Stock Market Valuations: BofA Assures Investors, Dispelling Valuation Worries

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's argument against widespread stock market overvaluation centers around a multifaceted analysis utilizing various stock valuation metrics. They challenge the prevailing narrative by presenting a more nuanced picture, considering factors often overlooked in simpler assessments. Their research suggests that while some sectors may appear expensive based on superficial analysis, a deeper dive reveals a more balanced picture.

-

Examination of Price-to-Earnings (P/E) ratios: BofA's analysis goes beyond simply comparing current P/E ratios to historical averages. They delve into sector-specific P/E ratios, acknowledging that different industries have inherent valuation differences. For instance, high-growth technology companies often command higher P/E multiples than more mature, slower-growth sectors. This granular approach provides a more accurate reflection of individual stock valuations.

-

Analysis of discounted cash flow (DCF) models: BofA employs sophisticated DCF models to project future earnings and cash flows. These models consider factors such as revenue growth, operating margins, and capital expenditures to arrive at a more intrinsic valuation. This approach helps to mitigate the limitations of solely relying on trailing P/E ratios, which can be skewed by short-term market fluctuations.

-

Comparison of relative valuations across different asset classes: BofA doesn't limit its analysis to equities. They compare equity valuations to other asset classes like bonds and real estate, providing a broader context for assessing relative attractiveness. This comparative analysis helps determine whether stocks are genuinely overvalued or simply more appealing than alternative investments given prevailing interest rates and economic conditions.

-

Consideration of factors like interest rates and inflation: The impact of macroeconomic factors such as interest rates and inflation on stock valuation is a key component of BofA's analysis. Rising interest rates, for example, can impact the present value of future cash flows, affecting stock market valuations across various sectors. Their models incorporate these crucial macroeconomic elements for a more holistic view.

Addressing Specific Sector Valuations

BofA's analysis doesn't treat all sectors uniformly. Their research differentiates sector valuations, acknowledging that some sectors are indeed more richly valued than others. This granular approach allows investors to identify potential opportunities and risks within specific market segments.

-

Analysis of technology stock valuations: The technology sector is often subject to intense scrutiny regarding stock market valuations. BofA's analysis likely acknowledges the elevated valuations of some technology companies, but considers growth prospects and future earnings potential. They differentiate between high-growth, disruptive companies and more mature players, providing a nuanced assessment of the sector’s overall valuation.

-

Assessment of value stock valuations: In contrast to the high-growth segments, BofA's analysis likely highlights the potential of undervalued value stocks. These companies may offer attractive entry points for investors seeking stable returns and less exposure to market volatility.

-

Discussion of the impact of rising interest rates on different sectors: BofA's research undoubtedly addresses the impact of monetary policy changes on different sectors. Some sectors are more sensitive to interest rate fluctuations than others. Understanding this sensitivity is critical for making informed investment decisions.

-

Identification of undervalued sectors: Based on their comprehensive analysis, BofA may identify sectors that appear undervalued relative to their fundamentals and future growth prospects. This information is valuable for investors seeking to build well-diversified portfolios.

Long-Term Growth Prospects and Market Outlook

BofA's assessment extends beyond short-term market fluctuations to incorporate long-term market outlook and economic growth projections. Their analysis provides a framework for investors looking to make informed long-term investment decisions.

-

BofA's predictions for economic growth: Their projections for economic growth will significantly influence their overall stock market forecast. Strong economic growth typically supports higher corporate earnings and, consequently, higher stock valuations.

-

Their projections for corporate earnings growth: BofA's analysis likely incorporates projections for corporate earnings growth across various sectors. These projections, combined with their macroeconomic forecasts, form the basis for their stock market valuation assessments.

-

Their assessment of geopolitical risks and their impact on valuations: Geopolitical risks, such as international conflicts or trade wars, can significantly impact stock market valuations. BofA likely incorporates an assessment of these risks into their overall market outlook.

-

Identification of potential investment opportunities: Based on their long-term growth projections and risk assessments, BofA may highlight specific investment opportunities across various sectors. This insight is beneficial for investors seeking to capitalize on attractive valuations and long-term growth potential.

Conclusion

BofA's analysis of stock market valuations provides a reassuring perspective amidst prevailing investor concerns. Their use of multiple valuation metrics, sector-specific analyses, and incorporation of macroeconomic factors offer a more nuanced view than simple P/E ratio comparisons. While they highlight potential pockets of overvaluation, their long-term outlook suggests opportunities for growth and investment. However, while BofA offers reassurance, independent research is crucial. Conduct thorough due diligence before making any investment decisions. Understand the nuances of stock market valuations and consider consulting with a financial advisor before investing based on any market analysis, including BofA's assessment of stock market valuations. Learn more about effective stock market valuation strategies and continue monitoring the market closely.

Featured Posts

-

Apples Privacy Practices Under Scrutiny E1 Billion Fine In France

Apr 30, 2025

Apples Privacy Practices Under Scrutiny E1 Billion Fine In France

Apr 30, 2025 -

Beyonce En Jay Z Namen Geschrapt Uit Aanklacht Tegen Diddy

Apr 30, 2025

Beyonce En Jay Z Namen Geschrapt Uit Aanklacht Tegen Diddy

Apr 30, 2025 -

Beyonce And Jay Z Cotswolds Life Swap A Realistic Look

Apr 30, 2025

Beyonce And Jay Z Cotswolds Life Swap A Realistic Look

Apr 30, 2025 -

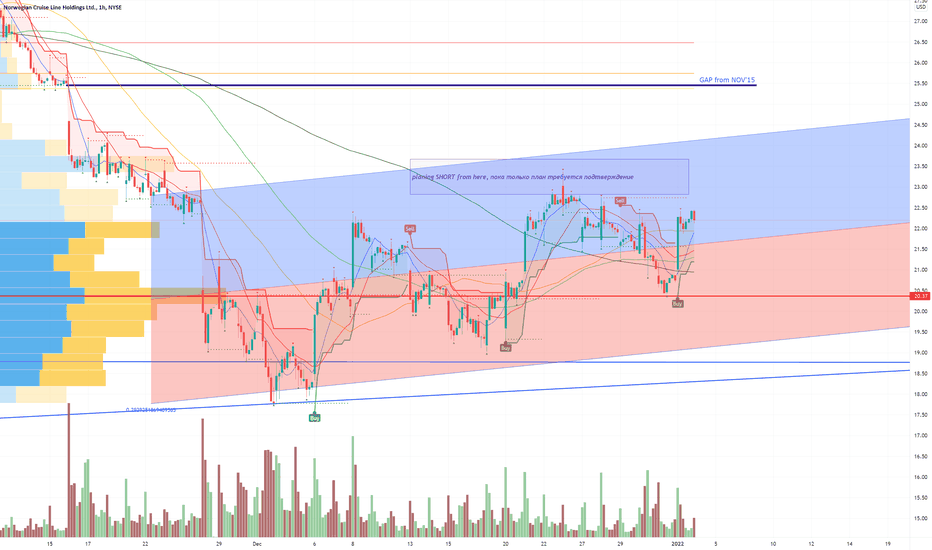

Analyzing Nclh Stock Insights From Hedge Fund Investments

Apr 30, 2025

Analyzing Nclh Stock Insights From Hedge Fund Investments

Apr 30, 2025 -

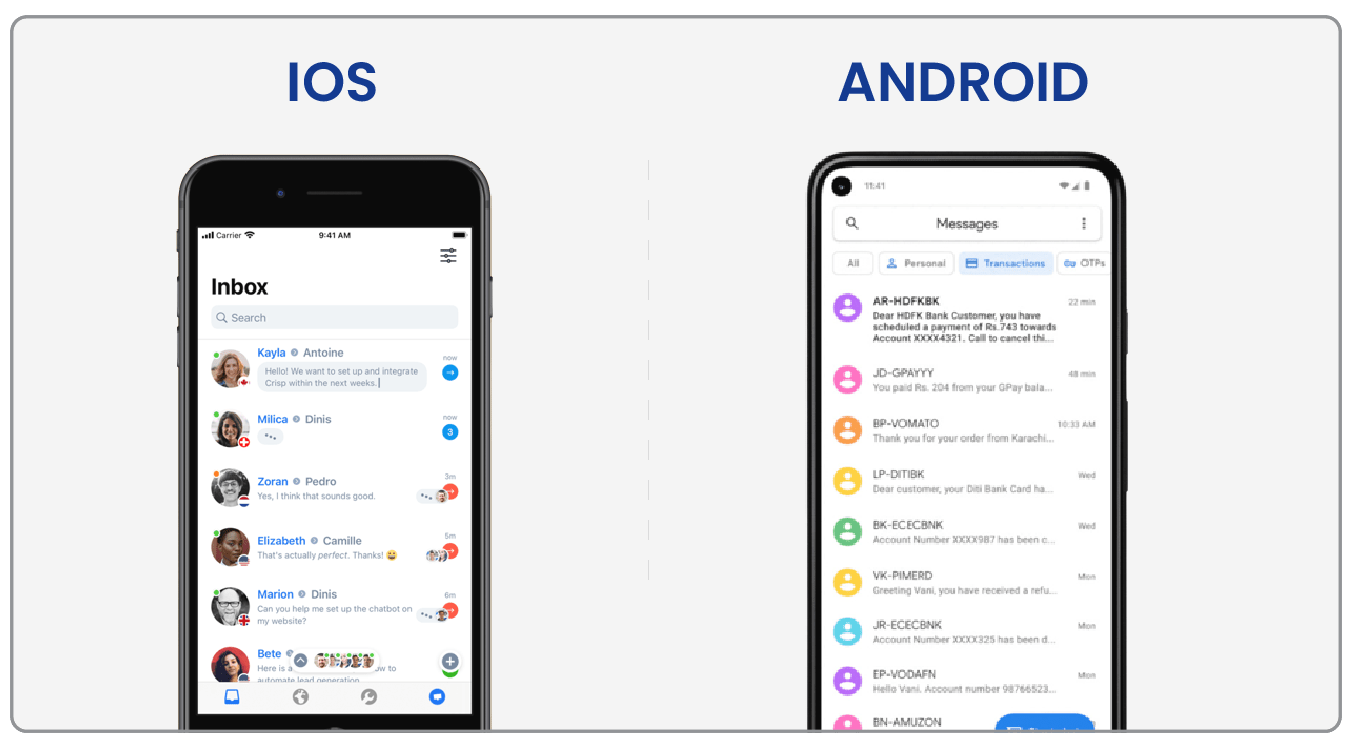

Download The Google Slides App Free Android I Os Web

Apr 30, 2025

Download The Google Slides App Free Android I Os Web

Apr 30, 2025

Latest Posts

-

Celtics Championship Credentials The Ultimate Homestand Test

Apr 30, 2025

Celtics Championship Credentials The Ultimate Homestand Test

Apr 30, 2025 -

Championship Pressure Mounts Celtic Face Crucial Homestand Tests

Apr 30, 2025

Championship Pressure Mounts Celtic Face Crucial Homestand Tests

Apr 30, 2025 -

Pacers Cavaliers Season Matchups Full Schedule Viewing Options And Season Analysis

Apr 30, 2025

Pacers Cavaliers Season Matchups Full Schedule Viewing Options And Season Analysis

Apr 30, 2025 -

133 129 Ot Thriller Cavaliers Beat Blazers Hunter Scores 32

Apr 30, 2025

133 129 Ot Thriller Cavaliers Beat Blazers Hunter Scores 32

Apr 30, 2025 -

Celtics Mettle Crucial Homestand Tests Championship Hopes

Apr 30, 2025

Celtics Mettle Crucial Homestand Tests Championship Hopes

Apr 30, 2025