'Sell America' Sentiment Resurfaces As Moody's Pushes 30-Year Yield To 5%

Table of Contents

Moody's Downgrade and its Impact on the "Sell America" Narrative

Moody's rating agency's actions played a pivotal role in triggering the renewed "Sell America" sentiment. Their assessment, leading to the significant increase in the 30-year bond yield, wasn't taken lightly by the markets.

The Rationale Behind Moody's Actions

Moody's cited several key factors contributing to their decision, all pointing towards a weakening of the US economic outlook. These include:

- Fiscal Challenges: The US continues to grapple with a massive national debt, raising concerns about long-term fiscal sustainability.

- Debt Ceiling Concerns: Recurring debates and near-misses regarding the debt ceiling create uncertainty and erode investor confidence in the government's ability to manage its finances.

- Political Gridlock: Persistent political polarization hinders effective policymaking and contributes to a climate of uncertainty.

- Potential for Increased Inflation: Concerns remain about persistent inflationary pressures, potentially necessitating further interest rate hikes by the Federal Reserve.

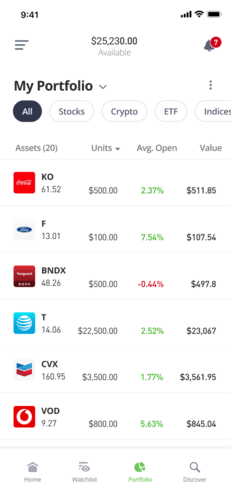

Market Reactions to Moody's Assessment

The market reacted swiftly to Moody's assessment, exhibiting several key responses:

- Stock Market Volatility: Increased uncertainty led to heightened volatility in the US stock market, with significant daily fluctuations becoming more common.

- Flight to Safety: Investors sought refuge in safer assets, such as US Treasury bonds (ironically, despite the yield increase) and gold, further impacting market dynamics.

- Impact on the Dollar: The value of the US dollar experienced fluctuations as investors reevaluated their holdings and shifted capital.

- Changes in Investor Behavior: A noticeable shift in investor behavior was observed, with many adopting a more cautious approach and reducing their exposure to US assets.

The Connection Between Moody's Actions and "Sell America" Sentiment

Moody's actions directly contributed to the resurgence of the "Sell America" sentiment. The agency's downgrade, even if subtle, signaled a reduction in confidence in US creditworthiness, prompting the following consequences:

- Reduced Confidence in US Assets: Investors became less confident in the attractiveness of US assets, including stocks and bonds.

- Capital Flight to Other Markets: Capital began flowing out of the US, seeking higher returns or perceived greater safety in other markets.

- Potential for Negative Economic Consequences: This capital flight could ultimately negatively impact the US economy, potentially slowing growth and affecting employment.

Economic Implications of Rising 30-Year Yields and the "Sell America" Trade

The increase in 30-year Treasury yields, driven in part by the "Sell America" sentiment, has wide-ranging economic consequences.

Impact on Mortgage Rates and Housing Market

The rise in 30-year yields has a direct impact on mortgage rates:

- Increased Borrowing Costs for Homebuyers: Higher mortgage rates make homeownership less affordable, potentially cooling the housing market.

- Potential Slowdown in Housing Construction: Reduced demand for mortgages can lead to a slowdown in new home construction.

- Impact on Real Estate Investment: Real estate investment becomes less attractive due to higher borrowing costs and decreased demand.

Broader Economic Consequences

The broader implications extend beyond the housing market:

- Increased Inflation Pressure: Higher yields can contribute to inflation, making it more expensive for businesses and consumers.

- Slower Economic Growth: Increased borrowing costs can stifle business investment and consumer spending, leading to slower economic growth.

- Potential for Increased Unemployment: Slower economic growth can lead to job losses and increased unemployment.

- Impact on Consumer Spending: Higher interest rates reduce disposable income, potentially impacting consumer confidence and spending.

International Implications

The "Sell America" sentiment has significant global repercussions:

- Impact on the US Dollar: The outflow of capital can weaken the US dollar, affecting international trade and investment.

- Shifts in Global Capital Flows: Capital will shift towards other economies perceived as more stable, potentially altering global economic power dynamics.

- Potential for Geopolitical Instability: Economic uncertainty can contribute to geopolitical tensions, particularly regarding global trade and alliances.

Strategies for Navigating the "Sell America" Environment

Navigating this challenging market requires strategic adjustments:

Diversification Strategies

To mitigate risk, investors should consider:

- International Diversification: Spreading investments across different countries to reduce reliance on the US market.

- Asset Class Diversification: Investing in a mix of asset classes (stocks, bonds, real estate, etc.) to balance risk.

- Hedging Strategies: Employing financial instruments to protect against losses from adverse market movements.

Risk Management Techniques

Effective risk management is critical:

- Stress Testing Portfolios: Analyzing how a portfolio would perform under various adverse economic scenarios.

- Setting Stop-Loss Orders: Setting predetermined limits to minimize potential losses.

- Rebalancing Investments: Periodically adjusting the portfolio to maintain the desired asset allocation.

Opportunities in a Shifting Market

While uncertainty prevails, opportunities may emerge:

- Potential Undervalued Assets: Some assets may become undervalued during periods of market correction, creating potential buying opportunities.

- Sectors Likely to Perform Well: Certain sectors might be more resilient during economic downturns, offering better prospects.

- Emerging Markets: Emerging markets could offer higher growth potential, although they also carry higher risk. (Thorough due diligence is crucial).

Conclusion: Understanding and Responding to the "Sell America" Trend

The resurgence of the "Sell America" sentiment, exacerbated by Moody's actions and the resulting spike in the 30-year Treasury yield to 5%, presents a complex challenge for investors and policymakers alike. The economic and market implications are far-reaching, affecting everything from mortgage rates to international capital flows. Understanding the nuances of this trend is crucial for investors navigating this complex market. Consult with a financial advisor to develop a personalized strategy for mitigating risk and capitalizing on potential opportunities presented by the evolving "Sell America" sentiment and the high 30-year Treasury yields. Proactive risk management and strategic diversification are essential tools in this environment.

Featured Posts

-

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025

The Goldbergs Exploring The Shows Enduring Popularity

May 21, 2025 -

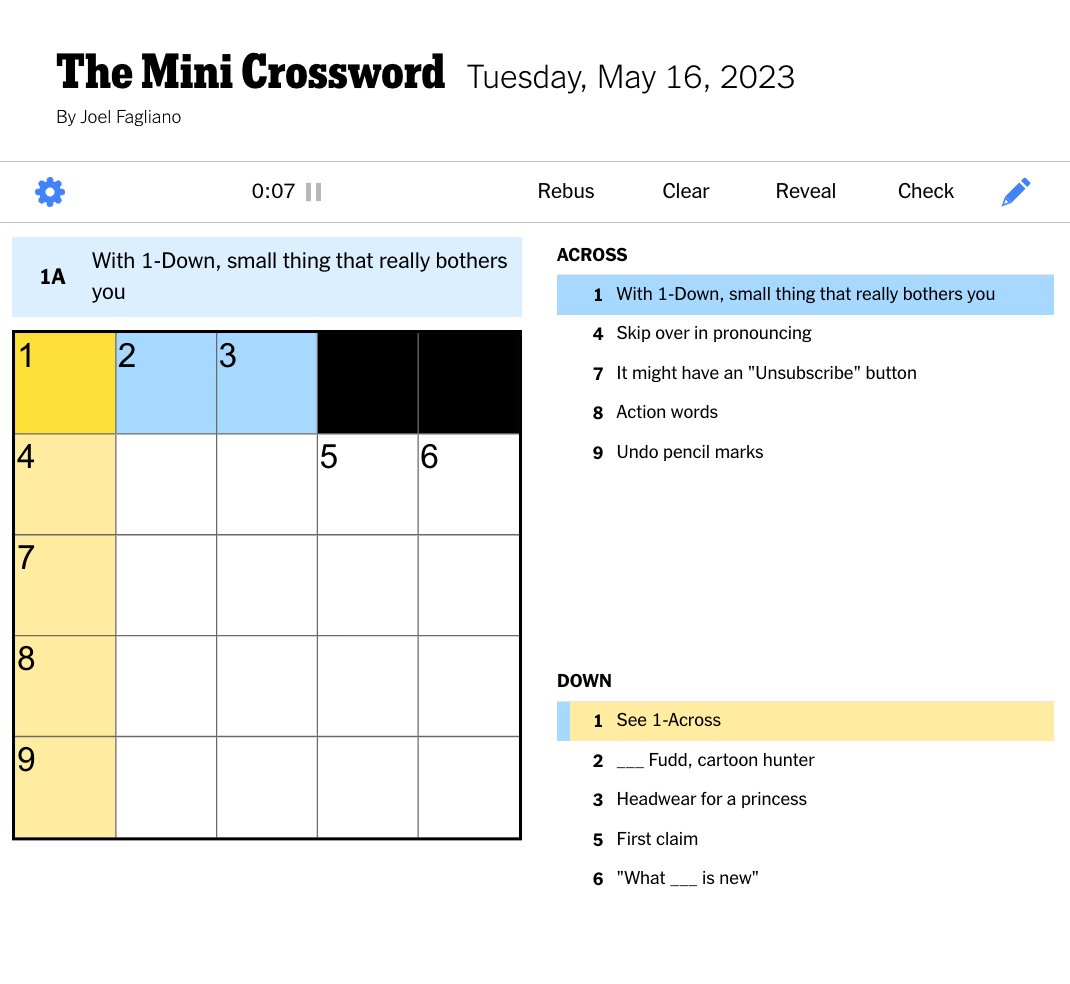

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025

Nyt Mini Crossword Answers March 13 2025 Full Solution

May 21, 2025 -

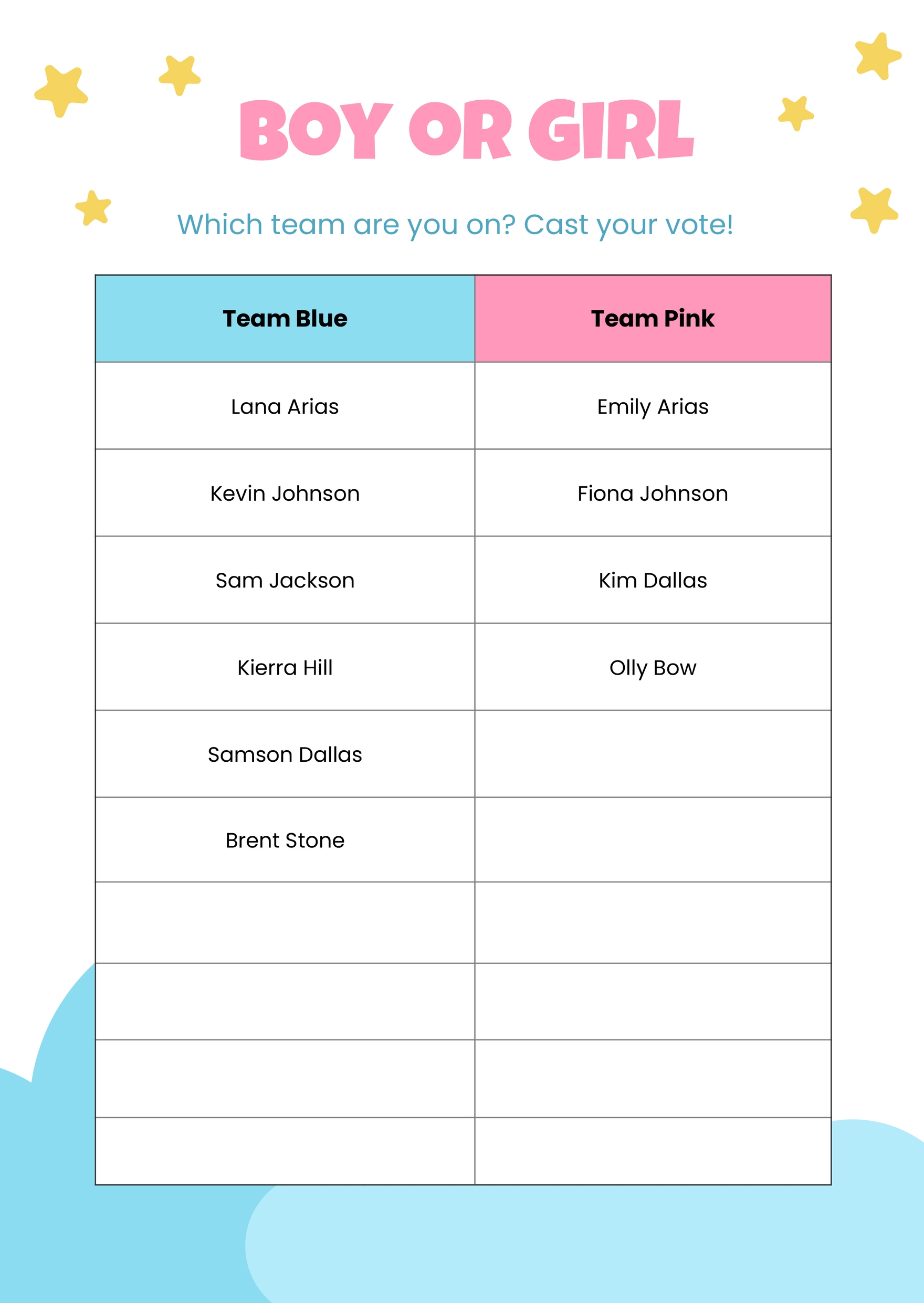

The Pig Familys Gender Reveal Celebrating A New Addition

May 21, 2025

The Pig Familys Gender Reveal Celebrating A New Addition

May 21, 2025 -

Chinas Space Supercomputer Progress Challenges And Future Outlook

May 21, 2025

Chinas Space Supercomputer Progress Challenges And Future Outlook

May 21, 2025 -

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025

Latest Posts

-

D Wave Quantum Qbts Stock Market Activity Explaining Todays Surge

May 21, 2025

D Wave Quantum Qbts Stock Market Activity Explaining Todays Surge

May 21, 2025 -

Why Did D Wave Quantum Inc Qbts Stock Rise Today Analysis And Insights

May 21, 2025

Why Did D Wave Quantum Inc Qbts Stock Rise Today Analysis And Insights

May 21, 2025 -

Big Bear Ai Bbai Penny Stock Potential And Investment Risks

May 21, 2025

Big Bear Ai Bbai Penny Stock Potential And Investment Risks

May 21, 2025 -

D Wave Quantum Qbts Stock Price Increase Understanding Todays Gains

May 21, 2025

D Wave Quantum Qbts Stock Price Increase Understanding Todays Gains

May 21, 2025 -

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 21, 2025

Is Big Bear Ai Holdings Inc Nyse Bbai A Top Penny Stock To Watch

May 21, 2025