The Return Of Trump Tariffs: A European Economic Forecast

Table of Contents

Sectors Most Vulnerable to Renewed Trump-Style Tariffs

The reintroduction of Trump-style tariffs would disproportionately affect certain sectors of the European economy. These protectionist measures, characterized by their targeted nature and potential for retaliatory actions, would create significant challenges for European businesses.

Automotive Industry

The automotive industry is arguably the most vulnerable. European car manufacturers, with significant exports to the US, face the prospect of increased production costs due to tariffs. This would reduce their competitiveness against American and other global players.

- Increased production costs: Tariffs directly increase the price of exported vehicles, making them less attractive to US consumers.

- Reduced competitiveness: Higher prices could lead to a significant drop in market share for European brands like BMW, Mercedes-Benz, Volkswagen, and Volvo, who collectively hold a substantial portion of the US market.

- Job losses: Reduced demand and profitability could lead to factory closures and widespread job losses across the supply chain.

- Potential for retaliatory tariffs from the EU: The EU could retaliate with its own tariffs on US goods, escalating the trade war and further harming both economies.

Agricultural Products

European agricultural exports, encompassing products like wine, cheese, and other specialty foods, would also be significantly impacted. American consumers might shift to domestically produced alternatives, reducing demand for European goods.

- Price increases: Tariffs would increase the price of European agricultural products in the US market.

- Reduced demand: Higher prices could lead to lower sales and potentially long-term market share loss for EU producers.

- Impact on farming communities: Reduced export revenue could devastate farming communities across Europe, especially in regions heavily reliant on exports to the US.

- Potential government support measures: EU governments might implement subsidies or other support measures to cushion the blow for affected farmers, but these measures would come at a fiscal cost.

Steel and Aluminum

The European steel and aluminum industries are also particularly susceptible to renewed tariffs. These industries are already facing global competition, and additional tariffs would severely hamper their competitiveness.

- Price fluctuations: Increased tariffs would create uncertainty and volatility in the market, affecting price stability for both producers and consumers.

- Decreased competitiveness: Higher production costs would erode the profitability of European steel and aluminum producers, making them less competitive against global players.

- Potential for plant closures: Some producers might be forced to close plants or reduce production capacity, leading to further job losses.

- Impact on related industries: The impact would ripple across related industries, affecting businesses reliant on steel and aluminum as inputs.

Potential Economic Ripple Effects Across Europe

The impact of renewed Trump-style tariffs would extend far beyond the directly affected sectors, creating significant ripple effects throughout the European economy.

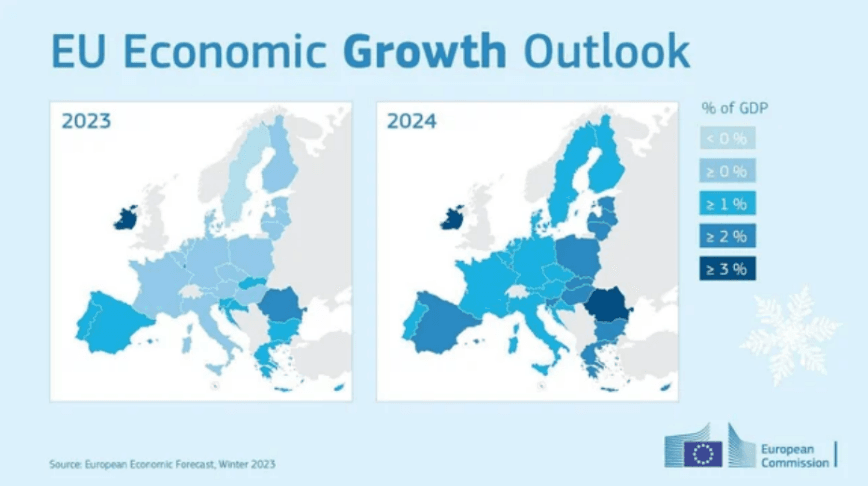

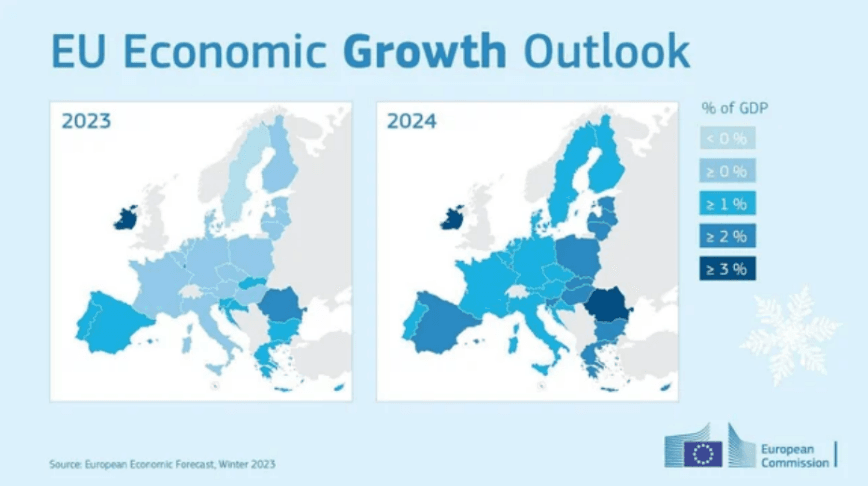

GDP Growth

The imposition of tariffs could significantly dampen European GDP growth.

- Decreased consumer spending: Higher prices for imported goods could reduce consumer spending power.

- Reduced investment: Uncertainty and decreased profitability might lead businesses to reduce investment in expansion and innovation.

- Potential recessionary pressures: A combination of decreased spending and investment could create recessionary pressures across the EU. Economic models suggest a substantial negative impact on growth depending on the scope and intensity of the tariffs.

Inflation

Increased import costs due to tariffs would likely lead to inflationary pressures.

- Increased prices for consumers: Tariffs would directly increase the price of imported goods, impacting consumers' purchasing power.

- Reduced purchasing power: Higher prices would lead to a decline in real disposable income for households.

- Potential for wage stagnation: Inflation without commensurate wage increases could result in a decline in real wages.

Job Market

Job losses would extend beyond the directly affected sectors.

- Direct job losses: Significant job losses are expected in export-oriented industries directly targeted by the tariffs.

- Indirect job losses: Job losses would ripple through related industries and service sectors.

- Potential for increased unemployment: The overall effect would be a substantial increase in unemployment across the EU.

Europe's Response Strategies and Mitigation Measures

The EU has several options to mitigate the negative impacts of potential renewed Trump-style tariffs.

Trade Negotiations and Diplomacy

Proactive diplomacy is crucial.

- Bilateral negotiations: The EU should engage in direct negotiations with the US to find a mutually acceptable solution.

- WTO dispute settlement mechanisms: The EU can utilize the World Trade Organization's dispute settlement mechanisms to challenge unfair trade practices.

- Potential alliances with other trading partners: The EU could form alliances with other countries to create a united front against protectionist policies.

Internal Market Reforms

Strengthening the EU's internal market is essential.

- Increased investment in research and development: Investments in innovation would help European industries become more competitive.

- Diversification of export markets: Reducing reliance on the US market by diversifying export destinations would lessen the impact of any future tariffs.

- Support for affected industries: Targeted support programs can help affected industries adapt and remain competitive.

Financial Policies

Fiscal and monetary measures can provide a crucial safety net.

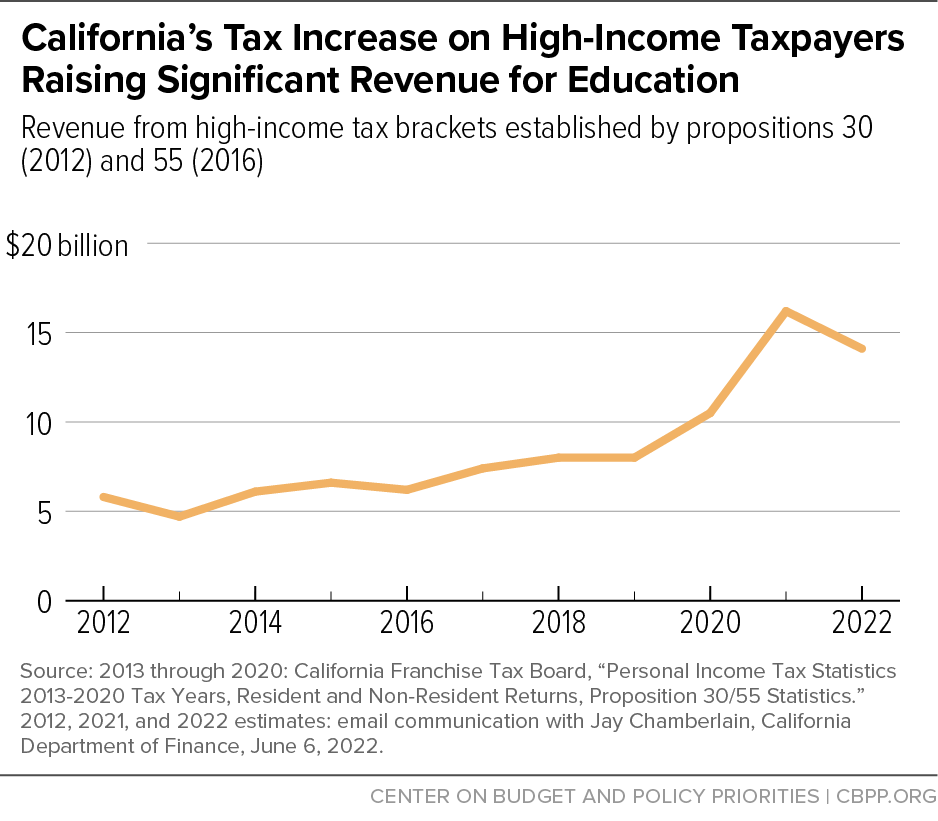

- Government subsidies: Governments can provide subsidies to businesses to offset the increased costs of tariffs.

- Tax breaks: Tax incentives can encourage investment and help businesses stay afloat.

- Interest rate adjustments by the European Central Bank: The ECB may adjust interest rates to stimulate economic activity and mitigate the negative effects of the tariffs.

Conclusion: Navigating the Uncertainties of a Potential Return of Trump Tariffs

The potential return of Trump-style tariffs poses a significant threat to the European economy. Sectors like automotive, agriculture, and steel and aluminum are particularly vulnerable, and the ripple effects could lead to decreased GDP growth, inflation, and job losses. The EU needs to proactively engage in trade negotiations, strengthen its internal market, and implement strategic financial policies to mitigate the negative consequences. Staying updated on the latest developments regarding Trump tariffs and their impact on the European economy is crucial for businesses and policymakers alike. Understanding the potential consequences of renewed protectionist measures is key to navigating this challenging economic landscape.

Featured Posts

-

House Budget Plan Significant Tax Increase For Harvard Yale Endowments

May 13, 2025

House Budget Plan Significant Tax Increase For Harvard Yale Endowments

May 13, 2025 -

The Nightmare In Gaza Families Of Hostages Endure Prolonged Suffering

May 13, 2025

The Nightmare In Gaza Families Of Hostages Endure Prolonged Suffering

May 13, 2025 -

Mosque Under Scrutiny Police Investigation Launched Amidst Mega City Project

May 13, 2025

Mosque Under Scrutiny Police Investigation Launched Amidst Mega City Project

May 13, 2025 -

Peak Day Travel Forecast Schiphol Roads And Ferries During Easter Weekend

May 13, 2025

Peak Day Travel Forecast Schiphol Roads And Ferries During Easter Weekend

May 13, 2025 -

Hertha Bscs Crisis Boateng And Kruses Conflicting Views

May 13, 2025

Hertha Bscs Crisis Boateng And Kruses Conflicting Views

May 13, 2025