The Stealthy Wealthy: How They Accumulate Wealth Without The Hype

Table of Contents

The term "stealthy wealthy" refers to individuals who amass significant wealth not through impulsive spending or high-profile investments, but through a carefully crafted, long-term approach. They prioritize financial stability, mindful spending, and strategic growth over immediate gratification. This article will delve into the key elements of their success.

Strategic Saving and Investing

The foundation of stealthy wealth is a robust strategy for saving and investing. This isn't about deprivation; it's about mindful resource management and strategic allocation.

Mindful Budgeting and Spending

The stealthy wealthy understand the power of budgeting. They meticulously track their expenses, differentiate between needs and wants, and actively seek ways to reduce unnecessary spending.

- Utilize budgeting apps: Mint, YNAB (You Need A Budget), and Personal Capital offer powerful tools for tracking expenses, setting budgets, and monitoring progress.

- Reduce recurring expenses: Identify and eliminate unnecessary subscriptions, explore cheaper alternatives for utilities, and prioritize cooking at home over eating out.

- Mindful spending: Before making a significant purchase, ask yourself if it aligns with your long-term financial goals. Delaying gratification and prioritizing needs over wants is crucial. This mindful approach to spending fuels savings and allows for more significant investments. Keywords: budgeting, savings, financial planning, expense tracking, frugality

Diversified Investment Portfolio

The stealthy wealthy don't put all their eggs in one basket. They understand the importance of diversifying their investments across various asset classes to minimize risk.

- Diversify across asset classes: A well-diversified portfolio typically includes stocks, bonds, real estate, and potentially alternative investments like commodities or private equity.

- Long-term investment horizon: They focus on long-term growth, understanding that market fluctuations are a normal part of the investment process. Patience and discipline are key.

- Seek professional advice: Consulting a financial advisor can provide personalized guidance on building and managing a diversified portfolio that aligns with your risk tolerance and financial goals. Keywords: investment strategies, portfolio diversification, asset allocation, risk management, long-term investing

Long-Term Vision and Patience

Patience is a virtue, especially when it comes to building wealth. The stealthy wealthy understand the power of compounding and resist the temptation of short-term gains.

- Power of compounding: The longer your money is invested, the more it grows exponentially due to the compounding effect of interest or returns.

- Avoid emotional decision-making: Market fluctuations are inevitable. Sticking to a long-term investment plan and avoiding emotional reactions to short-term market volatility is crucial for long-term success.

- Regular contributions: Consistent contributions to your investment accounts, even small amounts, contribute significantly to long-term growth. Keywords: long-term investing, patience, financial discipline, compounding, wealth building

High-Income Skills and Entrepreneurship

The stealthy wealthy often possess high-income skills or have built successful businesses. This isn't solely about luck; it's about continuous learning and strategic career development.

Developing In-Demand Skills

Investing in education and training to acquire high-income skills is a key strategy for wealth accumulation.

- High-demand skills: Fields like technology, healthcare, and finance often offer high earning potential. Identify skills in high demand and invest in your development.

- Continuous learning: The job market is constantly evolving. Commit to lifelong learning to stay ahead of the curve and adapt to emerging trends.

- Resources for skill development: Online courses, bootcamps, and traditional education provide numerous avenues for skill development. Keywords: skill development, career advancement, professional development, high-income skills, education

Building a Successful Business

Entrepreneurship offers a powerful pathway to wealth creation. Building a successful business requires dedication, strategic planning, and a strong understanding of market needs.

- Identify market needs: Successful businesses solve problems and meet unmet demands. Thoroughly research your target market and identify areas where you can provide value.

- Develop a strong business plan: A well-defined business plan provides a roadmap for your venture, outlining your goals, strategies, and financial projections.

- Strategic planning: Continuous adaptation and refinement of your business strategy are essential for sustained growth and success. Keywords: entrepreneurship, business planning, startup, small business, wealth creation

Protecting and Growing Wealth

Accumulating wealth is only half the battle. Protecting and growing your assets requires strategic planning and proactive measures.

Tax Optimization Strategies

Understanding and utilizing tax-efficient strategies is crucial for maximizing wealth retention.

- Tax-advantaged accounts: Utilize retirement accounts (401k, IRA) and other tax-advantaged investment vehicles to reduce your tax liability.

- Tax deductions and credits: Explore available deductions and credits to minimize your taxable income.

- Consult a tax professional: Seeking advice from a qualified tax professional ensures you are taking full advantage of all available tax benefits. Keywords: tax planning, tax optimization, tax efficiency, financial planning

Debt Management and Avoidance

High levels of debt can significantly hinder wealth accumulation. The stealthy wealthy prioritize debt management and avoidance.

- Debt reduction strategies: Develop a plan to systematically pay down existing debt, prioritizing high-interest debt first.

- Avoid high-interest debt: Be wary of credit card debt and other high-interest loans, as they can quickly erode your wealth.

- Debt-free lifestyle: Striving for a debt-free lifestyle provides financial freedom and allows you to allocate more resources towards savings and investments. Keywords: debt management, debt reduction, financial freedom, debt avoidance

Conclusion

The path to becoming stealthy wealthy is built on a foundation of strategic saving and investing, developing high-income skills or building a successful business, and protecting and growing your assets through tax optimization and debt management. It's not about flashy displays of wealth; it's about building a solid financial future through disciplined action and a long-term perspective. Embrace the principles of the stealthy wealthy and take control of your financial destiny. Become a stealthy wealthy individual by implementing these strategies today. Discover the secrets of the stealthy wealthy and embark on your journey towards lasting financial security. Embrace the stealthy wealthy mindset and build a future of financial freedom.

Featured Posts

-

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025

A Durable Forever Mouse Logitechs Next Big Challenge

May 19, 2025 -

Understanding The Value Of Interdisciplinary And Transdisciplinary Methods

May 19, 2025

Understanding The Value Of Interdisciplinary And Transdisciplinary Methods

May 19, 2025 -

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giris Suerecinde Son Durum

May 19, 2025

Gazze Ye Yardim Malzemesi Tasiyan Tirlar Giris Suerecinde Son Durum

May 19, 2025 -

Aileler Ve Gencler Icin 2025 Nevresim Takimi Modelleri Ve Trendleri

May 19, 2025

Aileler Ve Gencler Icin 2025 Nevresim Takimi Modelleri Ve Trendleri

May 19, 2025 -

Region Francaise Coupe 19 Millions D Euros De Financement A L Universite Islamique De Gauche

May 19, 2025

Region Francaise Coupe 19 Millions D Euros De Financement A L Universite Islamique De Gauche

May 19, 2025

Latest Posts

-

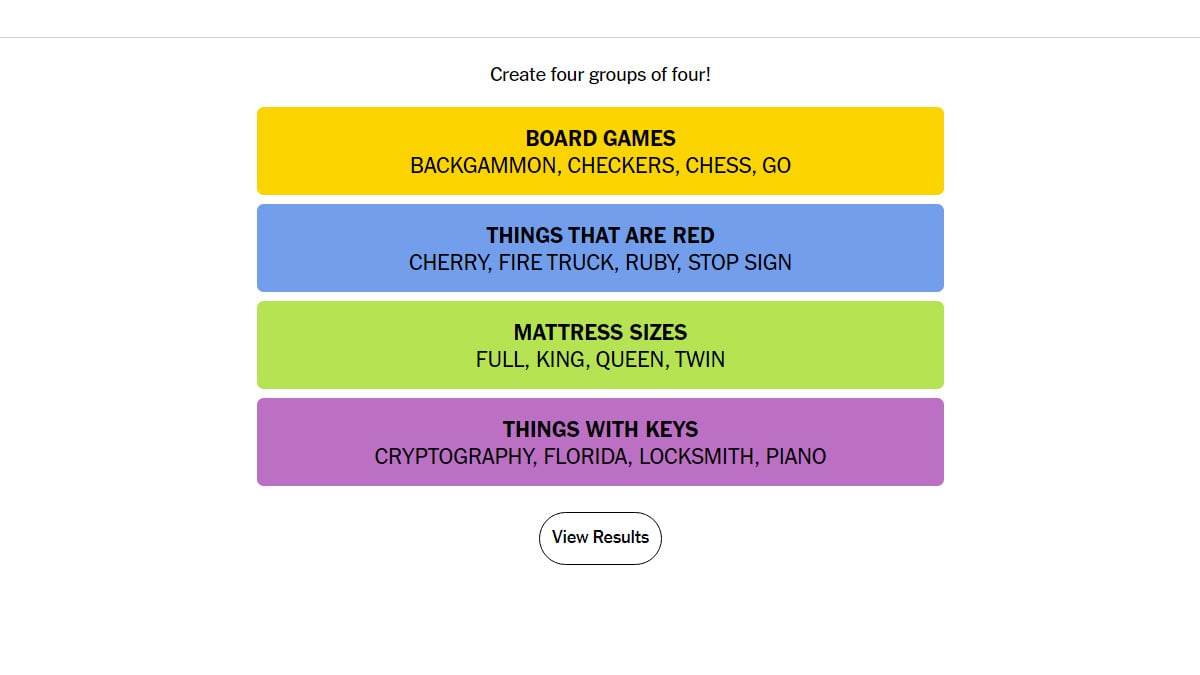

Nyt Connections Answers For May 8 2024 Puzzle 697

May 19, 2025

Nyt Connections Answers For May 8 2024 Puzzle 697

May 19, 2025 -

Scarlett Johansson And Colin Josts Snl Revenge The Crude Roast Beef Joke Backlash

May 19, 2025

Scarlett Johansson And Colin Josts Snl Revenge The Crude Roast Beef Joke Backlash

May 19, 2025 -

Todays Nyt Connections Puzzle 697 May 8 Hints And Solutions

May 19, 2025

Todays Nyt Connections Puzzle 697 May 8 Hints And Solutions

May 19, 2025 -

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 19, 2025

Analyzing The Canadian Tire Hudsons Bay Merger Opportunities And Challenges

May 19, 2025 -

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Assessment

May 19, 2025

Will Canadian Tires Acquisition Of Hudsons Bay Succeed A Cautious Assessment

May 19, 2025