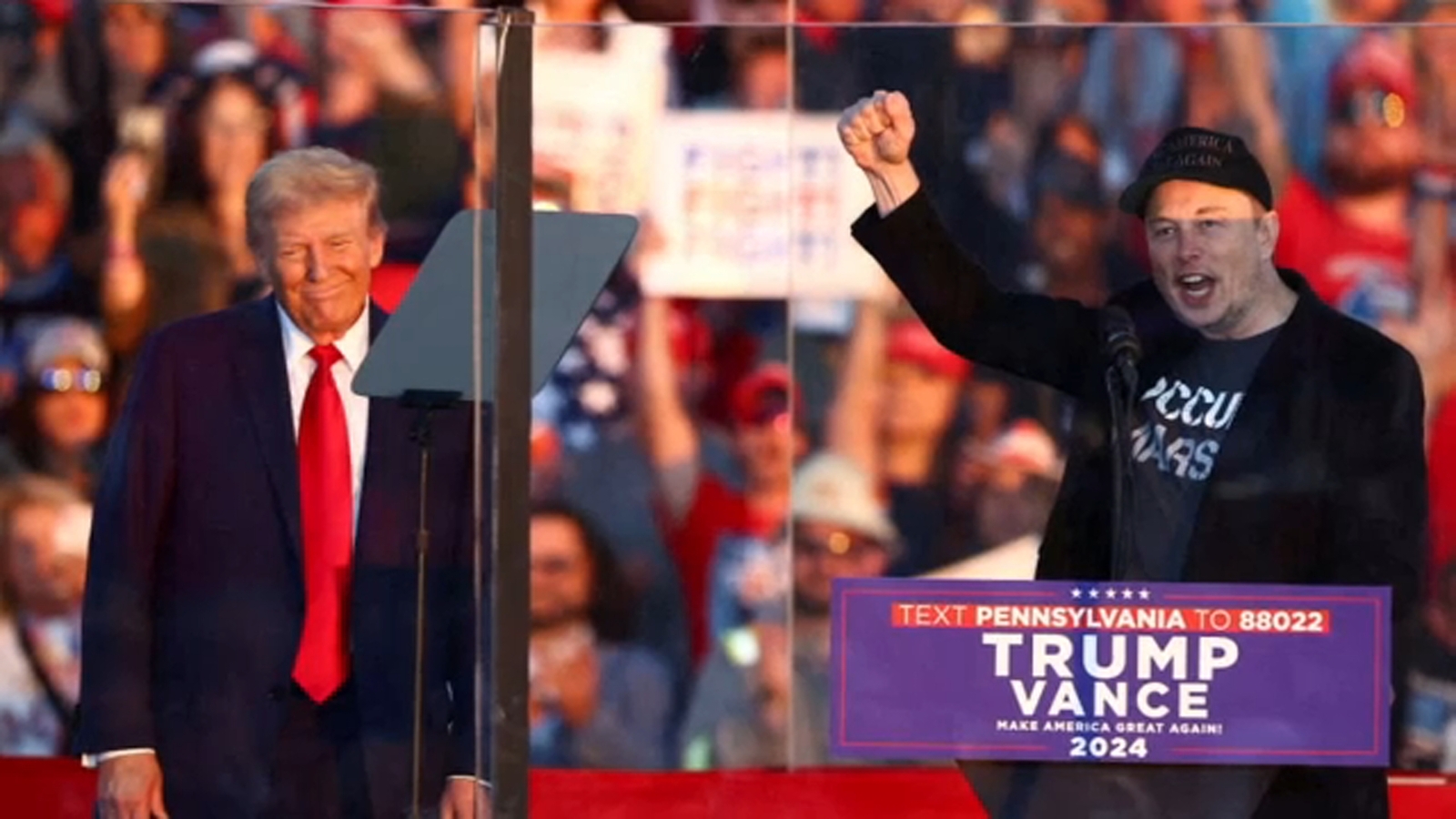

The Tesla-Dogecoin Connection: Analyzing Market Impacts Of Elon Musk's Decisions

Table of Contents

Elon Musk's Influence on Tesla Stock Price

Direct Correlation Between Tweets and Stock Performance

A direct correlation exists between Elon Musk's tweets and Tesla's stock performance. Numerous instances demonstrate this, with both positive and negative impacts.

- Positive Impacts: A tweet announcing a new product or a significant technological breakthrough often leads to a surge in Tesla's stock price. For example, announcements regarding new battery technology or advancements in autonomous driving capabilities have historically resulted in positive market reactions.

- Negative Impacts: Conversely, controversial tweets or statements, especially those perceived negatively by investors, can cause significant drops in Tesla's stock value. Musk's tweets about taking Tesla private, his comments on short-sellers, and various other controversial pronouncements have all demonstrably impacted Tesla's stock price.

The SEC's investigations into Musk's tweets highlight the seriousness of this correlation. These investigations underscore the potential for market manipulation through social media pronouncements, emphasizing the need for greater regulatory oversight in this area. The potential for market manipulation via social media platforms remains a significant concern, impacting both investor confidence and market stability.

Tesla's Brand and Musk's Persona

Musk's public image is inextricably linked to Tesla's brand. This creates a powerful, albeit risky, dynamic.

- Cult-like Following: Musk cultivates a cult-like following among Tesla investors, leading to unwavering loyalty and a strong buying sentiment regardless of market fluctuations. This intense brand loyalty shields Tesla from some market downturns that might otherwise affect other companies.

- Risks of Personality-Driven Brands: The heavy reliance on Musk's personality presents inherent risks. His actions and statements can directly affect investor sentiment, creating significant volatility in Tesla's stock price. A shift in public perception of Musk could negatively impact Tesla's valuation and long-term stability.

- Long-Term Brand Impact: The long-term effect of this personality-driven brand remains to be seen. While it currently provides Tesla with a strong competitive advantage, any significant negative shift in public opinion of Musk could damage the Tesla brand irreparably.

The Dogecoin Phenomenon and Musk's Role

Musk's Promotion of Dogecoin

Elon Musk's enthusiastic promotion of Dogecoin has played a significant role in the cryptocurrency's rise and volatility.

- Public Endorsements: Musk's endorsements have ranged from casual mentions in tweets to formal pronouncements, significantly impacting Dogecoin's price. For instance, a simple tweet mentioning Dogecoin has historically led to immediate price spikes.

- Ethical Implications: The ethical implications of such endorsements are debatable. Critics argue that Musk's actions constitute market manipulation, given his significant influence on social media and Dogecoin's relatively small market capitalization.

- Regulatory Concerns: The SEC and other regulatory bodies are closely monitoring Musk's activities and the potential for market manipulation via social media. Increased scrutiny of such practices is likely, leading to potential regulatory changes affecting cryptocurrency endorsements.

Dogecoin Volatility and Investor Behavior

Dogecoin's price volatility is extreme, primarily fueled by Musk's actions and the speculative nature of the cryptocurrency market.

- Speculative Investment: Dogecoin is largely considered a speculative investment, driven by hype and social media trends rather than fundamental value. This makes it highly susceptible to price swings based on news, tweets, and overall market sentiment.

- Retail Investor Behavior: Retail investors, particularly those influenced by Musk's pronouncements, drive a significant portion of Dogecoin's price volatility. Their reactions to Musk's tweets often lead to rapid price increases or crashes.

- Risks of Volatile Investments: Investing in highly volatile cryptocurrencies like Dogecoin carries significant risks. Investors need to understand these risks and make informed decisions, avoiding impulsive trades based solely on social media influence.

The Intertwined Fate of Tesla and Dogecoin

The futures of Tesla and Dogecoin are increasingly intertwined, largely due to Elon Musk's influence on both.

- Correlation: A continued correlation between Tesla's stock performance and Dogecoin's price movements seems plausible, given Musk's central role in both. Events affecting one asset often impact the other.

- Impact of Musk's Decisions: Musk's decisions regarding both Tesla and Dogecoin significantly influence the markets, highlighting the concentration of power and influence in the hands of a single individual.

- Future Implications for Investors: Investors need to carefully consider the risks associated with this interconnectedness. Diversification and a cautious approach are essential for managing portfolio risk in this volatile landscape.

- Potential Regulatory Responses: Regulatory responses are likely to evolve as the influence of social media on financial markets becomes increasingly apparent. Increased scrutiny of influencer marketing and market manipulation is highly probable.

Conclusion

The Tesla-Dogecoin connection exemplifies the significant influence of social media and a single individual on financial markets. Elon Musk's pronouncements have created substantial volatility in both Tesla's stock price and Dogecoin's value, highlighting the inherent risks associated with investing based solely on individual pronouncements. Understanding this complex relationship is crucial for navigating the modern financial landscape. Further research into the implications of social media influence on markets and responsible investing practices in the cryptocurrency space is vital. Stay informed about the evolving relationship between Tesla, Dogecoin, and Elon Musk to make informed investment decisions. Continue your research on the Tesla-Dogecoin connection and learn more about responsible investing.

Featured Posts

-

Immigration Debate Trump Explores Changes To Detention Appeals Process

May 10, 2025

Immigration Debate Trump Explores Changes To Detention Appeals Process

May 10, 2025 -

Beyonces Renaissance Tour Boosts Cowboy Carters Streams

May 10, 2025

Beyonces Renaissance Tour Boosts Cowboy Carters Streams

May 10, 2025 -

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 10, 2025

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 10, 2025 -

Elon Musks Billions Tesla Rally Fuels Wealth Increase Post Dogecoin Step Back

May 10, 2025

Elon Musks Billions Tesla Rally Fuels Wealth Increase Post Dogecoin Step Back

May 10, 2025 -

Dangote Refinery And Its Potential Effect On Nnpcs Petrol Pricing Strategy

May 10, 2025

Dangote Refinery And Its Potential Effect On Nnpcs Petrol Pricing Strategy

May 10, 2025