Your Place In The Sun: Navigating The International Property Market

Table of Contents

Researching Your Ideal Location & Property Type

Before you start browsing stunning villas and charming cottages online, thorough research is crucial for successful overseas property investment. Analyzing your budget and desired lifestyle is the first step. Consider factors like climate, culture, and proximity to amenities. Do you envision yourself enjoying vibrant city life or a peaceful rural retreat? This will significantly influence your choice of location and property type.

-

Analyze your budget and desired lifestyle: How much can you realistically afford to spend? Consider not only the purchase price but also ongoing costs like property taxes, maintenance, and insurance. Your lifestyle preferences will dictate whether you seek a bustling city apartment, a secluded countryside villa, or something in between.

-

Research specific countries and regions: Some countries are known for their attractive international property markets, offering various investment opportunities. Research countries with stable economies, transparent legal systems, and strong property rights protection. Popular choices often include Portugal, Spain, Italy, Greece, and various Caribbean islands, each with its unique appeal and market dynamics.

-

Investigate local property laws and regulations: Every country has its own set of laws and regulations governing property ownership. Understanding these nuances is crucial to avoid future complications. Research building permits, zoning laws, and any restrictions on foreign ownership.

-

Understand different property types: From apartments and condos to villas, townhouses, and even land plots, the options are vast. The best property type will depend on your needs, budget, and lifestyle preferences. Consider the maintenance requirements and long-term implications of each type.

-

Utilize online resources and real estate agents: Leverage online platforms specializing in international property to browse listings and gather market information. Connecting with a reputable real estate agent experienced in the international property market is invaluable. Their local expertise will guide you through the process efficiently.

Financing Your International Property Purchase

Securing financing for your international property purchase is a critical step. Explore various options, including international mortgages and cash purchases. International mortgages often come with more stringent requirements and higher interest rates than domestic loans.

-

Explore financing options: Cash purchases offer simplicity but may limit your options. International mortgages require a thorough understanding of foreign currency exchange rates and potential currency risk. Your credit history and financial stability will heavily influence lender decisions.

-

Understand foreign currency exchange rates and currency risk: Fluctuations in exchange rates can significantly impact the overall cost of your purchase. Hedging strategies may be necessary to mitigate currency risk, especially for larger investments. Consult with a financial expert for guidance on mitigating this risk.

-

Compare interest rates and loan terms: Don't settle for the first offer. Compare interest rates and loan terms from multiple lenders specializing in international property investment loans to secure the best possible deal.

-

Secure necessary documentation: Be prepared to provide comprehensive financial documentation, including proof of income, credit reports, and bank statements. The requirements may vary depending on the lender and the country of purchase.

-

Consult with a financial advisor: Seek professional advice from a financial advisor specializing in international investments. They can guide you through the complexities of international financing and help you make informed decisions.

Legal and Tax Considerations in International Property Transactions

Navigating the legal and tax aspects of buying property abroad is crucial. These considerations can be complex and vary significantly between countries. Professional guidance is strongly recommended.

-

Seek legal counsel: Engage a lawyer specializing in international property transactions to ensure you comply with all legal requirements. They can guide you through the conveyancing process, ensuring a smooth and legally sound transaction.

-

Understand local property laws: Familiarize yourself with the specific laws related to property ownership, transfer of ownership, and any regulations on foreign buyers.

-

Research property taxes and capital gains taxes: Understand the implications of property taxes, annual property taxes, and potential capital gains taxes when you eventually sell the property. These vary significantly across different jurisdictions.

-

Ensure proper translation and verification of documents: All legal documents should be professionally translated and verified to prevent misunderstandings and potential legal disputes.

-

Consider inheritance and estate planning: Plan for the eventual transfer of ownership and address potential inheritance tax implications related to your overseas property.

Due Diligence and Avoiding Common Pitfalls

Thorough due diligence is paramount to protect your investment. Avoid common pitfalls by conducting comprehensive checks and seeking professional advice.

-

Conduct a professional property inspection: Engage a qualified surveyor or inspector to assess the property's condition and identify any potential problems.

-

Verify the property title and ownership history: A thorough title search is necessary to ensure clear ownership and no outstanding liens or encumbrances on the property.

-

Be aware of common scams: The international property market can unfortunately attract fraudulent schemes. Be vigilant, verify all information independently, and avoid deals that seem too good to be true.

-

Obtain a professional survey: A land survey helps define the property boundaries and helps avoid potential boundary disputes in the future.

-

Use reputable professionals: Engage a reputable local real estate agent and lawyer to navigate the complexities of the international property market.

Understanding the Local Market Dynamics

Analyzing the local market dynamics is crucial for a sound investment. Factors to consider include:

-

Market trends and price fluctuations: Research historical and current property prices to understand market trends and potential price fluctuations in your chosen area.

-

Potential rental yields: If you plan to rent out your property, investigate potential rental yields and the local rental market conditions.

-

Capital appreciation potential: Assess the long-term potential for capital appreciation, considering factors like economic growth, infrastructure development, and tourism.

-

Local economic conditions: Understand the impact of local economic conditions on property values and the stability of the market.

Conclusion

Buying property internationally can be a rewarding experience, offering both personal enjoyment and potential investment opportunities. However, success requires careful planning, thorough research, and professional guidance. By following the steps outlined above and understanding the nuances of the international property market, you can increase your chances of finding your perfect "place in the sun." Start your journey today by researching the best locations and financing options for your dream international property. Don't delay – your place in the sun awaits!

Featured Posts

-

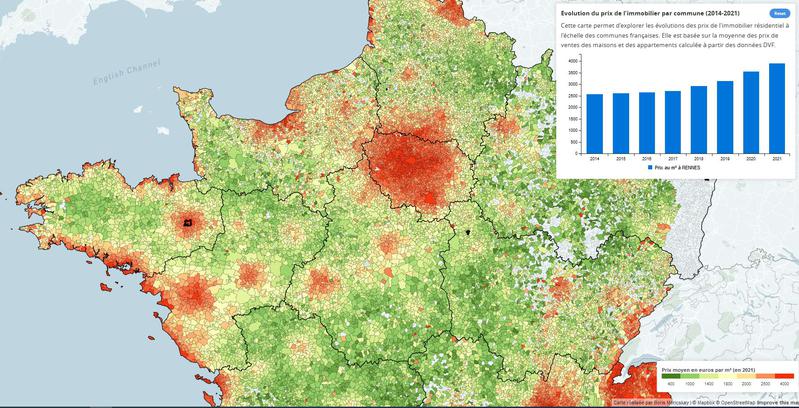

Carte Interactive Prix Des Maisons En France Selon Les Donnees Notariales

May 19, 2025

Carte Interactive Prix Des Maisons En France Selon Les Donnees Notariales

May 19, 2025 -

Complete Guide To The Nyt Mini Crossword March 26 2025 Answers

May 19, 2025

Complete Guide To The Nyt Mini Crossword March 26 2025 Answers

May 19, 2025 -

Ufc Vegas 106 Morales Vs Burns Fight Result And Post Fight Analysis

May 19, 2025

Ufc Vegas 106 Morales Vs Burns Fight Result And Post Fight Analysis

May 19, 2025 -

Sovereign Bond Market Update Swissquote Banks Perspective

May 19, 2025

Sovereign Bond Market Update Swissquote Banks Perspective

May 19, 2025 -

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

The Morales Knockout Ufc Fighters React To Vegas 106 Headliner

May 19, 2025

Latest Posts

-

Finalen Melodifestivalen 2025 Komplett Guide Till Artister Och Startordning

May 19, 2025

Finalen Melodifestivalen 2025 Komplett Guide Till Artister Och Startordning

May 19, 2025 -

Melodifestivalen 2025 Final Artister Startordning Och Datum

May 19, 2025

Melodifestivalen 2025 Final Artister Startordning Och Datum

May 19, 2025 -

Najgori Rezultati Hrvatske Na Eurosongu Popis I Analiza

May 19, 2025

Najgori Rezultati Hrvatske Na Eurosongu Popis I Analiza

May 19, 2025 -

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025

Finalen I Melodifestivalen 2025 Artister Startordning Och Allt Du Behoever Veta

May 19, 2025 -

Hrvatski Eurosong Debakli 10 Najgorih Plasmana

May 19, 2025

Hrvatski Eurosong Debakli 10 Najgorih Plasmana

May 19, 2025