Trump's Fierce Criticism Of Jerome Powell: A Demand For Removal

Table of Contents

The Core of the Disagreement: Interest Rate Hikes and Economic Growth

The fundamental conflict between Trump and Powell centered on interest rate policy and its effect on economic growth. Trump, prioritizing rapid economic expansion, consistently advocated for low interest rates to stimulate borrowing and investment. He viewed higher rates as a threat to his economic agenda and a hindrance to the stock market's performance. Powell, on the other hand, focused on controlling inflation and maintaining the long-term health of the US economy. He argued that raising interest rates, while potentially slowing short-term growth, was necessary to prevent runaway inflation and prevent a future economic crisis.

-

Trump's criticism of Powell's interest rate hikes: Trump frequently attacked Powell's decisions, characterizing them as "crazy" and detrimental to economic progress. He believed that Powell's actions were deliberately designed to undermine his presidency.

-

Powell's defense of his policies: Powell, despite the intense political pressure, defended his policies as necessary to ensure the long-term stability of the US economy. He emphasized the importance of the Federal Reserve's independence from political influence.

-

Impact on the stock market and investor sentiment: The fluctuating interest rates and the public clashes between Trump and Powell created significant uncertainty in the financial markets. Investor sentiment was directly impacted, leading to periods of both volatility and significant market corrections during Trump's presidency. This uncertainty also affected business investment decisions.

Trump's Public Attacks and Their Impact on the Federal Reserve's Independence

Trump's criticism of Powell was not confined to private conversations; it was a highly public affair. He frequently used Twitter, speeches, and interviews to express his displeasure, employing strong and often personal language. These attacks were unprecedented in their intensity and frequency, directly targeting the head of an institution traditionally shielded from overt political pressure.

-

Unprecedented nature of the attacks: The sheer volume and intensity of Trump's public criticism were unique in US history, raising serious concerns about the potential for political interference in the Federal Reserve's decision-making process.

-

Erosion of the Federal Reserve's independence: Many economists and political analysts worried that Trump's actions could erode public trust in the Federal Reserve's independence. An independent central bank is considered crucial for maintaining price stability and managing the economy effectively. The perception that the Fed was subject to political pressure could undermine its effectiveness.

-

Reaction of financial markets: The financial markets reacted with a mixture of concern and volatility to Trump's attacks. The uncertainty created by the conflict negatively impacted investor confidence and made it more difficult for the Federal Reserve to effectively manage monetary policy.

Political Ramifications and the Debate on Central Bank Independence

Trump's actions ignited a broader debate about the appropriate level of independence for central banks worldwide. The controversy surrounding the "Jerome Powell removal" calls brought the issue into sharp focus, highlighting the delicate balance between political accountability and the need for central banks to make decisions based on economic data rather than short-term political considerations.

-

Arguments for and against central bank independence: Proponents of independence argue that it protects central banks from short-sighted political pressures, allowing them to focus on long-term economic stability. Opponents argue that independent central banks can become unresponsive to the needs of the broader population.

-

Consequences of political interference: The potential consequences of political interference in monetary policy decisions are severe. It can lead to inflation, economic instability, and a loss of public trust in both the central bank and the government.

-

Comparison with other countries: The debate surrounding the Jerome Powell removal and the broader issue of central bank independence mirrors similar discussions in other countries, highlighting the universality of the challenges involved in balancing political accountability with economic expertise in monetary policy decision-making.

The Legacy of the Conflict: Long-term Economic Effects

The conflict between Trump and Powell left a lasting impact on the US economy and the future of monetary policy. The uncertainty created during this period affected investor confidence, business investment decisions and the overall economic climate.

-

Lasting effects of uncertainty: The period of heightened uncertainty during the Trump-Powell conflict undoubtedly had long-term consequences for the US economy. The volatility created impacted investment decisions and overall economic growth.

-

Influence on future Federal Reserve appointments: The controversy influenced the selection criteria for future Federal Reserve appointments. The emphasis on independence became even more pronounced, and future nominees were scrutinized more closely for their commitment to avoiding political influence.

-

Shaping public perception of the Federal Reserve: The conflict shaped the public's understanding of the Federal Reserve's role and its independence. It highlighted the importance of understanding the complexities of monetary policy and the potential consequences of political interference.

Conclusion

The intense conflict between Trump and Powell highlighted fundamental disagreements over economic policy and raised significant concerns about the independence of the Federal Reserve. Trump's repeated calls for Powell's removal represent a watershed moment in US economic and political history. Further research into the "Jerome Powell removal" debate is crucial to understanding the complexities of monetary policy and the importance of central bank independence. Explore the topic further to fully grasp the implications of this historic clash for the future of the US economy. Understanding the nuances of this conflict, including the arguments surrounding the attempted Jerome Powell removal, is essential for informed civic engagement.

Featured Posts

-

Trumps Trade War Imf Warns Of Systemic Financial Risk

Apr 23, 2025

Trumps Trade War Imf Warns Of Systemic Financial Risk

Apr 23, 2025 -

Are Elon Musks Priorities Hurting Tesla State Treasurers Demand Answers

Apr 23, 2025

Are Elon Musks Priorities Hurting Tesla State Treasurers Demand Answers

Apr 23, 2025 -

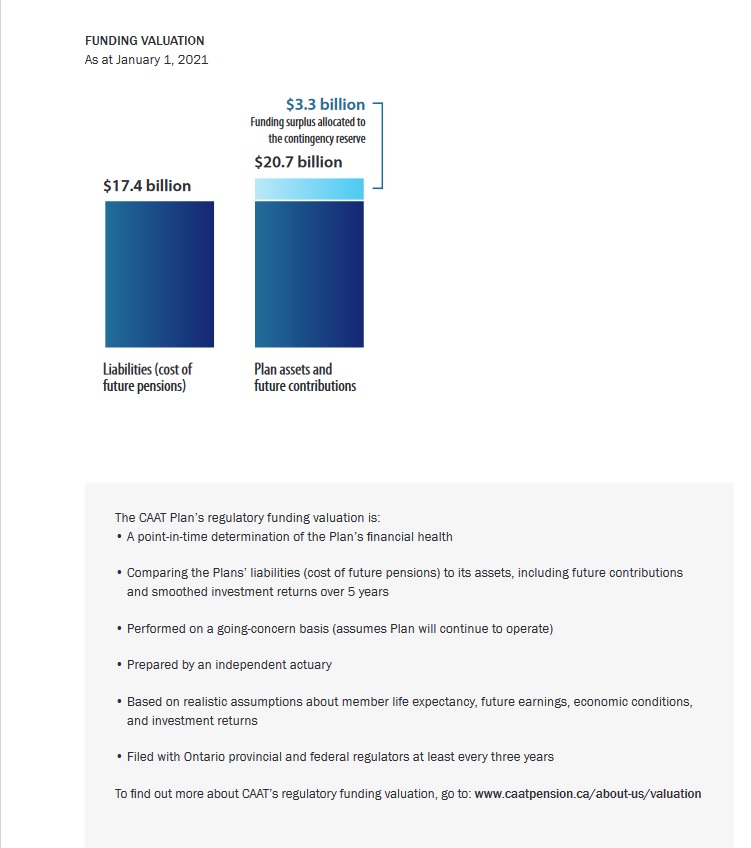

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025

Caat Pension Plan Seeks Increased Canadian Private Investment

Apr 23, 2025 -

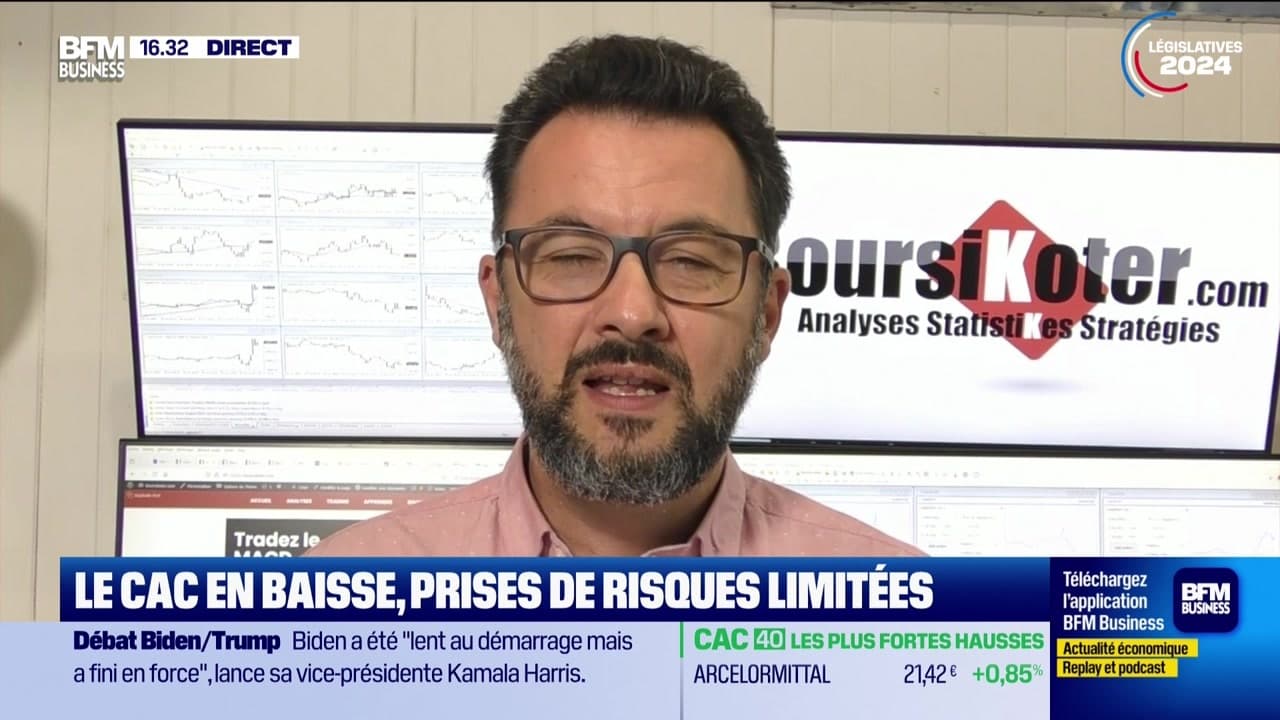

Gerer Les Risques Avec Les Alertes Trader Et Les Seuils Techniques

Apr 23, 2025

Gerer Les Risques Avec Les Alertes Trader Et Les Seuils Techniques

Apr 23, 2025 -

Anti Trump Rallies Hearing The Voices Of Resistance

Apr 23, 2025

Anti Trump Rallies Hearing The Voices Of Resistance

Apr 23, 2025