The Fed's Dilemma: Balancing Economic Growth With Tariff Pressures

Table of Contents

The Impact of Tariffs on Inflation

Tariffs, essentially taxes on imported goods, directly increase the cost of these goods. This leads to higher consumer prices, a phenomenon known as tariff inflation. This inflationary pressure can significantly undermine economic growth. Higher prices reduce consumer purchasing power, potentially leading to decreased demand and slower economic expansion. The ripple effect can be substantial.

- Increased prices for consumer goods: Everyday items from clothing to electronics become more expensive, impacting household budgets.

- Reduced consumer purchasing power: Higher prices mean consumers can afford less, potentially leading to a slowdown in consumer spending, a major driver of economic growth.

- Potential for wage-price spiral: If businesses pass on increased costs through higher prices, workers may demand higher wages to compensate, further fueling inflation.

- Impact on the Consumer Price Index (CPI): The CPI, a key measure of inflation, will inevitably reflect the price increases caused by tariffs, providing a clear indicator of the impact on the broader economy. Careful monitoring of CPI is crucial for assessing the severity of tariff inflation.

The Impact of Tariffs on Employment and Investment

The impact of tariffs extends far beyond simple price increases. Industries heavily reliant on imported inputs or exports are particularly vulnerable. Higher costs due to tariffs can make these businesses less competitive, potentially leading to job losses and reduced investment. The uncertainty created by unpredictable tariff policies further discourages investment.

- Job losses in import-sensitive industries: Businesses facing higher input costs may be forced to cut jobs or even shut down, resulting in unemployment.

- Reduced business investment due to uncertainty: Businesses are hesitant to invest in expansion or new projects when facing unpredictable trade policies and increased costs.

- Impact on supply chains and global trade: Tariffs disrupt established global supply chains, creating bottlenecks and inefficiencies that impact businesses worldwide.

- Retaliatory tariffs and their consequences: When one country imposes tariffs, others often retaliate, leading to a cycle of escalating trade tensions and further economic damage. This tit-for-tat exchange exacerbates the negative impact on global trade.

The Fed's Policy Response Options

The Federal Reserve has limited tools to directly address the economic challenges posed by tariffs. Its primary levers are monetary policy tools, such as interest rate adjustments and quantitative easing. However, the effectiveness of these tools in mitigating tariff-induced economic problems is debatable.

- Interest rate adjustments (monetary policy): The Fed could lower interest rates to stimulate borrowing and investment, but this could also exacerbate inflation if the primary problem is tariff-driven price increases.

- Quantitative easing (monetary policy): This involves injecting money into the economy by purchasing assets, but its effectiveness in offsetting tariff impacts is uncertain and might inflate asset bubbles.

- Communication strategy and forward guidance: Clear communication about the Fed's assessment of the economic situation and its policy intentions can help to manage market expectations and reduce uncertainty.

- Coordination with fiscal policy: Effective policy requires cooperation between the Federal Reserve and the government's fiscal policy makers to address both the monetary and the structural aspects of the economic challenges.

Navigating Uncertainty: Forecasting Economic Growth Under Tariff Pressures

Forecasting economic growth under the current climate of trade uncertainty presents significant challenges. Tariffs introduce considerable complexity into economic modeling and prediction, making accurate forecasting difficult.

- Difficulty in predicting consumer behavior under tariff uncertainty: Consumer confidence and spending patterns are highly sensitive to uncertainty, making reliable predictions challenging.

- Impact of tariffs on business investment and long-term growth: Uncertainty surrounding tariffs discourages long-term investment planning, hindering economic growth.

- The role of geopolitical factors in exacerbating uncertainty: Geopolitical events and international trade tensions further complicate economic forecasting, increasing the uncertainty surrounding future economic growth. The interaction between these geopolitical factors and tariff pressures presents a significant challenge to accurate economic modeling.

Conclusion: The Ongoing Fed Dilemma: Balancing Growth and Tariff Impacts

The Federal Reserve faces a complex and ongoing dilemma: balancing the need for economic growth with the mitigating effects of tariffs on inflation, employment, and investment. The limited policy options available to the Fed highlight the significant challenge presented by protectionist trade policies. Understanding the complexities of the Fed's dilemma—balancing economic growth with tariff pressures—is crucial for investors, policymakers, and businesses alike. Stay informed about the ongoing developments and the Fed's responses to navigate this challenging economic landscape.

Featured Posts

-

Um Trailer Que Mudou O Cinema Analise De Uma Frase Iconica 20 Anos Depois

May 26, 2025

Um Trailer Que Mudou O Cinema Analise De Uma Frase Iconica 20 Anos Depois

May 26, 2025 -

Visible Injuries Documented In Photo Of Kidnapped Soldier Matan Angrest

May 26, 2025

Visible Injuries Documented In Photo Of Kidnapped Soldier Matan Angrest

May 26, 2025 -

Info Lengkap Jadwal Siaran Moto Gp Argentina 2025 Di Trans7

May 26, 2025

Info Lengkap Jadwal Siaran Moto Gp Argentina 2025 Di Trans7

May 26, 2025 -

Russell And The Typhoons Discography Influences And Lasting Legacy

May 26, 2025

Russell And The Typhoons Discography Influences And Lasting Legacy

May 26, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Urban Activism

May 26, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Urban Activism

May 26, 2025

Latest Posts

-

Meilleur Prix Samsung Galaxy S25 256 Go 5 Etoiles 862 42 E

May 28, 2025

Meilleur Prix Samsung Galaxy S25 256 Go 5 Etoiles 862 42 E

May 28, 2025 -

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025

Voici Les 5 Smartphones Avec La Meilleure Autonomie En 2024

May 28, 2025 -

15

May 28, 2025

15

May 28, 2025 -

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025 -

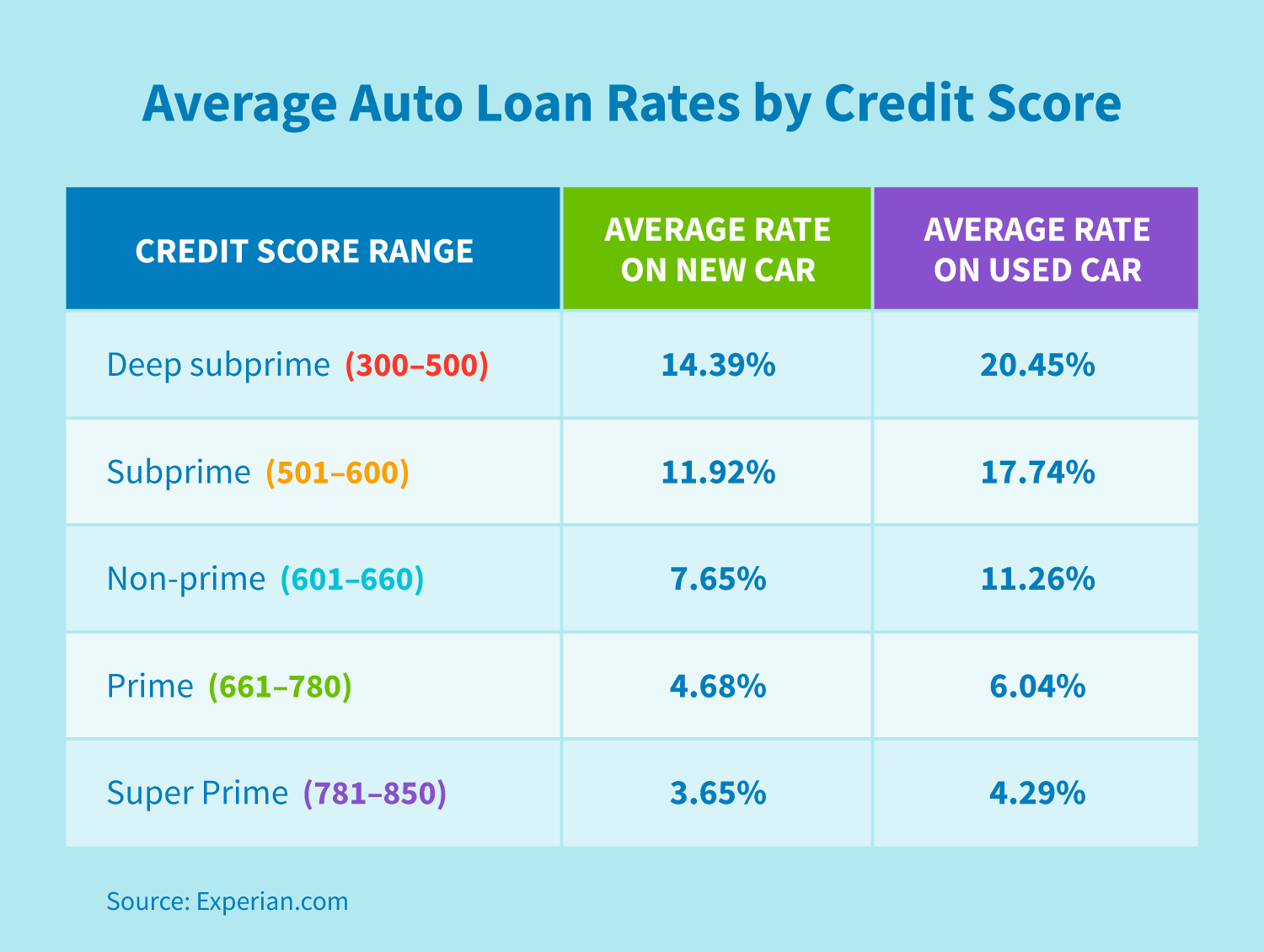

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025

Personal Loan Interest Rates Today Financing Starting Under 6

May 28, 2025