Succession Planning: Essential Strategies For Ultra-High-Net-Worth Families

Table of Contents

Developing a Comprehensive Wealth Transfer Strategy

Effective wealth transfer requires a multi-faceted approach that addresses tax implications, asset protection, and intergenerational wealth preservation. Ignoring these crucial aspects can lead to significant financial losses and family discord.

Tax Optimization and Minimization

Minimizing tax liabilities associated with wealth transfer is paramount. Sophisticated tax planning strategies are crucial for UHNW families.

- Utilize grantor retained annuity trusts (GRATs): These trusts can significantly reduce gift and estate taxes by leveraging the growth of assets over a predetermined term.

- Employ charitable remainder trusts (CRTs): These trusts allow for charitable giving while generating income for the grantor and beneficiaries.

- Strategic gifting: Making gifts during your lifetime can reduce your taxable estate and take advantage of annual gift tax exclusions.

- Family Limited Partnerships (FLPs) and Limited Liability Companies (LLCs): These structures can offer significant tax advantages and asset protection benefits.

Protecting Assets from Litigation and Creditors

Protecting your assets from unforeseen circumstances is crucial. Robust asset protection strategies are essential for preserving family wealth.

- Dynasty trusts: These trusts can protect assets for multiple generations, shielding them from creditors and lawsuits.

- Offshore trusts: In certain jurisdictions, these trusts offer strong asset protection features, although careful consideration of legal and regulatory implications is vital.

- Insurance strategies: Utilizing high-value life insurance policies can provide significant liquidity for estate taxes and other financial obligations.

Preserving Family Wealth Across Generations

Preserving wealth isn't just about the money; it's about instilling responsible financial stewardship in future generations.

- Financial education: Educate heirs about responsible wealth management, investment strategies, and the importance of financial literacy.

- Family council: Establishing a family council provides a platform for open communication, decision-making, and conflict resolution regarding family wealth.

- Mentorship programs: Pair younger generations with experienced financial advisors and family members to foster a smooth transition of wealth and responsibility.

Family Governance and Communication

Open communication and a well-defined governance structure are cornerstones of successful succession planning for UHNW families. Failing to address these aspects can lead to disputes and erode family unity.

Establishing a Family Constitution

A family constitution serves as a roadmap for future generations, outlining family values, wealth management principles, and decision-making processes.

- Clearly defined ownership structure: Outline clear guidelines for family business ownership, management, and distribution of profits.

- Dispute resolution mechanisms: Establish processes for resolving conflicts and disagreements among family members.

- Philanthropic guidelines: Define the family's philanthropic goals and how charitable giving will be managed.

Facilitating Open Communication and Conflict Resolution

Proactive communication is key to preventing conflicts and ensuring a smooth wealth transfer.

- Regular family meetings: Schedule regular meetings to discuss family matters, financial updates, and succession planning progress.

- Professional mediation services: Utilize professional mediators to facilitate discussions and resolve conflicts in a constructive manner.

- Family therapy: Consider family therapy to address underlying family dynamics that may impact wealth transfer.

Developing a Family Office

A family office can streamline the complexities of managing substantial wealth.

- Centralized investment management: Professional investment management tailored to the family's specific needs and risk tolerance.

- Tax planning and compliance: Dedicated tax professionals ensure compliance with all relevant tax laws and regulations.

- Philanthropic administration: Streamlined management of charitable giving and foundation activities.

Business Succession Planning for UHNW Families

For families with significant business holdings, a comprehensive business succession plan is vital for ensuring continuity and minimizing disruption.

Valuing and Transferring Family Businesses

Accurately valuing and transferring family businesses requires a methodical approach.

- Professional valuation: Engage qualified professionals to determine the fair market value of the business.

- Phased transfer: Gradually transfer ownership and management responsibilities over time to allow for a smoother transition.

- Employee Stock Ownership Plans (ESOPs): ESOPs can provide a tax-efficient method for transferring ownership to employees.

Ensuring Business Continuity

Maintaining the smooth operation of the family business is essential during and after the transition.

- Succession planning for key personnel: Develop comprehensive succession plans for key employees to ensure business continuity.

- Management training programs: Provide comprehensive training and development programs for the next generation of leaders.

- Strategic partnerships: Explore strategic alliances or partnerships to strengthen the business and facilitate a successful transition.

Managing Family Business Conflicts

Conflicts among family members involved in the business can jeopardize its future.

- Clear roles and responsibilities: Establish clear roles, responsibilities, and decision-making processes within the business.

- Independent board of directors: Consider establishing an independent board of directors to provide oversight and guidance.

- Conflict resolution mechanisms: Develop clear protocols for addressing and resolving conflicts among family members.

Philanthropic Planning and Legacy Giving

Integrating philanthropic goals into succession planning can create a lasting legacy and reinforce family values.

Establishing a Family Foundation

A private family foundation offers a structured approach to charitable giving.

- Grant-making flexibility: Allows for flexibility in directing charitable grants based on the family’s priorities.

- Tax benefits: Provides potential tax advantages for the donors.

- Long-term impact: Enables the family to make a lasting impact on causes they care about.

Integrating Philanthropy into Family Values

Involving younger generations in philanthropic activities fosters a sense of shared purpose and responsibility.

- Family philanthropy committees: Establish a committee involving different generations to make charitable giving decisions.

- Volunteer opportunities: Encourage family members to volunteer with organizations they support.

- Educational opportunities: Provide opportunities for younger generations to learn about effective philanthropy.

Tax-Efficient Charitable Giving

Maximize the tax benefits of charitable giving by utilizing various tax-advantaged vehicles.

- Donor-advised funds (DAFs): DAFs offer tax benefits while providing flexibility in making charitable donations over time.

- Charitable gift annuities (CGAs): CGAs provide a stream of income for the donor while supporting a charitable cause.

- Charitable lead trusts (CLTs): CLTs offer tax advantages while providing income to a charity for a specific period.

Conclusion: Safeguarding Your Family's Future Through Effective Succession Planning

Succession planning for ultra-high-net-worth families is a multifaceted process requiring careful consideration of wealth transfer strategies, family governance, business succession, and philanthropic endeavors. By proactively addressing tax optimization, asset protection, family communication, and business continuity, UHNW families can secure their legacy, protect their assets, and foster harmony across generations. Don't wait until it's too late. Contact our team of experts today to begin crafting your comprehensive succession planning strategy for your ultra-high-net-worth family, ensuring a secure and prosperous future for generations to come.

Featured Posts

-

Will Trumps Tax Cuts Pass The Gops Divided Future

May 22, 2025

Will Trumps Tax Cuts Pass The Gops Divided Future

May 22, 2025 -

Middle Managers The Unsung Heroes Of Business Success And Employee Development

May 22, 2025

Middle Managers The Unsung Heroes Of Business Success And Employee Development

May 22, 2025 -

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025

Jim Cramers Take On Core Weave Crwv Its Open Ai Connection

May 22, 2025 -

Blockbusters On Bgt Highlights And Performances

May 22, 2025

Blockbusters On Bgt Highlights And Performances

May 22, 2025 -

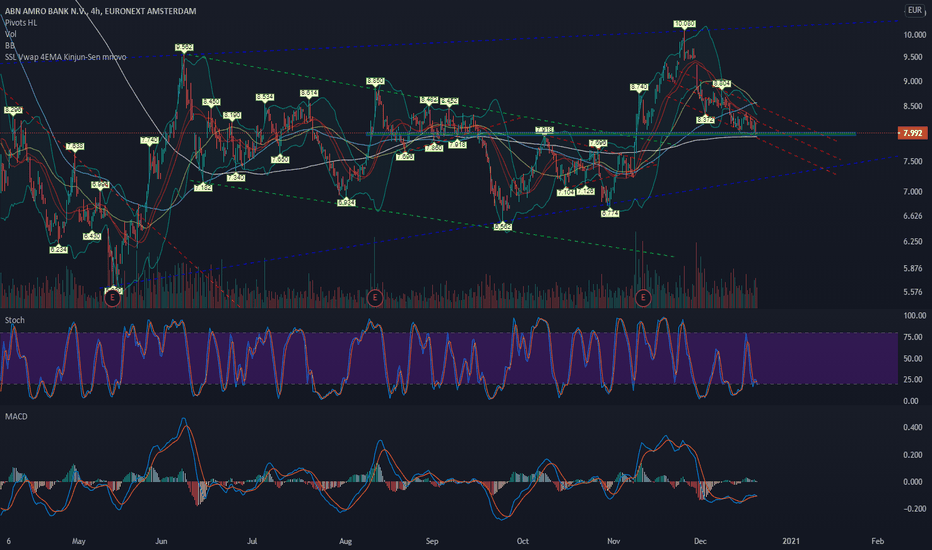

Abn Amro Aex Koers Stijgt Na Positieve Kwartaalcijfers

May 22, 2025

Abn Amro Aex Koers Stijgt Na Positieve Kwartaalcijfers

May 22, 2025

Latest Posts

-

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

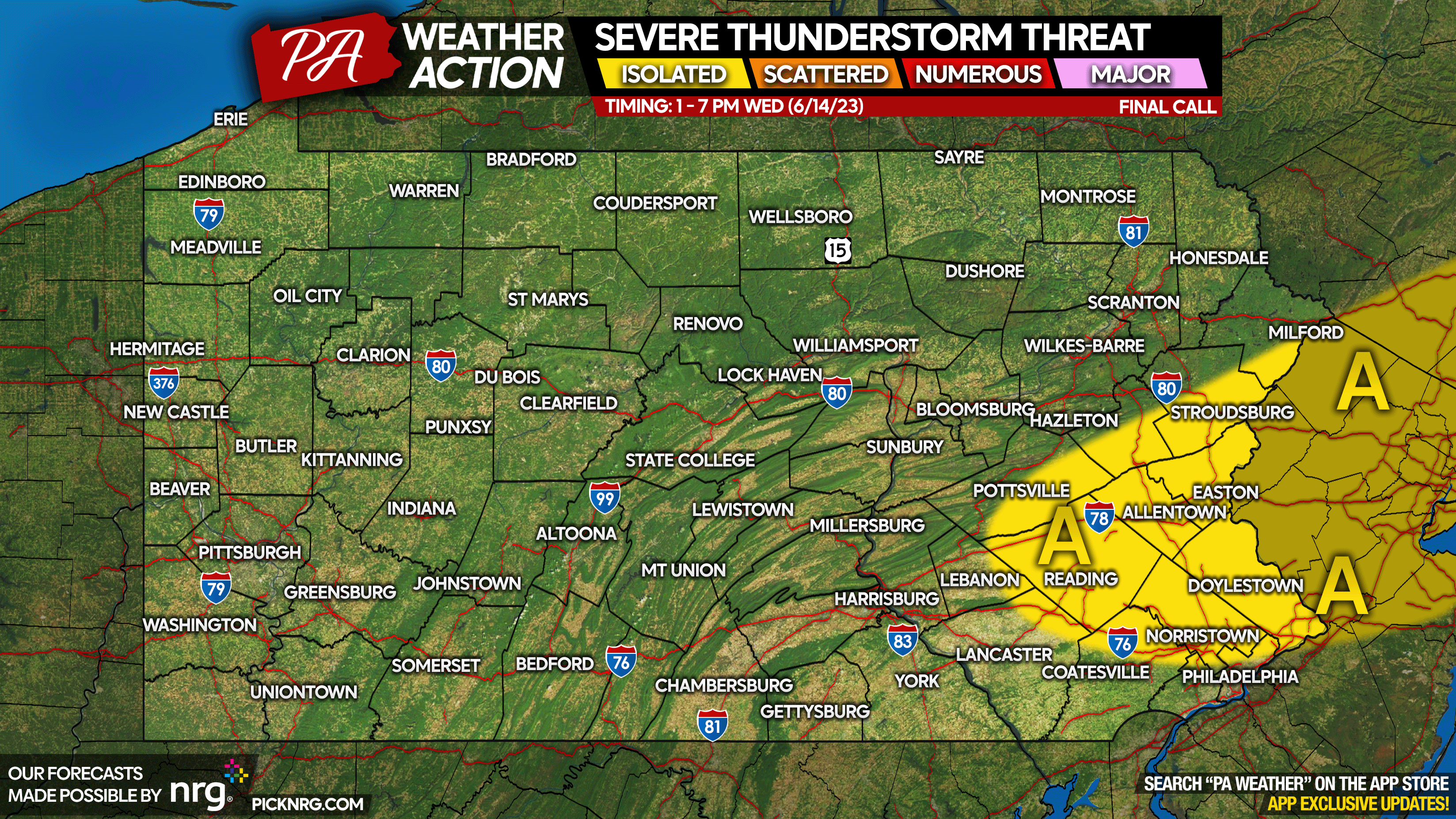

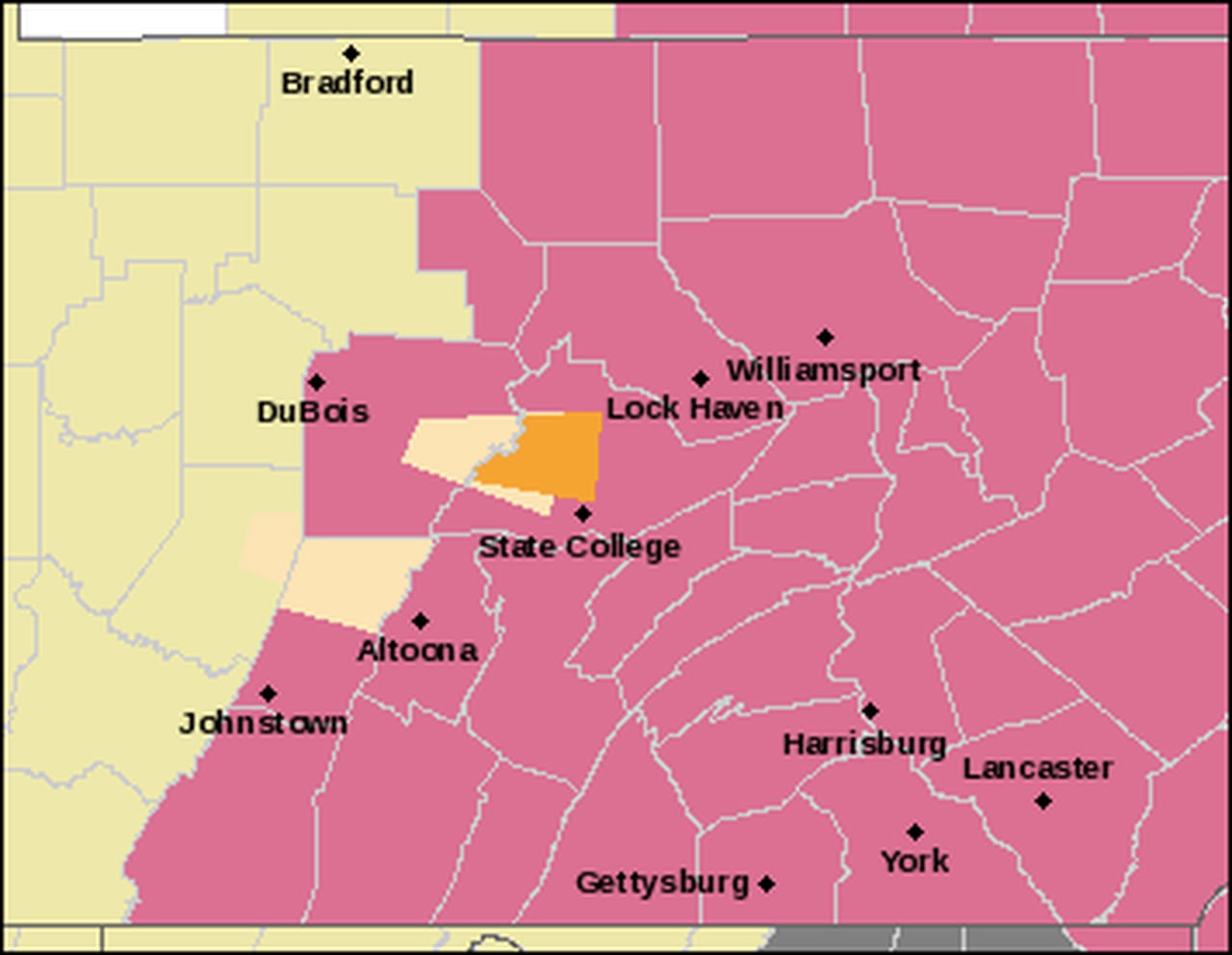

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025

Pennsylvania Thunderstorm Warning Urgent Action Needed In South Central Region

May 22, 2025 -

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025

Major Fire Damages Dauphin County Apartment Complex Overnight

May 22, 2025 -

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025

South Central Pennsylvania Under Severe Thunderstorm Watch

May 22, 2025