Stock Market News Today: Dow Futures And Dollar React To Trade Tensions

Table of Contents

Dow Futures: A Sensitive Indicator

Dow futures, a key indicator of the US stock market's expected performance, are acutely sensitive to shifts in global trade dynamics. Understanding their current state is crucial for assessing the overall market sentiment.

Current Dow Futures Performance

As of [Insert current date and time], Dow futures are showing [Insert current Dow Futures value and percentage change]. This represents a [increase/decrease] of [percentage] compared to yesterday's closing value and a [increase/decrease] of [percentage] compared to last week's closing value. The volatility in Dow futures throughout the day reflects the ongoing uncertainty surrounding trade negotiations.

- Opening Value: [Insert opening value]

- Closing Value (at time of writing): [Insert closing value]

- Daily Volatility: [Describe the range of fluctuation observed throughout the day and its relation to news headlines on trade.]

Factors Influencing Dow Futures

Several factors are significantly influencing the performance of Dow futures, with trade-related news playing a dominant role.

- Specific Trade Policy Announcements: [Mention specific recent trade announcements, tariffs, or agreements and their direct impact on Dow futures. Include links to reputable news sources for verification].

- Investor Sentiment: The prevailing investor sentiment is currently [optimistic/pessimistic/cautious] due to [explain reasons related to trade tensions – e.g., fears of a trade war, uncertainty about future trade agreements, etc.]. This significantly impacts trading decisions and consequently, Dow futures prices.

- Related Economic Indicators: [Mention any relevant economic indicators like inflation rates, manufacturing PMI, or consumer confidence that are correlated with Dow futures and influenced by trade tensions.]

The US Dollar's Reaction to Trade Uncertainty

The US dollar's value is intricately linked to global trade dynamics. Its performance against other major currencies often reflects investor confidence and risk appetite in the face of trade uncertainty.

Dollar Strength and Weakness

Currently, the US dollar is [strengthening/weakening] against the Euro ([EUR/USD exchange rate]), Yen ([USD/JPY exchange rate]), and [mention other relevant currencies and their exchange rates].

- Safe Haven Status: The dollar's role as a "safe haven" currency during periods of global uncertainty is once again apparent. [Explain how this role influences its value during times of trade tension].

- Currency Trading Strategies: Trade tensions are prompting shifts in currency trading strategies. [Explain how traders are adjusting their strategies in response to the dollar's fluctuating value, e.g., hedging, short-selling, etc.].

- Comparative Performance: [Discuss how the dollar's performance compares to other major currencies considered "safe havens" during times of economic instability].

Impact on International Trade

Fluctuations in the dollar's value have significant implications for US businesses engaged in international trade.

- Impact on US Businesses: A stronger dollar makes US exports more expensive and imports cheaper, potentially impacting the competitiveness of US businesses in the global market. Conversely, a weaker dollar can boost exports but increase the cost of imports.

- Global Supply Chains: Trade tensions disrupt established global supply chains, leading to delays, increased costs, and potential shortages. [Provide specific examples of industries or supply chains affected by trade tensions].

- Inflationary/Deflationary Pressures: Changes in the dollar's value can exert inflationary or deflationary pressures depending on the direction of the change and the elasticity of import and export demand. [Explain the potential inflationary and deflationary effects].

Expert Analysis and Predictions

Understanding the perspectives of market experts is crucial for navigating the current market climate. Their analyses provide insights into potential future trends.

Market Analyst Opinions

Several leading market analysts have offered their perspectives on the ongoing situation. [Cite reputable sources and provide concise summaries of their opinions and predictions on Dow futures, the US dollar, and the overall market implications of the trade tensions.]

- Analyst 1: [Quote and summarize their view]

- Analyst 2: [Quote and summarize their view, noting any differences with Analyst 1]

- Analyst 3: [Quote and summarize their view, highlighting any consensus or divergence in opinions]

Investment Strategies

The current market conditions necessitate a cautious and diversified investment approach.

- Diversification: Diversifying your investment portfolio across various asset classes is crucial to mitigate the risks associated with trade tensions.

- Risk Management: Implement effective risk management techniques to protect your investments from market volatility.

- Professional Advice: Seek professional financial advice tailored to your specific circumstances before making any significant investment decisions. This article provides general information and should not be considered financial counsel.

Conclusion

Trade tensions continue to significantly impact the stock market, influencing Dow futures and the US dollar's performance. The volatility experienced reflects the uncertainty surrounding future trade policies and their effect on global markets. The interconnectedness of these factors highlights the importance of carefully monitoring global trade news and its impact on investments. Market analysts offer diverse perspectives, emphasizing the need for diversified investment strategies and careful risk management.

Key Takeaways:

- Dow futures are highly sensitive to trade-related news, reflecting investor sentiment and market expectations.

- The US dollar's value fluctuates in response to trade uncertainty, impacting international trade and business competitiveness.

- Expert opinions highlight the need for diversified investment strategies and careful risk management in this volatile environment.

Stay informed on the latest stock market news and the impact of trade tensions by regularly checking back for updated analysis on Dow futures and the dollar. Consult reputable financial news sources for the most up-to-date information and always seek professional financial advice before making investment decisions.

Featured Posts

-

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 22, 2025

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 22, 2025 -

The Economic Fallout Of Trumps Trade Actions A Risk To Americas Financial Dominance

Apr 22, 2025

The Economic Fallout Of Trumps Trade Actions A Risk To Americas Financial Dominance

Apr 22, 2025 -

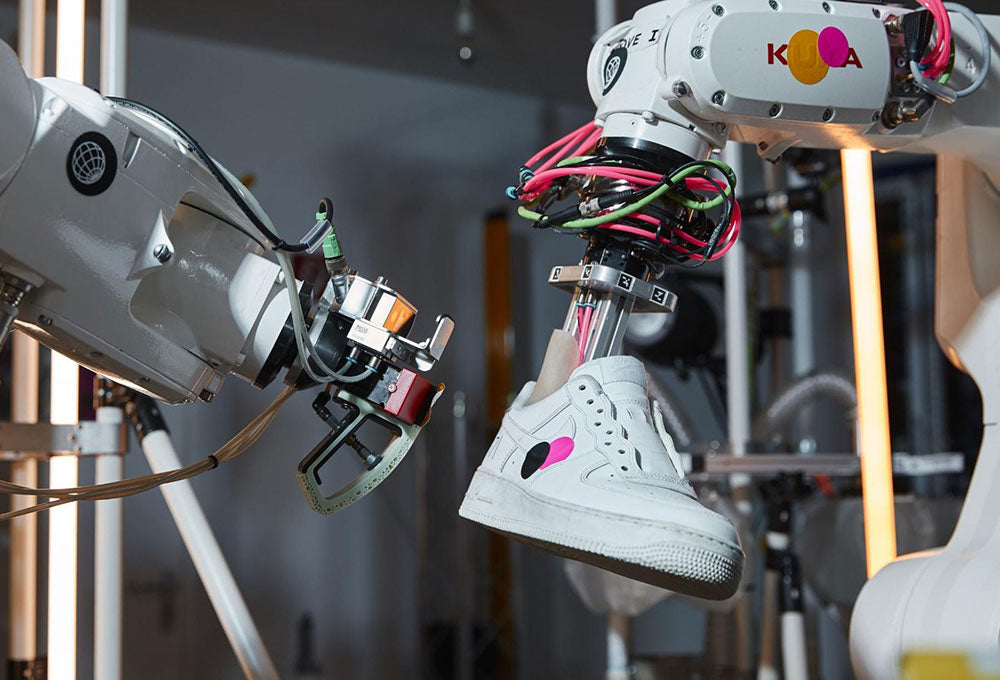

Why Nike Sneaker Production Remains A Challenge For Robots

Apr 22, 2025

Why Nike Sneaker Production Remains A Challenge For Robots

Apr 22, 2025 -

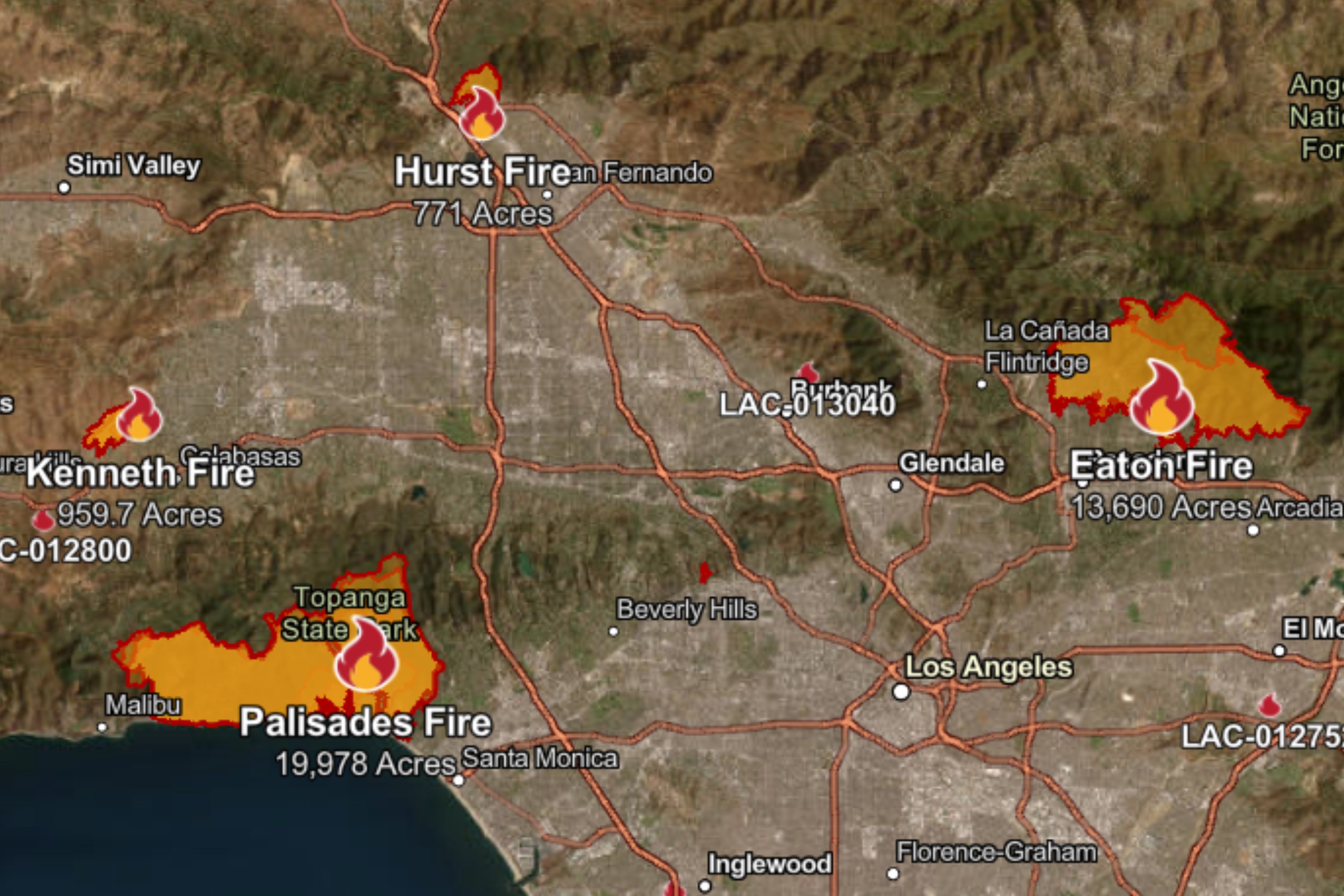

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025 -

Kyivs Dilemma Responding To Trumps Plan To End The Ukraine Conflict

Apr 22, 2025

Kyivs Dilemma Responding To Trumps Plan To End The Ukraine Conflict

Apr 22, 2025