Stock Market News: Analyzing The Impact Of Trump's Proposed Tariffs And The UK Trade Deal

Table of Contents

Trump's Proposed Tariffs: A Retrospective Analysis and Current Implications

While the specific tariffs proposed by the Trump administration are no longer in effect in their original form, their impact serves as a valuable case study for understanding the broader effects of trade wars on the stock market. This section examines the lingering consequences and their relevance to current geopolitical tensions.

Impact on Specific Sectors

The imposition of tariffs, even those no longer in place, had a ripple effect across various sectors.

-

Manufacturing: Increased production costs stemming from tariffs led to reduced competitiveness for some US manufacturers, impacting profitability and potentially leading to job losses in certain segments. Companies faced pressure to absorb the increased costs or raise prices, impacting consumer spending.

-

Agriculture: Farmers experienced reduced exports to countries subject to tariffs, resulting in price fluctuations and an increased reliance on domestic markets. This created both challenges and opportunities, leading to adjustments in farming practices and market diversification strategies.

-

Technology: While the technology sector was initially perceived as less directly impacted, supply chain disruptions and increased costs for components sourced internationally caused indirect effects on profitability and investment decisions.

Winners and Losers: While some domestic industries initially benefited from protectionist measures, the overall impact was often a redistribution of economic activity rather than a net gain. Companies that successfully diversified their supply chains or adapted to the new landscape ultimately proved more resilient.

Long-Term Economic Consequences

The long-term consequences of trade wars are complex and often debated. Economists point to potential effects on:

-

Inflation: Tariffs can increase the prices of imported goods, contributing to inflationary pressures. The magnitude of this effect depends on factors like the elasticity of demand and the availability of substitutes.

-

Economic Growth: Disruptions to global supply chains and reduced trade can hinder economic growth. The overall economic impact often varies significantly across nations.

-

Consumer Spending: Increased prices due to tariffs can reduce consumer purchasing power, impacting overall demand and economic activity.

The lasting impact of these effects is still being assessed, highlighting the need for careful analysis of future trade policies and their potential implications.

The UK Trade Deal: Opportunities and Challenges for the Stock Market

The UK's departure from the European Union and subsequent trade deals represent a significant development in global trade, with ongoing implications for the stock market.

Post-Brexit Trade Agreements

The UK has actively pursued trade agreements with various countries post-Brexit. These agreements offer both opportunities and challenges.

-

Increased Trade with Specific Regions: New trade deals have opened up opportunities for increased trade with countries in the Commonwealth and beyond.

-

New Market Access Opportunities: UK businesses have gained access to new markets, potentially boosting exports and economic growth.

-

Potential Regulatory Hurdles: Navigating different regulatory environments and increased administrative burdens associated with new trade deals presents challenges for businesses.

Uncertainty and Volatility

Uncertainty surrounding the UK's future trade relations continues to impact investor confidence and market volatility.

-

Lingering Uncertainty: The long-term implications of Brexit remain uncertain, leading to fluctuations in the stock market as investors assess the evolving situation.

-

Market Volatility: News and developments related to Brexit have historically caused significant swings in the stock market, demonstrating the link between trade policy and investment risk.

Investment Strategies in a Changing Global Trade Landscape

Navigating the complexities of global trade requires adaptable investment strategies.

Diversification and Risk Management

In a volatile market shaped by trade uncertainties, diversification is paramount.

-

Diversify Portfolio: Spreading investments across various asset classes, sectors, and geographies mitigates risk.

-

Risk Management Strategies: Employing strategies like hedging and options trading can help manage potential losses from trade-related market fluctuations.

-

Portfolio Adjustments: Regularly reviewing and adjusting investment portfolios based on changing global trade dynamics is essential.

Identifying Opportunities in Emerging Markets

Emerging markets, often less directly affected by trade disputes between major economies, may present attractive investment opportunities.

-

Emerging Market Potential: Countries with robust domestic economies and less reliance on exports to conflicting nations may be more resilient.

-

Sector-Specific Opportunities: Specific sectors within emerging markets may benefit from shifts in global trade patterns.

Conclusion: Stock Market News and Navigating Global Trade Uncertainty

The impact of past and present trade policies, such as the ramifications of Trump's proposed tariffs and the ongoing effects of the UK trade deal, underscore the dynamic relationship between global trade and stock market performance. Staying informed about stock market news and understanding the potential implications of trade developments is crucial for informed investment decisions. Effective diversification, robust risk management, and a keen eye on emerging markets are essential strategies for navigating this complex landscape.

To stay updated on critical stock market news, including analysis of current trade policies and their effects, subscribe to our newsletter, follow us on social media, or regularly visit our website for insightful analysis. Further research using keywords like "global trade impact," "Brexit investment," and "emerging market opportunities" will provide a more comprehensive understanding of this dynamic field.

Featured Posts

-

Celtics Pritchard Wins Nba Sixth Man Of The Year Award

May 11, 2025

Celtics Pritchard Wins Nba Sixth Man Of The Year Award

May 11, 2025 -

Enhancing The Reliability Of Automated Visual Inspection Systems For Lyophilized Vials

May 11, 2025

Enhancing The Reliability Of Automated Visual Inspection Systems For Lyophilized Vials

May 11, 2025 -

Conclave 2024 Nine Possible Successors To Pope Francis

May 11, 2025

Conclave 2024 Nine Possible Successors To Pope Francis

May 11, 2025 -

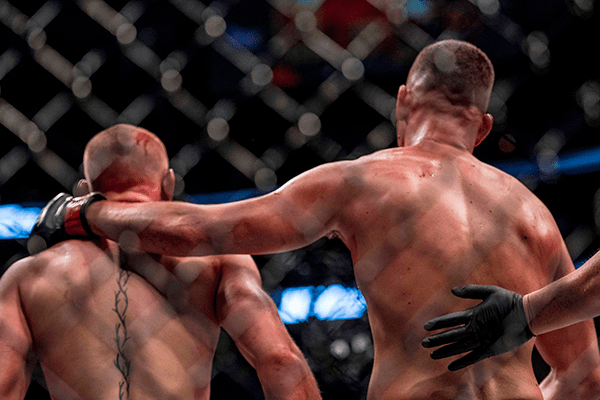

Mma Torchs Top 3 Fights 5 10 And 25 Minute Rounds

May 11, 2025

Mma Torchs Top 3 Fights 5 10 And 25 Minute Rounds

May 11, 2025 -

Valentina Shevchenko Considers Zhang Weili Superfight Following Ufc 315 Victory

May 11, 2025

Valentina Shevchenko Considers Zhang Weili Superfight Following Ufc 315 Victory

May 11, 2025