The D-Wave Quantum (QBTS) Stock Crash: A Detailed Analysis Of Monday's Events

Table of Contents

Potential Catalysts Behind the D-Wave Quantum (QBTS) Stock Plunge

Several factors likely contributed to the sharp D-Wave stock decline. Understanding these catalysts is crucial for assessing the severity and longevity of this setback.

Market Sentiment and the Broader Tech Sector Downturn

The recent D-Wave Quantum (QBTS) stock crash occurred amidst a broader negative sentiment gripping the technology sector. The tech-heavy Nasdaq Composite Index has experienced significant volatility recently, reflecting investor concerns about inflation, interest rate hikes, and potential economic slowdowns. This overall market downturn significantly impacted QBTS, dragging its stock price down alongside many other tech companies.

- Many other tech stocks, particularly those considered high-growth and speculative, experienced similar declines during the same period.

- The recent increase in interest rates by central banks globally has increased the cost of borrowing for companies, impacting future growth projections and investor confidence.

- A general climate of risk aversion among investors led many to divest from potentially volatile assets, including QBTS stock.

Lack of Recent Positive News or Catalysts for D-Wave Quantum

The absence of positive news or significant developments from D-Wave Quantum itself may have contributed to the QBTS stock plummet. Without positive catalysts, the stock became vulnerable to broader market pressures.

- A lack of announcements regarding new major contracts could have fueled investor uncertainty about D-Wave's revenue prospects.

- Potential delays in the launch of new products or key technological advancements could have undermined investor confidence in the company's future growth trajectory.

- Increasing competitive pressure from other companies in the rapidly developing quantum computing space likely played a role, highlighting the challenges D-Wave faces in maintaining its market share.

Impact of Short Selling and Institutional Investor Activity

The role of short selling and institutional investor activity cannot be ignored when analyzing the D-Wave stock decline. Increased short selling and sell-offs by large institutional investors could have amplified the downward pressure on the QBTS stock price.

- Analysis of short interest data might reveal a significant increase in the number of investors betting against D-Wave Quantum.

- Large-scale sell-offs by institutional investors, perhaps driven by portfolio rebalancing or negative sentiment, could have further exacerbated the price drop.

- Examining trading volume during the crash is essential to understand the intensity of selling pressure and the involvement of large players in the market.

Analysis of the Company's Financial Performance and Future Outlook

D-Wave Quantum's recent financial reports and overall financial health are critical factors. Poor performance could significantly impact investor confidence.

- Revenue figures for the recent quarters provide insight into the company's ability to generate income and demonstrate market traction.

- Profitability (or the lack thereof) reveals the company's financial sustainability and its ability to manage expenses effectively.

- High levels of debt or negative cash flow could raise concerns among investors about D-Wave's long-term viability.

Analyzing the Immediate and Long-Term Implications of the D-Wave Quantum (QBTS) Stock Crash

The D-Wave Quantum (QBTS) stock crash has significant short-term and long-term consequences.

Short-Term Impact on Investors and Trading Activity

The immediate impact on investors holding QBTS shares was substantial.

- Many investors experienced significant losses due to the sharp decline in the stock price.

- The crash negatively affected the overall value of investor portfolios, particularly for those with significant holdings in D-Wave Quantum.

- Increased volatility in the QBTS stock price added further uncertainty and risk to the market.

Long-Term Effects on D-Wave Quantum's Business and Future Prospects

The long-term consequences for D-Wave Quantum are complex and uncertain.

- The crash might make securing future funding rounds more challenging for the company, potentially hindering its growth.

- It could negatively impact D-Wave's ability to invest in crucial research and development, slowing down innovation.

- The company might need to consider strategic changes such as mergers or acquisitions to improve its financial position and market standing.

- A reassessment of its business strategy may be necessary to address the factors that contributed to the stock price decline.

Lessons Learned and Future Predictions for the Quantum Computing Sector

The D-Wave Quantum (QBTS) stock crash offers valuable lessons for the broader quantum computing sector.

- It highlights the increased scrutiny investors are now applying to companies in this relatively nascent industry.

- The incident underscores the potential for significant volatility and market corrections within the quantum computing market, indicating the need for cautious investment strategies.

- It signals the importance of rigorous due diligence, thorough financial analysis, and a realistic assessment of technological risks for investors in quantum computing companies.

Conclusion: Navigating the Aftermath of the D-Wave Quantum (QBTS) Stock Crash

The D-Wave Quantum (QBTS) stock crash resulted from a confluence of factors, including broader market sentiment, a lack of positive company-specific news, and potentially significant short selling. The short-term impact includes substantial investor losses and increased market volatility, while the long-term implications could affect D-Wave's funding, research, and overall strategic direction. The event serves as a cautionary tale for the entire quantum computing sector, emphasizing the need for careful evaluation and risk management. To stay updated on the D-Wave Quantum (QBTS) stock, monitor the QBTS stock market closely, and follow the future developments of D-Wave Quantum. Continued monitoring of QBTS stock performance and related news is crucial for informed decision-making in this dynamic sector.

Featured Posts

-

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 21, 2025

Occasionverkoop Abn Amro Flinke Toename Dankzij Meer Autobezit

May 21, 2025 -

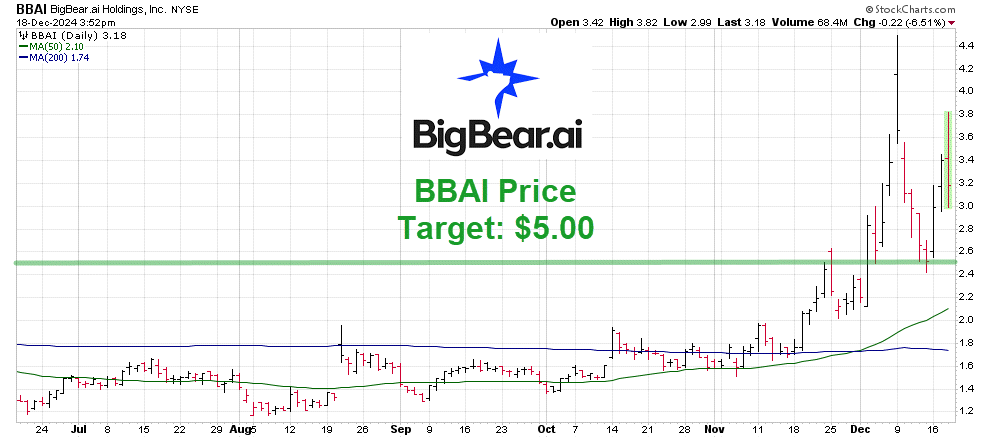

Bbai Stock Takes A Hit 17 87 Drop Due To Revenue Miss And Instability

May 21, 2025

Bbai Stock Takes A Hit 17 87 Drop Due To Revenue Miss And Instability

May 21, 2025 -

Breaking Israel Lifts Food Blockade On Gaza Strip

May 21, 2025

Breaking Israel Lifts Food Blockade On Gaza Strip

May 21, 2025 -

Analyzing The Friday Rally What Drove D Wave Quantum Qbts Higher

May 21, 2025

Analyzing The Friday Rally What Drove D Wave Quantum Qbts Higher

May 21, 2025 -

Cassis Blackcurrant History Cultivation And Culinary Applications

May 21, 2025

Cassis Blackcurrant History Cultivation And Culinary Applications

May 21, 2025

Latest Posts

-

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025

Efimereyontes Iatroi Patras Savvatokyriako 12 And 13 Aprilioy

May 21, 2025 -

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025

T Ha Epistrepsei O Giakoymakis Sto Mls Mia Vathyteri Matia

May 21, 2025 -

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025

Giatroi Se Efimeria Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025 -

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025

Giakoymakis Sto Mls Oi Elpides Kai Oi Amfivolies Ton Amerikanon Opadon

May 21, 2025 -

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025

Breite Efimereyonta Giatro Stin Patra 12 And 13 Aprilioy

May 21, 2025