Tesla's Future At Stake? State Treasurers Confront Board Over Musk's Focus

Table of Contents

State Treasurers' Concerns and Actions

State treasurers, responsible for managing significant public pension funds, are expressing deep concern about Elon Musk's divided attention, primarily stemming from his acquisition and management of Twitter. Their anxieties center around several key issues: distraction from Tesla's core business, overextension of resources, and the resulting potential risks to shareholder value. These concerns have led to concrete actions, including open letters to the Tesla board, shareholder proposals advocating for improved corporate governance, and even threats of divestment from Tesla stock held within state pension funds.

- Specific examples of Musk's actions that caused concern: The significant time and resources dedicated to Twitter, including frequent tweets impacting Tesla's stock price, and the potential for conflicts of interest between Tesla and Twitter.

- Quotes from official statements by state treasurers: (Insert actual quotes from official statements, properly attributed). For example, a statement might include concerns about the "impact of the CEO's divided attention on the company's strategic decision-making" or the "erosion of shareholder confidence."

- Number of states involved and the total value of their Tesla holdings: (Insert the number of states and the estimated value of their Tesla holdings. This requires research and up-to-date information.)

Impact on Tesla's Stock and Investor Confidence

The state treasurers' actions have undoubtedly impacted Tesla's stock and investor confidence. While pinpointing a direct causal link is complex, the news has coincided with stock price fluctuations, reflecting a degree of market uncertainty. Negative sentiment surrounding Musk's leadership and the perceived risks to Tesla's long-term strategy have contributed to this volatility.

- Stock price data before and after the news broke: (Insert relevant stock price data and charts. This necessitates real-time data analysis from reputable financial sources.)

- Analyst predictions and opinions on Tesla's future: (Summarize analyses from leading financial analysts, citing their reports and predictions on Tesla’s future performance.)

- Comparison to similar situations in other companies: (Discuss similar instances where CEO distractions or poor corporate governance affected company value in comparable companies).

Tesla's Board Response and Potential Strategies

Tesla's board has yet to issue a comprehensive public response directly addressing the state treasurers' concerns. However, potential strategies to regain investor confidence could include: enhanced corporate governance measures, a clearer articulation of Tesla's long-term strategic direction, and improved transparency regarding Musk's time allocation and potential conflicts of interest.

- Potential boardroom changes or policy adjustments: This might involve appointing independent directors with expertise in corporate governance or establishing stricter oversight mechanisms.

- Public relations strategies to mitigate negative publicity: A proactive communication strategy addressing investor concerns and emphasizing Tesla's ongoing commitment to its core business is crucial.

- Analysis of Tesla's long-term strategic plans: A transparent and detailed roadmap for the future would reassure investors about the company's vision and ability to navigate challenges.

The Broader Implications for Corporate Governance and ESG Investing

The situation highlights the growing importance of corporate governance and ESG investing. It underscores the power of shareholder activism in holding companies accountable for their actions and emphasizes the increasing influence of ESG factors in investment decisions.

- Examples of similar situations involving other major companies: (Discuss similar cases where shareholder activism led to corporate governance changes.)

- The increasing importance of ESG factors in investment decisions: (Analyze the trends in ESG investing and their impact on corporate behavior.)

- Potential future trends in corporate governance and shareholder activism: (Discuss potential future developments in corporate governance and investor activism.)

Tesla's Future at Stake: A Call to Action

The concerns raised by state treasurers regarding Elon Musk's divided attention are significant, impacting Tesla's stock performance and raising questions about the company's long-term trajectory. The board's response and the resulting changes in corporate governance will be crucial in determining Tesla's future. The ongoing debate surrounding "Tesla's Future at Stake" demands careful attention. Stay informed, follow the developments, and share your thoughts on this critical juncture for one of the world's most influential electric vehicle companies. Engage in the discussion—Tesla’s future depends on it.

Featured Posts

-

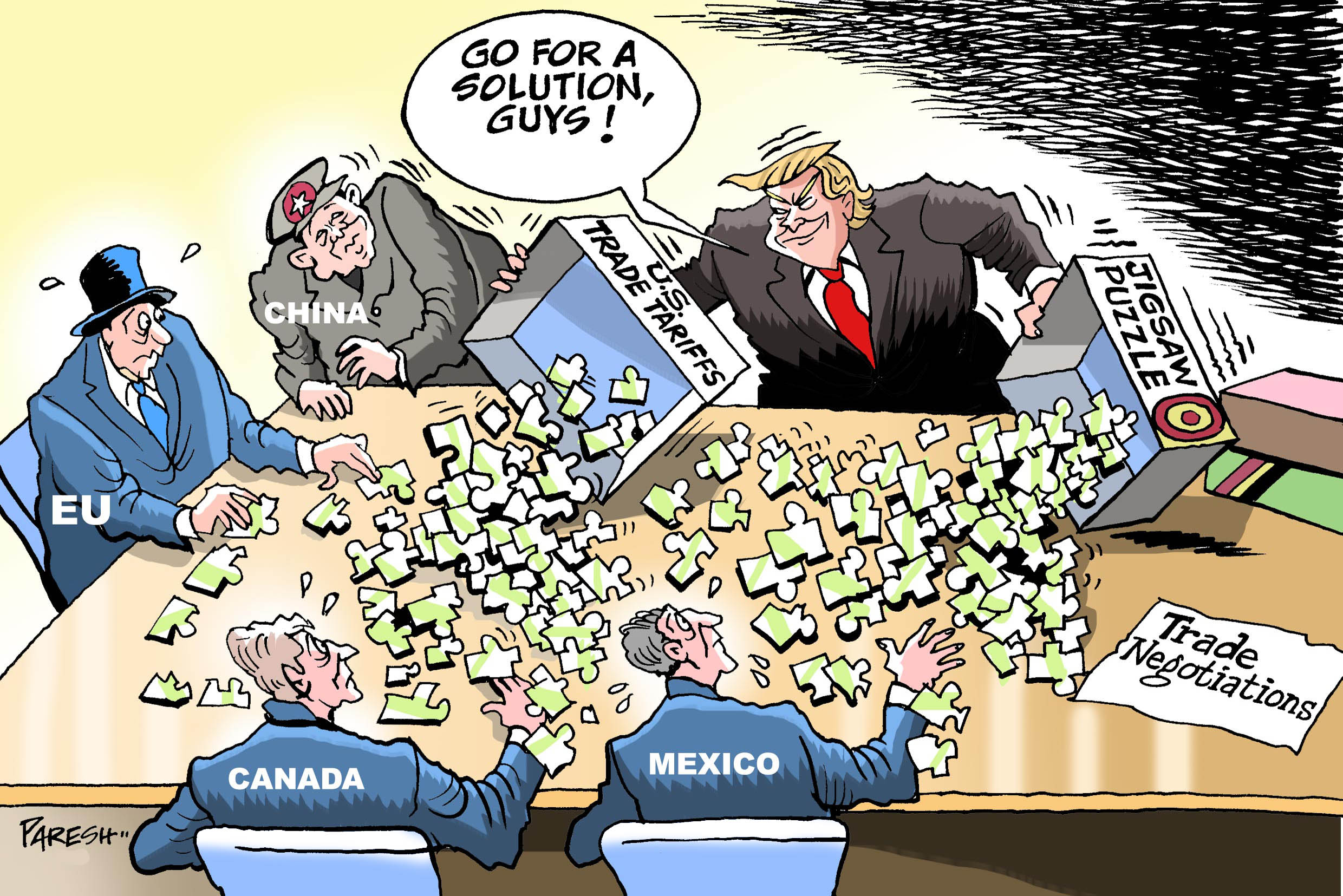

Us Tariffs Weigh On Copper Tonglings Short Term Forecast

Apr 23, 2025

Us Tariffs Weigh On Copper Tonglings Short Term Forecast

Apr 23, 2025 -

Tigers Skubal Throws 7 Shutout Innings Dominates Brewers

Apr 23, 2025

Tigers Skubal Throws 7 Shutout Innings Dominates Brewers

Apr 23, 2025 -

Dramatic Escape Woman Children Survive Manhole Blast

Apr 23, 2025

Dramatic Escape Woman Children Survive Manhole Blast

Apr 23, 2025 -

Istanbul Da 3 Mart Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025

Istanbul Da 3 Mart Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

Section 230 And Banned Chemicals A Ruling On E Bay Listings

Apr 23, 2025

Section 230 And Banned Chemicals A Ruling On E Bay Listings

Apr 23, 2025

Latest Posts

-

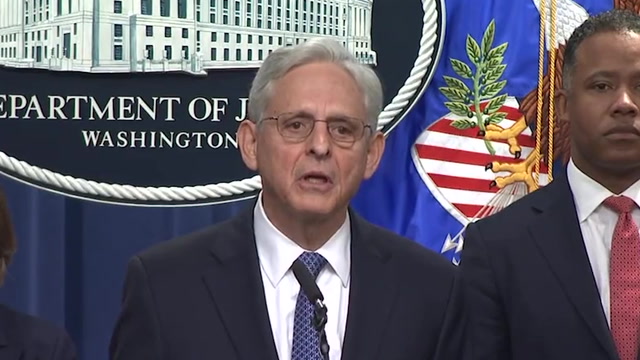

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025

Beyond Epstein Examining The Us Attorney Generals Frequent Fox News Interviews

May 10, 2025 -

Analyzing Chinas Post Canada Canola Import Diversification

May 10, 2025

Analyzing Chinas Post Canada Canola Import Diversification

May 10, 2025 -

Chinas Canola Supply Assessing New Partnerships

May 10, 2025

Chinas Canola Supply Assessing New Partnerships

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025 -

Navigating The New Landscape Chinas Canola Import Strategy

May 10, 2025

Navigating The New Landscape Chinas Canola Import Strategy

May 10, 2025