Significant Spending Cuts At SSE: £3 Billion Reduction Explained

Table of Contents

SSE, a major player in the UK energy sector, has announced a dramatic £3 billion reduction in its planned spending. This significant move, representing a substantial SSE budget reduction, has sent ripples throughout the industry, raising questions about the company's future investment strategy and the broader implications for the energy market. This article will delve into the reasons behind these drastic SSE spending cuts, their potential impact, and what they signify for investors and consumers alike.

Reasons Behind the £3 Billion Spending Cut at SSE

Several interconnected factors have driven SSE's decision to implement such a significant SSE cost-cutting measure. Understanding these underlying pressures is crucial to grasping the full scope of this financial restructuring.

Increased Regulatory Scrutiny and Pressure

The energy sector is facing increasingly stringent regulatory oversight. Energy regulation impact on profitability is substantial, forcing companies like SSE to re-evaluate their investment strategies. Regulators are scrutinizing energy companies' spending on various fronts, focusing on issues like affordability, environmental sustainability, and market competition. Non-compliance can lead to significant financial penalties.

- Examples of regulatory changes impacting SSE's investment plans: New carbon emission targets, stricter rules on energy pricing, and increased audits of investment projects.

- Potential fines or penalties: Non-compliance with regulations can result in hefty fines, impacting SSE's financial performance and investor confidence. This increased SSE regulatory compliance burden necessitates a more cautious approach to capital expenditure.

Shifting Energy Market Dynamics

The energy market is undergoing a rapid transformation. The growth of renewable energy sources, such as wind and solar power, is altering the landscape of energy generation and distribution. This is coupled with increased competition from new entrants and technological advancements.

- Examples of new technologies affecting SSE's investment decisions: The rapid cost reduction of renewable energy technologies, such as offshore wind farms, is changing the economic viability of traditional power generation methods. The rise of distributed energy resources and smart grids also presents both opportunities and challenges for large energy companies like SSE.

- Challenges posed by competitors: Increased competition from smaller, more agile companies specializing in renewable energy is forcing SSE to reassess its investment portfolio and prioritize projects with the highest returns. SSE's energy portfolio needs to adapt to this evolving competitive environment.

Financial Pressures and Investor Concerns

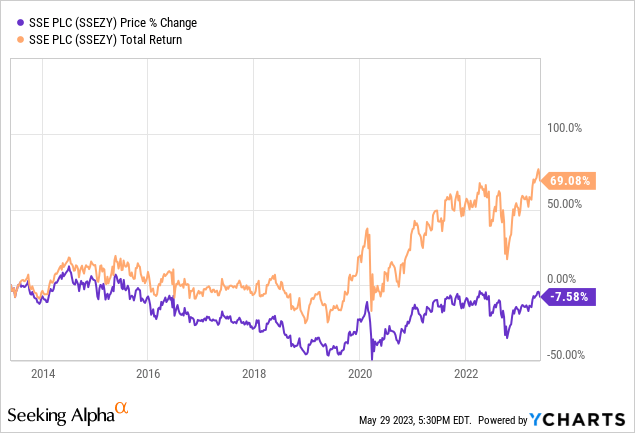

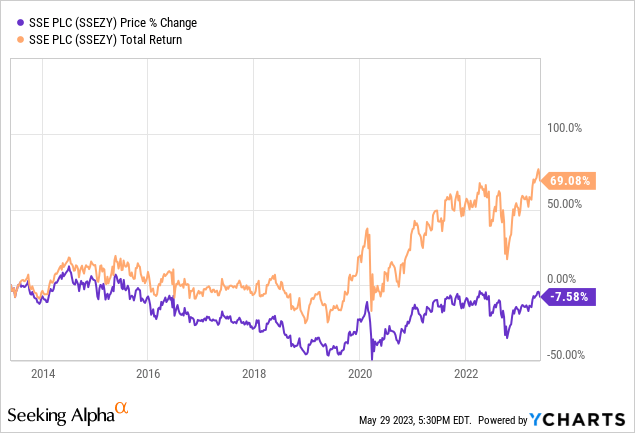

SSE is not immune to broader economic pressures. Concerns about debt levels, profit margins, and shareholder expectations of cost efficiency have contributed to the decision to reduce spending. Maintaining a healthy SSE share price is crucial for attracting investors and ensuring future growth.

- Mention debt levels, profit margins, and shareholder demands for cost efficiency: SSE's financial performance has been under scrutiny, leading to calls for improved cost management. Maintaining a healthy balance sheet and meeting shareholder expectations require difficult but necessary decisions regarding capital expenditure.

- SSE investor relations: Open communication with investors is critical during periods of significant change. The £3 billion reduction reflects SSE's commitment to fiscal responsibility and its effort to improve investor confidence.

Impact of the Spending Cuts on SSE's Operations and Future Projects

The £3 billion reduction in planned spending will have far-reaching consequences for SSE's operations and future projects. The implications extend to project development, workforce adjustments, and the company's long-term strategic goals.

Delayed or Cancelled Projects

The SSE spending cuts will inevitably lead to delays or cancellations of several projects, impacting SSE capital expenditure significantly. This is a direct consequence of prioritizing resource allocation towards more profitable or strategically important initiatives.

- Specific projects affected: While specific projects haven't all been publicly named, it's expected that some wind farm developments and potentially some power plant upgrades will experience delays or outright cancellation. This will significantly impact SSE project delays.

- Projected cost savings for each: The exact cost savings for each delayed or cancelled project will vary, but the overall aim is to achieve the £3 billion reduction target.

Job Security and Workforce Implications

The restructuring necessitated by the spending cuts will undoubtedly have implications for SSE's workforce. While SSE hasn't announced widespread job cuts, some level of workforce restructuring is anticipated.

- Potential job losses or restructuring plans: The company is likely to focus on streamlining operations and reducing redundancies where possible. The impact on individual employees will vary, and support packages are likely to be implemented. SSE job cuts remain a possibility but will be managed responsibly.

- Workforce restructuring: The process will aim to minimize job losses while enhancing efficiency and effectiveness.

Long-Term Strategic Implications

The long-term consequences of these spending cuts are significant and far-reaching. SSE's long-term strategy may need to be revisited, potentially impacting innovation, growth, and market competitiveness.

- Potential impacts on innovation, growth, and competitiveness: Reduced investment in research and development could hinder SSE's ability to innovate and stay ahead of its competitors. Delayed projects might also affect its market share and future growth prospects. SSE future energy investments will need to be carefully chosen.

Conclusion

SSE's £3 billion spending reduction is a substantial undertaking driven by increased regulatory pressure, evolving market dynamics, and financial considerations. The impact extends beyond immediate cost savings, significantly affecting future projects, potentially impacting the workforce, and requiring a reassessment of SSE's long-term strategy. Understanding the reasons behind this significant SSE financial restructuring is key to interpreting its future trajectory and its implications for the broader energy sector.

Call to Action: Stay informed about the ongoing developments surrounding these SSE spending cuts and their impact on the energy sector by following our regular updates. Subscribe to our newsletter or follow us on social media for the latest news and analysis on SSE and the energy market.

Featured Posts

-

Understanding Key Price Levels In Apple Stock Aapl

May 25, 2025

Understanding Key Price Levels In Apple Stock Aapl

May 25, 2025 -

The Angry Elon Musk Effect Analyzing Its Influence On Tesla

May 25, 2025

The Angry Elon Musk Effect Analyzing Its Influence On Tesla

May 25, 2025 -

The Countrys New Business Hot Spots Investment Opportunities And Trends

May 25, 2025

The Countrys New Business Hot Spots Investment Opportunities And Trends

May 25, 2025 -

Sean Penn Recent Appearance Sparks Concern And Controversy

May 25, 2025

Sean Penn Recent Appearance Sparks Concern And Controversy

May 25, 2025 -

Resurfaced Allegations Sean Penns Backing Of Woody Allen Sparks Debate

May 25, 2025

Resurfaced Allegations Sean Penns Backing Of Woody Allen Sparks Debate

May 25, 2025

Latest Posts

-

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025 -

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025 -

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025 -

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025 -

Toto Wolffs Latest Comments On George Russells Mercedes Future

May 25, 2025

Toto Wolffs Latest Comments On George Russells Mercedes Future

May 25, 2025