SMFG In Talks To Acquire Yes Bank Stake: Sources

Table of Contents

Details of the Potential SMFG-Yes Bank Acquisition

Reports suggest SMFG is considering acquiring a substantial stake in Yes Bank, although the exact percentage remains undisclosed at this time. The deal is reportedly in an advanced stage of negotiation, with due diligence processes potentially already underway. While precise figures are yet to be confirmed, sources hint at a considerable investment, potentially involving a significant price per share and a substantial total investment amount. The acquisition could involve further steps such as obtaining necessary board approvals and navigating the complexities of regulatory clearances in both India and Japan. However, significant uncertainty surrounds the final outcome, as ongoing negotiations are dynamic and subject to change. Key aspects influencing the final deal terms include the valuation of Yes Bank and the regulatory approvals needed for such a significant foreign investment.

Implications for Yes Bank

A successful SMFG acquisition could provide Yes Bank with a much-needed capital infusion, dramatically improving its financial stability and bolstering its balance sheet. SMFG's expertise in international banking and advanced technological capabilities could significantly enhance Yes Bank's operational efficiency and technological infrastructure. This strategic partnership has the potential to result in a considerable increase in Yes Bank's market share, expanding its reach and customer base. However, the specific terms and conditions of the deal will significantly influence Yes Bank's future operational strategies and overall direction. The acquisition could lead to changes in management, strategic focus, and even a potential rebranding to align with SMFG's global image.

Implications for SMFG

For SMFG, this acquisition represents a major expansion into the dynamic and rapidly growing Indian banking market. This strategic investment allows SMFG to diversify its international portfolio and gain access to India's vast and expanding customer base. The move could be seen as a calculated risk, however, given the challenges faced by Yes Bank and the inherent risks associated with the Indian banking sector. Therefore, SMFG will undoubtedly conduct thorough due diligence, focusing on areas like Yes Bank's asset quality, risk management practices, and regulatory compliance, before finalizing the deal. This expansion strategy is a significant step for SMFG's ambition to become a global financial player.

Wider Market Reactions and Speculations

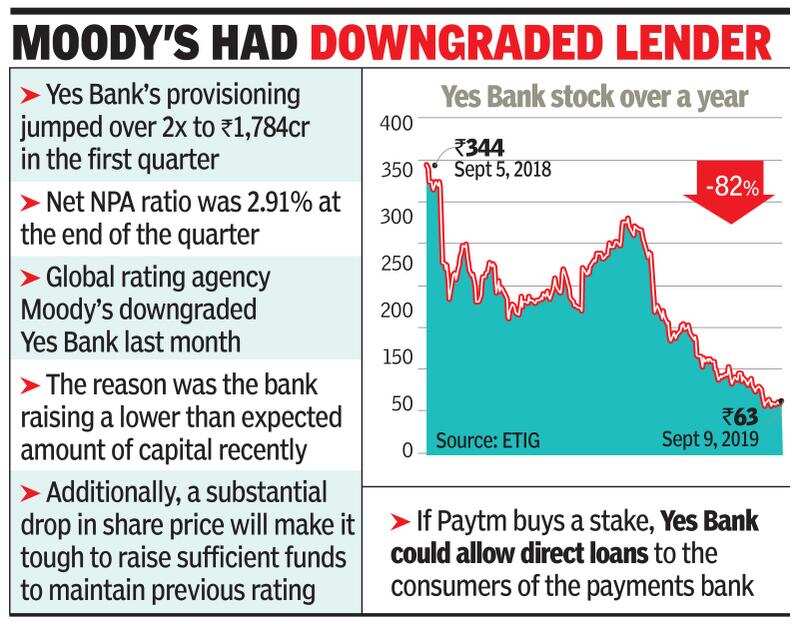

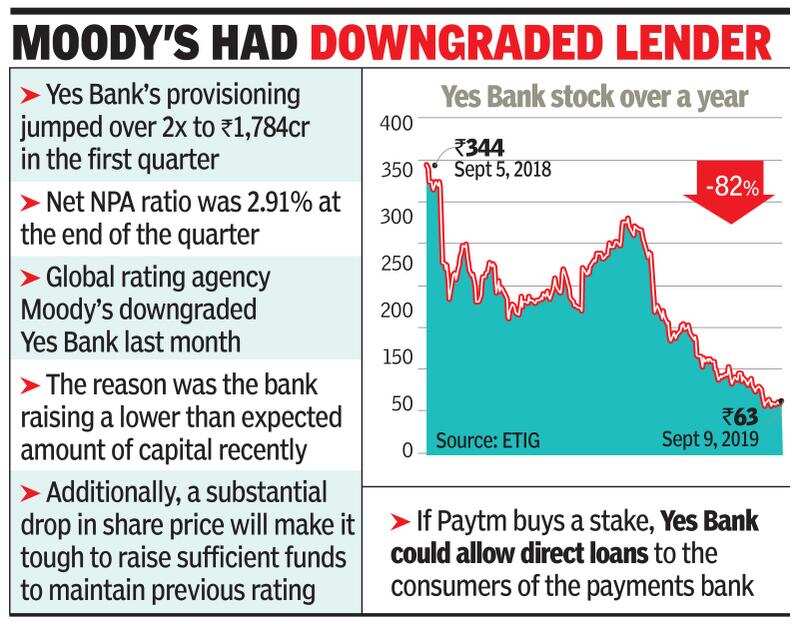

News of the potential SMFG-Yes Bank acquisition has already caused significant fluctuations in the stock prices of both companies. Investors are closely watching the situation, with opinions divided on the potential outcomes. The deal’s success hinges on various factors, including regulatory approval from the Reserve Bank of India (RBI) and other relevant authorities. The acquisition could trigger responses from other major players in the Indian banking sector, sparking increased competition and potentially leading to further mergers and acquisitions. Regulatory scrutiny from both Indian and Japanese authorities is expected, with a careful review of the deal’s compliance with all applicable laws and regulations.

Conclusion

The potential acquisition of a stake in Yes Bank by SMFG is a significant development within the Indian banking sector, with wide-reaching implications for both institutions. The success of this deal hinges on the ability of both parties to navigate the complex regulatory landscape and address the financial challenges facing Yes Bank. The ultimate outcome will likely significantly shape the competitive landscape of the Indian banking industry and could attract further foreign investment.

Call to Action: Stay updated on the latest developments in this unfolding SMFG and Yes Bank acquisition story. Check back frequently for updates and analysis on this potentially transformative event in the Indian financial market. Follow our coverage of this crucial SMFG-Yes Bank deal and all the latest banking industry news to stay informed.

Featured Posts

-

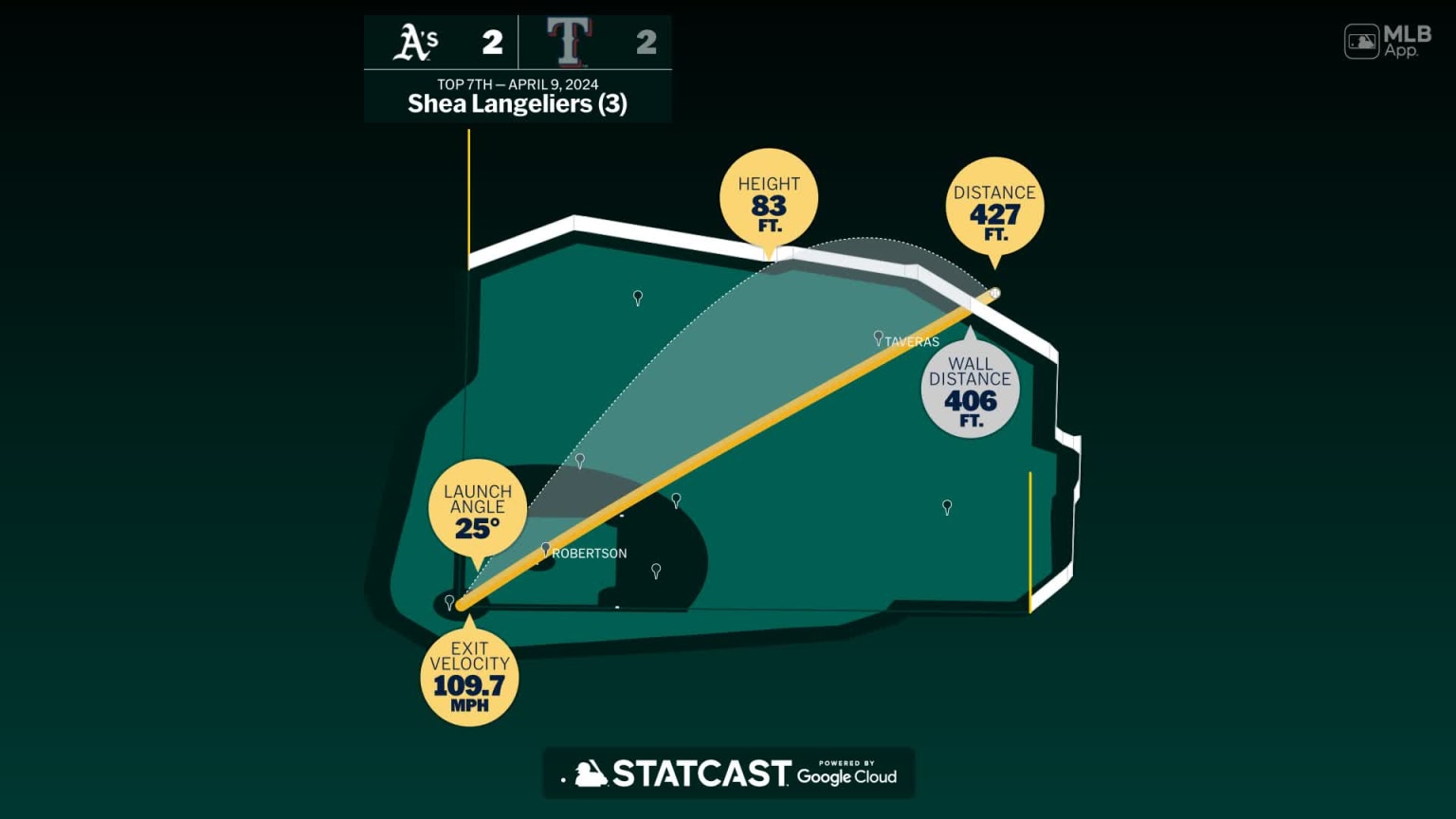

Shea Langeliers Home Run Key To As Win Against Mariners

May 07, 2025

Shea Langeliers Home Run Key To As Win Against Mariners

May 07, 2025 -

Replacing Previous Plans Wynns New Seafood Destination

May 07, 2025

Replacing Previous Plans Wynns New Seafood Destination

May 07, 2025 -

Minister Tavio To Attend Ldc Future Forum In Zambia Apo Group Press Release

May 07, 2025

Minister Tavio To Attend Ldc Future Forum In Zambia Apo Group Press Release

May 07, 2025 -

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025 -

Met Gala 2023 Rihanna Announces Third Pregnancy

May 07, 2025

Met Gala 2023 Rihanna Announces Third Pregnancy

May 07, 2025

Latest Posts

-

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025

Trump Medias Partnership With Crypto Com Etf Launch And Market Reaction

May 08, 2025 -

Cro Jumps As Trump Media Announces Crypto Com Etf Partnership

May 08, 2025

Cro Jumps As Trump Media Announces Crypto Com Etf Partnership

May 08, 2025 -

Trump Media And Crypto Com Partner On Etf Launch Boosting Cro Price

May 08, 2025

Trump Media And Crypto Com Partner On Etf Launch Boosting Cro Price

May 08, 2025 -

Ethereum Price Bullish Trend Supported By Large Scale Eth Accumulation

May 08, 2025

Ethereum Price Bullish Trend Supported By Large Scale Eth Accumulation

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators And Institutional Accumulation Point To 4 000

May 08, 2025

Ethereum Price Prediction Cross X Indicators And Institutional Accumulation Point To 4 000

May 08, 2025