Sovereign Bond Market Update: Swissquote Bank's Perspective

Table of Contents

Current Global Interest Rate Environment and its Impact on Sovereign Bonds

The current global interest rate environment significantly impacts the sovereign bond market. Central banks worldwide are actively managing monetary policy, leading to fluctuations in yields and prices of sovereign bonds.

Rising Interest Rates and their Influence

Rising global interest rates have a considerable influence on sovereign bond yields and prices.

- Inverse Relationship: There's an inverse relationship between bond prices and interest rates. As interest rates rise, the value of existing bonds with lower coupon rates falls, and vice versa.

- Maturity Impact: The impact varies across different sovereign bond maturities. Long-term bonds are generally more sensitive to interest rate changes than short-term bonds. A rise in interest rates will cause a greater price decline in a 30-year bond compared to a 2-year bond.

- Country-Specific Examples: Countries with higher levels of government debt are particularly vulnerable to rising interest rates. For instance, we've seen significant yield increases in the Italian and Greek sovereign bond markets recently.

Detailed Explanation: Central banks raise interest rates primarily to combat inflation. Higher rates make borrowing more expensive, cooling down economic activity and reducing inflationary pressures. This impacts investor behavior; as yields on new bonds increase, investors may sell existing lower-yielding bonds, driving down their prices. This interplay between interest rates, inflation, and investor sentiment creates volatility in the sovereign bond market, introducing significant interest rate risk and requiring effective inflation hedging strategies. The yield curve, which plots the yields of bonds with different maturities, provides crucial insights into market expectations of future interest rates.

Geopolitical Risks and Sovereign Credit Ratings

Geopolitical uncertainty and changes in sovereign credit ratings significantly affect sovereign bond yields and investor confidence.

- Geopolitical Events: Events like wars, political instability, or trade disputes can trigger flight-to-safety capital flows, impacting bond yields. The ongoing conflict in Ukraine, for example, has significantly affected global markets.

- Credit Rating Agencies: Agencies like Moody's, S&P, and Fitch play a crucial role. Their credit ratings influence investor perception of risk, directly affecting bond yields and spreads. A downgrade can lead to higher borrowing costs for a country.

- Country Examples: Countries facing political turmoil or economic instability often experience higher sovereign bond yields reflecting increased sovereign credit risk.

Detailed Explanation: Geopolitical risks increase the geopolitical risk premium, meaning investors demand higher yields to compensate for the increased uncertainty. Credit rating downgrades further amplify this effect. Credit default swaps (CDS), which are insurance contracts against default, become more expensive when geopolitical risks rise or credit ratings are downgraded, demonstrating the interconnectedness between these factors and sovereign bond pricing.

Key Sovereign Bond Market Trends & Opportunities

Navigating the sovereign bond market requires understanding key trends and identifying opportunities within various segments.

High-Yield Sovereign Bonds

High-yield sovereign bonds, often associated with emerging markets, present both opportunities and significant risks.

- Characteristics: These bonds offer higher yields than those of more established economies, reflecting the increased risk of default.

- Potential Returns and Risks: While potential returns are higher, the risk of default is also substantially greater. Economic and political instability in the issuing country can significantly impact repayment.

- Risk-Reward Profile: Factors like economic growth prospects, political stability, and debt levels influence the risk-reward profile of these bonds.

Detailed Explanation: Investing in high-yield bonds or emerging market debt demands a thorough understanding of country-specific economic conditions and the potential for default risk. Diversification and thorough due diligence are crucial to mitigate potential losses.

Safe-Haven Sovereign Bonds

During times of market volatility, safe-haven sovereign bonds issued by countries with strong economies and stable political systems offer a haven for investors.

- Safe-Haven Countries: The US, Germany, and Japan are frequently considered issuers of safe-haven sovereign bonds.

- Market Uncertainty Appeal: Their appeal increases during periods of global uncertainty as investors seek stability and capital preservation.

- Factors Contributing to Safe-Haven Status: Strong economic fundamentals, low inflation, and political stability contribute to this status.

Detailed Explanation: The demand for safe-haven assets rises during times of crisis, leading to a "flight to safety." Investors move their capital into these perceived secure investments, even if the yields are relatively low compared to riskier assets. Government bonds from stable countries are at the heart of such strategies.

Swissquote Bank's Outlook and Investment Strategies for Sovereign Bonds

Swissquote Bank provides valuable insights and tailored investment strategies for navigating the sovereign bond market.

Swissquote's Market Analysis

Swissquote Bank's analysis provides a comprehensive overview of the current market landscape.

- Interest Rate Forecast: Swissquote provides its forecast for future interest rate movements, considering macroeconomic factors and central bank policies.

- Geopolitical Risk Assessment: Swissquote analyzes potential geopolitical risks and their impact on sovereign bond yields.

- Key Market Assessment: Swissquote's assessment provides an overview of significant sovereign bond markets.

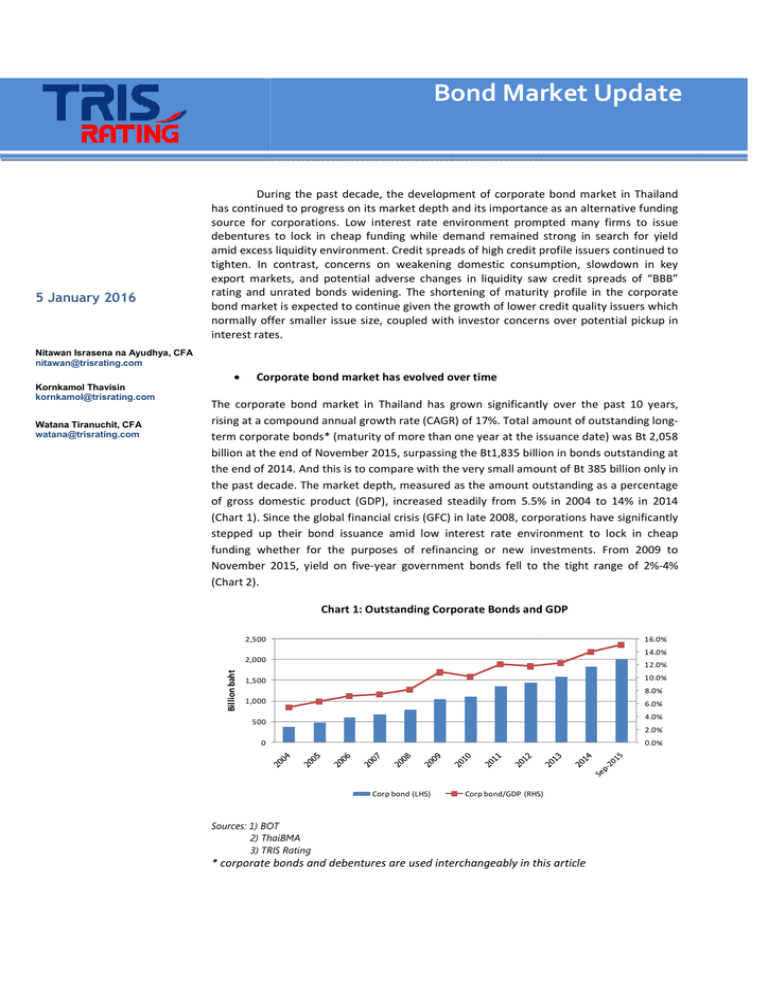

Detailed Explanation: Swissquote's analysis is supported by extensive research and data, helping investors understand market trends and potential risks. Charts and graphs are typically used to illustrate these findings.

Investment Recommendations

Swissquote offers strategic investment recommendations for the sovereign bond market.

- Specific Bond Suggestions: Swissquote may recommend specific types of bonds or markets based on the investor's risk profile and investment goals.

- Risk Tolerance: Appropriate risk tolerance levels are crucial for determining suitable investment strategies.

- Portfolio Diversification: Swissquote emphasizes portfolio diversification to mitigate risk.

Detailed Explanation: Swissquote’s investment recommendations emphasize risk mitigation and diversification strategies to optimize returns while minimizing exposure to potential market downturns.

Conclusion

The sovereign bond market remains a dynamic and influential sector of the global financial landscape. Understanding current trends, geopolitical risks, and potential opportunities is crucial for informed investment decisions. Swissquote Bank's analysis offers valuable insights into navigating the complexities of the sovereign bond market, helping investors make strategic choices. To learn more about navigating the complexities of the sovereign bond market and to access Swissquote Bank's expert insights and investment solutions, visit [link to Swissquote website]. Consider diversifying your portfolio with a strategic allocation of sovereign bonds to manage risk and potentially enhance returns. Remember to always consult a financial advisor before making any investment decisions.

Featured Posts

-

Correismo Impugna La Prohibicion De Celulares En Segunda Vuelta Electoral

May 19, 2025

Correismo Impugna La Prohibicion De Celulares En Segunda Vuelta Electoral

May 19, 2025 -

12 Milyon Avroluk Kktc Yardimi Tuerk Huekuemetlerinin Kararinin Detaylari Ve Etkileri

May 19, 2025

12 Milyon Avroluk Kktc Yardimi Tuerk Huekuemetlerinin Kararinin Detaylari Ve Etkileri

May 19, 2025 -

Senate Approves Education Cuts Universities Prepare Lawsuit

May 19, 2025

Senate Approves Education Cuts Universities Prepare Lawsuit

May 19, 2025 -

Kuzey Kibris Mutfagi Itb Berlin De Tanitildi Ziyaretci Yorumlari Ve Degerlendirmeler

May 19, 2025

Kuzey Kibris Mutfagi Itb Berlin De Tanitildi Ziyaretci Yorumlari Ve Degerlendirmeler

May 19, 2025 -

Abba Voyage Band Addresses Setlist Modifications

May 19, 2025

Abba Voyage Band Addresses Setlist Modifications

May 19, 2025

Latest Posts

-

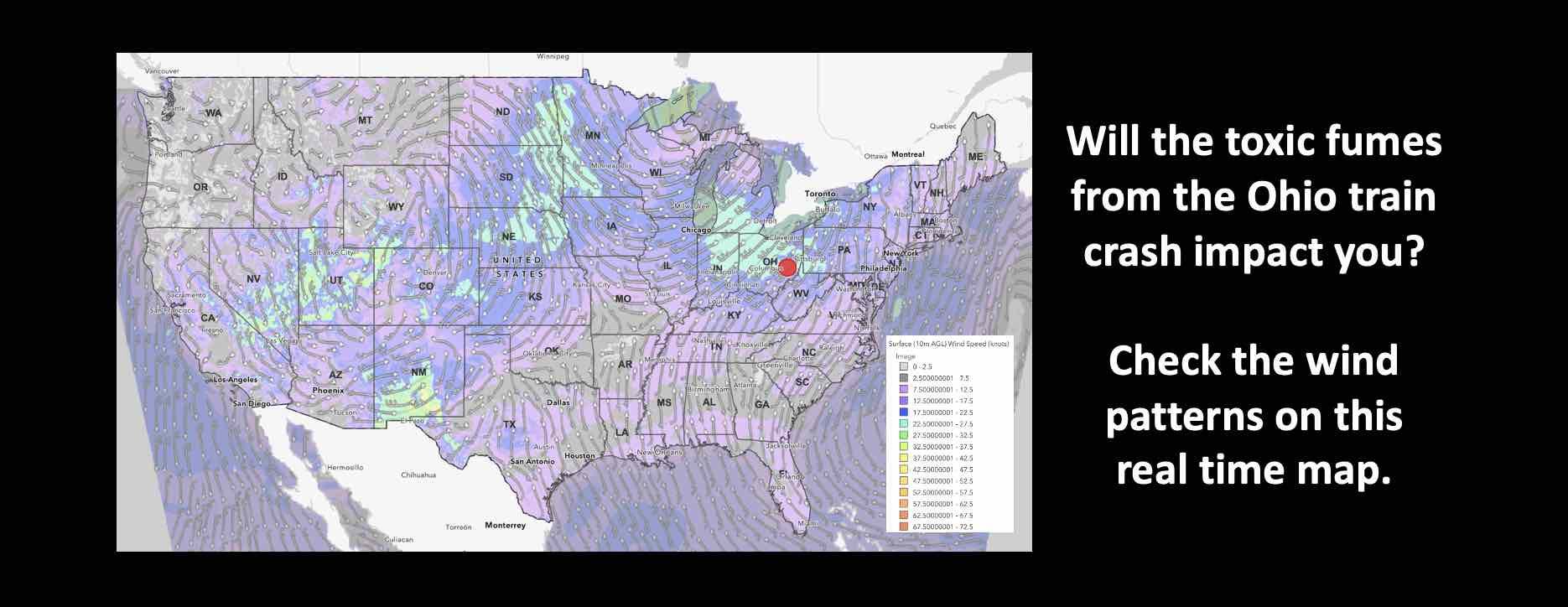

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025

Ohio Train Disaster Persistent Toxic Chemicals Found In Buildings

May 19, 2025 -

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025

Toxic Chemical Residue From Ohio Derailment Months Long Contamination

May 19, 2025 -

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025

Federal Investigation Office365 Breach Nets Millions For Hacker

May 19, 2025 -

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025

Millions Stolen After Office365 Hack Of Executive Inboxes Fbi Alleges

May 19, 2025 -

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025

Severe Storms And Tornadoes 25 Fatalities Extensive Damage In Central Us

May 19, 2025