Tariff Shock: How Rising Tariffs Impact The Bond Market

Table of Contents

H2: Inflationary Pressures from Tariffs

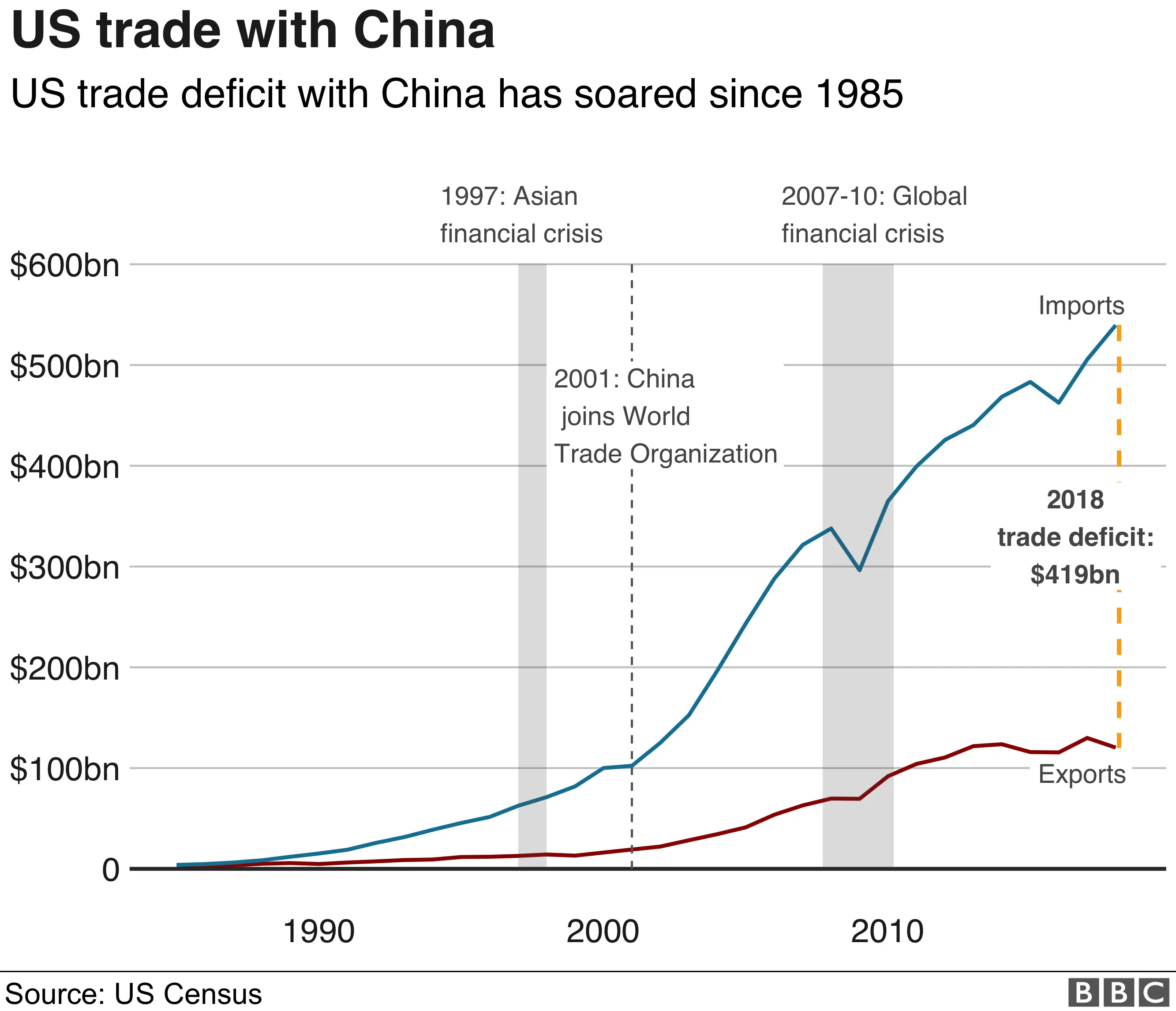

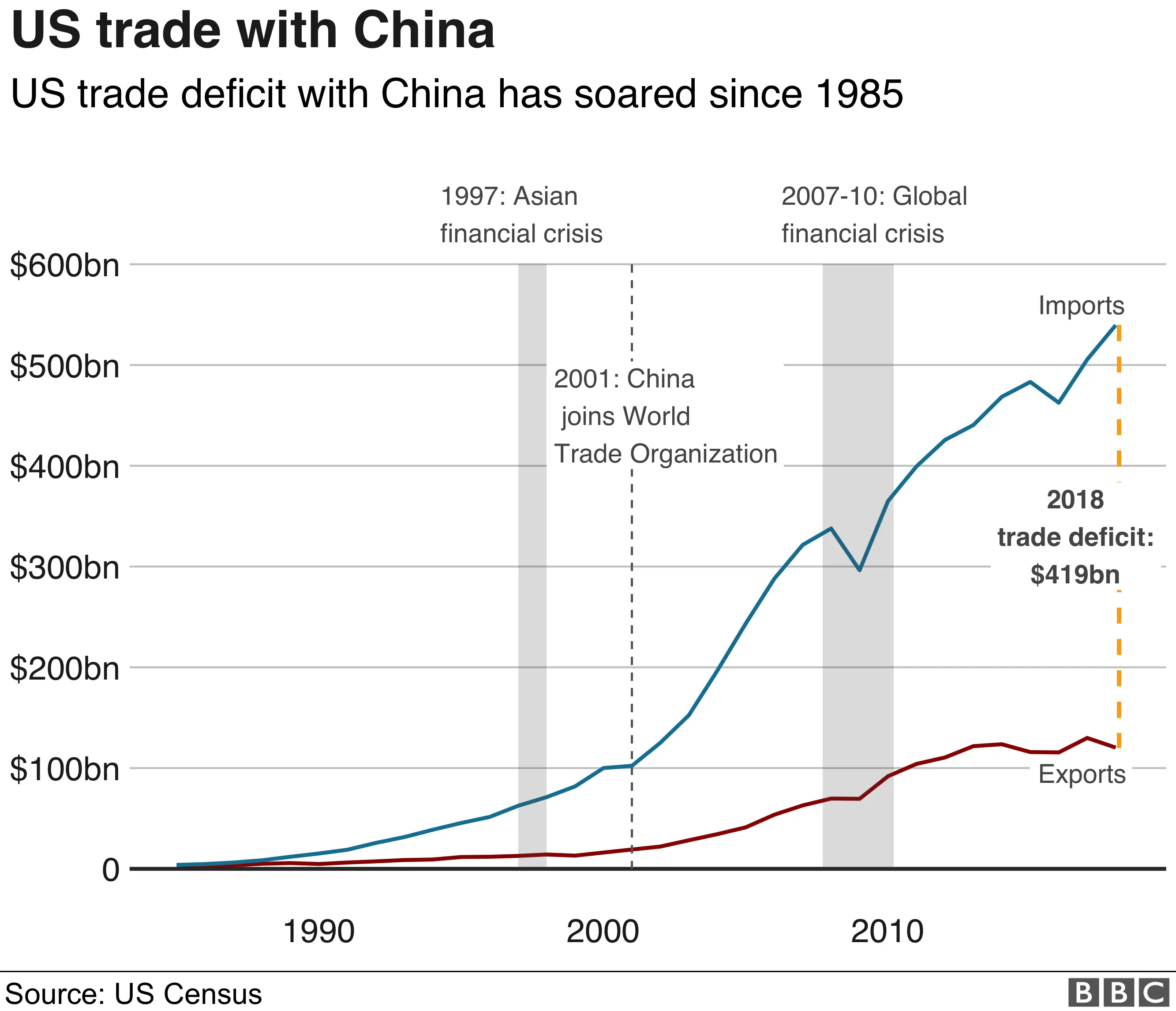

Tariffs, essentially taxes on imported goods, directly increase the cost of these goods. This increased cost is then passed down the supply chain, leading to higher consumer prices and fueling inflation. The impact of tariffs on inflation is multifaceted:

- Increased production costs: Businesses relying on imported materials for production face significantly higher input costs. This necessitates either absorbing the increased costs, reducing profit margins, or passing them on to consumers through higher prices. This ripple effect significantly impacts the overall cost of goods and services.

- Reduced consumer purchasing power: Higher prices for goods and services, directly attributable to tariffs, reduce consumer purchasing power. This can lead to decreased demand, potentially slowing economic growth. The consumer price index (CPI) often reflects this impact directly.

- Potential for a wage-price spiral: As prices rise, workers may demand higher wages to maintain their purchasing power. This can lead to a wage-price spiral, where rising wages further fuel inflation, creating a challenging environment for monetary policy. The tariff impact on inflation is a key concern for economists worldwide.

H2: Impact on Interest Rates and Bond Yields

Central banks closely monitor inflation. In response to rising inflation driven by a tariff shock, central banks often increase interest rates. This monetary policy tightening aims to curb inflation by making borrowing more expensive and cooling down economic activity. The consequences for the bond market are significant:

- Higher interest rates make bonds less attractive: Higher interest rates mean newly issued bonds offer higher yields, making existing bonds with lower yields less appealing. This leads to a decrease in the price of existing bonds.

- Increased demand for higher-yielding bonds: Investors seek to offset the effects of inflation by investing in bonds offering higher yields to protect their purchasing power. This increased demand can, however, be offset by the negative impact of higher interest rates on bond prices.

- Potential for an inverted yield curve: Aggressive interest rate hikes can lead to an inverted yield curve, where short-term interest rates exceed long-term rates. This is often seen as a predictor of future economic recession. Understanding central bank response to tariff-induced inflation is vital for navigating the bond market.

H2: Uncertainty and Investor Sentiment

The imposition of tariffs, and the subsequent retaliatory measures, introduces significant uncertainty into the global economy. This uncertainty creates volatility in the bond market as investors become hesitant:

- Reduced investor confidence leading to capital flight: Uncertainty about future economic conditions can lead to reduced investor confidence and capital flight from riskier assets, including certain types of bonds.

- Increased demand for safe-haven assets: Investors often seek refuge in safe-haven assets, such as government bonds, during times of economic uncertainty. This increased demand can drive up the prices of these bonds.

- Potential for a flight to quality: Investors might move away from riskier, higher-yielding corporate bonds towards safer, lower-yielding government bonds, a phenomenon known as a flight to quality. This shift significantly impacts the relative performance of different bond sectors.

H3: Sector-Specific Impacts

The impact of a tariff shock is not uniform across all sectors. Manufacturing sectors heavily reliant on imported materials will be disproportionately affected, leading to potential defaults or credit downgrades, impacting the value of corporate bonds issued by these companies. Similarly, technology sectors dependent on global supply chains may experience disruptions. This sector-specific analysis is critical for a nuanced understanding of tariff-related risks in the bond market.

3. Conclusion

Rising tariffs create significant inflationary pressures, directly impacting interest rates, bond yields, and overall investor sentiment. The uncertainty surrounding tariffs introduces considerable volatility into the bond market, requiring investors to adopt a more cautious and adaptive investment strategy. Understanding the dynamics of a "Tariff Shock" is crucial for navigating the bond market successfully. Stay informed on global trade policies and adjust your bond portfolio accordingly to mitigate potential risks associated with tariff impact and manage tariff risk effectively. Consider diversifying your holdings and carefully evaluating the creditworthiness of individual bonds, particularly those issued by companies in sectors highly exposed to import tariffs.

Featured Posts

-

Experience The John Wick Universe In Las Vegas

May 12, 2025

Experience The John Wick Universe In Las Vegas

May 12, 2025 -

Stem Pa Din Vinder I Dansk Melodi Grand Prix 2025

May 12, 2025

Stem Pa Din Vinder I Dansk Melodi Grand Prix 2025

May 12, 2025 -

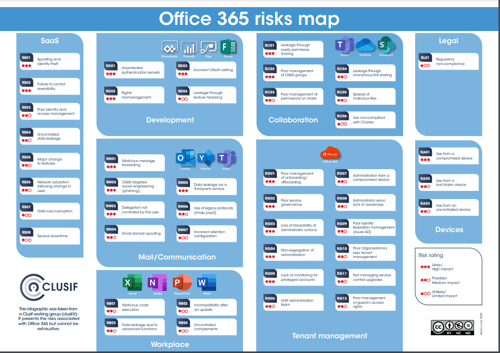

Office365 Security Failure Millions Stolen In Executive Account Hacks

May 12, 2025

Office365 Security Failure Millions Stolen In Executive Account Hacks

May 12, 2025 -

How Middle Managers Bridge The Gap Between Leadership And Employees

May 12, 2025

How Middle Managers Bridge The Gap Between Leadership And Employees

May 12, 2025 -

Rory Mc Ilroy And Shane Lowry To Defend Zurich Classic Title

May 12, 2025

Rory Mc Ilroy And Shane Lowry To Defend Zurich Classic Title

May 12, 2025

Latest Posts

-

Barnli I Lids Una Ted Slavechki Vrakjanje Vo Premier Ligata

May 13, 2025

Barnli I Lids Una Ted Slavechki Vrakjanje Vo Premier Ligata

May 13, 2025 -

Triumf Za Barnli Vrakjanje Vo Premier Ligata So Lids

May 13, 2025

Triumf Za Barnli Vrakjanje Vo Premier Ligata So Lids

May 13, 2025 -

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025

Barnli I Lids Se Vrakjaat Vo Premier Ligata

May 13, 2025 -

I Sefilnt Gioynaitent Nikise Kai O Mpalntok Giortase Gymnos

May 13, 2025

I Sefilnt Gioynaitent Nikise Kai O Mpalntok Giortase Gymnos

May 13, 2025 -

Texas Longhorns Deja Kelly A Leadership Focus In Oregon

May 13, 2025

Texas Longhorns Deja Kelly A Leadership Focus In Oregon

May 13, 2025