The £3 Billion Question: SSE's Spending Cuts And What They Mean

Table of Contents

Impact on SSE's Renewable Energy Investments

SSE's £3 billion spending cuts will undoubtedly impact its ambitious renewable energy portfolio. Reduced investment in wind and solar projects is a key concern, with potential consequences for the UK's net-zero ambitions.

Reduced Investment in Wind and Solar Projects

- Specific Projects Affected: While SSE hasn't publicly named all affected projects, industry analysts suggest delays or cancellations are likely for several planned wind farms, both onshore and offshore, and several large-scale solar projects. This uncertainty casts a shadow over the UK's renewable energy targets.

- Consequences for Renewable Energy Targets: The UK government has set ambitious targets for renewable energy generation. SSE's reduced investment could hinder progress towards these goals, potentially delaying the transition to a cleaner energy system. The impact on the nation's commitment to net-zero emissions is a significant concern.

- Impact on Shareholder Value and Long-Term Sustainability: The reduced investment in renewable energy might affect SSE's long-term sustainability goals and shareholder value. Investors increasingly favour companies committed to sustainable practices, and these cuts could negatively impact SSE's appeal to environmentally conscious investors.

Implications for Jobs and Regional Economies

The spending cuts pose a considerable threat to jobs and regional economies reliant on SSE's renewable energy projects.

- Job Losses: Construction and maintenance of renewable energy projects create numerous jobs. Delays or cancellations could lead to significant job losses in affected communities.

- Economic Impact: The economic impact extends beyond direct job losses, affecting local businesses and services that support renewable energy projects. The ripple effect could be substantial, particularly in rural communities.

- Government Response and Mitigation: The government might need to intervene with mitigation strategies, such as retraining programs or incentives for alternative investment in affected regions to lessen the economic blow. The creation of alternative job opportunities in green technologies is crucial.

Effects on SSE's Network Infrastructure Development

Decreased spending on network infrastructure is another critical consequence of SSE's £3 billion cost-cutting measures. This could have far-reaching implications for grid stability, energy security, and consumer prices.

Decreased Spending on Grid Modernization and Upgrades

- Grid Stability and Energy Security: Investing in grid modernization is crucial for integrating renewable energy sources and ensuring a stable and reliable electricity supply. Reduced spending risks compromising grid stability and energy security.

- Connecting New Renewable Energy Sources: Delays in grid upgrades could impede the connection of new renewable energy sources to the national grid, hindering the expansion of clean energy generation.

- Impact on Electricity Prices: Inadequate grid infrastructure can lead to increased transmission losses and potentially higher electricity prices for consumers.

Impact on the Reliability and Resilience of the Energy Network

- Increased Risk of Power Outages: A poorly maintained and upgraded grid is more vulnerable to power outages and disruptions. This increased risk poses a threat to businesses and households.

- Long-Term Consequences for Energy Supply and Demand: Failure to invest adequately in grid infrastructure could create bottlenecks in the energy system, potentially limiting future growth in renewable energy and affecting the balance of supply and demand.

- Alternative Strategies: SSE might need to explore alternative strategies to maintain grid reliability, perhaps through partnerships or innovative financing models.

The Broader Market Reaction to SSE's Cost-Cutting Measures

SSE's cost-cutting strategy has already elicited a reaction in the broader energy market. The impact on investor sentiment, competition, and market dynamics will be significant.

Investor Sentiment and Stock Market Performance

- Market Reaction: The announcement of the spending cuts has likely impacted SSE's share price and investor confidence. Investors are evaluating the long-term consequences of this strategy.

- Credit Rating Changes: Credit rating agencies may review SSE's credit rating in light of the reduced spending, potentially impacting its access to capital for future projects.

- Financial Projections: SSE's financial projections for the coming years will be carefully scrutinized, with investors looking for reassurance about the company's financial stability.

Competition and Market Dynamics within the Energy Sector

- Competitive Position: SSE's cost-cutting measures could affect its competitive position. Other energy companies may see an opportunity to gain market share.

- Market Consolidation: The reduced investment might lead to mergers, acquisitions, or other forms of industry consolidation as companies seek to adapt to the changing market landscape.

Conclusion: Understanding the Long-Term Ramifications of SSE's £3 Billion Spending Cuts

SSE's £3 billion spending cuts have significant implications for renewable energy investment, network infrastructure, and the wider energy market. The reduction in spending on renewable energy projects could hinder the UK's net-zero ambitions, while decreased investment in grid infrastructure poses risks to energy security and consumer prices. The market reaction has been mixed, with concerns about investor sentiment and SSE's competitive position. While cost-cutting can be necessary for financial stability, the long-term ramifications of these decisions require careful consideration. A balanced approach is crucial, ensuring that cost savings don't compromise the UK's energy transition and long-term sustainability. Stay updated on the evolving situation with SSE's spending cuts and their implications for the UK's energy future, paying close attention to SSE cost-cutting and energy sector investment news for a full picture.

Featured Posts

-

Understanding North Myrtle Beachs Water Crisis Public Safety Implications

May 25, 2025

Understanding North Myrtle Beachs Water Crisis Public Safety Implications

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025 -

Philips 2025 Annual General Meeting Key Updates And Agenda

May 25, 2025

Philips 2025 Annual General Meeting Key Updates And Agenda

May 25, 2025 -

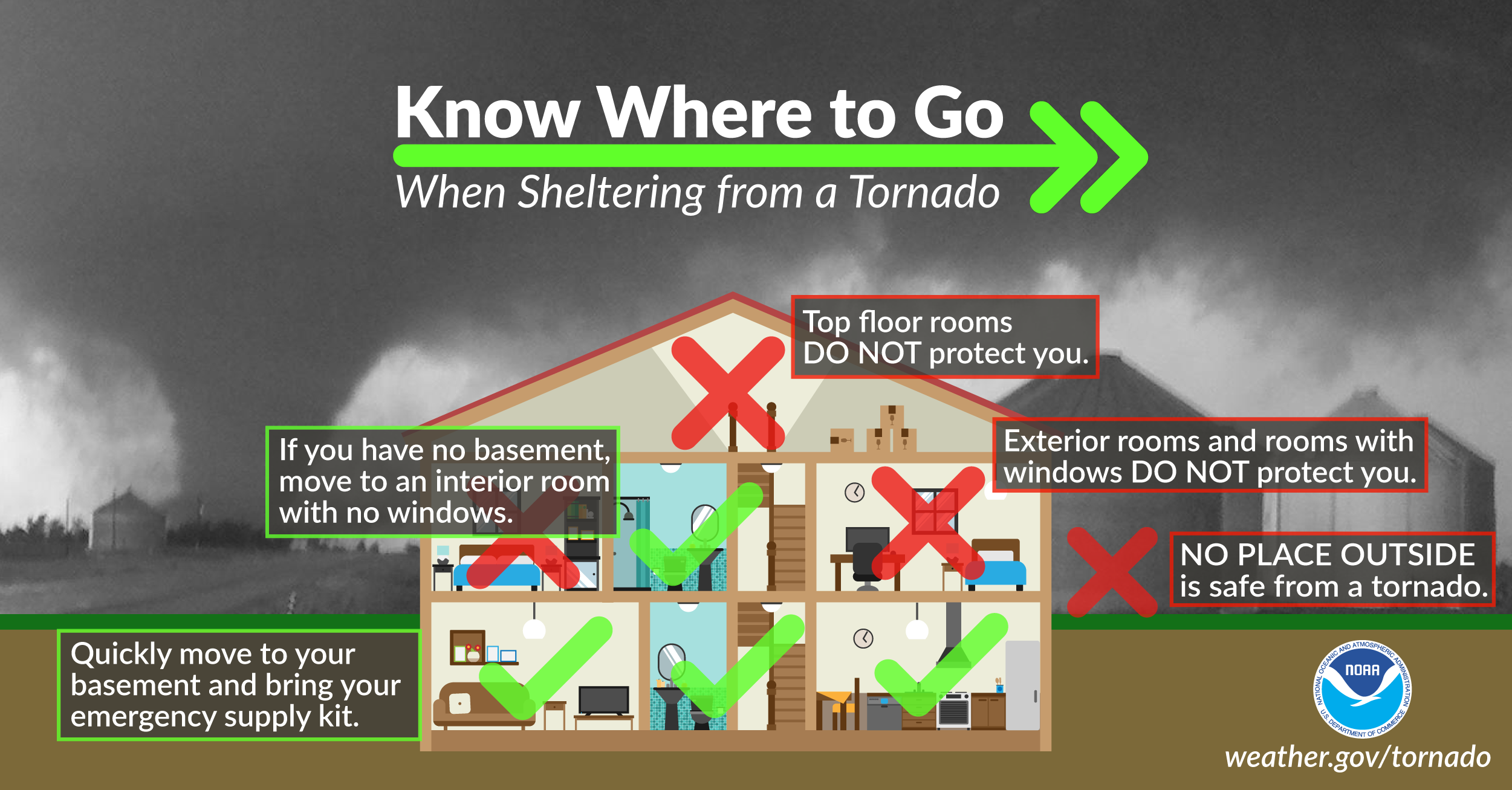

Floods And Severe Weather A Guide To Safety During Awareness Week

May 25, 2025

Floods And Severe Weather A Guide To Safety During Awareness Week

May 25, 2025 -

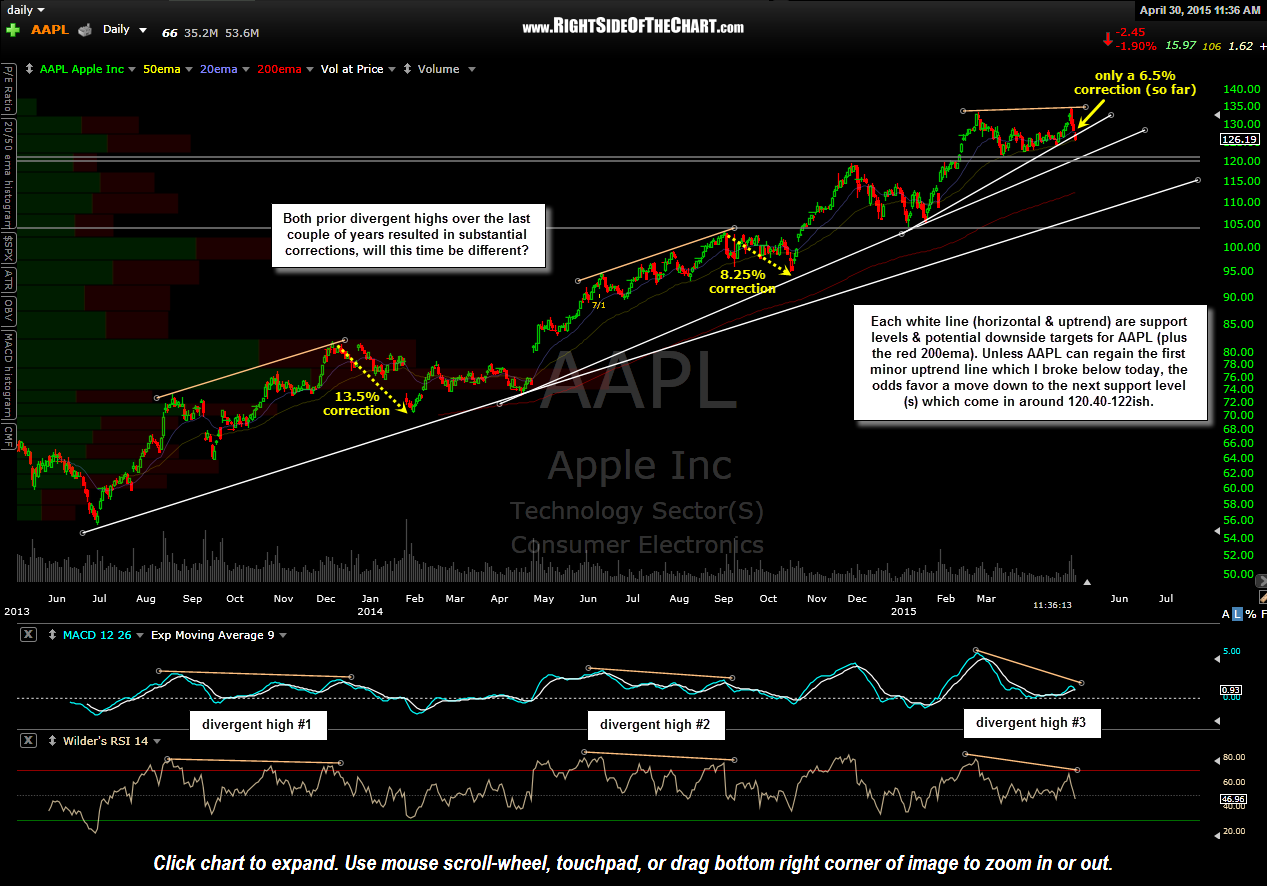

Aapl Stock Important Price Levels And Future Predictions

May 25, 2025

Aapl Stock Important Price Levels And Future Predictions

May 25, 2025

Latest Posts

-

300 Podiumov Mercedes Vklad Rassela I Rekord Khemiltona

May 25, 2025

300 Podiumov Mercedes Vklad Rassela I Rekord Khemiltona

May 25, 2025 -

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025

George L Russell Jr S Passing A Loss For Marylands Legal And Political Communities

May 25, 2025 -

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025

Maryland Mourns The Passing Of Legal Luminary George L Russell Jr

May 25, 2025 -

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025

George Russells Mercedes Future Wolff Drops Another Clue

May 25, 2025 -

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025

Mercedes And George Russell Contract Renewal Hinges On This One Factor

May 25, 2025