Should You Invest In Palantir Stock Before May 5, 2024?

Table of Contents

Palantir Technologies is a data analytics company specializing in providing software platforms for government and commercial clients. Its unique business model and potential for growth in the burgeoning big data market have attracted significant investor interest. However, navigating the complexities of Palantir stock requires a careful assessment of its financial performance, competitive landscape, and inherent risks.

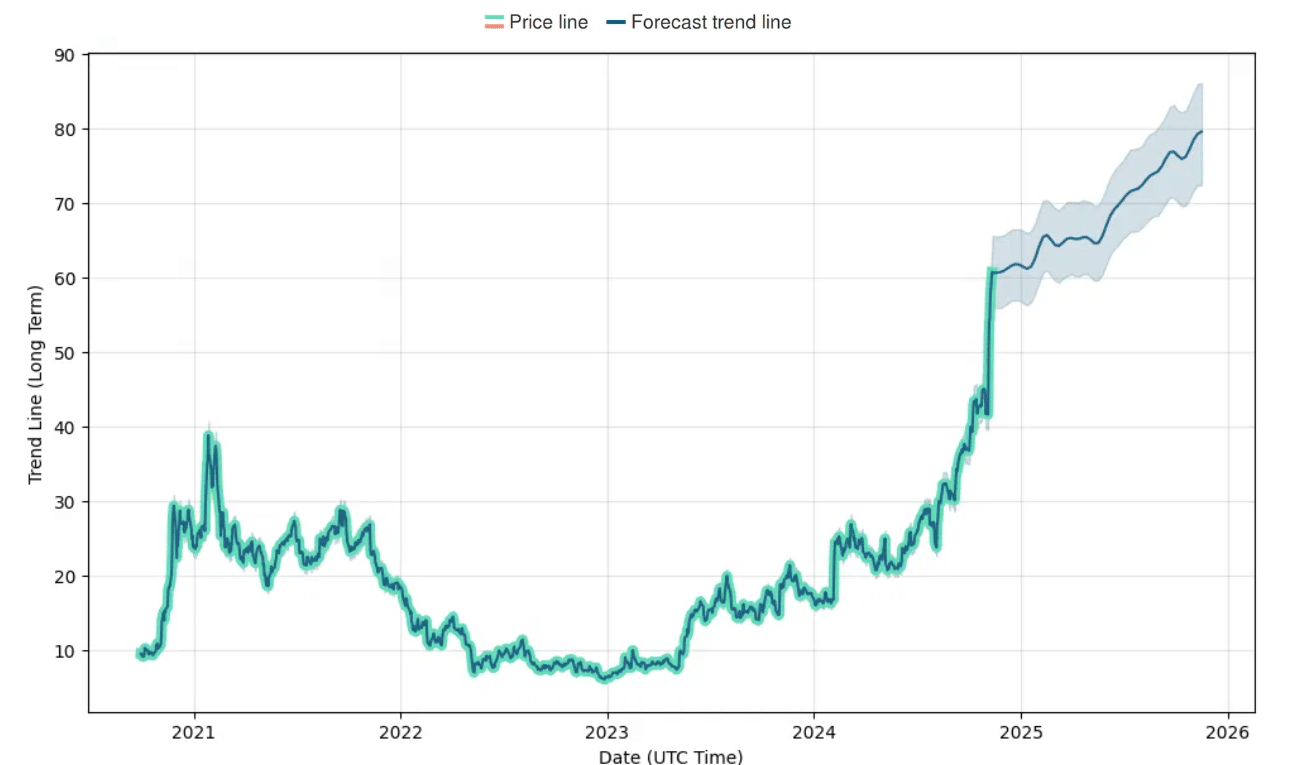

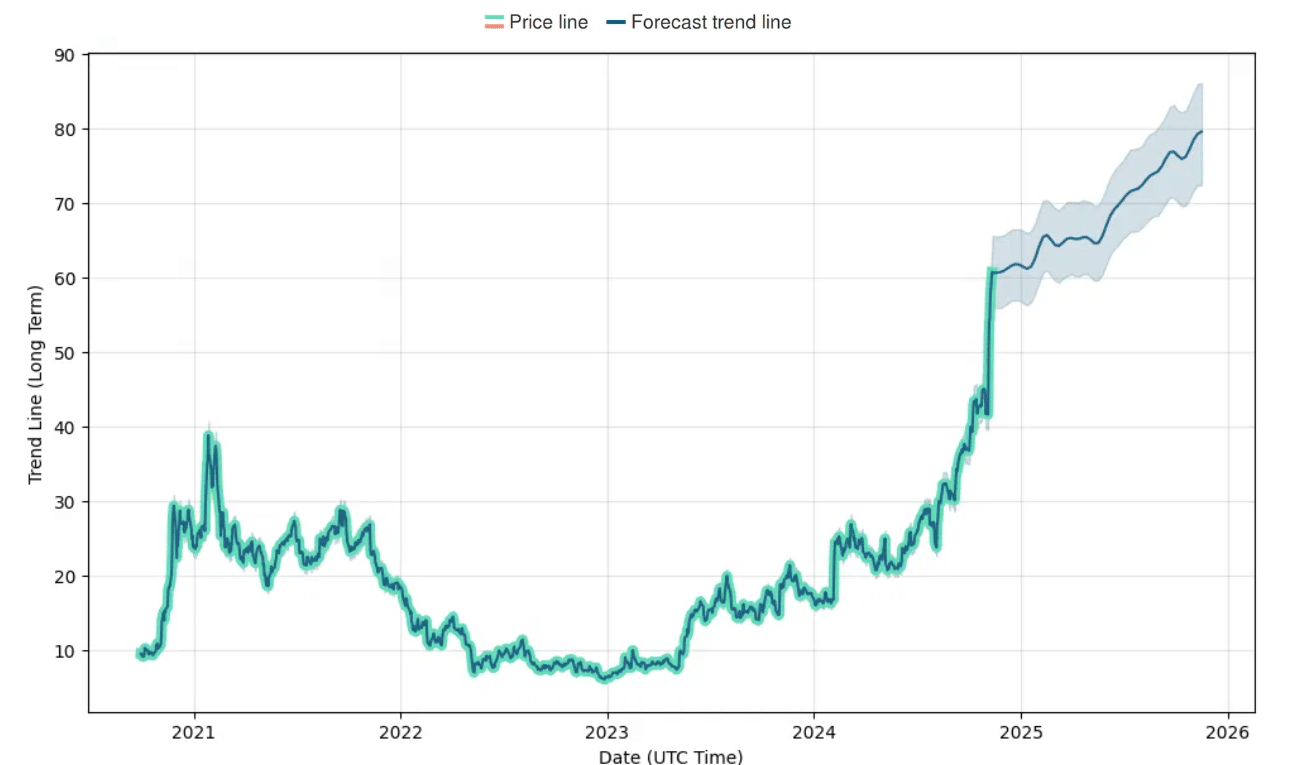

Palantir's Recent Financial Performance and Future Projections

Analyzing Palantir's recent quarterly earnings reports reveals valuable insights into its financial health and future prospects. Key performance indicators (KPIs) such as revenue growth, profitability margins, and key contract wins provide a snapshot of its current trajectory. While Palantir has shown consistent revenue growth, profitability remains a key area of focus for investors.

- Revenue Growth: Examine the year-over-year percentage increase in revenue. A consistently strong growth rate suggests a healthy and expanding market for Palantir's services.

- Profitability Margins: Analyze the trend of profitability margins (gross, operating, and net). Increasing margins indicate improved efficiency and cost management.

- Key Contract Wins: Significant contract wins, particularly in the government sector, can significantly impact Palantir's revenue and future projections. These should be carefully analyzed for their long-term impact on the Palantir stock price.

- Analyst Predictions: Refer to reputable financial analysts' predictions and price targets for Palantir stock. This provides an external perspective on the company's potential. However, remember that these are just predictions and not guarantees.

Analyzing Palantir's Competitive Landscape and Market Position

Palantir operates in a competitive landscape dominated by established players and emerging tech companies. Understanding Palantir's market position and competitive advantages is vital for assessing its long-term growth potential. Key aspects to consider include:

- Competitors: Identify Palantir's main competitors (e.g., AWS, Microsoft Azure, Google Cloud) and analyze their market share, strengths, and weaknesses.

- Market Share: Assessing Palantir's current market share within the big data analytics and government contracting sectors helps determine its dominance and potential for expansion.

- Unique Selling Propositions (USPs): Palantir's technological advantages, such as its advanced data integration capabilities and user-friendly interface, are crucial USPs that differentiate it from the competition.

- Threats and Opportunities: Analyze potential threats (e.g., increased competition, regulatory changes) and opportunities (e.g., expansion into new markets, technological advancements) in the market.

Evaluating the Risks Associated with Investing in Palantir Stock Before May 5, 2024

Investing in Palantir stock, like any investment, carries inherent risks. It's crucial to acknowledge these risks before making any investment decisions. Specific risks associated with Palantir include:

- Government Contract Dependence: Palantir's significant reliance on government contracts exposes it to potential risks associated with contract loss or changes in government policy.

- Competition: Intense competition from established players in the big data analytics market poses a significant challenge to Palantir's growth.

- Regulatory and Geopolitical Risks: Changes in regulations or geopolitical instability could negatively impact Palantir's operations and financial performance.

- Valuation Concerns: It's important to carefully evaluate Palantir's valuation to determine whether the current stock price accurately reflects its future growth potential. Overvaluation can lead to significant losses.

Considering Alternative Investment Strategies

Before investing solely in Palantir stock, consider diversifying your portfolio to mitigate risk. Alternatives could include:

- Diversification: Spread your investments across different asset classes (e.g., stocks, bonds, real estate) to reduce the overall risk.

- Index Funds or ETFs: Investing in index funds or ETFs that track broader market indices provides diversification and reduces reliance on individual company performance.

- Other Tech Companies: Explore other tech companies with similar growth potential but potentially lower risk profiles.

Conclusion: Should You Invest in Palantir Stock Before May 5, 2024? A Final Verdict

Investing in Palantir stock presents both opportunities and risks. While the company demonstrates strong revenue growth and innovative technology, its dependence on government contracts and the competitive landscape necessitate cautious consideration. Before making any decisions regarding Palantir investment, thorough due diligence is crucial. Remember to consult with a financial advisor to assess your risk tolerance and determine if Palantir shares align with your personal investment strategy. Consider diversifying your portfolio and exploring alternative investment options in the tech sector or broader market to manage risk effectively. Don't rush into a Palantir investment; conduct your research and make informed decisions about your Palantir investment strategy.

Featured Posts

-

Analyzing Palantir Stock A Buying Decision Before May 5th

May 09, 2025

Analyzing Palantir Stock A Buying Decision Before May 5th

May 09, 2025 -

Exploring The Enigma Four New Theories On Stephen Kings Randall Flagg

May 09, 2025

Exploring The Enigma Four New Theories On Stephen Kings Randall Flagg

May 09, 2025 -

Dakota Johnson With Family At Materialist La Screening

May 09, 2025

Dakota Johnson With Family At Materialist La Screening

May 09, 2025 -

Anchorage Fin Whale Skeleton Recovery Delayed Impact Of Warming Weather And Mud

May 09, 2025

Anchorage Fin Whale Skeleton Recovery Delayed Impact Of Warming Weather And Mud

May 09, 2025 -

The Nottingham Attacks Unheard Voices Finally Speak

May 09, 2025

The Nottingham Attacks Unheard Voices Finally Speak

May 09, 2025