconomic indicators have significantly contributed to the bullish sentiment surrounding the Canadian stock market.

-

Robust GDP Growth: Canada has seen consistent GDP growth, signaling a healthy and expanding economy. This positive economic momentum attracts both domestic and foreign investment.

-

Low Unemployment Rate: A low unemployment rate demonstrates a strong labor market, supporting consumer spending and business investment. This contributes to a positive feedback loop that boosts economic activity.

-

Controlled Inflation: While inflation remains a concern globally, Canada has managed to keep inflation relatively under control, boosting investor confidence and reducing uncertainty. This stability makes the Canadian market attractive to investors seeking less volatile environments.

-

Government Initiatives: Government policies supporting infrastructure development and innovation have also played a crucial role in fostering economic growth and investor confidence. These initiatives create a favourable environment for businesses to thrive and expand.

Global Market Influences

The performance of the S&P/TSX Composite Index is not isolated from global market trends.

-

Global Economic Growth: While global economic uncertainty persists, moderate global growth has positively impacted the Canadian market, with international investors showing continued interest in Canadian assets.

-

Correlation with Global Indices: The TSX exhibits a degree of correlation with major global indices like the Dow Jones and S&P 500, indicating that global market sentiment can influence the Canadian market's performance. Positive trends in these global indices often translate into positive movements in the TSX.

-

Geopolitical Events: Global events, both positive and negative, can significantly affect investor sentiment and consequently, the performance of the S&P/TSX Composite Index. For example, global geopolitical instability can increase demand for safe haven assets, indirectly impacting the Canadian market.

Implications for Investors

The record high of the S&P/TSX Composite Index presents both opportunities and challenges for investors.

Investment Opportunities

The current market conditions offer several attractive investment opportunities.

-

Sector-Specific Investments: Investors can capitalize on the strong performance of specific sectors like energy and technology by carefully selecting well-performing companies within those sectors.

-

Value Investing Strategy: Some investors might find undervalued companies within the market, presenting opportunities for long-term growth.

-

Growth Investing Strategy: Investing in companies with high growth potential, particularly in the technology and renewable energy sectors, could yield significant returns.

Risk Management Considerations

While the market presents opportunities, investors should also be aware of potential risks.

-

Market Volatility: Markets are inherently volatile, and even during periods of growth, corrections can occur. Investors should be prepared for potential downturns.

-

Portfolio Diversification: Diversifying investments across different sectors and asset classes is crucial to mitigate risk and reduce the impact of any single sector's underperformance.

-

Risk Tolerance Assessment: Investors should carefully assess their own risk tolerance before making any investment decisions. Understanding one's own risk profile is essential for making sound investment choices.

Long-Term Outlook for the S&P/TSX Composite Index

Predicting the future trajectory of the S&P/TSX Composite Index is challenging, but several factors suggest a positive, though potentially volatile, long-term outlook.

-

Continued Economic Growth: Sustained economic growth in Canada is expected to support the continued upward trajectory of the index.

-

Global Economic Conditions: The global economic landscape will continue to play a crucial role in influencing the index's performance.

-

Potential Corrections: It's crucial to acknowledge the possibility of market corrections; investors should prepare for potential volatility and adjust their strategies accordingly.

Conclusion

The S&P/TSX Composite Index reaching a new intraday high signifies a positive outlook for the Canadian stock market. This impressive achievement is driven by robust performance across multiple sectors, favourable economic indicators, and positive global market influences. While substantial investment opportunities exist, investors should exercise caution, carefully manage risk, and diversify their portfolios.

Call to Action: Stay informed about the evolving dynamics of the S&P/TSX Composite Index and explore the potential investment opportunities within the thriving Canadian equity market. Understanding the factors influencing the S&P/TSX Composite Index is crucial for making informed investment decisions. Monitor the index closely and consult with a qualified financial advisor before making any significant investment choices.

Featured Posts

-

Indias Greenko Founders Target Orix Stake Acquisition

May 17, 2025

Indias Greenko Founders Target Orix Stake Acquisition

May 17, 2025 -

High School Confidential Week 26 In 2024 25

May 17, 2025

High School Confidential Week 26 In 2024 25

May 17, 2025 -

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025

Thibodeaus Transformation Overcoming Past Flaws To Resurrect The Knicks

May 17, 2025 -

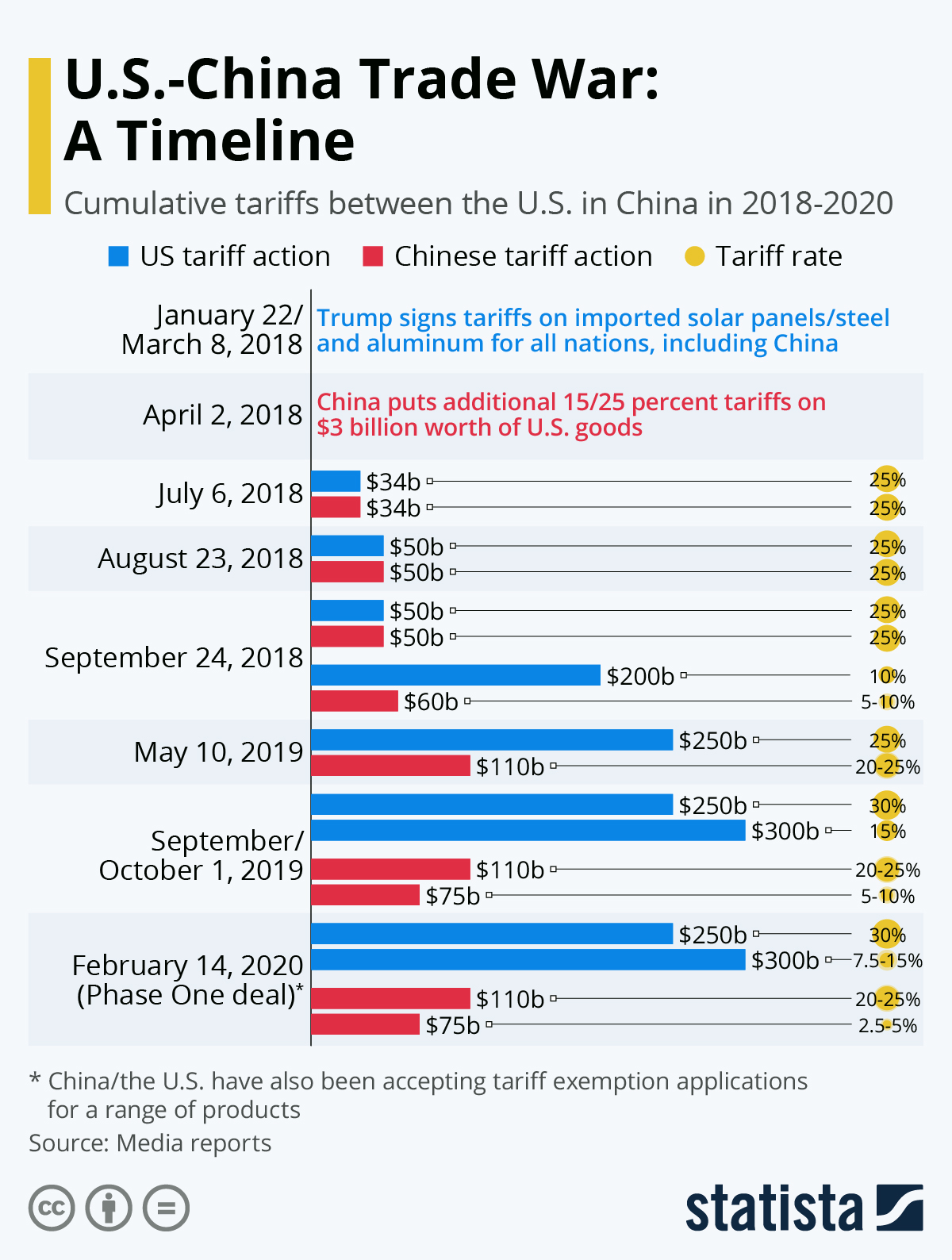

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025

Trumps 30 Tariffs On China An Extended Forecast Through 2025

May 17, 2025 -

Kevin Durant And Angel Reese Dating Rumors A Pre Game Comment Analysis

May 17, 2025

Kevin Durant And Angel Reese Dating Rumors A Pre Game Comment Analysis

May 17, 2025

Latest Posts

-

Knicks Brunson Faces Podcast Pressure From Perkins

May 17, 2025

Knicks Brunson Faces Podcast Pressure From Perkins

May 17, 2025 -

Brunson Under Fire Perkins Advice To End Podcast

May 17, 2025

Brunson Under Fire Perkins Advice To End Podcast

May 17, 2025 -

Nba Analyst Perkins Critiques Brunsons Podcast

May 17, 2025

Nba Analyst Perkins Critiques Brunsons Podcast

May 17, 2025 -

Detroit Pistons Loss Crew Chief Admits Final Second Non Call Error

May 17, 2025

Detroit Pistons Loss Crew Chief Admits Final Second Non Call Error

May 17, 2025 -

Week In Review Turning Failures Into Success

May 17, 2025

Week In Review Turning Failures Into Success

May 17, 2025