Sharp Decline In Amsterdam Stock Index: Lowest Point In Over A Year

Table of Contents

Causes of the Sharp Decline in the Amsterdam Stock Index

Several interconnected factors have contributed to the recent sharp decline in the AEX, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

- Weakening global growth forecasts: International organizations like the IMF and OECD have recently downgraded their global growth projections, citing persistent inflation and rising interest rates as major headwinds. This uncertainty makes investors hesitant to commit capital, leading to sell-offs across global markets, including the AEX.

- Rising inflation: Persistently high inflation rates in many countries are forcing central banks to aggressively raise interest rates to curb price increases. Higher interest rates increase borrowing costs for businesses, dampening investment and potentially leading to economic slowdowns. This negatively impacts company profits and investor confidence.

- Interest rate hikes by central banks: The aggressive monetary tightening policies adopted by central banks worldwide, including the European Central Bank, directly impact the cost of capital and can trigger a slowdown in economic activity.

- Geopolitical tensions: The ongoing war in Ukraine continues to disrupt global supply chains, increase energy prices, and fuel broader geopolitical uncertainty, further contributing to investor anxiety.

- Energy crisis impact: The energy crisis, exacerbated by the war in Ukraine, has significantly impacted energy prices and inflation across Europe, including the Netherlands. This has a knock-on effect on businesses and consumer spending, impacting the performance of companies listed on the AEX. For example, energy-intensive industries have seen significant profit margin erosion.

Performance of Key Dutch Companies

The decline in the AEX is also a reflection of the performance of individual Dutch companies. Major companies listed on the AEX, spanning various sectors, have experienced varying degrees of negative impact.

- Technology sector: Companies in the technology sector, often sensitive to interest rate changes and global economic uncertainty, have seen significant share price declines.

- Energy sector: Although energy companies might benefit from high energy prices in the short term, the long-term implications of the energy crisis and government regulations regarding sustainability present challenges.

- Financial sector: Banks and financial institutions are exposed to risks related to rising interest rates and potential loan defaults.

Specific companies have seen declines attributed to factors such as declining profits, supply chain disruptions, and changes in consumer demand. For instance, [insert example of a specific company and its challenges].

Investor Sentiment and Market Volatility

The sharp decline in the AEX is largely driven by deteriorating investor sentiment and heightened market volatility.

- Decreasing investor confidence: Concerns about global economic growth, inflation, and geopolitical risks have led to a significant decrease in investor confidence, prompting many to move funds to safer assets.

- Increased market volatility: The AEX, like other global stock markets, has experienced increased volatility, characterized by sharp price swings, reflecting investor uncertainty and heightened risk aversion.

- Flight to safer assets: Investors are increasingly seeking refuge in safer assets like government bonds, gold, and other low-risk investments, contributing to the sell-off in riskier assets like stocks. This trend is mirrored in other major indices such as the Dow Jones and FTSE 100.

Impact of the AEX Decline on the Dutch Economy

The sharp decline in the AEX has far-reaching consequences for the Dutch economy.

Effect on Dutch Businesses and Investments

- Reduced investment: The decline in stock prices and investor confidence can lead to a decrease in business investment, potentially hindering economic growth.

- Decreased consumer spending: Negative economic sentiment can impact consumer confidence, potentially leading to decreased spending and slower economic growth.

- Potential job losses: If businesses face financial difficulties due to reduced investment and lower consumer demand, job losses may follow. This creates a negative feedback loop, exacerbating the economic slowdown.

Implications for Pension Funds and Individual Investors

The AEX decline has significant implications for Dutch pension funds and individual investors holding AEX-listed stocks.

- Potential losses: Pension funds and individual investors holding AEX-listed stocks have experienced significant losses as a result of the market downturn.

- Strategies for mitigating risk: Investors need to carefully assess their risk tolerance and diversify their investment portfolios to mitigate the impact of market volatility. Strategies might include shifting to less volatile assets or adopting a longer-term investment horizon.

Potential Recovery Scenarios for the Amsterdam Stock Index

While the current outlook is challenging, there are potential scenarios for recovery of the Amsterdam Stock Index.

Short-Term Outlook

- Positive economic news: Positive economic data from the Netherlands or globally could boost investor confidence and trigger a short-term rebound.

- Stabilizing global markets: A stabilization in global markets and a reduction in geopolitical uncertainties would contribute to increased investor appetite for riskier assets.

- Strong corporate earnings reports: Strong corporate earnings from AEX-listed companies could signal improved business conditions and lead to a price increase in their stocks.

Long-Term Projections

- Sustainable economic growth in the Netherlands: Sustained economic growth in the Netherlands, driven by innovation and strong domestic demand, is essential for long-term recovery.

- Innovation in key sectors: Continued innovation and investment in key sectors like technology and renewable energy will be crucial for the long-term growth of the AEX.

- Government policies: Supportive government policies aimed at stimulating economic growth and promoting investment can contribute to a long-term recovery.

Conclusion: Navigating the Sharp Decline in the Amsterdam Stock Index

The sharp decline in the Amsterdam Stock Index is a complex issue resulting from a confluence of global and domestic factors including global economic uncertainty, weak performance of key Dutch companies, and declining investor sentiment. The impact on the Dutch economy is significant, affecting businesses, investors, and pension funds. Understanding the factors behind this sharp decline in the Amsterdam Stock Index is crucial for navigating the current market conditions. Staying informed about economic developments and consulting with financial experts to develop a suitable investment strategy is vital for managing your investments effectively during periods of market volatility. Remember to diversify your portfolio and consider your personal risk tolerance before making any investment decisions.

Featured Posts

-

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025

Analysts Bold Prediction Apple Stock To Reach 254 Investment Advice

May 24, 2025 -

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025

Karisik Seyir Avrupa Borsalarinin Guenluek Performansi

May 24, 2025 -

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Drop To Year Low

May 24, 2025 -

Refleksiya Nad Chelovecheskoy Prirodoy Schekotanie Nervov V Rabotakh Fedora Lavrova

May 24, 2025

Refleksiya Nad Chelovecheskoy Prirodoy Schekotanie Nervov V Rabotakh Fedora Lavrova

May 24, 2025 -

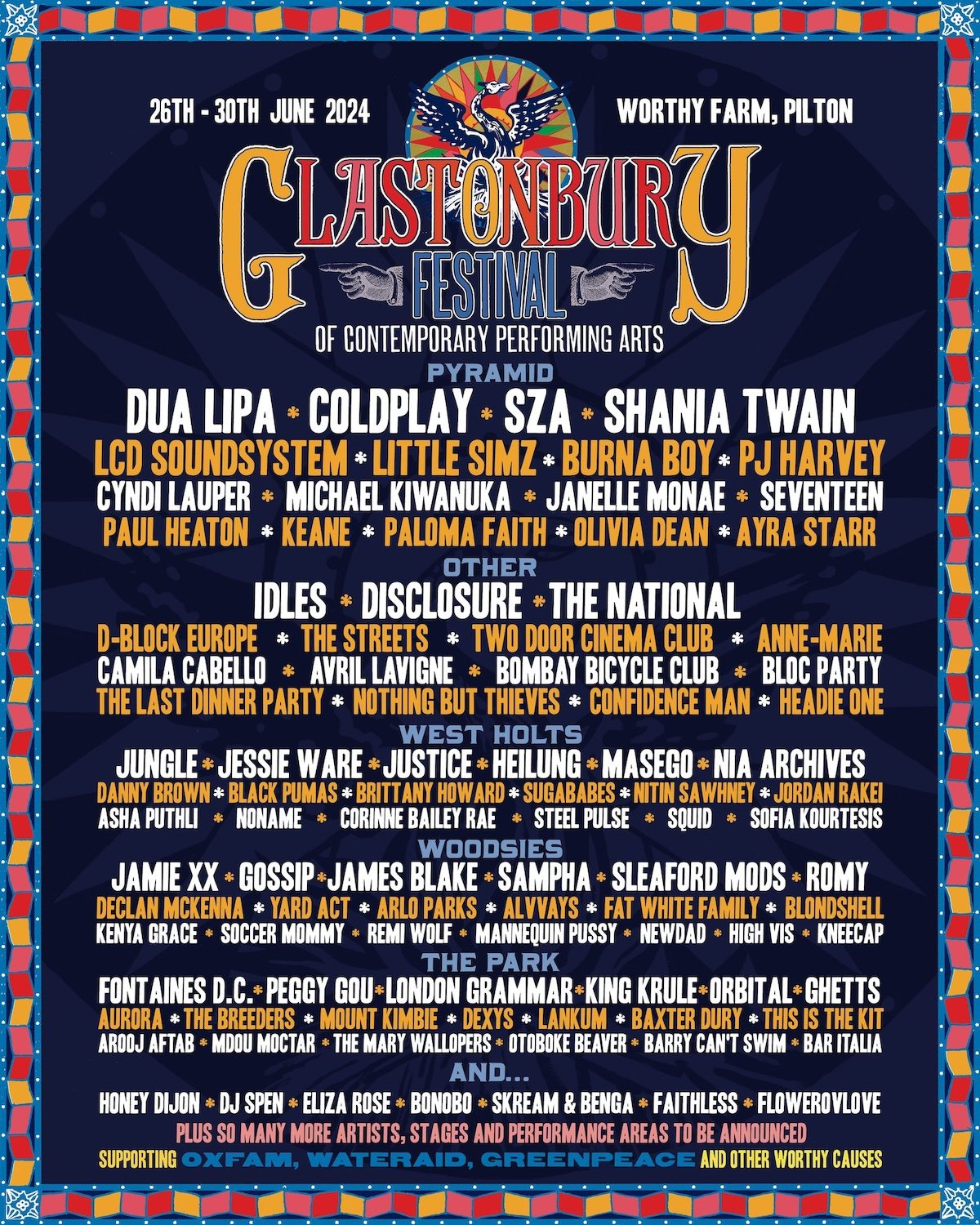

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025

Glastonbury 2024 Unannounced Us Band Performance Confirmed

May 24, 2025

Latest Posts

-

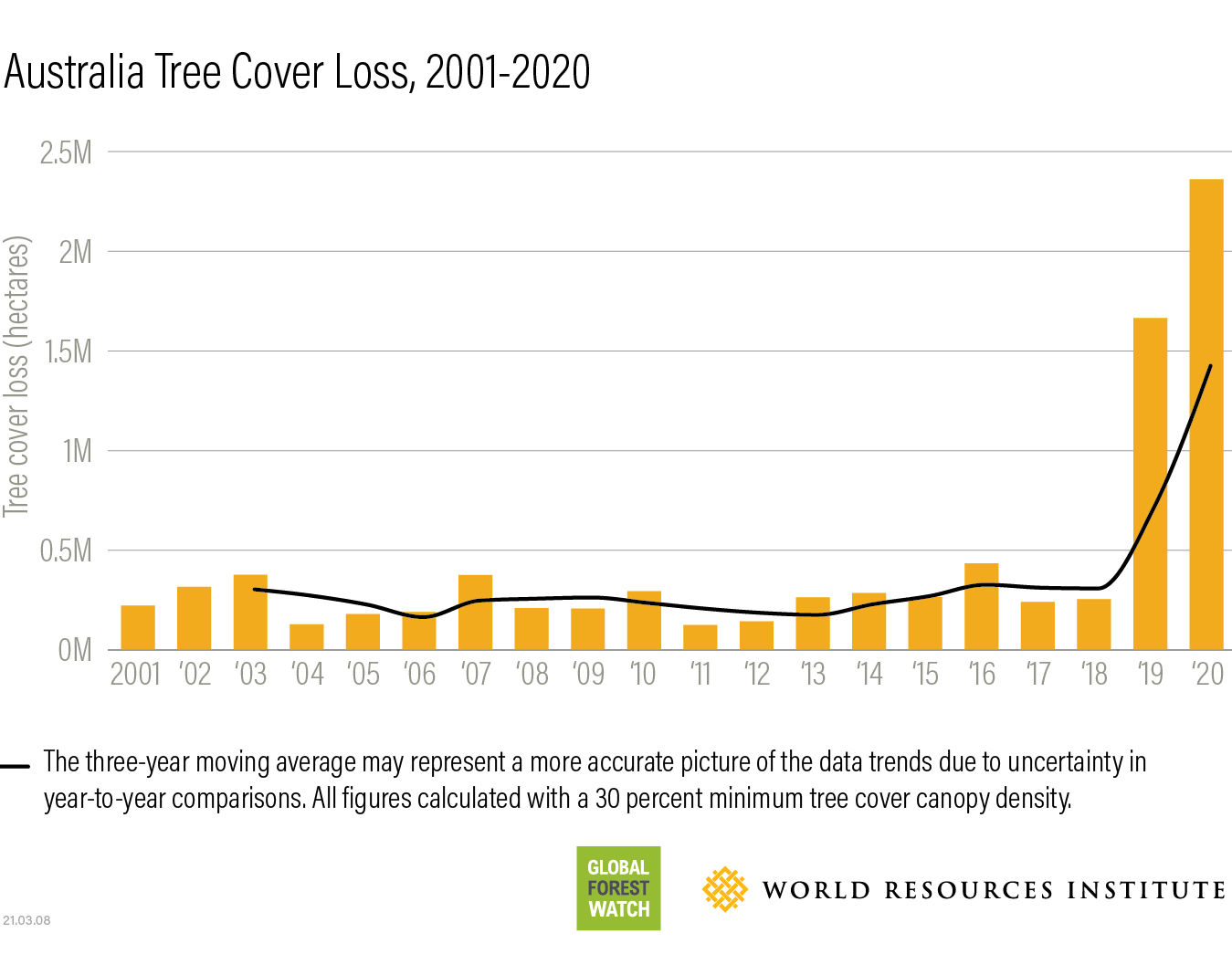

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025 -

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Auto Brands

May 24, 2025