Sasol (SOL) 2023 Strategy Update: What Investors Need To Know

Table of Contents

Sasol's Revised Financial Projections and Guidance for 2023

Sasol's 2023 strategy update included revised financial projections, offering a glimpse into the company's anticipated performance. These projections are influenced by various factors, including global commodity prices, operational efficiency improvements, and capital expenditure plans.

-

Key Financial Metrics: The updated guidance likely included revised earnings per share (EPS) and revenue projections. It's crucial to compare these figures to previous projections to gauge the extent of any upward or downward revisions. Specific numbers, if available publicly, should be included here. Any changes in the projected free cash flow are also vital for assessing the company's ability to manage debt and return capital to shareholders.

-

Impact of Global Economic Conditions: Macroeconomic factors such as inflation, interest rate hikes, and potential recessions significantly influence Sasol’s performance. The 2023 strategy update should address how these external factors impact their projections and what contingency plans are in place. Analyzing the sensitivity of Sasol's projections to changes in commodity prices (oil, gas, chemicals) is crucial.

-

Debt Levels and Credit Rating: The company's debt levels and credit rating are key indicators of its financial health. The update should provide insight into Sasol's debt management strategy and any anticipated changes to its credit rating. High debt levels could pose a risk, especially in a volatile market.

-

Dividend Policy: Any changes to Sasol's dividend policy, whether an increase, decrease, or maintaining the current payout, are essential for income-focused investors. The rationale behind any changes should be carefully considered.

Key Strategic Initiatives and Operational Highlights

The Sasol (SOL) 2023 Strategy Update detailed several key strategic initiatives designed to drive growth and improve profitability. These initiatives focus on areas such as cost optimization, operational excellence, and strategic growth opportunities.

-

Cost Reduction Measures: The update should outline specific cost-cutting measures implemented by Sasol, including details about streamlining operations, improving efficiency in production processes, and negotiating better terms with suppliers. Examples could include workforce optimization, technology upgrades, and energy efficiency improvements.

-

Progress on Key Projects: Investors need to understand the progress made on key projects, their expected timelines, and their potential impact on future profitability. Delayed projects or unexpected challenges should be clearly addressed.

-

Sustainability Initiatives: Environmental, Social, and Governance (ESG) factors are increasingly important for investors. The update should detail Sasol's progress on its sustainability initiatives, including targets for reducing carbon emissions, improving water management, and enhancing community relations.

-

Mergers, Acquisitions, and Divestitures: Any mergers, acquisitions, or divestitures undertaken or planned by Sasol should be thoroughly explained, emphasizing their strategic rationale and potential financial implications.

Risk Assessment and Potential Challenges for Sasol in 2023

Understanding the risks facing Sasol is crucial for any investor. The Sasol (SOL) 2023 Strategy Update should have addressed potential challenges and the company's mitigation strategies.

-

Commodity Price Volatility: Fluctuations in commodity prices (oil, gas, chemicals) are a major risk for Sasol. The company's strategy for managing this volatility – such as hedging strategies – should be detailed.

-

Geopolitical Uncertainty: Geopolitical instability can significantly impact Sasol's operations and supply chains. The update should assess the potential impact of geopolitical events and any measures taken to mitigate these risks.

-

Regulatory Changes: Changes in environmental regulations or other governmental policies can affect Sasol's operations and profitability. The update should identify and assess potential regulatory risks.

-

Resilience to Unforeseen Events: The ability of Sasol to withstand unforeseen events (e.g., natural disasters, pandemics) is a vital factor. The company's contingency planning and resilience should be evaluated.

Investment Implications: Should Investors Buy, Sell, or Hold Sasol Stock?

Based on the Sasol (SOL) 2023 Strategy Update, investors must carefully assess the investment implications. This involves evaluating Sasol's valuation, growth prospects, and risk profile.

-

Price Target and Rationale: Based on the revised projections and risk assessment, analysts will likely provide a price target for Sasol stock, along with a clear rationale justifying this target.

-

Comparison to Industry Peers: A comparison of Sasol’s performance and valuation with its industry peers provides valuable context for assessing its investment attractiveness.

-

Catalysts for Price Appreciation or Decline: Identifying potential catalysts that could drive Sasol's stock price higher or lower is crucial for informed decision-making. These could include changes in commodity prices, successful project completion, or unforeseen geopolitical events.

-

Investment Recommendations: After a thorough analysis, investors can formulate their investment recommendations (Buy, Sell, or Hold), supported by a clear justification based on the information presented in the strategy update.

Conclusion: Summarizing the Sasol (SOL) 2023 Strategy Update

The Sasol (SOL) 2023 Strategy Update offered insights into the company's revised financial projections, key strategic initiatives, and potential risks. Investors should carefully consider the revised EPS and revenue projections, the progress of key projects, and the company's strategies for mitigating risks associated with commodity price volatility and geopolitical uncertainty. The investment implications, as outlined above, suggest a careful evaluation of the risk-reward profile before making any investment decisions. Stay informed on the evolving Sasol (SOL) story by regularly reviewing updated financial reports and expert analyses. Understanding the Sasol (SOL) 2023 strategy update is crucial for navigating the complexities of this energy sector giant and making informed investment decisions regarding Sasol stock (SOL).

Featured Posts

-

March 31 Nyt Mini Crossword Puzzle Solutions

May 20, 2025

March 31 Nyt Mini Crossword Puzzle Solutions

May 20, 2025 -

Biarritz Trois Journees D Echanges Sur Le Parcours Des Femmes

May 20, 2025

Biarritz Trois Journees D Echanges Sur Le Parcours Des Femmes

May 20, 2025 -

Navys Second In Command Convicted In Major Corruption Scandal

May 20, 2025

Navys Second In Command Convicted In Major Corruption Scandal

May 20, 2025 -

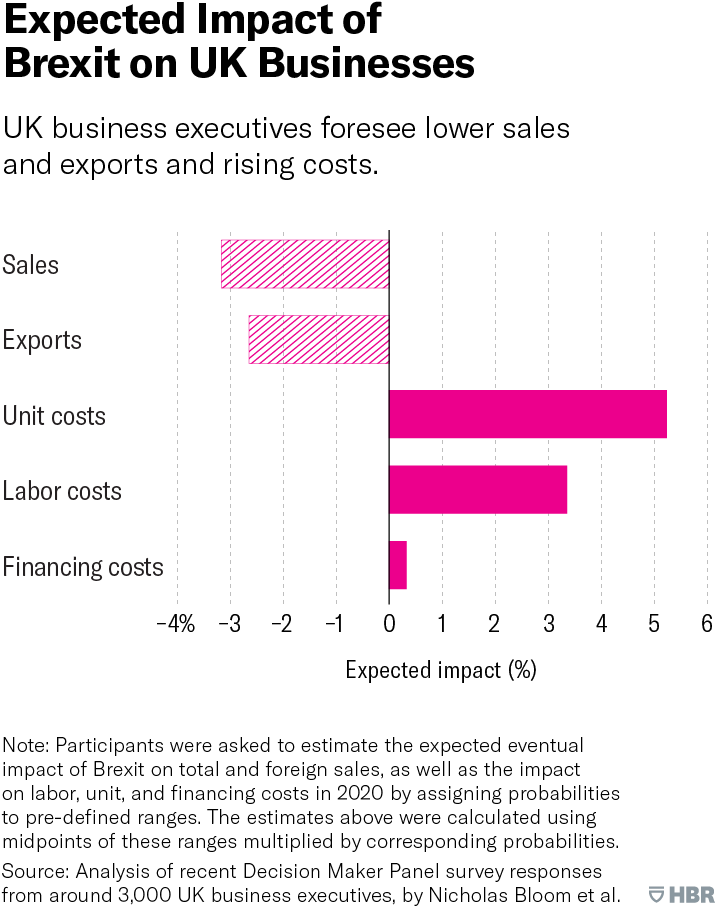

Uk Luxury Sector Brexits Lingering Export Challenges

May 20, 2025

Uk Luxury Sector Brexits Lingering Export Challenges

May 20, 2025 -

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025

Wwe Money In The Bank Ripley And Perez Punch Their Tickets

May 20, 2025