The Posthaste Reality: How Large Down Payments Block Canadian Homebuyers

Table of Contents

The Rising Cost of Homeownership in Canada

The Canadian housing market has witnessed a dramatic surge in prices over the past decade, making homeownership increasingly difficult to achieve. This isn't just limited to major urban centers; even smaller cities and towns are experiencing significant price increases. Inflation and recent interest rate hikes have further exacerbated the affordability crisis, pushing home prices beyond the reach of many Canadians.

- Average home prices in major cities: Toronto ($1,000,000+), Vancouver ($1,200,000+), Calgary ($500,000+), Montreal ($600,000+) (Note: These are estimations and fluctuate; current data should be referenced).

- Percentage increase in home prices over the past 5-10 years: A significant double-digit percentage increase is typical across most Canadian markets. Specific data should be sourced from reputable real estate organizations.

- Comparison of Canadian home prices to other countries: Canada consistently ranks among the most expensive countries globally for homeownership. International comparisons should be made using reliable economic indices.

This escalating cost of living, coupled with the requirement for substantial down payments, creates a perfect storm that disproportionately impacts first-time buyers.

The Impact of Large Down Payments on First-Time Homebuyers

The minimum down payment requirement in Canada varies depending on the home price. For homes priced below $500,000, a 5% down payment is needed. However, for homes priced between $500,000 and $1 million, the down payment jumps to 5% of the first $500,000 and 10% of the portion exceeding $500,000. Anything above $1 million requires a 20% down payment. This creates a significant barrier for first-time homebuyers, especially those in higher-cost markets.

- CMHC insurance requirements and their implications: While the Canada Mortgage and Housing Corporation (CMHC) offers mortgage loan insurance for down payments below 20%, this comes with added costs, further increasing the financial burden.

- Challenges faced by millennials and Gen Z in saving for a down payment: Younger generations often face higher student loan debt, lower starting salaries, and increased competition for rental properties, making saving for a large down payment extremely challenging.

- The psychological barrier of accumulating such a substantial sum: The sheer magnitude of saving for a down payment can be daunting, leading to feelings of discouragement and delaying homeownership plans. This psychological impact is often underestimated.

Alternative Financing Options and Solutions

Several alternative financing options can help alleviate the pressure of large down payments for Canadian homebuyers.

- First-time homebuyer programs and incentives: Various federal, provincial, and municipal programs offer grants, tax breaks, and other incentives to assist first-time homebuyers. Researching these programs is crucial.

- Government grants and subsidies: Government initiatives can provide financial assistance to reduce the initial down payment burden.

- Mortgages with smaller down payments (and their associated higher costs): Mortgages with smaller down payments are available, but they typically involve higher interest rates and additional insurance premiums.

- Shared equity mortgage options: Programs allowing a government or private entity to share the equity in the home can reduce the down payment needed by the buyer.

The Broader Economic and Social Implications of Unaffordable Housing

The unaffordability of housing in Canada has far-reaching economic and social consequences.

- Increased homelessness rates: The inability to secure affordable housing is a primary driver of homelessness.

- Strain on social services: Increased demand for social housing and related support services puts a significant strain on public resources.

- Impact on workforce mobility and economic productivity: High housing costs can limit workforce mobility, preventing individuals from moving for better job opportunities and hindering economic growth.

Overcoming the Hurdles of Large Down Payments in Canada

The challenges posed by large down payments for Canadian homebuyers are significant and multifaceted. Addressing the affordability crisis requires a multi-pronged approach involving government intervention, innovative financing solutions, and a reevaluation of housing policies. However, hope remains. Numerous resources and programs exist to assist aspiring homeowners in navigating the complexities of securing a mortgage with a smaller down payment.

Don't let the high cost of large down payments deter your dreams of homeownership. Research available resources and programs to find solutions that work for you. Learn more about navigating the complexities of securing a mortgage with a smaller down payment and achieving your Canadian homeownership goals. Start your research today – your dream home awaits!

Featured Posts

-

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025 -

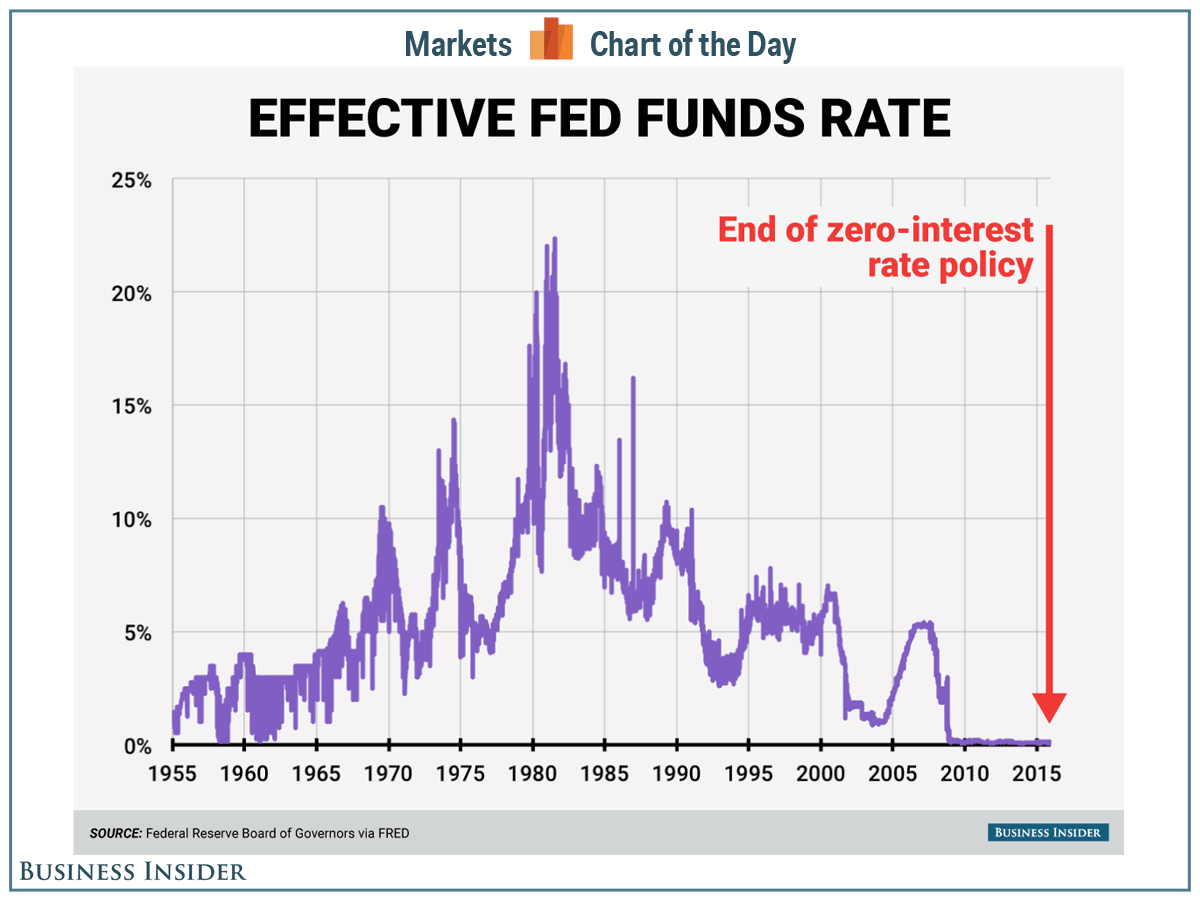

Feds Hesitation Why Interest Rate Cuts Arent Imminent

May 10, 2025

Feds Hesitation Why Interest Rate Cuts Arent Imminent

May 10, 2025 -

Beyonces Renaissance Tour Cowboy Carter Streams Double After Launch

May 10, 2025

Beyonces Renaissance Tour Cowboy Carter Streams Double After Launch

May 10, 2025 -

Figmas Ai Update Redefining Design And Content Workflow

May 10, 2025

Figmas Ai Update Redefining Design And Content Workflow

May 10, 2025 -

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Young Thug Teases Uy Scuti Album Release Date

May 10, 2025

Latest Posts

-

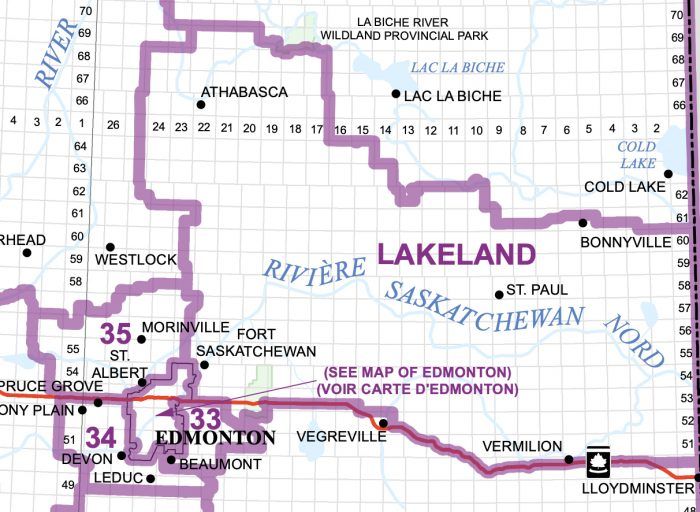

New Strategy From Edmonton Unlimited Scaling Tech Innovation Globally

May 10, 2025

New Strategy From Edmonton Unlimited Scaling Tech Innovation Globally

May 10, 2025 -

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 10, 2025

Edmonton Unlimited A New Strategy For Global Tech And Innovation

May 10, 2025 -

Nhl Playoffs Edmonton Oilers Odds To Defeat Los Angeles Kings

May 10, 2025

Nhl Playoffs Edmonton Oilers Odds To Defeat Los Angeles Kings

May 10, 2025 -

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025

Analyzing The Effects Of Federal Riding Changes On Edmonton Area Voters

May 10, 2025 -

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025

Edmonton Oilers Projected To Win Against Los Angeles Kings Betting Analysis

May 10, 2025