The Trade War's Impact: One Cryptocurrency That Could Still Thrive

Table of Contents

Decentralization as a Hedge Against Trade War Uncertainty

Trade wars introduce significant risks to traditional financial systems. However, the decentralized nature of cryptocurrencies offers a potential hedge against this instability.

Reduced Reliance on Traditional Financial Systems

Cryptocurrencies operate outside the traditional banking infrastructure, making them less susceptible to disruptions caused by trade wars.

- Bypasses geopolitical risks: Crypto transactions aren't bound by national borders or subject to the same political risks as traditional banking systems. This means they are less vulnerable to sanctions and trade restrictions imposed during trade disputes.

- Decentralized international transactions: Cryptocurrencies offer a compelling alternative to systems like SWIFT, which can be impacted by geopolitical tensions. This facilitates smoother cross-border payments, irrespective of trade war implications.

- Reduced impact of sanctions and tariffs: While not immune to regulation, cryptocurrencies offer a pathway for international transactions that aren’t directly subject to tariffs or sanctions applied to traditional financial flows.

Increased Demand During Economic Instability

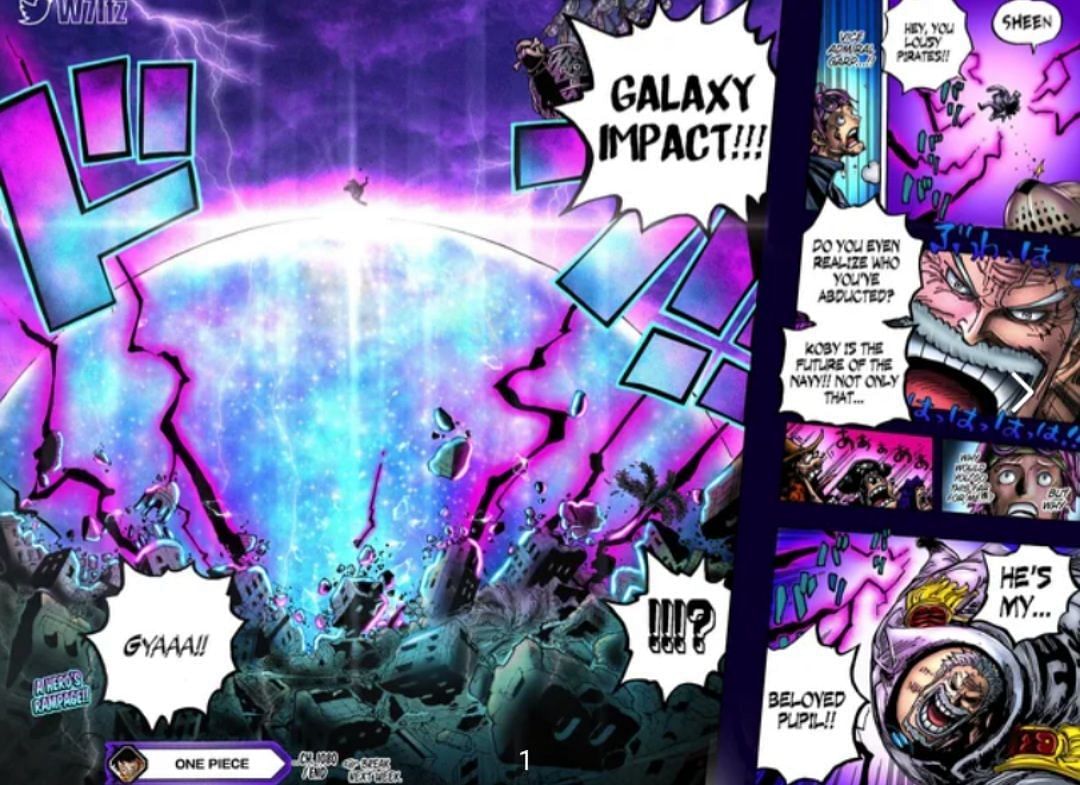

Periods of economic uncertainty often lead investors to seek alternative assets perceived as "safe havens." Cryptocurrencies, particularly those with strong fundamentals and a proven track record, can benefit from this "flight to safety."

- Safe haven appeal: During trade wars, the inherent volatility of traditional markets can push investors towards assets perceived as less correlated to geopolitical events, such as Bitcoin.

- Price appreciation potential: Increased demand, fueled by uncertainty, can drive up the price of specific cryptocurrencies, potentially offering significant returns for investors.

- Community and use cases matter: Cryptocurrencies with established use cases, large active communities, and strong technological foundations are more likely to attract investment during times of global instability.

The Rise of Bitcoin: A Case Study in Trade War Resilience

Bitcoin, the original and most well-known cryptocurrency, has shown resilience during periods of global economic uncertainty, making it a prime example of a cryptocurrency that could thrive during trade wars.

Bitcoin's Properties as a Safe Haven Asset

Bitcoin's limited supply (21 million coins) and decentralized nature make it an attractive store of value during economic downturns, potentially acting as a hedge against trade war-induced volatility.

- Technology unaffected by geopolitics: The underlying blockchain technology is unaffected by international trade disputes, offering a level of stability not found in traditional markets.

- Digital gold alternative: Many see Bitcoin as a digital equivalent of gold, a traditional safe haven asset, providing diversification in a volatile portfolio.

- Growing institutional adoption: Despite trade tensions, institutional investors continue to show increasing interest in Bitcoin, signaling growing confidence in its long-term value.

Bitcoin's Use as a Tool for Circumventing Trade Restrictions

While not intended for this purpose, Bitcoin's ability to facilitate peer-to-peer transactions across borders could see increased usage during times of trade conflict.

- Eased cross-border payments: Bitcoin transactions bypass traditional banking systems, potentially making it easier to conduct international trade despite trade barriers.

- Avoiding trade tariffs and sanctions: Businesses might utilize Bitcoin to minimize the impact of trade tariffs or sanctions imposed during trade wars, streamlining their transactions.

- Regulatory compliance considerations: It’s crucial to acknowledge that utilizing Bitcoin to circumvent regulations carries substantial risks and legal ramifications. Compliance with local and international laws is paramount.

Beyond Bitcoin: Other Cryptocurrencies Potentially Benefiting

While Bitcoin is a notable example, other cryptocurrencies might also experience increased demand during trade wars, depending on their specific features and market positioning.

Privacy-Focused Cryptocurrencies

Trade wars could increase demand for cryptocurrencies offering greater user privacy features. This stems from a desire to conduct transactions with reduced transparency.

- Enhanced anonymity: Some cryptocurrencies are designed to provide a higher degree of anonymity compared to Bitcoin.

- Scrutiny and regulation: The increased demand for privacy-focused cryptocurrencies could attract regulatory scrutiny and impact their adoption.

- Jurisdictional considerations: It’s essential to be aware of the diverse privacy regulations in various jurisdictions before using privacy coins.

Stablecoins and Their Role in Global Trade

Stablecoins, pegged to fiat currencies like the US dollar, offer relative price stability, mitigating the volatility inherent in other cryptocurrencies.

- Stability in volatile markets: Stablecoins can provide a more predictable alternative to traditional currencies during times of uncertainty, streamlining international trade.

- Reduced price fluctuation risks: Their price stability can make stablecoins an appealing option for businesses seeking to minimize risks associated with cryptocurrency price swings during trade wars.

- Adoption and regulation challenges: The widespread adoption and success of stablecoins depend heavily on regulatory frameworks and acceptance within the global financial community.

Conclusion

While trade wars inject uncertainty into the global economy, they may paradoxically create opportunities for certain cryptocurrencies. The decentralized and borderless nature of cryptocurrencies like Bitcoin, combined with their potential as safe haven assets, positions them favorably. Other cryptocurrencies, focusing on privacy or stability, could also see increased demand. Understanding these dynamics is vital for investors. Investing in cryptocurrency during trade wars requires careful research and an understanding of your risk tolerance. Learn more about navigating the impact of trade wars on cryptocurrency and build a diversified portfolio today.

Featured Posts

-

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025

Tnt Announcers Roast Jayson Tatum In Hilarious Lakers Celtics Promo

May 08, 2025 -

Ethereum Activity Surge Address Interactions Up Nearly 10 In 48 Hours

May 08, 2025

Ethereum Activity Surge Address Interactions Up Nearly 10 In 48 Hours

May 08, 2025 -

Vs

May 08, 2025

Vs

May 08, 2025 -

Ben Affleck Lauds Matt Damons Discerning Role Selection

May 08, 2025

Ben Affleck Lauds Matt Damons Discerning Role Selection

May 08, 2025 -

4 Mlzman Grftary Mraksh Myn Kshty Hadthh Awr Ansany Asmglng Ka Ankshaf

May 08, 2025

4 Mlzman Grftary Mraksh Myn Kshty Hadthh Awr Ansany Asmglng Ka Ankshaf

May 08, 2025