Stock Market Valuations: BofA's Case For Why Investors Shouldn't Worry

Table of Contents

BofA's Key Arguments Against Overvaluation Concerns

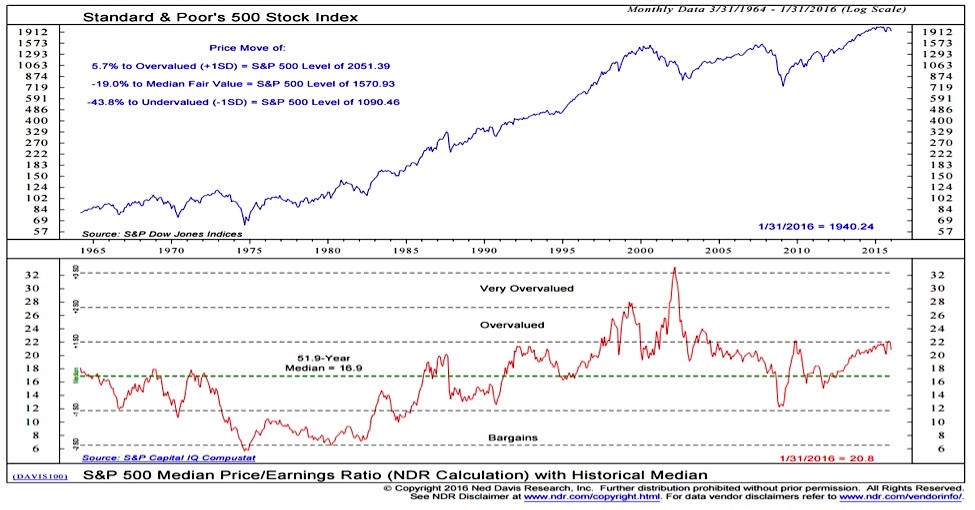

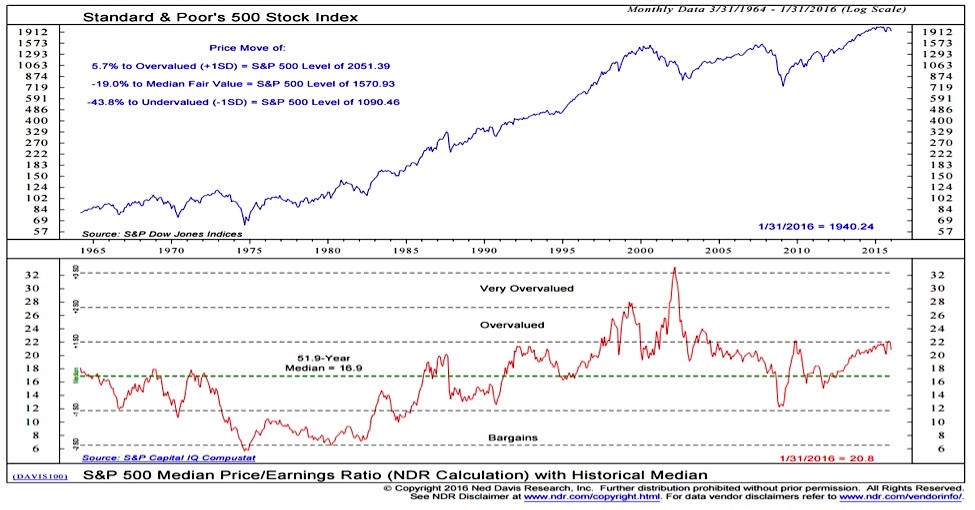

BofA's analysis suggests that current stock market valuations, while perhaps seemingly high, are not necessarily cause for immediate alarm. Their argument rests on several key pillars: strong corporate earnings growth, the influence of low interest rates and monetary policy, and resilient economic fundamentals.

Strong Corporate Earnings Growth

BofA points to robust corporate earnings growth as a key justification for current valuations. They argue that strong earnings provide a solid foundation for supporting higher price-to-earnings (P/E) ratios. The report highlights several sectors demonstrating exceptional growth, suggesting that the market’s valuation isn’t entirely detached from underlying performance.

- Robust Growth Sectors: Technology, healthcare, and consumer staples have shown particularly strong earnings growth.

- Projected Earnings Growth: BofA projects continued, albeit potentially moderating, earnings growth for the next few years, indicating sustained market support.

- Historical Context: Comparing current P/E ratios to historical averages, considering the low interest rate environment, BofA suggests that valuations are not excessively inflated compared to past periods of similar economic conditions.

Low Interest Rates & Monetary Policy

The prevailing low interest rate environment, largely a result of accommodative monetary policies, plays a significant role in BofA's analysis. Lower interest rates make borrowing cheaper for companies, stimulating investment and fueling growth. This also makes stocks, comparatively, a more attractive investment compared to bonds offering historically low yields.

- Quantitative Easing (QE): Previous rounds of QE have injected significant liquidity into the markets, driving up asset prices, including stocks. BofA’s analysis considers the lingering effects of QE on valuations.

- Bond Yields and Stock Valuations: The inverse relationship between bond yields and stock valuations is crucial; low bond yields can support higher stock valuations as investors seek higher returns in the equity market.

- Future Monetary Policy: BofA's forecasts on future monetary policy, while subject to change, suggest a continuation of accommodative policies, at least in the near term, supporting their perspective on valuations.

Resilient Economic Fundamentals

BofA's assessment of the global and US economies is crucial to their stance on stock market valuations. They highlight several key economic indicators pointing to a healthy, if not rapidly expanding, economy.

- Positive Economic Indicators: Positive employment figures, steady consumer spending, and moderate economic growth all contribute to BofA's view.

- Potential Risks: While acknowledging potential risks like inflation or unexpected geopolitical events, BofA assesses them as manageable within their projections.

- Future Growth Projections: BofA's projections for future economic growth suggest continued, if not necessarily explosive, expansion, supporting their optimism regarding stock valuations.

Counterarguments and Considerations

While BofA's analysis presents a reassuring outlook, it's essential to consider potential counterarguments and limitations.

Potential Risks and Limitations of BofA's Analysis

Any analysis carries limitations, and BofA's perspective is no exception. Several factors could challenge their optimistic viewpoint.

- Market Bubbles: Certain sectors might be experiencing localized bubbles, leading to overvaluation in specific areas, even if the broader market is relatively healthy.

- Geopolitical Risks: Unforeseen geopolitical events, such as trade wars or international conflicts, could significantly impact market sentiment and valuations.

- Inflationary Pressures: Rising inflation and the subsequent potential for interest rate hikes could dampen economic growth and negatively impact stock valuations.

Diversification and Risk Management

Regardless of BofA's assessment, diversification and robust risk management remain critical for investors. It's crucial to remember that no single analysis can perfectly predict market behavior.

- Asset Allocation Strategies: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk.

- Portfolio Rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation can help limit potential losses.

- Professional Financial Advice: Seeking professional financial advice tailored to your individual circumstances and risk tolerance is highly recommended.

Stock Market Valuations: A Balanced Perspective for Informed Investing

BofA's analysis provides a valuable perspective on current stock market valuations, emphasizing strong earnings growth, low interest rates, and resilient economic fundamentals. However, it’s crucial to acknowledge potential risks and limitations inherent in any market analysis. A balanced perspective, considering both optimistic and pessimistic scenarios, is essential for informed investing. Remember to diversify your investments and manage risk appropriately. Stay informed about stock market valuations and make smart investment choices by conducting thorough research and, if necessary, seeking professional financial advice before making any investment decisions. Learn more about navigating stock market valuations effectively.

Featured Posts

-

L Analyse De Je T Aime Moi Non Plus Par Amandine Gerard Perspectives Europeennes Et Marches

Apr 23, 2025

L Analyse De Je T Aime Moi Non Plus Par Amandine Gerard Perspectives Europeennes Et Marches

Apr 23, 2025 -

Actions Fdj Et Schneider Electric Bilan De La Seance Parisienne Du 17 02

Apr 23, 2025

Actions Fdj Et Schneider Electric Bilan De La Seance Parisienne Du 17 02

Apr 23, 2025 -

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025

Nationals Reliever Jorge Lopez Receives Three Game Suspension

Apr 23, 2025 -

Trumps Fierce Criticism Of Jerome Powell A Demand For Removal

Apr 23, 2025

Trumps Fierce Criticism Of Jerome Powell A Demand For Removal

Apr 23, 2025 -

Wer Ist Raus Bei Die 50 Im Jahr 2025 Teilnehmerliste And Mehr

Apr 23, 2025

Wer Ist Raus Bei Die 50 Im Jahr 2025 Teilnehmerliste And Mehr

Apr 23, 2025