The Bull Market's Return: Overturning Bearish Predictions On Wall Street

Table of Contents

Economic Indicators Suggesting a Bull Market Rebound

Several key economic indicators point towards a sustained bull market rebound. The shift in market sentiment is not merely speculative; it’s backed by tangible data.

Inflation Cooling and Interest Rate Adjustments

Decreasing inflation rates have significantly boosted investor confidence. The Consumer Price Index (CPI) and Producer Price Index (PPI) have shown signs of cooling, suggesting that the Federal Reserve's aggressive interest rate hikes are starting to have the desired effect. This easing of inflationary pressures reduces the risk of further aggressive rate increases, creating a more favorable environment for investment.

- CPI and PPI data: Charts and graphs illustrating the downward trend in inflation would be included here.

- Federal Reserve influence: The Fed's role in managing inflation and its impact on interest rates is crucial to understand. The analysis should detail how their actions have affected market sentiment.

Strong Corporate Earnings Reports

Robust corporate earnings reports from across various sectors demonstrate strong underlying economic activity. Many major companies have exceeded expectations, signaling confidence in future growth and profitability.

- Examples: Specific examples of companies that have exceeded earnings expectations should be provided, categorized by sector (e.g., technology, consumer goods, energy).

- Consumer spending: The correlation between increased consumer spending and corporate profits should be clearly explained.

Increased Consumer and Business Confidence

Rising consumer and business confidence levels are crucial indicators fueling investment and economic expansion. Surveys such as the Consumer Confidence Index and various business sentiment indices provide valuable insights into market trends.

- Sentiment indices: Data and links to relevant surveys measuring consumer and business confidence should be included.

- Government policies: Analysis of the impact of government policies on confidence levels is essential.

Factors Challenging the Bearish Predictions on Wall Street

The resurgence of the bull market has directly challenged many of the bearish predictions prevalent on Wall Street. Several factors contributed to this unexpected resilience.

Underestimation of Resilience in Certain Sectors

Certain sectors demonstrated remarkable resilience, defying bearish forecasts. This unexpected strength highlights the limitations of broad market predictions.

- Examples: Specific sectors that exceeded expectations should be named and analyzed, explaining the factors behind their outperformance.

- Supply chain improvements: The impact of improved supply chains on specific sectors should be included in the discussion.

Technological Advancements Driving Growth

Technological innovation continues to be a powerful engine of economic growth. Emerging technologies are transforming various sectors, creating new opportunities and driving market expansion.

- AI and renewable energy: The transformative impact of artificial intelligence and renewable energy technologies should be highlighted.

- Examples: Examples of companies benefiting from technological advancements need to be provided.

Geopolitical Factors and Unexpected Outcomes

Geopolitical events significantly influence market trends. However, in several instances, unexpected positive outcomes or shifts in the geopolitical landscape have contributed to the bull market’s resurgence.

- Examples: Specific geopolitical events and their surprising impacts on market sentiment should be discussed. Unexpected positive developments should be highlighted.

Potential Risks and Challenges Ahead for the Bull Market

While the current bull market is encouraging, several risks and challenges remain. It is crucial to acknowledge these potential headwinds.

Inflationary Pressures and Interest Rate Volatility

The possibility of renewed inflationary pressures and volatile interest rates represents a significant threat to the bull market. Unpredictable interest rate adjustments can significantly impact investment decisions and market stability.

- Impact on consumer spending: The analysis should clearly explain how inflation affects consumer spending and corporate profits.

Geopolitical Uncertainty and Global Economic Slowdowns

Lingering geopolitical uncertainties and the potential for global economic slowdowns in various regions could negatively impact the market. International trade relations also play a critical role in market stability.

- Risk assessment: A detailed assessment of the geopolitical risks and potential for global economic slowdowns is needed.

Overvaluation Concerns and Potential Corrections

Concerns about market overvaluation and the potential for future corrections are warranted. Identifying potential triggers for a market correction is crucial for effective risk management.

- Risk mitigation: Discussion of strategies for mitigating risk in a potentially volatile market is needed.

Conclusion: Navigating the Bull Market's Return

The surprising return of the bull market is a complex phenomenon driven by a confluence of factors: cooling inflation, robust corporate earnings, increased consumer and business confidence, and the underestimation of resilience in certain sectors. Technological advancements and unexpected positive shifts in the geopolitical landscape have further fueled this growth. However, potential risks remain, including renewed inflationary pressures, geopolitical uncertainty, and the possibility of market overvaluation. Navigating this bull market requires a careful analysis of these factors and a proactive approach to risk management. Stay informed about market trends, utilize reputable resources, and consider consulting with financial professionals to make informed investment decisions during this dynamic period. Understanding the interplay between the bull market and the initial bearish predictions on Wall Street is critical for success in this evolving market landscape.

Featured Posts

-

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025

Wynne Evans Health Update A Nasty Illness And Showbiz Return Hints

May 10, 2025 -

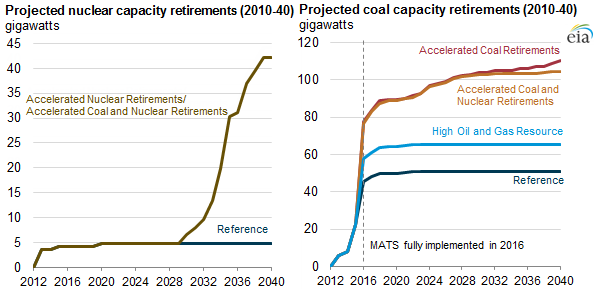

Accelerated Nuclear Power Plant Construction A Trump Administration Proposal

May 10, 2025

Accelerated Nuclear Power Plant Construction A Trump Administration Proposal

May 10, 2025 -

2025 Palantir Stock Outlook Is A 40 Increase Realistic Should You Invest

May 10, 2025

2025 Palantir Stock Outlook Is A 40 Increase Realistic Should You Invest

May 10, 2025 -

Dijon La 3e Ligne De Tramway Un Projet Valide Apres Concertation Metropolitaine

May 10, 2025

Dijon La 3e Ligne De Tramway Un Projet Valide Apres Concertation Metropolitaine

May 10, 2025 -

Executive Orders And The Transgender Community Your Stories Matter

May 10, 2025

Executive Orders And The Transgender Community Your Stories Matter

May 10, 2025