The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Increase in the National Debt

The GOP tax plan is projected to significantly increase the national debt. While proponents argue that economic growth spurred by the tax cuts will offset the revenue loss, independent analyses paint a more concerning picture. The Committee for a Responsible Federal Budget, for example, projects a substantial increase in the national debt over the next decade. This projected increase represents a significant departure from previous tax cut legislation and raises serious concerns about long-term fiscal sustainability.

- Projected debt increase over the next 10 years: Estimates vary, but many independent analyses predict an increase in the trillions of dollars over the next decade, adding to the already substantial national debt.

- Comparison to previous tax cuts and their deficit impact: Previous tax cuts, such as those enacted under Presidents Reagan and Bush, also led to increased deficits. However, the scale of the projected increase under the current GOP plan is significantly larger in relation to the size of the economy.

- Breakdown of the increase by spending category: The increased debt will likely necessitate cuts in crucial government programs or an expansion of the national debt, impacting various areas from infrastructure to social security.

- Mention of any independent analyses confirming or refuting the projections: Several non-partisan organizations, including the Congressional Budget Office (CBO), have released analyses providing varying but largely concerning estimates of the plan’s fiscal impact. These analyses should be considered for a comprehensive understanding of the GOP tax plan deficit impact.

Revenue Loss from Tax Cuts

A core component of the GOP tax plan is significant tax cuts for both corporations and individuals. These cuts are expected to lead to substantial revenue loss for the federal government, directly contributing to the projected increase in the national debt. The magnitude of the revenue loss is a central point of contention in the debate surrounding the plan.

- Impact of corporate tax rate reduction: The proposed reduction in the corporate tax rate is expected to significantly reduce tax revenue collected from corporations. This reduction could incentivize companies to repatriate profits, but the extent of this effect is debatable and depends heavily on economic conditions and corporate behavior.

- Effect of individual income tax cuts on different income brackets: The individual income tax cuts disproportionately benefit high-income earners, which increases inequality and raises questions about fairness and economic efficiency. The projected revenue loss from these cuts is substantial.

- Analysis of the potential for increased tax avoidance: Tax cuts can inadvertently incentivize tax avoidance strategies. The complexity of the tax code provides numerous opportunities for minimizing tax liability, potentially mitigating the revenue-generating potential of the tax cuts.

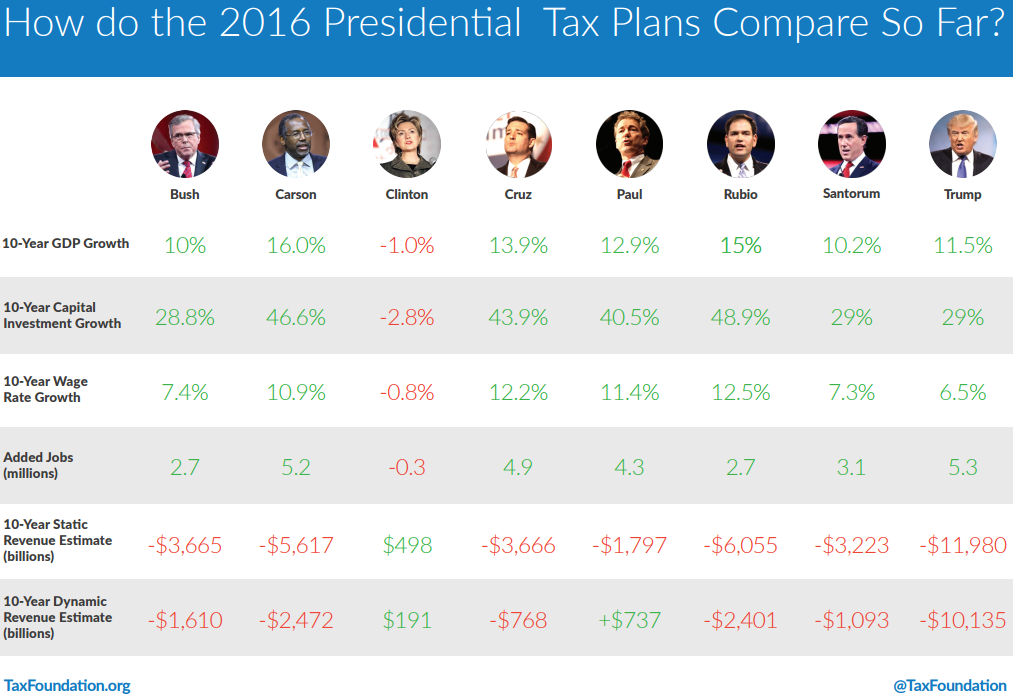

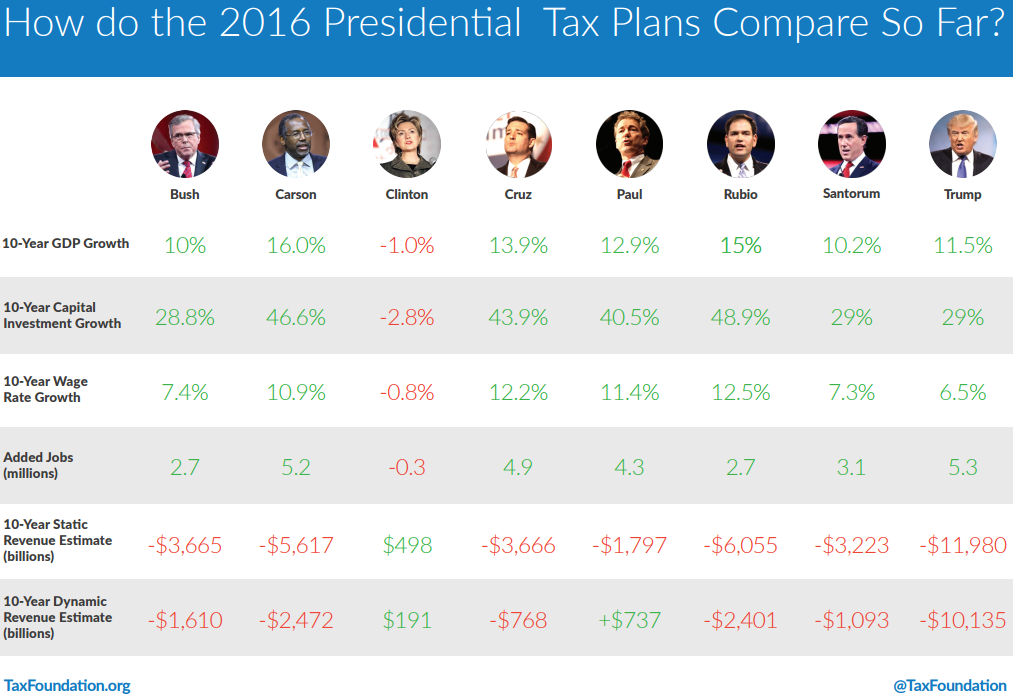

- Discussion of dynamic scoring vs. static scoring of the tax plan: The debate surrounding the plan’s fiscal impact often involves dynamic scoring (which considers the effects of tax cuts on economic growth) versus static scoring (which only considers direct revenue impacts). Understanding the difference is vital when assessing the credibility of different projections.

Economic Growth Projections and Their Reliability

The justification for the GOP tax plan often centers on projections of increased economic growth. Proponents argue that the tax cuts will stimulate investment and job creation, ultimately offsetting the revenue loss. However, the reliability of these projections is questionable, resting on several significant assumptions.

- Source of the economic growth projections: The source of these projections and the methodology used must be critically examined. Are these projections based on robust economic models, or are they based on more optimistic, less realistic assumptions?

- Assumptions made regarding economic growth: Many assumptions underpin these growth projections, including assumptions about labor participation rates, productivity growth, and investment behavior. These assumptions are rarely certain and can significantly affect the final outcomes.

- Potential risks and uncertainties affecting the projections: External factors, such as global economic conditions, interest rate fluctuations, and unforeseen events (like a recession), can significantly affect the accuracy of these projections.

- Comparison to alternative economic forecasts: It's crucial to compare the official growth projections to alternative forecasts from independent economists and organizations to gain a more balanced perspective.

The Role of Spending Cuts (or Lack Thereof)

A crucial aspect of fiscal responsibility is the interplay between tax cuts and spending cuts. The GOP tax plan, in its initial form, lacked significant accompanying spending cuts to offset the revenue losses from the proposed tax reductions. This lack of commensurate spending cuts exacerbates the potential for a substantial increase in the national debt.

- Details of any proposed spending cuts: If any spending cuts are proposed, a thorough examination of their details and potential impact is essential.

- Assessment of their effectiveness in mitigating the deficit: Even with proposed cuts, their impact on the deficit needs careful evaluation. Will they significantly offset the revenue loss from the tax cuts?

- Potential for future budget cuts or increased borrowing: The lack of sufficient spending cuts increases the likelihood of future budget cuts, or alternatively, a dramatic increase in borrowing to fund the national debt.

- Impact on government programs and services: Any potential cuts would have far-reaching impacts on government programs and services, potentially affecting healthcare, education, and infrastructure.

Long-Term Sustainability and Intergenerational Equity

The projected increase in the national debt raises significant concerns about long-term fiscal sustainability and intergenerational equity. The burden of this increased debt will fall not only on current taxpayers but also on future generations.

- Long-term projections of the national debt: The long-term consequences of the proposed tax plan must be evaluated, considering compounding interest and future economic conditions.

- Impact on future generations’ ability to fund government programs: A larger national debt limits the resources available for future generations to fund essential government programs and services.

- Ethical considerations of increasing the national debt: The ethical implications of saddling future generations with a substantially larger debt burden need careful consideration.

- Comparison to other countries' debt levels and management: Comparing the projected US debt levels to those of other developed countries can provide useful context for understanding the long-term implications.

Conclusion

This analysis reveals a potentially catastrophic increase in the national debt under the GOP tax plan. The projections of economic growth used to justify the plan are based on optimistic assumptions and lack strong empirical support. The absence of sufficient corresponding spending cuts exacerbates the already alarming projections. The long-term consequences, including a heavy burden on future generations, raise serious concerns about fiscal responsibility and intergenerational equity. Understanding the true GOP tax plan deficit impact is crucial for informed civic engagement. Continue your research and demand transparency regarding the long-term fiscal consequences of this significant policy change. Explore further analyses using keywords like "GOP tax plan deficit analysis," "national debt impact," and "tax policy consequences" to gain a complete understanding of the potential implications.

Featured Posts

-

Porsches Struggle Balancing Ferraris Sportiness And Mercedes Luxury In A Trade War

May 21, 2025

Porsches Struggle Balancing Ferraris Sportiness And Mercedes Luxury In A Trade War

May 21, 2025 -

Ofitsiyniy Spisok Kritichno Vazhlivikh Telekanaliv Vid Minkulturi Ukrayini

May 21, 2025

Ofitsiyniy Spisok Kritichno Vazhlivikh Telekanaliv Vid Minkulturi Ukrayini

May 21, 2025 -

How Will Qbts Earnings Affect Its Stock Price

May 21, 2025

How Will Qbts Earnings Affect Its Stock Price

May 21, 2025 -

Overcoming The Love Monster Finding Lasting Love And Fulfillment

May 21, 2025

Overcoming The Love Monster Finding Lasting Love And Fulfillment

May 21, 2025 -

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025

Will Trent Actor Ramon Rodriguezs Unexpected Night Three Scorpion Stings

May 21, 2025

Latest Posts

-

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025

Huuhkajien Yllaetykset Avauskokoonpanoon Kolme Muutosta

May 21, 2025 -

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025

Huuhkajien Avauskokoonpano Naein Se Muuttui Kaellman Pois

May 21, 2025 -

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 21, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolan Seuran

May 21, 2025