The FTC's Appeal: Will It Block The Microsoft-Activision Deal?

Table of Contents

The FTC's Antitrust Concerns

The FTC's primary concern revolves around the potential for the Microsoft-Activision deal to create a monopoly and stifle competition.

Market Domination Fears

The FTC argues that the merger would grant Microsoft undue market power, particularly in the console and cloud gaming markets. This fear stems from the acquisition of Activision Blizzard's vast portfolio of popular game franchises.

- Call of Duty: This massively popular franchise is a major selling point for gaming consoles, and the FTC fears Microsoft could make it exclusive to Xbox, harming PlayStation and other competitors.

- World of Warcraft, Candy Crush, and other titles: Activision Blizzard's diverse portfolio includes numerous successful games across various genres, further strengthening Microsoft's market position.

The FTC supports its claims with market share statistics showing Microsoft's growing dominance in the gaming sector. Projected growth figures paint a picture of a near-monopolistic future if the merger proceeds unchecked. Financial analyses further bolster the FTC's argument, highlighting the potential for reduced consumer choice and higher prices.

Potential for Anti-Competitive Practices

Beyond market domination, the FTC worries about potential anti-competitive practices. Microsoft could leverage its newly acquired power to disadvantage competitors.

- Exclusive Game Deals: Microsoft could make Activision Blizzard games exclusive to Xbox, locking out competitors like Sony's PlayStation.

- Limiting Access to APIs: Restricting access to Activision Blizzard's APIs could hinder the development of competing games and services.

- Pricing strategies: Microsoft could use its market power to increase prices for its games and services.

Experts like [Insert name and credentials of a relevant expert] have voiced concerns about the potential for Microsoft to engage in anti-competitive behaviors, pointing to past instances of similar acquisitions leading to reduced competition.

Microsoft's Defense Strategy

Microsoft counters the FTC's claims with a robust defense strategy, highlighting commitments to fair competition and arguing the merger's benefits for consumers.

Arguments Against Anti-Competitive Behavior

Microsoft has pledged to continue licensing Call of Duty and other Activision Blizzard titles to competitors for a decade, aiming to alleviate the FTC's concerns about market domination. They argue this ensures continued access to these popular titles for players regardless of console.

- Long-term licensing agreements: These agreements aim to prevent Microsoft from leveraging its acquisition to stifle competition.

- Commitment to cross-platform play: Microsoft emphasizes its commitment to maintain cross-platform play, allowing players on different consoles to interact within the same game universe.

Microsoft points to data showing the continued success of rival platforms, suggesting that even with the acquisition, a vibrant competitive gaming market will remain.

Benefits of the Merger

Microsoft emphasizes the positive impacts of the merger for gamers, including accelerated innovation and the development of new games.

- Increased investment in game development: The merger would allow Microsoft to invest further in developing new and innovative games.

- Expansion of game studios and franchises: The merger promises to broaden the range of available games and franchises.

- Enhanced gaming experiences: Microsoft pledges to improve the overall gaming experience for players, potentially through technological advancements and improved services.

Positive financial projections highlight the potential for economic growth and job creation within the gaming industry as a result of this merger.

The Appeal Process and Potential Outcomes

The FTC's appeal will now undergo a rigorous legal process, with various potential outcomes.

Legal Precedents and Similar Cases

This case has parallels with past antitrust challenges in the tech industry, such as [mention relevant examples, e.g., the AT&T-T-Mobile merger attempt]. Analyzing these precedents offers insights into potential outcomes. The specific legal arguments and the judge's interpretation of antitrust law will significantly shape the final decision. Expert legal opinions are divided, with some suggesting a strong FTC case and others highlighting the potential for Microsoft's defense to prevail.

Timeline and Expected Decision

The appeal process is expected to span [mention estimated timeframe]. Key deadlines for filings and hearings will influence the timeline.

- Possible outcomes include:

- The FTC's appeal is successful, blocking the merger entirely.

- The FTC's appeal is partially successful, leading to modifications in the merger agreement.

- The court upholds the initial approval of the merger.

The likelihood of each outcome is a subject of ongoing debate among legal experts and industry analysts.

Conclusion: The Future of the Microsoft-Activision Deal and its Implications

The FTC's appeal against the Microsoft-Activision deal represents a pivotal moment for the gaming industry. The FTC's concerns about market dominance and anti-competitive practices are countered by Microsoft's emphasis on continued competition and consumer benefits. The outcome of this legal battle will have significant implications, not only for this specific merger but also for future mergers and acquisitions within the gaming industry. The decision will set a precedent for future antitrust cases in the tech sector, potentially influencing how regulators approach similar deals in the years to come. Keep an eye on this ongoing legal battle; the outcome of the FTC's appeal on the Microsoft-Activision deal will significantly shape the future of the gaming landscape.

Featured Posts

-

Jeremie Frimpong Agrees To Transfer Liverpool Fc Remains Silent

May 22, 2025

Jeremie Frimpong Agrees To Transfer Liverpool Fc Remains Silent

May 22, 2025 -

Premier League 2024 25 Champions Celebrating The Victory In Pictures

May 22, 2025

Premier League 2024 25 Champions Celebrating The Victory In Pictures

May 22, 2025 -

Juergen Klopp Mu Carlo Ancelotti Mi Ideal Teknik Direktoer Tartismasi

May 22, 2025

Juergen Klopp Mu Carlo Ancelotti Mi Ideal Teknik Direktoer Tartismasi

May 22, 2025 -

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025

Arda Gueler In Kariyeri Real Madrid In Yeni Teknik Direktoeruenuen Etkisi

May 22, 2025 -

Googles Ai Investment Progress Challenges And The Path To Investor Trust

May 22, 2025

Googles Ai Investment Progress Challenges And The Path To Investor Trust

May 22, 2025

Latest Posts

-

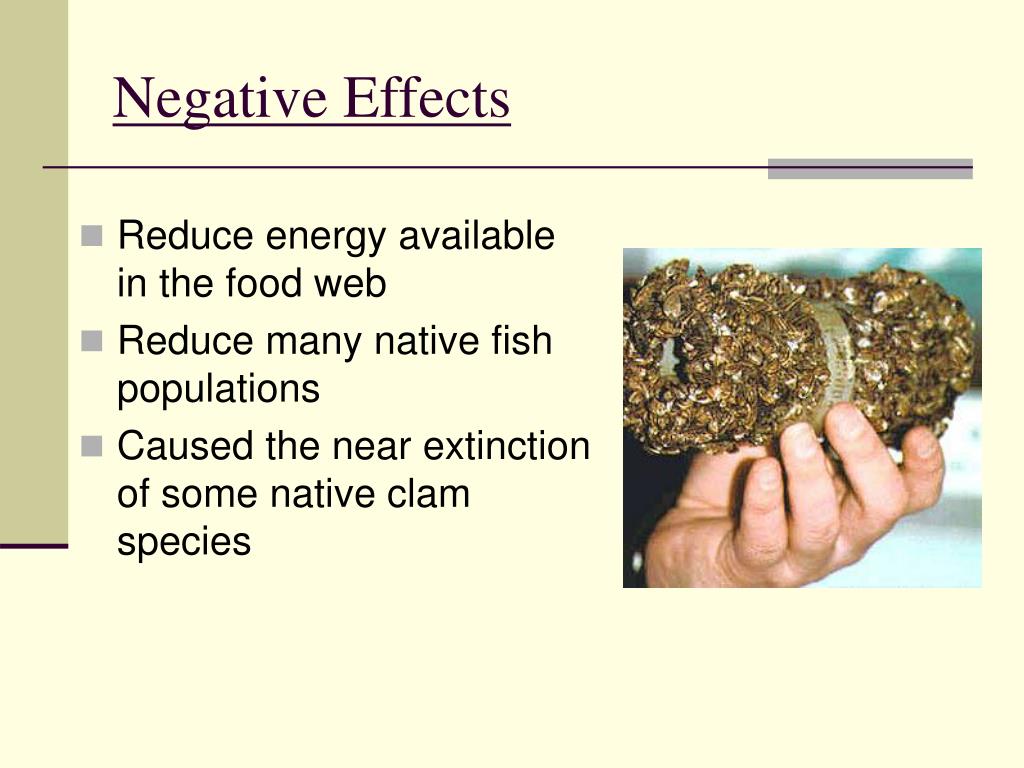

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025

Thousands Of Zebra Mussels Found On Casper Boat Lift

May 22, 2025 -

Otter Conservation In Wyoming Reaching A Turning Point

May 22, 2025

Otter Conservation In Wyoming Reaching A Turning Point

May 22, 2025 -

Casper Residents Shocking Zebra Mussel Discovery

May 22, 2025

Casper Residents Shocking Zebra Mussel Discovery

May 22, 2025 -

Zebra Mussel Infestation Found On New Boat Lift In Casper Wyoming

May 22, 2025

Zebra Mussel Infestation Found On New Boat Lift In Casper Wyoming

May 22, 2025 -

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025

Dealing With A Zebra Mussel Invasion A Casper Residents Story

May 22, 2025