Stock Market Valuation Concerns: BofA's Insights For Investors

Table of Contents

BofA's extensive research and market expertise provide a crucial perspective for navigating the current climate of investor concerns. By analyzing their findings, we aim to help investors make more informed decisions regarding their portfolios.

BofA's Current Market Outlook and Valuation Metrics

BofA's current market outlook often reflects a nuanced perspective rather than a strictly bullish or bearish stance. Their analysis incorporates a range of valuation metrics to gauge market health and potential future performance. Key metrics frequently employed include:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share, offering a snapshot of how much investors are willing to pay for each dollar of earnings. BofA's recent reports might highlight elevated P/E ratios in specific sectors, suggesting potential overvaluation.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue, providing a broader valuation measure, particularly useful for companies with negative earnings. BofA's analysis may reveal undervalued sectors based on lower P/S ratios.

- Shiller PE (Cyclically Adjusted Price-to-Earnings Ratio): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable valuation picture. BofA might use this to compare current valuations to historical averages, identifying potential bubbles or undervaluation.

Data Points (Hypothetical, replace with actual BofA data): For example, BofA analysts might predict a 5% increase in the S&P 500 based on their valuation models, but with caveats due to potential interest rate hikes.

- Key Valuation Ratios (Hypothetical): According to BofA's latest report (replace with actual report), the average P/E ratio for the S&P 500 is 25, compared to the historical average of 15. The P/S ratio for the technology sector is at 6, while the energy sector shows a P/S ratio of 2.

- Comparison to Historical Averages: BofA's analysis may show that current P/E ratios are significantly above historical averages, indicating potential overvaluation in certain sectors.

- Overvalued and Undervalued Sectors: Based on BofA's analysis, technology may be considered overvalued, while energy and certain value stocks might be deemed undervalued.

Identifying Potential Risks and Opportunities Based on BofA's Analysis

BofA's analysis invariably highlights potential risks and opportunities impacting stock market valuation. Current market anxieties often revolve around:

- Interest Rate Hikes: Rising interest rates increase borrowing costs for companies, potentially impacting earnings and reducing valuations. BofA's forecasts on interest rate trajectories are critical here.

- Inflation: Persistent inflation erodes purchasing power and can lead to higher input costs for businesses, affecting profitability and valuations.

- Geopolitical Events: Global instability can significantly impact market sentiment and stock prices, adding uncertainty to valuation assessments.

BofA's insights also uncover potential opportunities:

- Sectors Less Susceptible to Valuation Risks: Sectors with strong fundamentals and lower reliance on debt might be identified as less vulnerable to interest rate hikes.

- Investment Strategies: BofA might suggest strategies such as value investing, focusing on undervalued companies, or sector rotation to capitalize on shifts in market dynamics.

Specific Risks and Their Impact: BofA might warn that aggressive interest rate hikes could decrease valuations across the board by 10-15% in specific sectors.

Sectors Less Susceptible: BofA may recommend defensive sectors, such as consumer staples or healthcare, which are often less volatile during economic downturns.

BofA's Recommendations for Investors Regarding Stock Market Valuation

BofA's advice typically emphasizes a balanced approach to managing risk and capitalizing on opportunities within the context of current stock market valuation concerns. Key recommendations often include:

- Diversification: Spreading investments across different asset classes and sectors to reduce overall portfolio risk.

- Sector Rotation: Shifting investments from overvalued sectors to those deemed undervalued based on BofA's analysis.

- Asset Allocation: Adjusting the mix of assets (stocks, bonds, etc.) in a portfolio to align with the investor's risk tolerance and market outlook.

- Risk Tolerance: BofA would stress the importance of aligning investment strategies with the investor's individual risk profile.

Recommendations for Different Investor Profiles:

- Aggressive Investors: Might be advised to maintain a higher equity allocation but with a focus on sectors identified by BofA as having growth potential.

- Conservative Investors: Would likely be recommended to increase their bond allocation or focus on less volatile investments.

The Role of Interest Rates in Stock Market Valuation

BofA’s analysis likely highlights the inverse relationship between interest rates and stock valuations. Higher interest rates generally decrease stock valuations as they make bonds (which offer fixed income) more attractive compared to stocks (which offer variable returns). BofA's interest rate projections will play a crucial role in their stock market valuation predictions. For instance, if BofA forecasts a significant increase in interest rates, it could influence their recommendations towards a more conservative investment strategy.

Navigating Stock Market Valuation Concerns with BofA's Guidance

Understanding BofA's insights on stock market valuation is crucial for navigating the current market. Their analysis provides a framework for identifying both risks and opportunities, enabling investors to make more informed decisions. By carefully considering BofA's valuation metrics, risk assessments, and recommendations, investors can better manage their portfolios and potentially optimize their returns. Learn more about BofA's latest research and adjust your investment strategy accordingly, considering your own risk tolerance and long-term financial goals. Remember that this article provides a general overview; always conduct your own thorough research before making any investment decisions.

Featured Posts

-

Uber Stock And Recession Why Analysts Remain Bullish

May 19, 2025

Uber Stock And Recession Why Analysts Remain Bullish

May 19, 2025 -

Universal Epic Universe Everything You Need To Know About Themed Lands Attractions And Shows

May 19, 2025

Universal Epic Universe Everything You Need To Know About Themed Lands Attractions And Shows

May 19, 2025 -

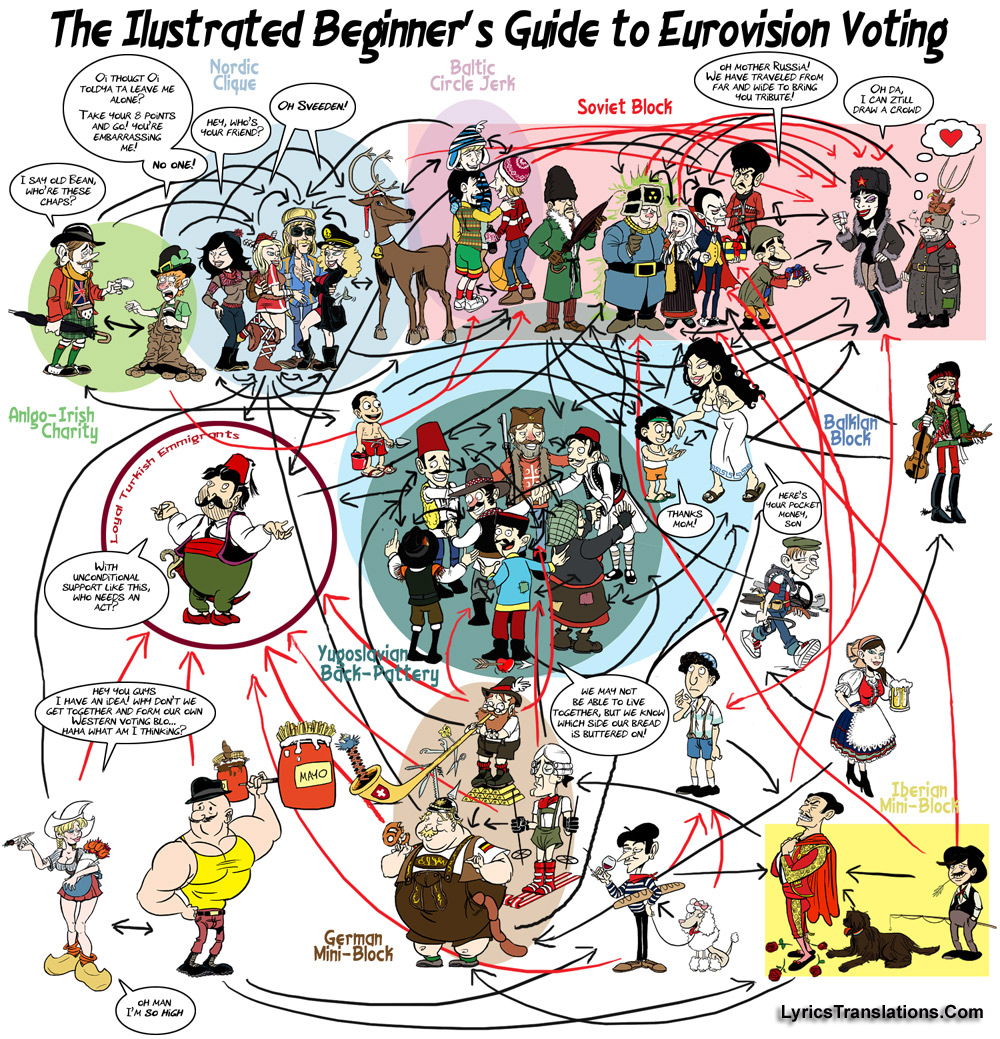

How Eurovision Voting Works A Complete Guide

May 19, 2025

How Eurovision Voting Works A Complete Guide

May 19, 2025 -

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025 -

Early 2025 Air Travel A Focus On Maastricht Airport Passenger Numbers

May 19, 2025

Early 2025 Air Travel A Focus On Maastricht Airport Passenger Numbers

May 19, 2025

Latest Posts

-

Paige Bueckers A Husky Legend Honored

May 19, 2025

Paige Bueckers A Husky Legend Honored

May 19, 2025 -

Azzi Fudd And Paige Bueckers Comparing Their Wnba Draft And U Conn Looks

May 19, 2025

Azzi Fudd And Paige Bueckers Comparing Their Wnba Draft And U Conn Looks

May 19, 2025 -

Azzi Fudd And Paige Bueckers U Conn Casuals Vs Wnba Draft Glamour

May 19, 2025

Azzi Fudd And Paige Bueckers U Conn Casuals Vs Wnba Draft Glamour

May 19, 2025 -

Final Destination 5 Where To Stream And Find Showtimes

May 19, 2025

Final Destination 5 Where To Stream And Find Showtimes

May 19, 2025 -

Hopkins To Become Paige Bueckers For A Day May 16th Announcement

May 19, 2025

Hopkins To Become Paige Bueckers For A Day May 16th Announcement

May 19, 2025