The Bank Of England And QE: A Case For Moderation In Future Responses

Table of Contents

The Effectiveness of QE in Previous Crises

The Bank of England's deployment of QE aimed to stimulate economic activity by lowering long-term interest rates and increasing money supply. Let's analyze its impact across different economic indicators.

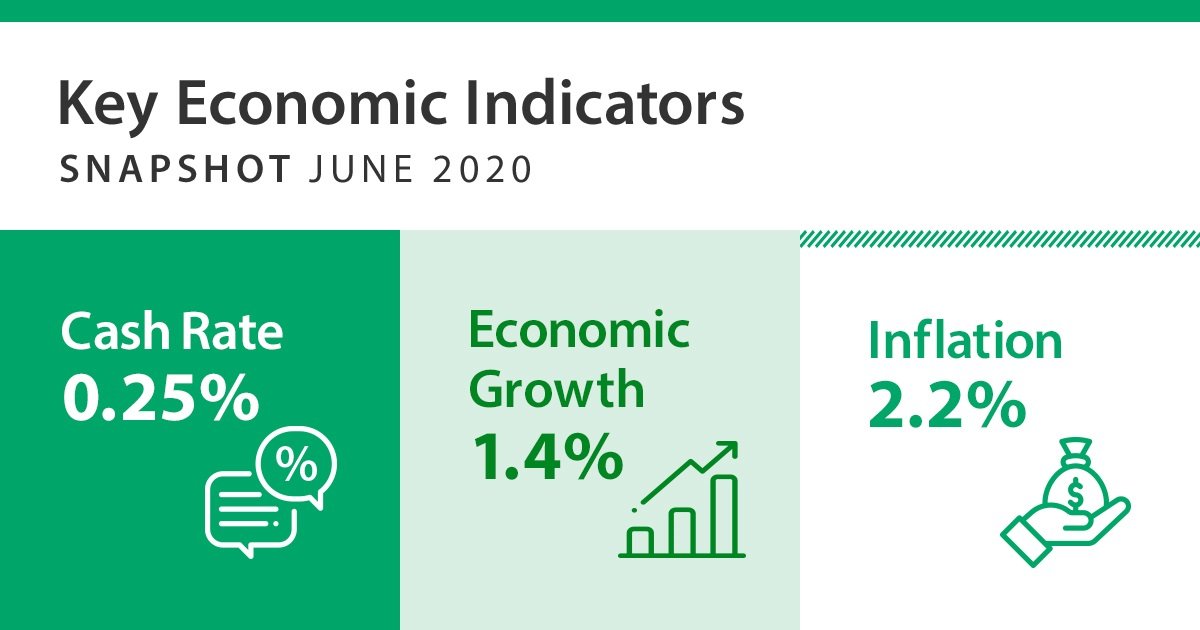

QE's impact on inflation and economic growth in the UK post-2008 and during the COVID-19 pandemic

- Post-2008: While QE helped avert a deeper recession, inflation remained stubbornly low, suggesting a limited impact on aggregate demand. Government borrowing costs did decline, facilitating increased public spending. However, the benefits were not evenly distributed, with asset price inflation disproportionately benefiting wealthier segments of the population.

- COVID-19 Pandemic: The rapid and large-scale QE program implemented during the pandemic successfully lowered borrowing costs for businesses and prevented a financial market collapse. However, it also contributed to a surge in inflation, exceeding the Bank of England's inflation targeting mandate.

The effectiveness of QE in achieving its stated goals is therefore debatable and depended heavily on the specific economic context. The interplay between monetary policy, fiscal policy, and the broader economic environment significantly impacted the outcomes.

Assessing unintended consequences: Did QE create asset bubbles? Did it disproportionately benefit the wealthy?

- Asset Bubbles: The significant increase in asset prices (especially housing and equities) following QE programs raises concerns about the creation of asset bubbles. This could lead to future financial instability if these bubbles burst.

- Wealth Inequality: QE's impact on wealth inequality is a key concern. The benefits primarily accrued to those who already owned assets, exacerbating existing wealth disparities. This distributional effect raises questions about the social equity of relying heavily on QE as a primary economic stimulus tool. Furthermore, the increase in asset prices might have inflated the overall perceived wealth, creating a false sense of economic security.

The Risks of Overreliance on QE

The potential downsides of relying too heavily on QE as a primary response to economic downturns are significant.

The moral hazard of QE: Does it encourage excessive risk-taking by financial institutions?

- Incentivizing Risk: The knowledge that the Bank of England might intervene with QE during a crisis can incentivize excessive risk-taking by financial institutions. They might engage in more aggressive lending practices, knowing that the central bank will likely provide a safety net in case of failure.

- Weakening Risk Management: Overreliance on QE can weaken the incentives for robust risk management practices within the financial sector. This increases the likelihood of future crises and necessitates even larger QE interventions in the future, creating a dangerous cycle. Improved financial regulation is crucial to mitigate this moral hazard.

The limits of monetary policy: Can QE alone solve deep-seated economic problems?

- Structural Issues: QE is primarily a monetary policy tool. It is less effective in addressing deep-seated structural economic problems such as low productivity, skill mismatches, or regional inequalities.

- Supply-Side Constraints: QE primarily operates on the demand side of the economy. If economic downturns are caused by supply-side constraints (e.g., disruptions in global supply chains), QE may be less effective and could even contribute to inflation. A comprehensive approach incorporating supply-side policies is crucial.

Alternative Policy Tools for Economic Stabilization

A diversified approach to economic stabilization is crucial, minimizing reliance on QE alone.

The role of fiscal policy in mitigating economic downturns

- Fiscal Stimulus: Government spending on infrastructure projects, social programs, or tax cuts can directly stimulate demand and create jobs, offering a more targeted approach than QE.

- Targeted Interventions: Fiscal policy allows for more targeted interventions, addressing specific sectors or demographics most affected by an economic downturn. This can be more equitable than the broad-based effects of QE. The trade-off involves managing increased government debt.

Strengthening financial regulation to prevent future crises

- Macroprudential Regulation: Strengthening macroprudential regulation, focusing on the stability of the financial system as a whole, is vital to prevent future crises. This reduces the need for extraordinary measures like QE.

- Enhanced Banking Supervision: Improved banking supervision and stricter capital requirements for financial institutions can mitigate excessive risk-taking and improve the resilience of the financial sector.

Conclusion: A Measured Approach to Future QE by the Bank of England

The Bank of England's past use of QE demonstrates both its potential benefits and significant limitations. While effective in preventing financial collapses, its overreliance carries substantial risks, including asset bubbles, increased wealth inequality, and a moral hazard that encourages excessive risk-taking. Future economic downturns require a more nuanced and diversified policy response. A moderated QE approach, complemented by robust fiscal policy, targeted interventions, and strengthened financial regulation, is essential for achieving sustainable economic growth while mitigating the risks associated with QE. Further research and open public discussion on the optimal use of Bank of England QE and its long-term consequences are crucial for informing future policy decisions. We must move towards a more sustainable and equitable approach to managing economic fluctuations, moving beyond a sole reliance on QE.

Featured Posts

-

Todays Market Dow Futures Gold Prices And Key Economic Indicators

Apr 23, 2025

Todays Market Dow Futures Gold Prices And Key Economic Indicators

Apr 23, 2025 -

Revealed The Uks Top And Bottom Diy Stores

Apr 23, 2025

Revealed The Uks Top And Bottom Diy Stores

Apr 23, 2025 -

Imanagas Splitter A Statistical Look At Its Mlb Dominance

Apr 23, 2025

Imanagas Splitter A Statistical Look At Its Mlb Dominance

Apr 23, 2025 -

Pazartesi Dizileri 7 Nisan Tv Programi

Apr 23, 2025

Pazartesi Dizileri 7 Nisan Tv Programi

Apr 23, 2025 -

Second Trial For Karen Read Opening Statements Highlight Key Evidence

Apr 23, 2025

Second Trial For Karen Read Opening Statements Highlight Key Evidence

Apr 23, 2025