Stock Market Today: Sensex & Nifty Rally, Sector-Wise Analysis

Table of Contents

Sensex and Nifty Performance Overview

Today's market witnessed a strong bullish trend, with both major indices, the Sensex and Nifty, registering impressive gains. The Sensex closed at [Insert Closing Value] points, representing a [Insert Percentage Change]% increase, while the Nifty closed at [Insert Closing Value] points, exhibiting a [Insert Percentage Change]% surge. This marks a significant improvement from yesterday's closing values of [Insert Yesterday's Sensex Closing Value] and [Insert Yesterday's Nifty Closing Value] respectively. The indices reached a high of [Insert High Value] and a low of [Insert Low Value] during the trading session. Trading volume was notably high at [Insert Trading Volume], indicating robust participation in the market.

- Sensex: Closing value: [Insert Closing Value], Percentage change: [Insert Percentage Change]%, High: [Insert High Value], Low: [Insert Low Value]

- Nifty: Closing value: [Insert Closing Value], Percentage change: [Insert Percentage Change]%, High: [Insert High Value], Low: [Insert Low Value]

- Yesterday's Closing: Sensex: [Insert Yesterday's Sensex Closing Value], Nifty: [Insert Yesterday's Nifty Closing Value]

- Trading Volume: [Insert Trading Volume]

Sector-Wise Performance Analysis

The rally wasn't uniform across all sectors. While some sectors experienced significant growth, others saw more moderate gains or even slight declines. Let's delve into a detailed sector-wise analysis to understand the nuances of today's market movement.

Banking Sector Analysis

The banking sector was among the top performers today. Leading banking stocks saw substantial gains, driven by positive investor sentiment fueled by [mention specific news, e.g., strong Q2 earnings reports, positive RBI commentary on credit growth, or expectations of further rate hikes]. Increased lending rates, while potentially impacting borrowers, generally boost the profitability of banks in the short term. The RBI's recent policy announcements also played a crucial role in influencing investor confidence in this sector.

- Key Factors: Strong Q2 earnings, positive RBI commentary, increased lending rates.

- Top Performers: [List top-performing banking stocks and their percentage gains]

- Potential Challenges: Increased NPAs (Non-Performing Assets) could be a future concern.

IT Sector Analysis

The IT sector showed a mixed performance. While some companies benefited from strong global demand and successful project wins, others faced headwinds due to concerns about [mention specific challenges, e.g., slowing global economic growth, rupee appreciation, or increased competition]. The fluctuating value of the rupee against the dollar played a significant role in shaping the performance of individual IT stocks.

- Key Factors: Global demand, rupee value fluctuations, competition.

- Top Performers: [List top-performing IT stocks and their percentage gains]

- Underperformers: [List underperforming IT stocks and their percentage changes]

Pharmaceutical Sector Analysis

The pharmaceutical sector displayed [mention overall trend - positive, negative, or mixed] performance. [Mention specific factors influencing this performance, e.g., new drug approvals, pricing pressures, or regulatory updates]. The sector's performance was largely influenced by [mention specific factors, e.g., global demand for specific drugs, pricing regulations, or successful clinical trials].

- Key Factors: New drug approvals, pricing pressures, regulatory environment.

- Top Performers: [List top-performing pharmaceutical stocks and their percentage gains]

- Underperformers: [List underperforming pharmaceutical stocks and their percentage changes]

(Repeat H3 for other major sectors: Auto, FMCG, etc., following the same structure.)

Factors Influencing the Market Rally

The significant rally in the Sensex and Nifty today can be attributed to a combination of factors. Positive global economic indicators played a crucial role, alongside robust domestic economic data that boosted investor confidence. Furthermore, improving investor sentiment and the absence of major geopolitical disruptions contributed to the overall positive market trajectory.

- Global Economic News: [Describe the positive global news that impacted the market]

- Domestic Economic Data: [Highlight positive domestic economic indicators]

- Investor Sentiment: [Explain the prevailing positive sentiment]

- Geopolitical Events: [Mention any geopolitical factors and their influence, if any]

Conclusion

Today's stock market witnessed a strong rally, with the Sensex and Nifty recording substantial gains. The banking sector emerged as a top performer, driven by factors like strong earnings and positive RBI commentary. Other sectors like IT and Pharma showed mixed results, influenced by various global and domestic factors. This overall positive trend was largely influenced by positive global economic indicators, improved investor sentiment, and the absence of major geopolitical headwinds. Stay informed about the daily fluctuations of the Stock Market Today, and continue following the Sensex and Nifty movements with our regular updates. Subscribe to our newsletter for daily market analysis!

Featured Posts

-

Ai Driven Podcast Creation Transforming Mundane Scatological Data Into Engaging Content

May 10, 2025

Ai Driven Podcast Creation Transforming Mundane Scatological Data Into Engaging Content

May 10, 2025 -

Ajaxs Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025

Ajaxs Brobbey Physical Prowess Poses A Threat In Europa League

May 10, 2025 -

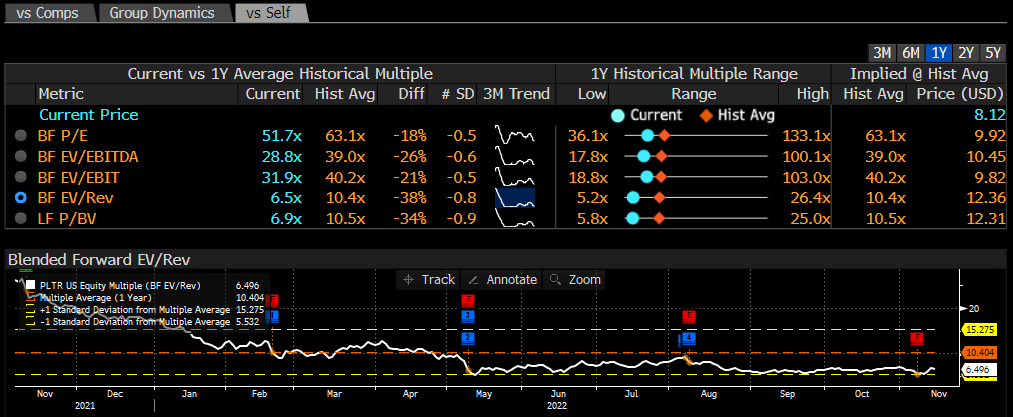

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 10, 2025

2 Stocks Predicted To Surpass Palantirs Value In 3 Years

May 10, 2025 -

Beautiful Castle Near Manchester Hosts Huge Music Festival With Olly Murs

May 10, 2025

Beautiful Castle Near Manchester Hosts Huge Music Festival With Olly Murs

May 10, 2025 -

Fyraty Fy Alerby Tqyym Mstwah Bed Rhylh En Alahly Almsry

May 10, 2025

Fyraty Fy Alerby Tqyym Mstwah Bed Rhylh En Alahly Almsry

May 10, 2025