Sabic's Gas Business IPO: Exploring Saudi Arabia's Energy Future

Table of Contents

The Strategic Significance of Sabic's Gas Business IPO

The Sabic IPO is far more than a simple financial transaction; it's a cornerstone of Saudi Arabia's Vision 2030, a national transformation plan aiming to reduce reliance on oil revenue and diversify the economy. This initiative holds profound strategic significance for several reasons:

-

Economic Diversification: The IPO directly supports Vision 2030's ambitious goals by reducing the Kingdom's dependence on oil, a crucial step towards a more resilient and sustainable economy. This diversification strategy aims to create a more robust and less volatile economic environment.

-

Foreign Investment Magnet: The offering is designed to attract substantial foreign direct investment (FDI), injecting capital into the Saudi stock market and boosting its global standing. This inflow of capital will stimulate economic growth and development across various sectors.

-

Global Gas Market Leadership: By listing its gas business, Saudi Arabia aims to strengthen its presence and influence in the global gas market, potentially securing a more significant share of this crucial energy resource. This enhances national energy security and opens doors to new international partnerships.

-

Downstream Gas Industry Development: The IPO will likely spur the development and expansion of downstream gas industries within Saudi Arabia, creating jobs, fostering technological advancements, and furthering industrial diversification. This will lead to a more comprehensive and integrated energy sector.

-

Enhanced Energy Security: Increasing domestic gas production through investments fueled by the IPO contributes to greater energy security for Saudi Arabia, reducing reliance on volatile international gas markets and ensuring a stable energy supply for the nation's needs.

Analyzing the Investment Potential of the Sabic Gas Business

The Sabic gas business IPO presents compelling investment opportunities, but a thorough assessment is crucial. Potential investors should consider the following factors:

-

Market Value and Returns: Projected market valuations and potential returns on investment (ROI) are key considerations. Analyzing financial projections and comparing them to similar IPOs in the energy sector will help potential investors determine the attractiveness of the opportunity.

-

Risks and Challenges: Any investment carries inherent risks. A thorough risk assessment should consider geopolitical factors, fluctuations in global gas prices, regulatory changes, and potential operational challenges. A balanced view of both potential benefits and risks is essential.

-

Long-Term Growth Potential: The long-term growth prospects of the Sabic gas business are dependent on factors such as global energy demand, technological advancements in gas production and utilization, and the overall trajectory of the global energy transition.

-

Investment Strategies: Investors should carefully consider various investment strategies, ranging from long-term buy-and-hold approaches to more active trading strategies, based on their individual risk tolerance and financial goals. Diversification within one's overall portfolio is also a crucial element.

Understanding the Role of Aramco in the IPO

Saudi Aramco's involvement is paramount to the success of the Sabic gas business IPO. Aramco's strategic partnership has several key implications:

-

Major Shareholder Influence: As a significant shareholder, Aramco's influence on the strategic direction of the newly listed entity will be substantial. This close relationship ensures alignment with broader national energy objectives.

-

Synergies and Collaboration: The potential synergies between Aramco's upstream gas production and the downstream operations of the Sabic gas entity are considerable. This integrated approach could optimize efficiency and enhance overall profitability.

-

Market Dominance: The combined strength of Aramco and the Sabic gas business could lead to a more dominant position in regional and global gas markets, further strengthening Saudi Arabia's energy influence. This combined market power could affect global pricing and supply dynamics.

The Broader Implications for Saudi Arabia's Energy Future

The Sabic gas business IPO has far-reaching implications for Saudi Arabia's energy future, extending beyond immediate financial gains:

-

Energy Strategy Alignment: The IPO is a significant component of Saudi Arabia's overall energy strategy, helping to diversify its energy sources and reduce reliance on oil. This is a key element of achieving a long-term sustainable energy future.

-

Renewable Energy Development: The revenue generated from the IPO could be reinvested in renewable energy projects, accelerating the Kingdom's transition to a more sustainable energy mix. This could attract further investment in renewable energy technologies and infrastructure.

-

Global Energy Transition Leadership: By strategically positioning itself in both traditional and renewable energy sectors, Saudi Arabia aims to be a leader in the global energy transition, attracting investment and expertise in sustainable energy solutions.

Conclusion:

The Sabic gas business IPO is a momentous event that reflects Saudi Arabia's commitment to economic diversification and its ambitions within the global energy market. This strategic move promises to yield substantial financial benefits, attract foreign investment, and fortify the Kingdom's position as a major player in the energy sector. The long-term implications are far-reaching, shaping not only the Saudi economy but also influencing the global energy transition.

Call to Action: Stay informed about the latest developments surrounding the Sabic IPO and explore the exciting investment opportunities in Saudi Arabia's evolving energy sector. Learn more about the Sabic gas business IPO and its impact on Saudi Arabia's energy future.

Featured Posts

-

Eurovision 2025 Luca Haennis Involvement Confirmed

May 19, 2025

Eurovision 2025 Luca Haennis Involvement Confirmed

May 19, 2025 -

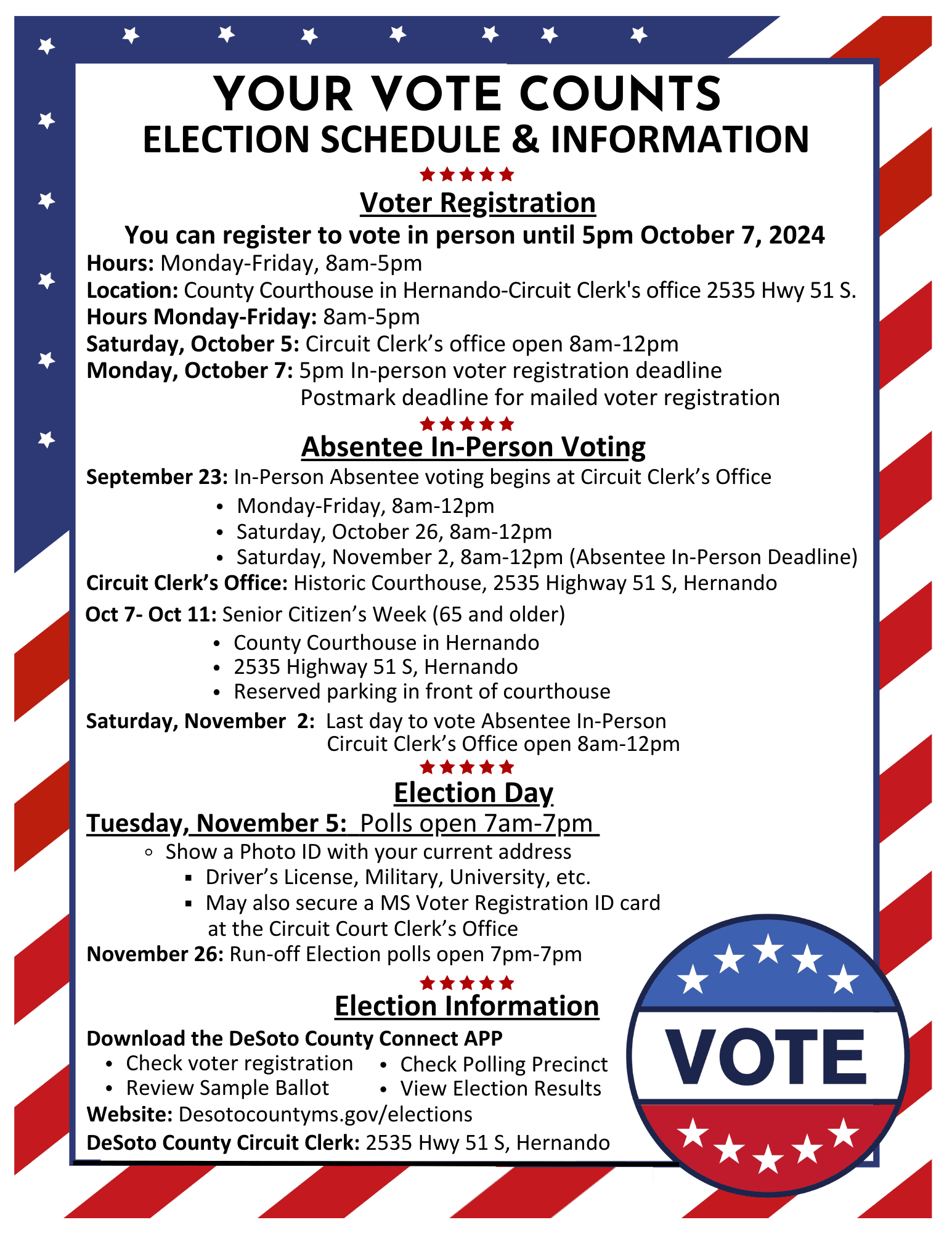

Southaven Mayoral Candidates A Closer Look At The Election In De Soto County

May 19, 2025

Southaven Mayoral Candidates A Closer Look At The Election In De Soto County

May 19, 2025 -

Eurowizja Ranking Najwiekszych Przegranych Polskich Preselekcji

May 19, 2025

Eurowizja Ranking Najwiekszych Przegranych Polskich Preselekcji

May 19, 2025 -

Building Wealth The Stealthy Way Practical Strategies For Quiet Accumulation

May 19, 2025

Building Wealth The Stealthy Way Practical Strategies For Quiet Accumulation

May 19, 2025 -

Resultats Q4 2024 Credit Mutuel Am Impact Et Perspectives

May 19, 2025

Resultats Q4 2024 Credit Mutuel Am Impact Et Perspectives

May 19, 2025

Latest Posts

-

Mensik La Historia Detras De La Suerte Del Campeon De Miami

May 19, 2025

Mensik La Historia Detras De La Suerte Del Campeon De Miami

May 19, 2025 -

Adios A Juan Aguilera El Tenis Espanol Llora Su Perdida

May 19, 2025

Adios A Juan Aguilera El Tenis Espanol Llora Su Perdida

May 19, 2025 -

Mensik Y La Suerte Del Campeon De Miami El Supervisor Almorzaba

May 19, 2025

Mensik Y La Suerte Del Campeon De Miami El Supervisor Almorzaba

May 19, 2025 -

Muere Juan Aguilera El Tenis Espanol De Luto

May 19, 2025

Muere Juan Aguilera El Tenis Espanol De Luto

May 19, 2025 -

La Muerte De Juan Aguilera Un Legado En El Tenis Mundial

May 19, 2025

La Muerte De Juan Aguilera Un Legado En El Tenis Mundial

May 19, 2025