Tesla's Board Of Directors Grilled By State Treasurers On Musk's Strategy

Table of Contents

Concerns Regarding Musk's Leadership and Decision-Making

Criticism of Elon Musk's leadership style is a central theme in the state treasurers' scrutiny of the Tesla Board of Directors. His impulsive decision-making and perceived lack of long-term strategic planning are major points of concern. This leadership style has led to several issues:

-

Frequent and drastic shifts in company direction: Musk's penchant for abrupt changes in strategy, often announced via social media, creates uncertainty for investors and employees alike. Examples include rapid shifts in production goals, marketing campaigns, and even product development. This volatility makes it difficult for the company to maintain a consistent and predictable trajectory.

-

Public statements impacting stock prices: Musk's tweets and public pronouncements have repeatedly caused significant fluctuations in Tesla's stock price. These actions raise concerns about market manipulation and the need for more robust controls over his communication. The SEC has previously taken action against Musk for similar behavior, highlighting the severity of this issue.

-

Perceived disregard for regulatory compliance: Tesla has faced multiple regulatory investigations and lawsuits related to safety, environmental compliance, and labor practices. This raises questions about the company's overall commitment to ethical and legal standards.

-

Examples of controversial decisions and their consequences: The acquisition of Twitter (now X), alongside the significant financial resources diverted to this venture, exemplifies the concerns about resource allocation and potential risks to Tesla's core business. The distraction this has caused, and the related financial burdens, further fuels criticism of Musk's leadership. News sources have widely reported on the negative impact of this acquisition on Tesla’s stock price and overall performance.

Scrutiny of Tesla's Financial Performance and Sustainability

State treasurers are also intensely scrutinizing Tesla's financial performance and long-term sustainability. Musk's expansive projects, including SpaceX and his recent acquisition of X, raise concerns about overextension and potential financial instability:

-

Analysis of Tesla's profitability and debt levels: While Tesla has achieved profitability in recent periods, concerns remain about its debt levels and its ability to maintain profitability amidst increased competition and economic uncertainty. Detailed financial reports need to be carefully analyzed to assess its long-term financial health.

-

Evaluation of the financial risks associated with Musk's ambitious expansion plans: The significant financial resources diverted to ventures outside Tesla raise questions about the company's ability to fund its core electric vehicle business adequately and to invest in future research and development. A thorough risk assessment of these external projects is required.

-

Discussion of environmental concerns and ESG (Environmental, Social, and Governance) issues: Tesla's environmental impact, particularly concerning its supply chain and battery production, continues to attract scrutiny. Meeting ESG expectations is crucial for attracting investors and maintaining a positive brand image.

The Role and Responsibility of the Tesla Board of Directors

The effectiveness of the Tesla Board of Directors in overseeing Musk’s actions is a significant area of contention. Questions arise regarding the Board’s composition, independence, and ability to provide effective checks and balances:

-

Examination of the Board’s composition and independence: Concerns exist about the level of independence among the board members and their ability to challenge Musk's decisions objectively. The composition of the Board and the relationships between its members require close examination.

-

Assessment of the Board’s effectiveness in providing checks and balances on Musk’s power: The Board's perceived failure to adequately constrain Musk’s influence raises critical questions about its effectiveness in protecting shareholder interests. Their oversight of his actions, or lack thereof, is a key concern.

-

Discussion of potential conflicts of interest: The close personal and professional ties between some board members and Musk raise concerns about potential conflicts of interest that may impair their ability to make objective decisions. Transparency and a robust conflict-of-interest policy are crucial.

-

Analysis of the Board's accountability to shareholders: The Board's responsibility lies in representing the interests of all shareholders. Its actions, or lack thereof, in addressing concerns about Musk's leadership and financial management directly impact shareholder value. Greater accountability to shareholders is demanded.

Implications for Tesla's Investors and the Future of the Company

The ongoing scrutiny of the Tesla Board of Directors and Musk’s leadership has significant implications for Tesla's investors and its long-term prospects:

-

Potential impact on Tesla's stock price and investor confidence: The uncertainty surrounding Musk’s leadership and the company’s financial trajectory is likely to impact investor confidence and stock prices in the future. Fluctuations in the market are a direct consequence of these events.

-

Risks to Tesla's reputation and brand image: Negative publicity surrounding the leadership and financial issues can harm Tesla's reputation and brand image, affecting sales and market share in the long run. Careful management of its public image is vital.

-

Possible changes in corporate governance and leadership: The current situation may lead to significant changes in Tesla's corporate governance structures and potentially even changes in leadership to restore investor confidence. Structural changes may be inevitable.

-

Future strategies Tesla might adopt in response to the criticism: To regain investor trust and address the concerns raised, Tesla may need to adopt new strategies, focusing on improved corporate governance, more transparent financial reporting, and a more consistent long-term strategic vision. A strategic re-evaluation is necessary.

Conclusion

The state treasurers' grilling of the Tesla Board of Directors highlights significant concerns about Elon Musk's leadership style, Tesla's financial sustainability, and the effectiveness of its corporate governance. The potential consequences for Tesla's investors, reputation, and future are substantial. The actions (or inactions) of the Tesla Board of Directors will be crucial in determining the company’s long-term success. Stay informed about the ongoing developments concerning the Tesla Board of Directors and Elon Musk’s strategies. Follow reputable financial news sources for updates on this evolving situation impacting the future of Tesla. Understanding the complexities surrounding the Tesla Board of Directors is crucial for investors and anyone interested in the future of electric vehicle technology.

Featured Posts

-

Hakkari Valiligi Aciklamasi Okullar Tatil Mi Degil Mi 24 Subat 2024

Apr 23, 2025

Hakkari Valiligi Aciklamasi Okullar Tatil Mi Degil Mi 24 Subat 2024

Apr 23, 2025 -

Michael Lorenzen Stats Highlights And Career Achievements

Apr 23, 2025

Michael Lorenzen Stats Highlights And Career Achievements

Apr 23, 2025 -

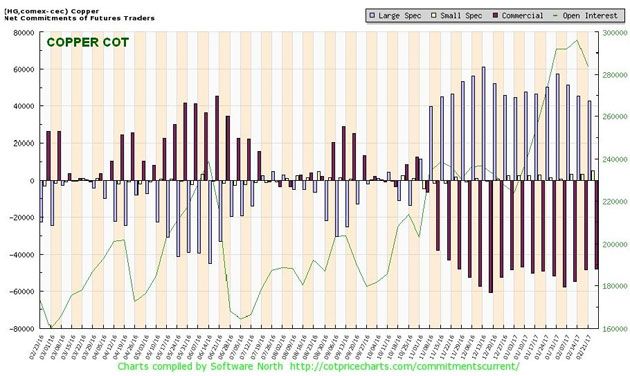

Tongling Metals Forecasts Copper Market Impact Of Us Tariffs

Apr 23, 2025

Tongling Metals Forecasts Copper Market Impact Of Us Tariffs

Apr 23, 2025 -

Good Morning Business L Integrale Du Lundi 24 Fevrier En Video

Apr 23, 2025

Good Morning Business L Integrale Du Lundi 24 Fevrier En Video

Apr 23, 2025 -

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 23, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 23, 2025