Stock Market Pain: Investors Push Prices Higher Despite Risks

Table of Contents

Ignoring the Warning Signs: Why Investors are Pushing Prices Higher

Several factors contribute to the current market surge, even as red flags wave. Understanding these underlying forces is crucial to assess the potential for future stock market pain.

FOMO (Fear Of Missing Out): The Driving Force Behind Irrational Exuberance

The relentless upward trend of the past months has fueled a powerful Fear Of Missing Out (FOMO) among investors. This psychological factor encourages hesitant investors to jump in, fearing they'll miss out on further gains. This, in turn, creates a self-fulfilling prophecy, pushing prices even higher, regardless of underlying fundamentals.

- Increased trading volume from retail investors: Data shows a significant increase in trading activity from individual investors, many of whom are new to the market and potentially less risk-averse.

- Social media influence and hype cycles driving investment decisions: The amplification of positive news and speculative narratives on social media platforms further contributes to FOMO and fuels impulsive investment decisions. Meme stocks and cryptocurrency trends exemplify this phenomenon.

- A belief that the "bull market" will continue indefinitely: Many investors are operating under the assumption that the current bull market will persist indefinitely, leading to a disregard for potential downsides and a willingness to take on greater risk.

Low Interest Rates & Alternative Investment Scarcity: Seeking Higher Yields in a Low-Return Environment

With traditional savings accounts and bonds offering meager returns, investors are actively seeking higher yields, pushing money into riskier assets like stocks. This shift is partly driven by the prolonged period of low interest rates.

- Comparison of stock market returns vs. bond yields and savings accounts: A stark contrast exists between the comparatively higher returns offered by the stock market and the paltry yields available in safer alternatives.

- Analysis of the impact of quantitative easing on investor behavior: Years of quantitative easing by central banks have contributed to a low-yield environment, encouraging investors to seek higher returns in the stock market.

- Discussion on the lack of attractive alternatives in the current economic climate: The scarcity of alternative investment options that offer competitive yields further drives capital into the stock market, regardless of inherent risks.

Company Earnings and Positive Economic Sentiment: A Glimmer of Reality Amidst the Hype

Strong corporate earnings reports and positive economic indicators, while legitimate factors influencing stock prices, may be overshadowed by the overarching optimism fueling the current rally. The disconnect between fundamentals and current market valuations is a concern.

- Examination of recent corporate earnings reports and their impact on stock prices: While some companies are reporting strong earnings, the market's reaction might be disproportionate to the actual improvement in fundamentals.

- Analysis of economic indicators and their correlation with market performance: While positive economic indicators exist, their relationship with the current market valuation needs careful scrutiny. Are current prices sustainable given underlying economic realities?

- Discussion of potential disconnect between fundamentals and current market valuations: A significant gap may exist between the intrinsic value of companies and their current market prices, indicating a potential for a significant correction.

The Potential Risks: A Market Correction is Looming

Despite the current exuberance, several significant risks could trigger a market correction, leading to considerable stock market pain.

Inflationary Pressures: Eroding Purchasing Power and Stock Valuations

Rising inflation erodes the purchasing power of future earnings, potentially leading to a significant market correction. Central banks' attempts to curb inflation through interest rate hikes further complicate the situation.

- Explanation of the relationship between inflation and stock valuations: High inflation reduces the present value of future earnings, impacting company valuations and potentially leading to price declines.

- Discussion on the Federal Reserve's response to inflation and its impact on the market: The Federal Reserve's actions to combat inflation, including interest rate hikes, can significantly impact market sentiment and potentially trigger volatility.

- Analysis of historical instances where inflation triggered market downturns: History offers numerous examples of how high inflation has led to market corrections, highlighting the potential for similar outcomes in the current environment.

Interest Rate Hikes: Dampening Economic Growth and Corporate Profitability

Increased interest rates make borrowing more expensive, potentially slowing economic growth and impacting corporate profitability. This can lead to reduced investment and a decline in stock prices.

- Explanation of the mechanics of interest rate hikes and their effect on businesses: Higher interest rates increase the cost of capital for businesses, impacting investment decisions and potentially reducing profitability.

- Discussion of the potential impact on consumer spending and investor confidence: Higher interest rates can also dampen consumer spending, affecting corporate revenues and leading to decreased investor confidence.

- Analysis of historical correlations between interest rate hikes and market corrections: Historical data demonstrates a correlation between interest rate hikes and market corrections, offering insights into potential future market behavior.

Geopolitical Instability: Uncertainty and Volatility in a Fragile Global Environment

Global conflicts and uncertainties can trigger significant market volatility and lead to sharp price drops. The current geopolitical landscape presents several potential sources of instability.

- Discussion of current geopolitical risks and their potential market impact: Ongoing geopolitical tensions and conflicts pose a significant threat to market stability and can lead to sudden and unpredictable price swings.

- Analysis of past market reactions to similar geopolitical events: Historical examples demonstrate the potential for significant market disruptions triggered by geopolitical events, emphasizing the potential for future volatility.

- Assessment of the potential for contagion effects across different market sectors: Geopolitical events can have wide-ranging effects, impacting various market sectors and potentially causing cascading effects.

Conclusion: Navigating the Stock Market and Mitigating Stock Market Pain

The current stock market surge presents a paradox: prices are rising despite significant underlying risks. While factors like strong earnings and low interest rates play a role, investor behavior, driven by FOMO and a search for higher returns, is a crucial element. However, the potential for a market correction due to inflation, interest rate hikes, and geopolitical instability remains significant. Understanding these risks is crucial for navigating the current market environment. Ignoring the potential for stock market pain could lead to significant financial losses. Therefore, investors should carefully assess their risk tolerance, diversify their portfolios to mitigate potential downsides, and engage in thorough research before making any significant investment decisions. Don't let the current rally blind you to the inherent risks; understand the realities of stock market pain and invest wisely. Consider consulting a financial advisor to create a strategy aligned with your risk profile and financial goals.

Featured Posts

-

Supreme Court Hearing On Obamacare Trumps Unexpected Role And Rfk Jr S Political Future

Apr 22, 2025

Supreme Court Hearing On Obamacare Trumps Unexpected Role And Rfk Jr S Political Future

Apr 22, 2025 -

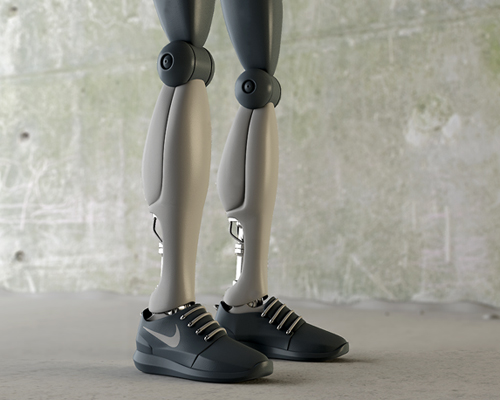

Exploring The Limitations Of Robots In Nike Shoe Production

Apr 22, 2025

Exploring The Limitations Of Robots In Nike Shoe Production

Apr 22, 2025 -

The Technological Barriers To Robotic Nike Shoe Production

Apr 22, 2025

The Technological Barriers To Robotic Nike Shoe Production

Apr 22, 2025 -

Combined Arms Approach How Sweden And Finlands Military Strengths Could Integrate

Apr 22, 2025

Combined Arms Approach How Sweden And Finlands Military Strengths Could Integrate

Apr 22, 2025 -

Understanding The Crucial Role Of Middle Managers In Modern Organizations

Apr 22, 2025

Understanding The Crucial Role Of Middle Managers In Modern Organizations

Apr 22, 2025