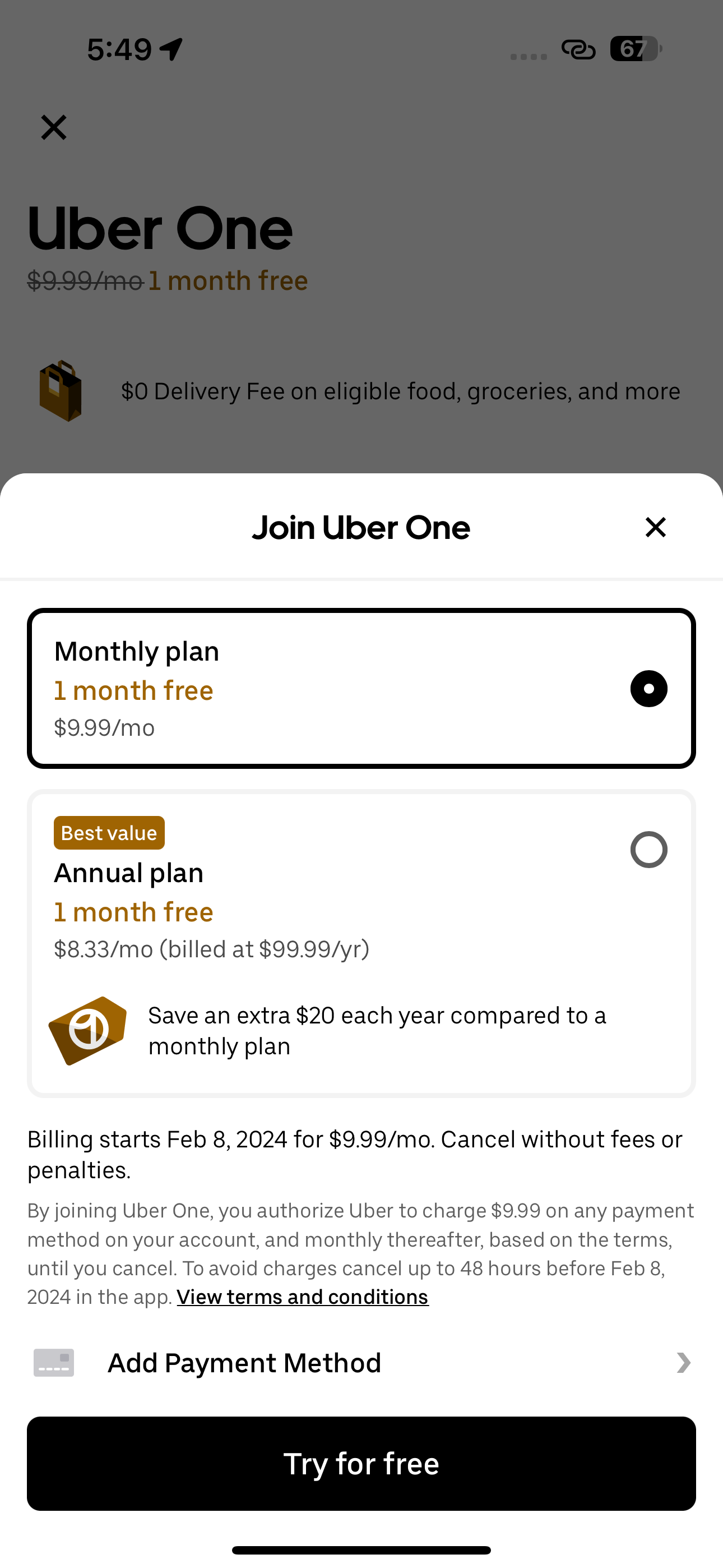

Uber Stock And Recession: Why Analysts Remain Bullish

Table of Contents

Uber's Recession-Resistant Business Model

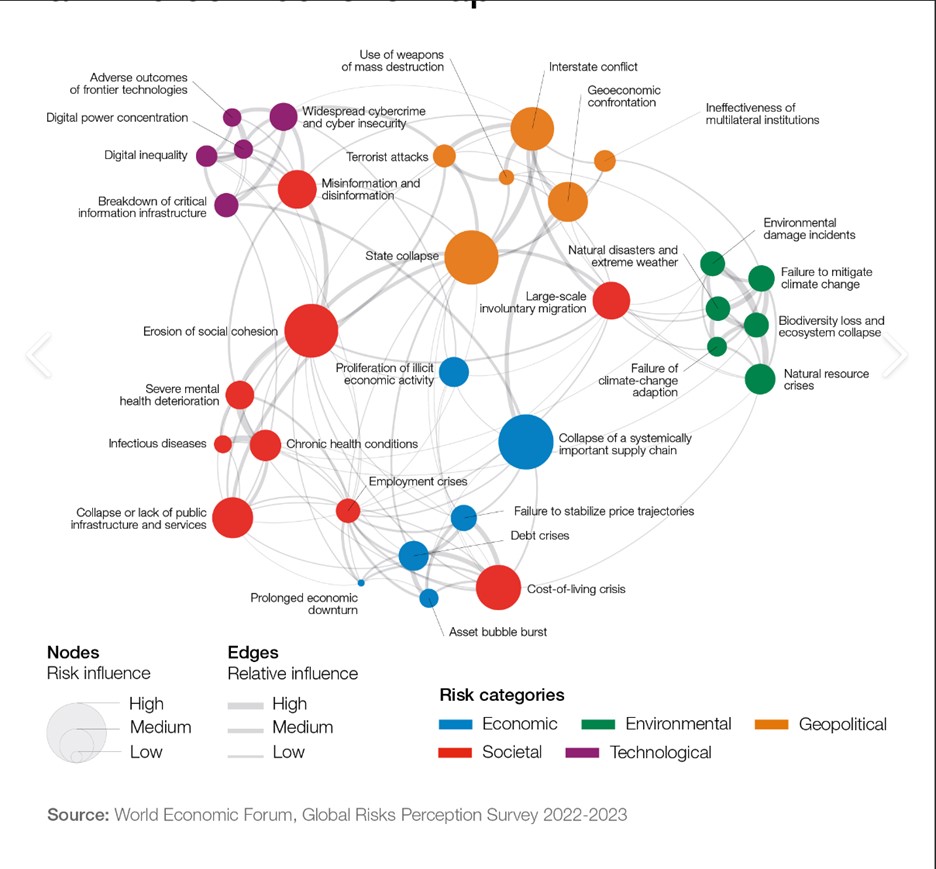

Uber's diversified revenue streams are a key factor contributing to analysts' bullishness. Unlike companies heavily reliant on a single product or service, Uber operates across multiple sectors, creating a more robust and recession-proof business model. This diversification provides a buffer against economic downturns.

-

Diversified Revenue: Uber's income comes from ridesharing, Uber Eats (food delivery), and Uber Freight (logistics). This spread reduces the risk associated with economic fluctuations.

-

Resilience During Downturns: While ridesharing might see a slight decrease during a recession as people cut back on discretionary spending, Uber Eats often experiences increased demand. People tend to order in more frequently when dining out becomes less affordable. Furthermore, Uber Freight, focusing on essential goods transportation, is often less impacted by economic slowdowns.

-

Cost Optimization: Uber possesses the ability to adjust its operations and implement cost-cutting measures efficiently during challenging economic periods. This adaptability contributes to the company's resilience. Through strategic cost optimization, Uber can maintain profitability even amidst reduced demand in certain segments. Keywords: diversified revenue, recession-proof business, cost optimization, Uber Eats, Uber Freight.

The Growing Importance of the Gig Economy

The gig economy is thriving, and its importance is only magnified during economic uncertainty. This trend significantly benefits Uber, a major player in the on-demand economy.

-

Increased Gig Worker Pool: Higher unemployment rates often lead to a surge in individuals seeking flexible employment options. This influx provides Uber with a larger pool of drivers and delivery personnel.

-

Potential Cost Reduction: A larger pool of gig workers can potentially lead to lower costs for Uber, as competition for work increases. This can improve profitability margins during periods of economic slowdown. Keywords: gig economy, flexible workforce, on-demand economy, side hustle.

Technological Advantages and Future Growth Potential

Uber's commitment to technological innovation is another reason analysts remain optimistic about its future, even in the face of a recession.

-

Self-Driving Technology: The development and eventual implementation of self-driving technology has the potential to dramatically reduce operating costs in the long term. This could significantly boost profitability and enhance Uber's competitive edge.

-

Market Expansion and New Services: Uber continues to expand into new international markets and develop innovative services. This growth potential mitigates risks associated with economic downturns in existing markets. Keywords: technological innovation, self-driving cars, artificial intelligence, market expansion, future growth.

Analyst Predictions and Valuation

Many leading analysts maintain bullish ratings on Uber stock, citing its resilience and growth potential.

-

Positive Price Targets: Several analyst reports predict significant price appreciation for Uber stock over the coming years, even factoring in potential economic headwinds. While specific names and figures are subject to change and should be verified independently, the consensus remains largely positive.

-

Long-Term Growth Potential: Analysts highlight Uber's long-term growth potential, emphasizing its position within a rapidly expanding gig economy and its ongoing technological advancements. Keywords: analyst ratings, price target, stock valuation, investment potential, long-term growth.

Conclusion: Investing in Uber Stock During a Recession?

Analysts remain bullish on Uber stock despite recessionary concerns due to the company's diversified revenue streams, its strategic positioning within the growing gig economy, and its ongoing investments in technological innovation. The resilience of Uber's business model and its potential for future growth are key factors driving this positive outlook. Before making any investment decisions, conduct thorough research. Explore Uber's financial reports and consult with various analyst opinions to inform your own assessment of "Uber Stock and Recession" dynamics. Despite the current economic uncertainty, the long-term upside potential of Uber stock remains attractive to many investors.

Featured Posts

-

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025

Experience Uber One In Kenya Free Deliveries And Exclusive Discounts

May 19, 2025 -

Top Rated Southern Restaurants In Orlando A Diners Guide

May 19, 2025

Top Rated Southern Restaurants In Orlando A Diners Guide

May 19, 2025 -

Fighting Woke France A Tech Billionaires Strategic Use Of Data

May 19, 2025

Fighting Woke France A Tech Billionaires Strategic Use Of Data

May 19, 2025 -

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025 -

Miles Caton As Spider Man Could He Swing Into The Mcu

May 19, 2025

Miles Caton As Spider Man Could He Swing Into The Mcu

May 19, 2025

Latest Posts

-

Modern Life In Global Art 1850 1950 A Critical Review

May 19, 2025

Modern Life In Global Art 1850 1950 A Critical Review

May 19, 2025 -

A Place In The Sun Top Locations For Retirement Overseas

May 19, 2025

A Place In The Sun Top Locations For Retirement Overseas

May 19, 2025 -

Parcay Sur Vienne La Fete De La Marche Rassemble Une Centaine De Personnes

May 19, 2025

Parcay Sur Vienne La Fete De La Marche Rassemble Une Centaine De Personnes

May 19, 2025 -

1850 1950 Global Art An Art Review And Analysis For 2025

May 19, 2025

1850 1950 Global Art An Art Review And Analysis For 2025

May 19, 2025 -

Your Place In The Sun Navigating The International Property Market

May 19, 2025

Your Place In The Sun Navigating The International Property Market

May 19, 2025