Saudi Arabia's ABS Market: A Post-Reform Analysis

Table of Contents

The Pre-Reform Landscape of Saudi Arabia's ABS Market

Before the implementation of Vision 2030 and subsequent financial reforms, the Saudi Arabia ABS market faced significant limitations. The pre-reform ABS market in Saudi Arabia was characterized by:

-

Limited Issuance: Compared to more developed global markets, the issuance of ABS was remarkably low, hindering the growth of the overall financial sector. This limited activity stemmed from various factors, creating a relatively small and underdeveloped market.

-

Regulatory Hurdles: Complex and sometimes unclear regulations posed considerable challenges for potential issuers. Bureaucratic processes were often lengthy and cumbersome, discouraging participation. This created a significant barrier to entry for both domestic and international investors.

-

Lack of Market Depth and Liquidity: The limited number of transactions resulted in a lack of market depth and liquidity, making it difficult for investors to buy and sell ABS efficiently. This low liquidity increased the risk for investors and further limited market participation.

-

Low Investor Awareness and Participation: A lack of awareness among investors about the benefits and risks associated with ABS contributed to low participation rates. Many potential investors lacked the necessary understanding or confidence to invest in this relatively new asset class.

Impact of Vision 2030 and Financial Reforms

Vision 2030's ambitious goals for economic diversification and financial sector development have directly impacted the Saudi Arabia ABS market. Several key reforms have played a pivotal role:

-

Deregulation and Liberalization: The Saudi Arabian government significantly deregulated and liberalized the financial sector, creating a more attractive environment for ABS issuances. This included streamlining bureaucratic processes and simplifying regulatory frameworks.

-

New Regulatory Frameworks: The introduction of clear and efficient regulatory frameworks specifically designed for securitization has greatly enhanced transparency and investor confidence. These new guidelines aim to facilitate the growth of the ABS market while minimizing associated risks.

-

Financial Inclusion and Diversification: Initiatives promoting financial inclusion and diversification have expanded the potential pool of both issuers and investors in the ABS market. This increased participation contributes to a more vibrant and resilient market.

-

Capital Market Infrastructure Development: Significant investments in developing the Saudi capital market infrastructure have improved market efficiency and accessibility. This includes upgrading trading platforms, enhancing data transparency, and developing specialized expertise.

Role of Islamic Finance in Saudi Arabia's ABS Market

Islamic finance plays a crucial role in the Saudi ABS market. The growth of Sharia-compliant ABS and Sukuk (Islamic bonds) is a significant driver of market expansion:

-

Growth Potential of Islamic ABS and Sukuk: Given Saudi Arabia's commitment to Islamic principles, the potential for growth in Sharia-compliant ABS and Sukuk issuance is immense. This aligns perfectly with the Kingdom's religious and cultural landscape.

-

Unique Characteristics of Islamic Securitization: Islamic securitization transactions are structured to adhere strictly to Sharia principles, offering unique features that attract specific investor groups.

-

Regulatory Considerations for Islamic ABS: Specific regulations are in place to ensure the compliance of Islamic ABS with Sharia law, adding a layer of complexity but also attracting a dedicated investor base.

Post-Reform Growth and Developments

Following the implementation of reforms, the Saudi Arabia ABS market has shown significant growth:

-

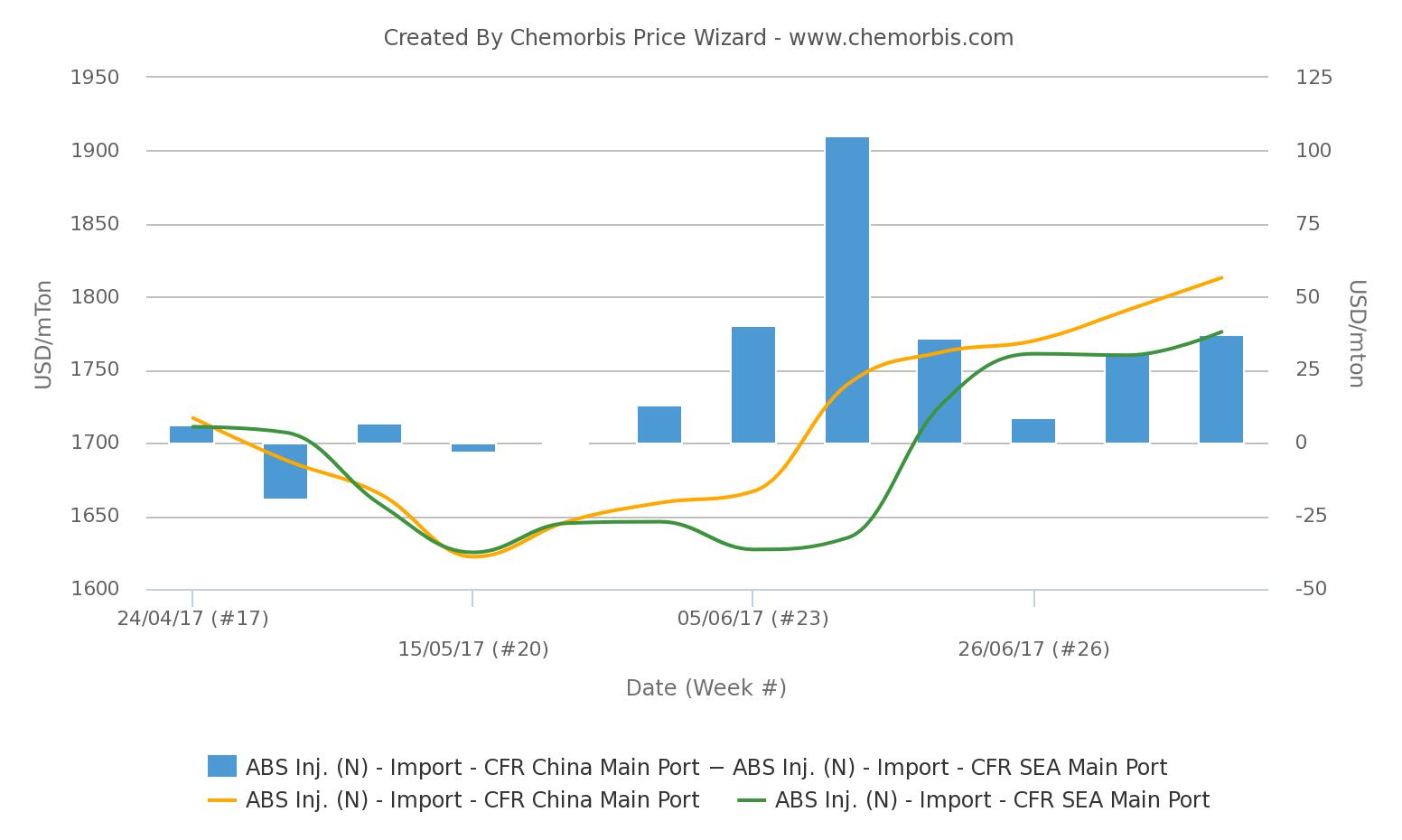

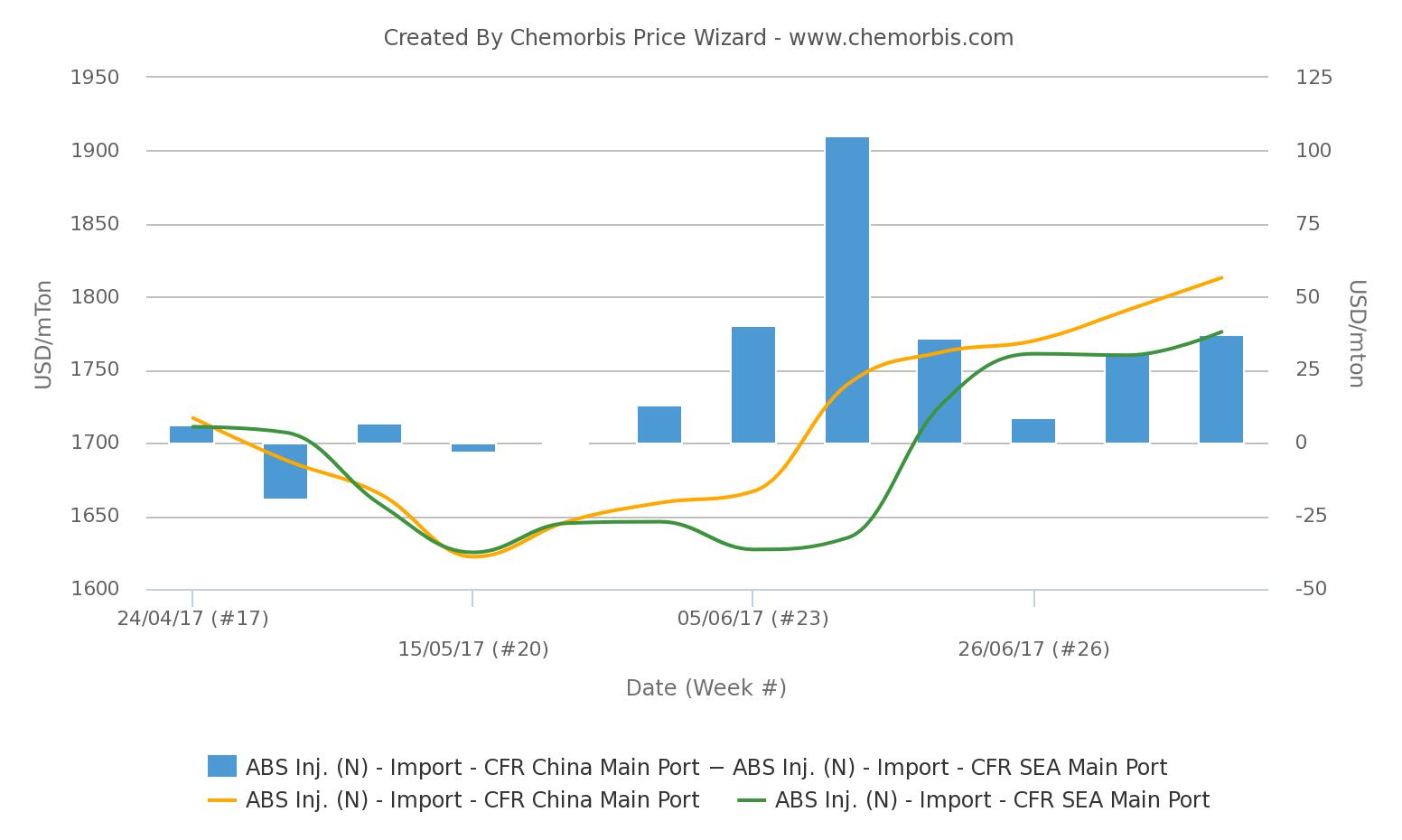

Increased Issuance Volume and Value: Data shows a notable increase in both the volume and value of ABS issuances since the reforms. This demonstrates a clear positive impact of the changes implemented.

-

Enhanced Investor Participation: Investor participation has broadened, with increased involvement from both domestic and international investors. This signifies growing confidence in the market and its future potential.

-

Successful ABS Transactions: Several successful ABS transactions have been completed, showcasing the effectiveness of the new regulatory framework and the increasing sophistication of the market.

-

Emerging Trends and Opportunities: New trends and opportunities are emerging, such as the use of technology to enhance market efficiency and the development of specialized ABS products.

Challenges and Future Outlook

While the Saudi Arabia ABS market is experiencing significant growth, challenges remain:

-

Competition from Other Asset Classes: The ABS market faces competition from other asset classes, requiring ongoing efforts to maintain its attractiveness to investors.

-

Maintaining Regulatory Stability and Investor Confidence: Maintaining a stable and predictable regulatory environment is crucial to sustain investor confidence and attract further participation.

-

Addressing Potential Credit Risks: The inherent credit risks associated with ABS require robust risk management practices and careful monitoring.

-

Further Development of Market Infrastructure: Continued investment in market infrastructure, technology, and human capital is essential for long-term growth and stability.

Conclusion

The post-reform analysis reveals a significant positive impact of Vision 2030 on Saudi Arabia's ABS market. The reforms have unlocked considerable growth potential, attracting both domestic and international investors. The increasing role of Islamic finance further solidifies this market's unique position. While challenges remain, the future outlook for the Saudi Arabia ABS market is bright. Addressing the remaining challenges, while maintaining regulatory stability and investor confidence, will be crucial for ensuring the sustainable growth of this vital sector. Invest in the future of finance by exploring the opportunities within Saudi Arabia's burgeoning ABS market. Learn more about the potential of the Saudi Arabia ABS market and its contribution to Vision 2030.

Featured Posts

-

Fortnite Update 34 30 Server Downtime Schedule And New Content

May 03, 2025

Fortnite Update 34 30 Server Downtime Schedule And New Content

May 03, 2025 -

Upcoming Loyle Carner Concert 3 Arena Dublin

May 03, 2025

Upcoming Loyle Carner Concert 3 Arena Dublin

May 03, 2025 -

Finding Your Dream A Place In The Sun Top Tips For Overseas Property Buyers

May 03, 2025

Finding Your Dream A Place In The Sun Top Tips For Overseas Property Buyers

May 03, 2025 -

To Ypoyrgiko Enekrine Tin Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Analytiki Paroysiasi

May 03, 2025

To Ypoyrgiko Enekrine Tin Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Analytiki Paroysiasi

May 03, 2025 -

6aus49 Lottozahlen Ziehung Vom 12 April 2025

May 03, 2025

6aus49 Lottozahlen Ziehung Vom 12 April 2025

May 03, 2025

Latest Posts

-

Graeme Souness Criticises Manchester Uniteds Transfer Blunder

May 03, 2025

Graeme Souness Criticises Manchester Uniteds Transfer Blunder

May 03, 2025 -

Champions League Race Heats Up Souness On Arsenal And A Dominant Rival

May 03, 2025

Champions League Race Heats Up Souness On Arsenal And A Dominant Rival

May 03, 2025 -

Arsenals Champions League Prospects Souness Points To A Formidable Challenger

May 03, 2025

Arsenals Champions League Prospects Souness Points To A Formidable Challenger

May 03, 2025 -

Souness Highlights Arsenals Champions League Threat A Top Tier Rival Emerges

May 03, 2025

Souness Highlights Arsenals Champions League Threat A Top Tier Rival Emerges

May 03, 2025 -

Graeme Souness Arsenal Warning A Champions League Contender Soars

May 03, 2025

Graeme Souness Arsenal Warning A Champions League Contender Soars

May 03, 2025