Securing Your Place In The Sun: Top Tips For Overseas Property Investment

Table of Contents

Researching Your Chosen Market

Before you even start browsing property listings, thorough due diligence is crucial for successful overseas property investment. This involves a deep dive into the specifics of your target market. Understanding the nuances of the international property market is key to minimizing risk and maximizing returns.

Keywords: Due diligence, property market research, international property market analysis, overseas property market trends.

-

Thoroughly research the local property market: Consider factors like economic stability—is the country experiencing consistent growth or facing economic uncertainty? What's the political climate like, and are there any foreseeable political risks that could impact property values? Analyze the future growth potential; is the area undergoing regeneration or planned developments that could increase property values?

-

Analyze property price trends, rental yields, and capital appreciation potential: Don't just look at current prices. Study historical data to identify trends. What are the average rental yields in the area? This is crucial if you plan to generate rental income. Analyze how property values have appreciated in the past to predict future capital growth.

-

Understand local regulations, taxation laws, and any restrictions on foreign property ownership: This is non-negotiable. Familiarize yourself with all relevant laws and regulations governing foreign property ownership in your chosen country. Understand the tax implications, including capital gains tax, property tax, and any other relevant levies. Are there any restrictions on the type of property you can buy or the length of time you can rent it out?

-

Utilize online resources, market reports, and consult with local real estate experts: Don't rely solely on online portals. Consult reputable market reports, research government statistics, and connect with experienced local real estate agents and lawyers who can offer invaluable insights into the local market.

Bullet Points:

- Compare different countries and regions based on your risk tolerance and investment goals (e.g., high-growth potential vs. stable, established markets).

- Identify areas with high rental demand and potential for capital growth – look beyond just tourist hotspots. Consider areas with growing populations and a strong local economy.

- Analyze the local infrastructure, amenities, and transportation links – easy access to amenities and good transportation networks are crucial factors in property value.

- Assess the risks associated with investing in a specific location – political instability, economic downturns, and natural disasters can all significantly impact property values.

Financing Your Overseas Property Investment

Securing the necessary financing is a critical step in your overseas property investment journey. Understanding your options and planning carefully will help you avoid financial pitfalls.

Keywords: Mortgage options, international mortgage brokers, currency exchange, overseas property financing

-

Explore various financing options: This might include international mortgages, personal loans, or cash purchases. The best option will depend on your financial situation and the specifics of the property.

-

Compare interest rates, repayment terms, and fees: Don't just focus on the initial interest rate. Consider the total cost of borrowing, including fees and any early repayment penalties. Compare offers from different lenders to secure the most favorable terms.

-

Secure a reliable currency exchange service: Fluctuations in exchange rates can significantly impact the overall cost of your investment. Use a reputable currency exchange service to minimize transaction costs and exchange rate risks. Consider hedging strategies to protect against significant fluctuations.

-

Consult with a financial advisor: A financial advisor specializing in international investments can help you create a sound financial plan, considering your risk tolerance and long-term financial goals. They can also advise on tax optimization strategies.

Bullet Points:

- Determine your budget and secure necessary financing before starting your property search – avoid falling in love with a property you can't afford.

- Understand the implications of currency fluctuations on your investment – factor these into your budget and consider hedging strategies.

- Explore mortgage options offered by international banks or specialized lenders – these often cater specifically to overseas property buyers.

- Consider the potential tax implications of financing your property purchase – seek professional tax advice to understand the implications in both your home country and the country where you are buying the property.

Finding the Right Property and Due Diligence

Once you've researched the market and secured financing, it's time to find the right property. However, due diligence is just as crucial at this stage.

Keywords: Property search, overseas property agents, legal advice, property inspection, conveyancing

-

Work with a reputable local real estate agent: A local agent will have in-depth market knowledge and can navigate the local legal intricacies.

-

Conduct a thorough inspection: Don't rely solely on photographs. Conduct a thorough inspection of the property, ideally with a qualified surveyor, to identify any potential structural issues, dampness, or other problems.

-

Engage a qualified lawyer: A lawyer specializing in international property transactions is essential. They will review contracts, ensure legal compliance, and protect your interests throughout the process.

-

Understand the conveyancing process: Familiarize yourself with the conveyancing process (the legal transfer of property ownership) in your chosen country. Understand the associated costs and timelines.

Bullet Points:

- Request detailed property information, including title deeds and building plans – verify the legitimacy of the documents.

- Verify the legitimacy of the seller and the property ownership – avoid scams by conducting thorough checks.

- Consider engaging a surveyor to conduct a comprehensive property inspection – this can save you significant costs in the long run.

- Protect yourself by seeking independent legal and financial advice throughout the process – don't hesitate to ask questions and seek clarification.

Managing Your Overseas Property Investment

Owning a property overseas is not a passive investment. Effective management is key to maximizing your returns and protecting your investment.

Keywords: Property management, rental income, property maintenance, long-term investment strategy

-

Develop a property management strategy: Will you self-manage the property, or will you hire a professional property management company? Each option has its pros and cons.

-

Consider the tax implications of rental income and capital gains: Understand the tax regulations in your chosen country regarding rental income and capital gains tax.

-

Plan for ongoing maintenance and upkeep: Factor in potential maintenance and repair costs, and establish a contingency fund.

-

Establish a long-term investment strategy: Define your long-term goals for the property. Are you planning to rent it out, use it as a vacation home, or eventually sell it?

Bullet Points:

- Factor in potential maintenance and repair costs – unexpected repairs can significantly impact your profitability.

- Understand local property tax regulations – these vary widely between countries.

- Consider potential risks associated with vacancy periods and tenant management – if renting, have a plan for dealing with tenant issues.

- Establish a clear exit strategy for your investment – how and when will you sell the property?

Conclusion

Securing your place in the sun through overseas property investment can be a rewarding experience, but it requires careful planning, thorough research, and professional advice. By following these top tips and conducting due diligence at every stage, you can significantly increase your chances of making a successful and profitable investment. Remember to always seek professional advice from legal and financial experts specializing in international property transactions. Don't delay your dream of owning overseas property – start your research and secure your place in the sun today! Begin your journey towards successful overseas property investment now!

Featured Posts

-

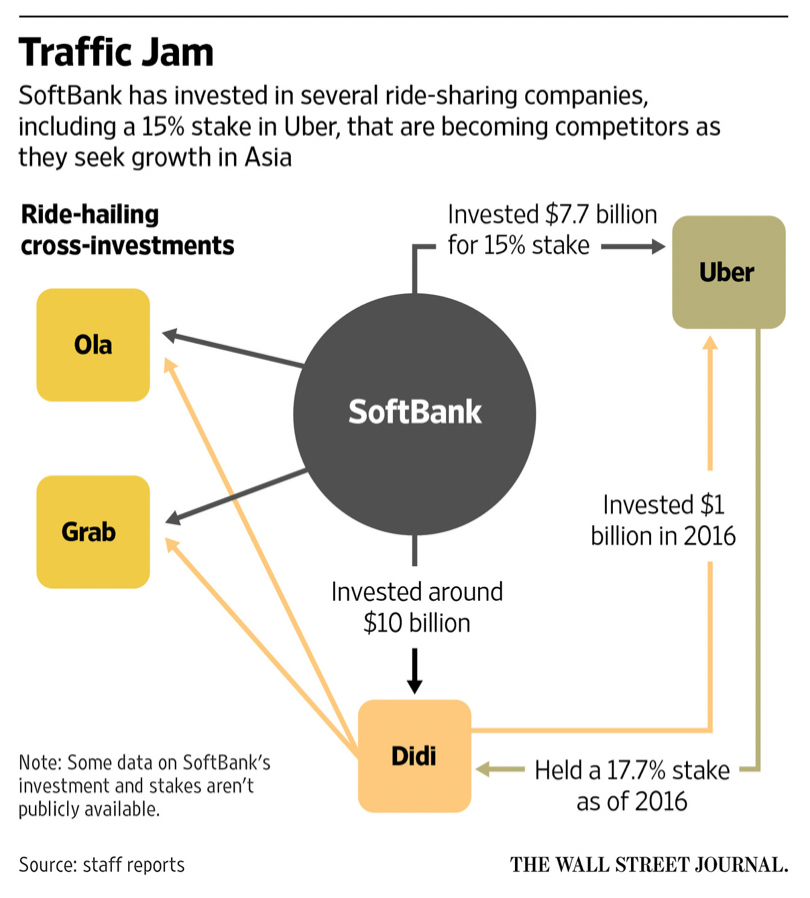

Evaluating Uber Technologies Uber As An Investment

May 19, 2025

Evaluating Uber Technologies Uber As An Investment

May 19, 2025 -

Marcus And Martinus Dublin Concert The Academy Show Announced

May 19, 2025

Marcus And Martinus Dublin Concert The Academy Show Announced

May 19, 2025 -

Ubers Double Digit April Rally Reasons Behind The Surge

May 19, 2025

Ubers Double Digit April Rally Reasons Behind The Surge

May 19, 2025 -

Ufc 313 Complete Guide Fight Card Viewing Options And Tickets

May 19, 2025

Ufc 313 Complete Guide Fight Card Viewing Options And Tickets

May 19, 2025 -

Payden And Rygel Understanding The Dynamics Of China To Us Containerized Shipping

May 19, 2025

Payden And Rygel Understanding The Dynamics Of China To Us Containerized Shipping

May 19, 2025

Latest Posts

-

Analysis Fewer Air Passengers Expected At Maastricht Airport In Early 2025

May 19, 2025

Analysis Fewer Air Passengers Expected At Maastricht Airport In Early 2025

May 19, 2025 -

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giris Suerecinde Son Durum

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giris Suerecinde Son Durum

May 19, 2025 -

Early 2025 Air Travel A Focus On Maastricht Airport Passenger Numbers

May 19, 2025

Early 2025 Air Travel A Focus On Maastricht Airport Passenger Numbers

May 19, 2025 -

Significant Drop In Maastricht Air Passengers Predicted For Early 2025

May 19, 2025

Significant Drop In Maastricht Air Passengers Predicted For Early 2025

May 19, 2025 -

Maastricht Airport Passenger Projections For Early 2025

May 19, 2025

Maastricht Airport Passenger Projections For Early 2025

May 19, 2025