The Fed's Stance: Holding Rates In The Face Of Economic Uncertainty (Inflation & Unemployment)

Table of Contents

H2: Persistent Inflation: The Primary Concern

Keywords: Inflation rate, CPI, PCE, core inflation, price stability, inflation target

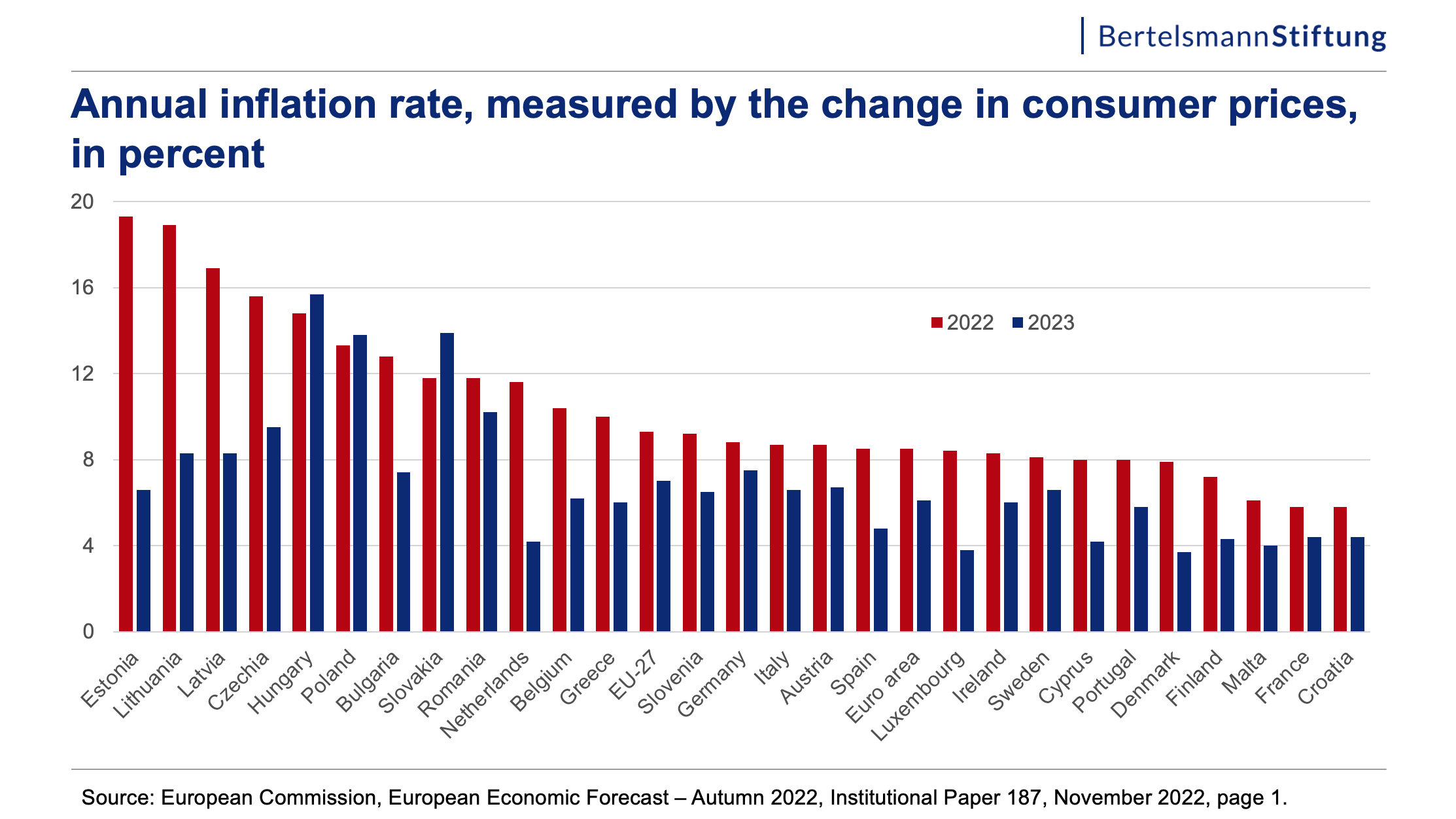

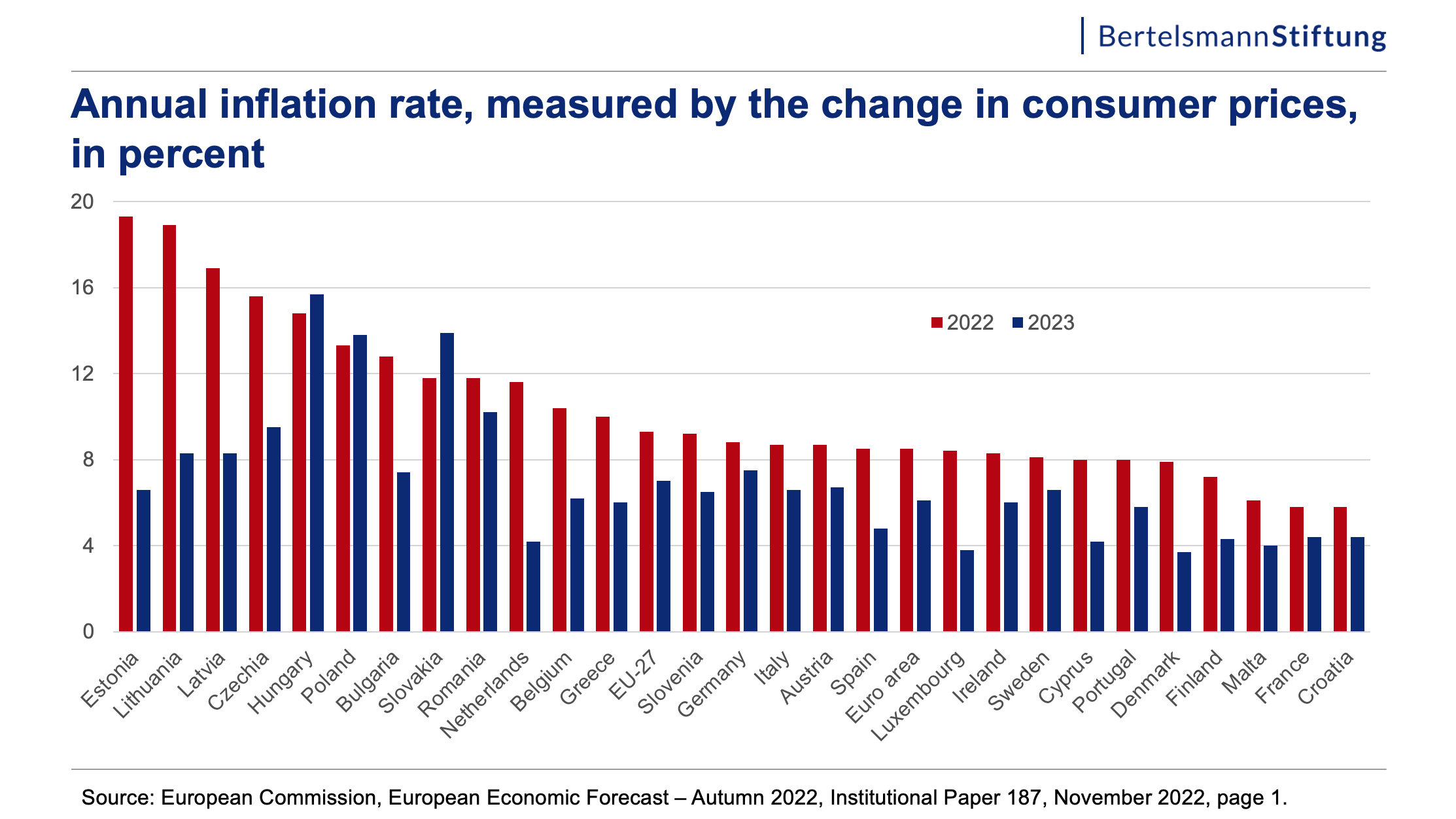

The current inflation rate remains a primary concern for the Federal Reserve. Deviation from the Fed's inflation target necessitates careful consideration of monetary policy adjustments. Several factors contribute to this persistent inflation:

- Supply Chain Issues: Ongoing disruptions to global supply chains continue to constrain the availability of goods, pushing prices upward. This supply-side inflation is proving stubbornly resistant to traditional monetary policy tools.

- Energy Prices: Fluctuations in energy prices, particularly oil and gas, significantly impact the overall inflation rate. Geopolitical events and global demand play a crucial role in these price movements.

- Demand-Pull Inflation: Robust consumer spending and strong demand for goods and services also contribute to inflationary pressures. This demand-side inflation necessitates a careful balance between supporting economic growth and curbing excessive spending.

Previous interest rate hikes have had some impact on curbing inflation, but their full effect is yet to be seen. The Fed's hesitancy to further increase rates stems from concerns about triggering a recession, highlighting the complexity of the situation.

H3: Analyzing the CPI and PCE Indices:

The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index are key metrics used to track inflation. The CPI measures changes in the price of a basket of consumer goods and services, while the PCE index provides a broader measure of consumer spending. Analyzing both indices provides a more comprehensive understanding of inflationary pressures. Discrepancies between the two indices offer valuable insights into the dynamics of price changes.

H3: The Role of Supply Chain Disruptions:

The ongoing impact of supply chain disruptions on inflation cannot be overstated. Delays in shipping, shortages of raw materials, and port congestion contribute to higher prices. Addressing these issues requires both short-term solutions, such as improving port efficiency, and long-term strategies, such as diversifying supply chains. The Fed's actions are only one piece of the puzzle in addressing this complex challenge.

H2: Unemployment and the Labor Market's Resilience

Keywords: Unemployment rate, labor market, job growth, wage growth, employment report, labor force participation

Despite economic headwinds, the labor market shows remarkable resilience. The unemployment rate remains relatively low, indicating a strong demand for labor. However, this strength presents a unique challenge for the Fed.

- Job Growth: Consistent job growth contributes to economic expansion but can also fuel inflationary pressures through increased wage demands.

- Wage Growth: While wage growth is positive for workers, it can also contribute to a wage-price spiral, further exacerbating inflation if not managed carefully.

- Labor Force Participation: Changes in labor force participation rates influence the overall unemployment figures and impact the Fed's assessment of the labor market's health.

Higher interest rates, while effective in curbing inflation, could negatively impact job creation, leading to a potential rise in unemployment. This trade-off presents a significant challenge for the Fed's monetary policy decisions.

H3: Analyzing the Latest Employment Situation Summary:

The monthly Employment Situation Summary, released by the Bureau of Labor Statistics, provides crucial data on job creation, unemployment rates, and wage growth. A thorough analysis of this report helps to gauge the health of the labor market and inform the Fed's policy decisions. Key indicators include the nonfarm payroll employment change, the unemployment rate, and average hourly earnings.

H3: Wage Growth and its Inflationary Impact:

The relationship between wage growth and inflation is complex. While wage increases improve workers' purchasing power, rapid wage growth without corresponding productivity gains can contribute to a wage-price spiral, perpetuating inflation. The Fed carefully monitors wage growth to assess its impact on price stability and overall economic stability.

H2: The Fed's Balancing Act: Growth vs. Stability

Keywords: Monetary policy, economic growth, recession risk, soft landing, quantitative easing, interest rate hikes

The Fed operates under a dual mandate: maintaining price stability and achieving maximum employment. This necessitates a delicate balancing act between controlling inflation and fostering economic growth.

- Recession Risk: Aggressive interest rate hikes increase the risk of triggering a recession. The Fed must carefully weigh the benefits of inflation control against the potential costs of an economic downturn.

- Soft Landing: The ideal scenario for the Fed is a "soft landing"—slowing inflation without causing a significant economic downturn. However, achieving a soft landing is exceptionally challenging and requires precise monetary policy adjustments.

- Quantitative Easing: Beyond interest rate adjustments, the Fed has other monetary policy tools at its disposal, including quantitative easing (QE), which involves buying assets to increase the money supply.

The Fed's challenge is to find the optimal level of monetary tightening to control inflation while minimizing the risk of a recession.

H3: The Risks of Aggressive Rate Hikes:

Rapidly increasing interest rates can have several negative consequences. Higher borrowing costs can stifle business investment, reduce consumer spending, and lead to job losses. This makes a measured approach crucial in navigating the current economic uncertainty.

H3: The Tools at the Fed's Disposal:

The Federal Reserve has a range of tools at its disposal to manage the economy. Beyond interest rate adjustments, these include reserve requirements, discount rate adjustments, and quantitative easing (QE) or quantitative tightening (QT). The appropriate tool or combination of tools depends on the prevailing economic conditions and the specific challenges faced.

3. Conclusion:

The Federal Reserve's decision to hold interest rates reflects a careful consideration of the complex interplay between persistent inflation and a resilient labor market. While inflation remains a primary concern, the Fed appears to be prioritizing a measured approach, acknowledging the potential risks of triggering a recession through aggressive rate hikes. The coming months will be crucial in determining the effectiveness of this strategy and the overall direction of the economy. Understanding the nuances of the Federal Reserve’s interest rate decisions is critical for making informed financial choices.

Call to Action: Stay informed about the evolving economic landscape and the Federal Reserve's response. Understanding the Federal Reserve's stance on interest rates is crucial for making informed financial decisions. Follow our blog for regular updates on the Fed's monetary policy and its impact on the economy. Continue to learn about the implications of the Fed's decisions concerning inflation and unemployment.

Featured Posts

-

Dijon Donner Ses Cheveux Un Geste Solidaire

May 09, 2025

Dijon Donner Ses Cheveux Un Geste Solidaire

May 09, 2025 -

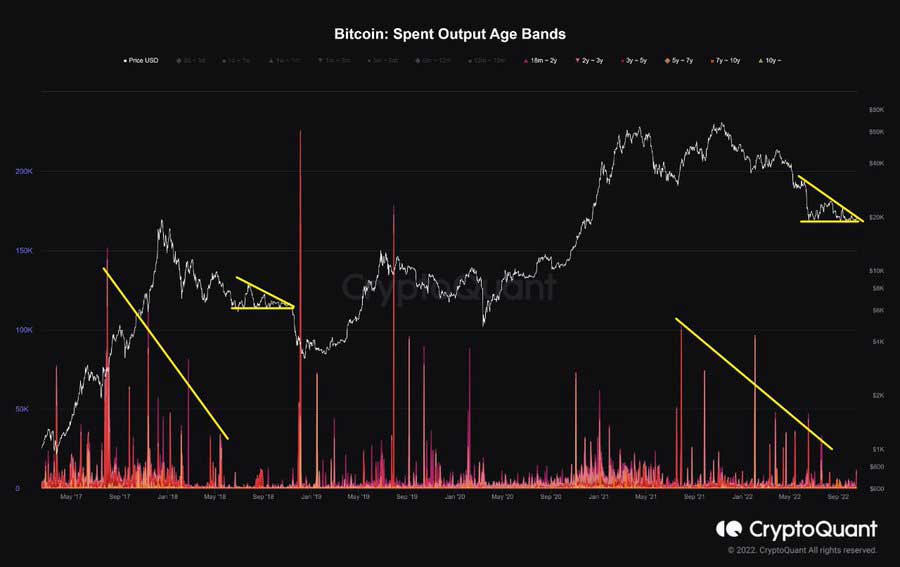

Bitcoin Madenciliginin Azalan Karliligi Yeni Bir Doenem Mi Basliyor

May 09, 2025

Bitcoin Madenciliginin Azalan Karliligi Yeni Bir Doenem Mi Basliyor

May 09, 2025 -

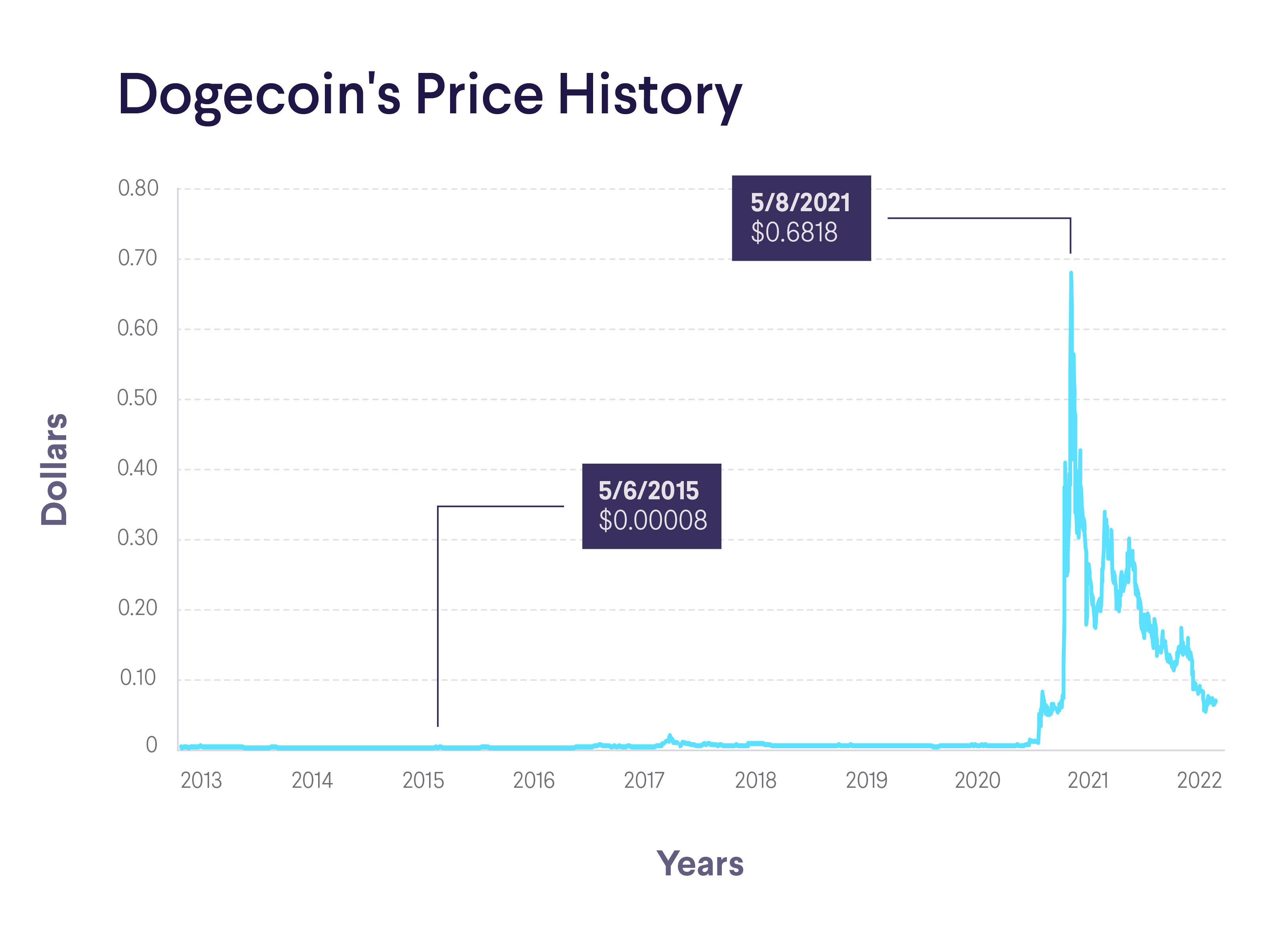

Recent Tesla Stock Decline Its Ripple Effect On The Dogecoin Market

May 09, 2025

Recent Tesla Stock Decline Its Ripple Effect On The Dogecoin Market

May 09, 2025 -

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 09, 2025

Vegas Claims Playoff Berth After Narrow Loss To Oilers 3 2

May 09, 2025 -

Vozdushnaya Gavan Permi Zakryta Snegopad I Posledstviya

May 09, 2025

Vozdushnaya Gavan Permi Zakryta Snegopad I Posledstviya

May 09, 2025